Power struggle over MediaMarktSaturn (Ceconomy): Is the takeover by JD.com, thought to be a sure thing, not so sure after all?

Xpert pre-release

Language selection 📢

Published on: December 5, 2025 / Updated on: December 5, 2025 – Author: Konrad Wolfenstein

Power struggle over MediaMarktSaturn (Ceconomy): Is the seemingly certain takeover by JD.com not so certain after all? – Image: Xpert.Digital

Fear of Amazon or Beijing? Europe's desperate way out of the "tech trap"

The battle for Europe's electronics crown: Europe's last giant on the life support of the red dragon?

Regulatory intervention: When raison d'état meets market logic

JD.com's acquisition of Ceconomy marks far more than just another transaction in global retail; it is a litmus test for the economic and political landscape of Europe in 2025. While antitrust hurdles, such as approval by the German Federal Cartel Office in September of this year, were cleared relatively quietly, the situation is now escalating into a highly complex political issue. The fact that the deal, which values Ceconomy at around €2.5 billion, has progressed this far demonstrates the economic urgency on the part of the company and the aggressive expansion plans of the Chinese tech giant.

MediaMarktSaturn is the central operating retail subsidiary of Ceconomy and consolidates the MediaMarkt and Saturn electronics stores in Europe within the group. Ceconomy functions as a publicly listed holding company whose core business essentially consists of the MediaMarktSaturn Retail Group, making MediaMarktSaturn the de facto main business segment of the Ceconomy Group.

But the real decision-making power has shifted from the boardroom to the ministries. The Federal Ministry for Economic Affairs and Climate Action (BMWK) is no longer examining the case solely from the perspective of free competition, but also under the scrutiny of "public order and security." At its core, the issue is whether the infrastructure of Europe's largest electronics retailer—and, more importantly, the data of millions of European consumers—should be classified as systemically critical. Here, the classic market logic, which seeks efficiency and access to capital, clashes head-on with the new geostrategic doctrine of "de-risking."

The skepticism of politicians is not unfounded, but it is economically risky. The discussion is strongly reminiscent of the debates surrounding the Port of Hamburg or the robotics manufacturer Kuka, although the MediaMarktSaturn case has a new dimension: it is not about high-tech patents in the classical sense, but about direct access to the end consumer and their behavioral data. Critics argue that Chinese corporations, due to their close ties to the Chinese government, inherently pose a security risk if they gain access to granular data streams of the European population. Proponents counter that an investment freeze based purely on political motives would send a disastrous signal to international investors and stifle the urgently needed capital inflow for the transformation of the European retail sector.

It is an irony of history that a Chinese corporation is seeking to play the role of "white knight" for a traditional German company, while European capital is scarce. The political obstruction, however understandable from a security policy perspective, ignores the harsh business reality: without massive technology transfer and fresh capital, MediaMarktSaturn risks being crushed between cost inflation and Amazon's dominance. In its attempt to protect sovereignty, policymakers risk sacrificing competitiveness.

The asymmetric conflict: Strategic autonomy versus global capital allocation

For JD.com, the move into Europe is not an opportunistic adventure, but a compelling strategic imperative. The Chinese domestic market is saturated, growth there is slowing, and internal competition with players like Pinduoduo and Alibaba is cutthroat. The acquisition of Ceconomy is an attempt to export the logistical and technological superiority that JD.com has built up in China to a new, high-spending market. The company no longer sees itself merely as a retailer, but as a supply chain technology group. The acquisition of over 1,000 physical locations in Europe offers JD.com what pure online retail lacks: a tightly woven network for last-mile logistics and showrooms for high-end electronics.

The Ceconomy Group, on the other hand, finds itself in a classic “incumbent trap.” Despite solid sales figures of around €22.8 billion in fiscal year 2024/25 and a slight recovery in margins, fundamental profitability remains thin. An operating margin of less than 4 percent leaves little room for the billions in investments that would be necessary to catch up technologically with Amazon. This highlights the asymmetry of the conflict: While JD.com is prepared to invest long-term strategic capital and leverage synergies from its highly automated logistics (“Retail as a Service”), European investors often lack the long-term perspective or the technological understanding for such a radical transformation.

The geopolitical stress test now arises from Europe's attempt to keep its markets open without relinquishing its strategic autonomy. Investment screening by the Federal Ministry for Economic Affairs and Climate Action (BMWK) under the Foreign Trade and Payments Ordinance (AWV) is the sharpest tool in this conflict. While the retail sector was once a politically neutral area, it is becoming a critical zone in the age of big data and AI. The fear is not that JD.com will stop delivering televisions tomorrow, but rather that European retail infrastructure is gradually becoming technologically dependent. If the software, warehouse logistics, and data analysis of a pan-European retailer are controlled in Beijing, power shifts – invisibly, but effectively.

At the same time, this case highlights the weakness of the European capital market. The fact that no European competitor or private equity fund was willing or able to submit a counteroffer speaks volumes. It reveals a gap in European tech sovereignty: We regulate markets excellently, but we rarely manage to scale or revitalize global champions on our own. Should policymakers ultimately block the deal, Ceconomy will not automatically be in a better position. On the contrary, a scenario of gradual erosion looms, in which the company could be forced to "downsize," costing jobs and further weakening its market position vis-à-vis US platforms.

Our EU and Germany expertise in business development, sales and marketing

Industry focus: B2B, digitalization (from AI to XR), mechanical engineering, logistics, renewable energies and industry

More about it here:

A topic hub with insights and expertise:

- Knowledge platform on the global and regional economy, innovation and industry-specific trends

- Collection of analyses, impulses and background information from our focus areas

- A place for expertise and information on current developments in business and technology

- Topic hub for companies that want to learn about markets, digitalization and industry innovations

Logistics, data, power: The hidden economy behind JD's billion-dollar bet on Ceconomy

The economic anatomy of the deal: valuation, synergies and risks

To truly understand the implications of this potential takeover, one must delve into the economic metrics. JD.com's offer, which included a premium of approximately 23 percent over the pre-announcement share price, values Ceconomy's equity at roughly €2.5 billion. At first glance, this might seem inexpensive for a company with over €20 billion in revenue – the price-to-sales ratio is well below 0.2. However, this low valuation reflects the massive structural challenges facing brick-and-mortar retail: high fixed costs for rent and personnel, low margins, and intense price competition.

For JD.com, the deal still makes financial sense, leveraging operational excellence and economies of scale. The Chinese company possesses one of the world's most advanced logistics infrastructures, heavily reliant on automation, AI-driven inventory management, and autonomous delivery. The acquisition's rationale is that if JD.com applies its technology ("supply chain efficiency") to MediaMarktSaturn's enormous volume, it can significantly increase its EBITDA margin. Every basis point of margin improvement through more efficient warehousing or better data mining translates directly into hundreds of millions of euros in additional profit at these sales volumes.

Another often overlooked aspect is the failure of JD.com's own organic market entry into Europe with the "Ochama" brand. The attempt to build its own logistics and pickup network from scratch proved arduous and expensive. The acquisition of Ceconomy is therefore also an admission that a "greenfield" strategy is too slow in the fragmented European market. The takeover is a shortcut: it buys market access, brand recognition, and—crucially—prime real estate locations in city centers that can serve as micro-logistics hubs for ultra-fast deliveries.

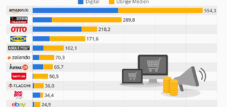

The risk for Ceconomy if the deal falls through lies in the funding gap. The company has made progress in recent years, for example through the sale of its Swedish subsidiary and the restructuring of its balance sheet. However, while its growth businesses, such as Retail Media (advertising on its own platforms) and its marketplace approach, are growing rapidly, they are not yet large enough to support the group on their own. Without the technological "big bang" that JD promises, MediaMarktSaturn risks remaining mediocre – too big to die, but too slow to compete with Amazon and Coolblue.

Data sovereignty as a trade barrier: The transparent customer

A key point that often remains vague in the public debate is the specific issue of data. Why is the German government interested in the purchasing data of consumers who buy washing machines or game consoles? The answer lies in aggregation. Individual data points are harmless, but the sheer volume of data from millions of customers over years allows for profound inferences about socioeconomic conditions, movement patterns, and consumer sentiment. In an era where data is considered a strategic resource, access by a power perceived as a systemic rival is viewed critically.

Added to this is the Chinese national security law, which theoretically allows Chinese companies to hand over data to the government in Beijing if it serves national security. Even though JD.com insists that it stores and processes European data strictly within Europe (GDPR compliance), a lingering mistrust remains. Technically, it is extremely difficult to ensure that deep integration of IT systems does not create backdoors or lead to data leaks. This mistrust fuels political intervention.

However, it's important to maintain a nuanced perspective. We use US platforms daily that also collect enormous amounts of data and sometimes process it opaquely. The difference lies in the geopolitical assessment of the country of origin. Europe is increasingly applying a double standard here, which may be justifiable from a security policy perspective, but distorts competition economically. If European companies are only allowed to be acquired by investors from "friendly" countries, this severely restricts the market for corporate control and potentially depresses the valuations of all European assets.

Scenarios for the future: protectionism or pragmatism?

Should the German government or another European body actually block the deal at the last minute, we face a scenario of uncertainty. Ceconomy's share price would plummet in the short term, as the takeover premium would be priced out. Management would be under enormous pressure to present a "Plan B," which would likely involve drastic cost-cutting measures and store closures to secure profitability organically. A "white knight" from Europe is nowhere in sight; the major European retail groups are either themselves undergoing transformation or simply lack the financial firepower.

If, however, the deal is approved under strict conditions (“conditional clearance”), this could become a blueprint for dealing with Chinese investments. Possible measures would include escrow structures for data storage, guarantees for local employment, and strict monitoring of IT integration. This would be the pragmatic “third way”: utilizing Chinese capital and know-how while drawing firm red lines regarding data security.

In the long run, this case will show whether Europe can develop its own industrial strategy for digital commerce or whether it will become a mere pawn in the game of the superpowers, the US and China. The acquisition of MediaMarktSaturn by JD.com would—despite all the risks—at least be an attempt to build a global competitor to Amazon, one that has its roots and physical base in Europe, even if the capital comes from the Far East. Blocking this path would effectively cement the monopoly of the US platforms that already dominate the market, without any government intervention. Politicians must decide: Do they fear Chinese influence more than American dominance? This balancing act is the real crux of the matter.

EU/DE Data Security | Integration of an independent and cross-data source AI platform for all business needs

Ki-Gamechanger: The most flexible AI platform-tailor-made solutions that reduce costs, improve their decisions and increase efficiency

Independent AI platform: Integrates all relevant company data sources

- Fast AI integration: tailor-made AI solutions for companies in hours or days instead of months

- Flexible infrastructure: cloud-based or hosting in your own data center (Germany, Europe, free choice of location)

- Highest data security: Use in law firms is the safe evidence

- Use across a wide variety of company data sources

- Choice of your own or various AI models (DE, EU, USA, CN)

More about it here:

Advice - planning - implementation

I would be happy to serve as your personal advisor.

contact me under Wolfenstein ∂ Xpert.digital

call me under +49 89 674 804 (Munich)

🎯🎯🎯 Benefit from Xpert.Digital's extensive, five-fold expertise in a comprehensive service package | BD, R&D, XR, PR & Digital Visibility Optimization

Benefit from Xpert.Digital's extensive, fivefold expertise in a comprehensive service package | R&D, XR, PR & Digital Visibility Optimization - Image: Xpert.Digital

Xpert.Digital has in-depth knowledge of various industries. This allows us to develop tailor-made strategies that are tailored precisely to the requirements and challenges of your specific market segment. By continually analyzing market trends and following industry developments, we can act with foresight and offer innovative solutions. Through the combination of experience and knowledge, we generate added value and give our customers a decisive competitive advantage.

More about it here: