The big AI bubble is bursting: Why the hype is over and only the big players are winning

Xpert pre-release

Language selection 📢

Published on: August 25, 2025 / Updated on: August 25, 2025 – Author: Konrad Wolfenstein

Billions invested, zero profit? What's really behind the great AI disillusionment

### The ChatGPT CEO, of all people, is sounding the alarm: Is the AI industry on the verge of collapse? ### The great AI death: Why small startups are now running out of money en masse ### The AI gold rush is over: Only a few are now reaping the billions ###

From hype to cold shower: Why the initial AI euphoria has now faded

The party is over: After a phase of boundless euphoria and seemingly endless investment, a palpable disillusionment is setting in in the AI sector. The once broad flow of venture capital that fueled countless startups is now being channeled into a few, massive deals with established players. This paradigm shift from a gold rush to strategic consolidation marks a turning point for the entire industry.

The signs are unmistakable: While small, innovative AI startups are increasingly fighting for funding and fearing the "great death," even the presentations of tech giants like OpenAI no longer trigger unanimous enthusiasm, but also sharp criticism. When even key figures like Sam Altman, who played a key role in shaping the hype, publicly warn of a bubble, it's more than just a faint alarm bell. At the heart of this change lies a fundamental discrepancy: Astronomical valuations and investment volumes of over $100 billion are colliding with a reality in which, according to studies, the majority of AI projects have yet to generate measurable profits. The following text analyzes the causes of this disillusionment and highlights the consequences this change has for investors, tech giants, and the entire startup ecosystem.

What is meant by the current paradigm shift in AI investment?

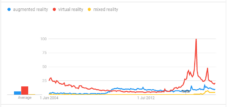

The AI investment market is currently undergoing a fundamental transformation. After years of widespread euphoria and numerous smaller bets on various AI startups, a clear strategic shift is taking place toward selective, large-scale investments. This development is characterized by several distinctive features that will have a lasting impact on investment behavior.

Investors are increasingly focusing on established companies with proven business models or concentrating on a few promising large-scale projects. Instead of spreading available capital among numerous smaller AI startups, they are pooling their resources for large-scale strategic investments that promise a higher chance of success. This development reflects a realistic reassessment of the AI industry, in which initial enthusiasm is giving way to a sober analysis of the actual market potential.

The numbers clearly confirm this trend: While AI investments doubled to over $100 billion in 2024 and now account for 37 percent of the global venture capital market, these sums are concentrated in fewer and fewer companies. At the same time, the number of financing rounds overall has declined, suggesting that investors are using their funds more selectively.

What concrete signs point to growing disillusionment?

This disillusionment manifests itself at various levels and is evident in several concrete developments. A particularly striking example was the introduction of OpenAI's GPT-5, which, instead of the expected enthusiasm, triggered a wave of criticism. Experts such as Gary Marcus, a professor emeritus of psychology and neuroscience at New York University, described the new model as "overdue, overhyped, and disappointing."

User reactions were even more drastic. Just hours after the presentation, resistance to the new model began to form on social media. Criticisms included shorter and inadequate responses, a more intrusive AI style, and the lack of the "personality" of previous models. Many users found it particularly problematic that GPT-5 was marketed as an "upgrade" but had limitations in practice.

The academic assessment was also sobering. An MIT study showed that 95 percent of the AI projects examined in companies have so far failed to deliver a measurable profit contribution. Steve Sosnick, chief strategist at Interactive Brokers, called these results a "splash of cold water in the face," highlighting the discrepancy between the enormous investments and the actual returns achieved.

How does this development affect small AI start-ups?

For small AI startups, the situation is becoming dramatically worse. The focus on large investments means that less capital is available for early-stage financing. This development is already reflected in concrete figures: In Germany, for example, the number of small deals under one million euros fell significantly by more than a fifth compared to the previous quarter.

The trend is particularly worrying for newly founded AI startups. While companies founded in 2021 have received a total of approximately $535 million so far, startups from 2022 and 2023 combined have received only about $93 million. Dr. Philip Hutchinson, Senior AI Expert at the appliedAI Institute, is concerned about this development: "It has become increasingly difficult for AI startups founded in 2022 or later to raise capital."

The high costs of training AI models and the expensive AI specialists further exacerbate this problem. Small startups often cannot raise the enormous resources required to develop competitive AI solutions. This creates a vicious circle: Without sufficient funding, they cannot develop competitive products, and without compelling products, they cannot obtain funding.

EU/DE Data Security | Integration of an independent and cross-data source AI platform for all business needs

Ki-Gamechanger: The most flexible AI platform-tailor-made solutions that reduce costs, improve their decisions and increase efficiency

Independent AI platform: Integrates all relevant company data sources

- Fast AI integration: tailor-made AI solutions for companies in hours or days instead of months

- Flexible infrastructure: cloud-based or hosting in your own data center (Germany, Europe, free choice of location)

- Highest data security: Use in law firms is the safe evidence

- Use across a wide variety of company data sources

- Choice of your own or various AI models (DE, EU, USA, CN)

More about it here:

AI investments: The big showdown of the giants

Why is Sam Altman warning of an AI bubble?

Sam Altman's warnings about a potential AI bubble are particularly surprising, given that, as CEO of OpenAI, he has played a key role in driving the current AI boom. His critical comments suggest several possible motivations, all of which could be strategic in nature.

First, investor pressure is mounting massively. The era of blind trust and unlimited funding for any AI approach is coming to an end. Smart money investors are increasingly demanding robust business models and real results. Altman's warning could be a clever leap forward—those who are the first to warn about the bubble position themselves as far-sighted cautionaries rather than as clueless followers.

Second, it could be an attempt to push weaker competitors out of the market before the big die-off begins. If Altman publicly states that "some investors will lose a lot of money," this could help investors focus their funds more on established players like OpenAI.

Financial realities support this interpretation. Although OpenAI tripled its revenue to approximately $3.7 billion in 2024, the company reported a loss of approximately $5 billion, according to estimates. Added to this is a dangerous cost spiral: OpenAI's o3 model was about 100 times more expensive than its predecessor.

What exactly does the term “large-scale investment trend” mean?

The large-scale investment trend is characterized by a fundamental shift in investment strategies. Instead of distributing many smaller sums among various startups, investors are concentrating on a few, but very large, financing rounds. This development can be illustrated by several concrete examples.

Databricks secured one of the largest funding rounds of 2024 with a $10 billion Series J funding round. The round, led by Thrive Capital, raised the company's valuation to $62 billion, surpassing even major companies like OpenAI, xAI, and Waymo.

The trend is equally evident in Germany. The Munich-based company Helsing, which specializes in artificial intelligence for the defense industry, raised €450 million. The Cologne-based translation service DeepL received €277 million, and Aachen-based Black Semiconductor secured €254 million. These three deals alone accounted for a significant portion of the total German AI investment volume.

The statistics illustrate the magnitude of this shift: In 2024, there were 29 major investments in Germany with a financing volume of at least €50 million each – eight more than in the previous year. At the same time, the total number of financing rounds fell by twelve percent, indicating that fewer companies are receiving funding, but those receiving significantly larger sums.

What role do the tech giants play in this development?

The major technology companies are playing a crucial role in concentrating AI investments on a few large-scale projects. Companies like Meta, Amazon, Microsoft, and Alphabet have fundamentally changed their investment strategies and are pumping billions into expanding their AI infrastructure.

Meta doubled its investments in 2025, Amazon is building gigantic AWS campuses, and Microsoft is serially constructing new data centers. These massive infrastructure investments are consuming billions and leading to a paradoxical situation: While profits are rising, free cash flow is collapsing. At the four major US tech companies, it has fallen by around 30 percent since 2023.

The tech giants are pursuing a clear strategy: They want to divide the AI market among themselves and control or acquire potential competitors as they emerge. Large financing rounds and acquisitions by these corporations are increasingly shaping the market landscape. This is creating a kind of oligopoly structure in which only a few large players determine development.

This development also has geographical implications. While the US dominates with a 62 percent market share of global VC investments, Europe overtakes Asia for the first time as the second-largest VC region. Nevertheless, the absolute differences remain enormous: startups in the US received €41.4 billion in venture capital commitments in the second quarter of 2024, compared to just €1.8 billion in Germany.

How is the valuation of AI companies developing?

Valuations in the AI sector have reached grotesque levels, which are only justified if profits increase explosively in the long term. Tesla is currently trading at a price-to-earnings ratio of around 200, while Nvidia is trading at around 60. These levels reflect extreme future expectations, which raise skepticism among many experts.

Particularly problematic is the discrepancy between valuations and actual earnings. Although AI companies achieve astronomical valuations, most remain far from profitability. OpenAI, valued at around $300 billion, continues to post massive losses, according to estimates.

The valuation bubble is also reflected in the market's extreme concentration. Nvidia and Microsoft now represent around 15 percent of the S&P 500—a weight that is historic even in the technology-loving US market. This concentration makes the entire market vulnerable to corrections, as even small setbacks for these companies can have major repercussions.

The warning signs are mounting: Nvidia lost 3.6 percent in three days, Microsoft 3 percent, and for other companies like Palantir, the setback was even more severe, dropping 14 percent. This volatility indicates that the markets are becoming increasingly nervous.

Which industries and application areas are particularly affected?

The transformation in AI investment is impacting different industries and application areas differently. Consumer-oriented AI applications and traditional software-as-a-service solutions, which are struggling with declining valuations, are particularly hard hit.

In contrast, specialized sectors benefit from the focus on large-scale investments. The healthcare sector dominates the financing volume with 1.039 billion Swiss francs, corresponding to 45 percent of the funds invested in Swiss startups. Biotech startups alone received 703 million Swiss francs.

The defense sector is experiencing a particular boom. German AI companies like Helsing, which specializes in artificial intelligence for the defense industry, are attracting massive investments. This development reflects the societal changes and geopolitical tensions that are increasingly focusing on military applications of AI.

The situation is particularly dramatic for traditional e-commerce and online retail companies. Berlin, which has traditionally been strong in this sector, suffered significant declines in financing, while Bavaria, with its focus on tech and AI, has overtaken the capital for the first time in terms of financing volume.

🎯🎯🎯 Benefit from Xpert.Digital's extensive, fivefold expertise in a comprehensive service package | R&D, XR, PR & SEM

AI & XR 3D Rendering Machine: Fivefold expertise from Xpert.Digital in a comprehensive service package, R&D XR, PR & SEM - Image: Xpert.Digital

Xpert.Digital has in-depth knowledge of various industries. This allows us to develop tailor-made strategies that are tailored precisely to the requirements and challenges of your specific market segment. By continually analyzing market trends and following industry developments, we can act with foresight and offer innovative solutions. Through the combination of experience and knowledge, we generate added value and give our customers a decisive competitive advantage.

More about it here:

AI bubble or reboot? Why only real problem solvers will survive

What are the long-term implications for the startup ecosystem?

The long-term effects of current developments will have a lasting impact on the entire startup ecosystem. The focus on large-scale investments is leading to polarization: a few companies receive significant capital, while the majority of startups struggle with significant financing difficulties.

This development exacerbates the existing problem of uneven survival prospects. While established startups with solid business models continue to have access to capital, it is becoming increasingly difficult for innovative but still untested business ideas to obtain the necessary start-up financing.

The numbers speak volumes: In 2024, 336 startups in Germany filed for insolvency, an increase of 17 percent compared to the previous year. Approximately eleven percent of the startups surveyed expect to file for insolvency within twelve months—a dramatic increase compared to the previous year.

The development in early-stage financing is particularly problematic. The decline in small investments under one million euros particularly affects young companies, which are often still in the development phase. This financing gap could weaken the innovative capacity of the entire ecosystem in the long term.

What regional differences are evident in this development?

Regional differences in the AI investment landscape are becoming increasingly pronounced, reflecting different strategic approaches. The US continues to dominate, accounting for 62 percent of global VC investments, while different patterns are emerging in Europe and Germany.

A remarkable geographical shift is taking place in Germany. In 2024, Bavaria overtook Berlin for the first time in terms of funding volume, raising €2.33 billion—a good €600 million more than in 2023. Berlin, in contrast, received only €2.17 billion, a decrease of €200 million. This development is primarily due to the tech and AI boom, in which Bavaria has traditionally been stronger.

North Rhine-Westphalia also saw strong growth, reaching €951 million, an increase of €620 million. This regional redistribution reflects a shift in investment focus from traditional online retail companies, Berlin's traditional strength, to technology-oriented sectors.

Across Europe, the picture is mixed. While Europe has overtaken Asia as a region to become the second-largest VC region, the absolute numbers remain modest. In France, startups received €2.1 billion in VC commitments in the second quarter of 2024, while in the UK, the figure was €5.1 billion—still far below the €41.4 billion in the US.

How do investors react to the changing market situation?

Investors have fundamentally adjusted their strategies and are adopting a significantly more selective approach. The expected internal rate of return (IRR) has declined overall: For early-stage investments, it fell from 36 to 31 percent, and for growth financing from 32 to 25 percent. Only for late-stage investments did the IRR increase from 24 to 28 percent, reflecting the preference for later, lower-risk investment phases.

This shift in risk appetite is leading to longer holding periods and an increase in secondary deals. Since trade sales and IPOs are now rare, investors are seeking alternative exit strategies. VC secondary deals make it possible to generate liquidity without having to wait for a full exit.

Due diligence processes have become more stringent. Investors are examining more closely and placing higher demands on business models and profitability paths. While in the boom years, ideas and teams were often already funded, investors today demand concrete evidence of market potential and competitiveness.

The role of foreign investors in large deals is particularly noteworthy. Almost half of the VC deals over €50 million in Germany are carried out solely by foreign investors. This suggests a type of valuation arbitrage: foreign investors invest at lower European valuations with the aim of later exiting in the US at higher valuations.

What conclusions can be drawn for the future of the AI sector?

Current developments in the AI sector point to a fundamental market shakeout that presents both opportunities and risks. The focus on large-scale investments will likely lead to oligopolization, with a few large players dominating the market. This development could hamper innovation, as disruptive ideas from smaller companies have fewer opportunities to secure funding.

At the same time, a more selective investment strategy could lead to more sustainable business models. The pressure to develop profitable and scalable solutions is forcing companies to take a more realistic approach to AI applications. The MIT study, which showed that 95 percent of AI projects fail to deliver measurable profit contributions, highlights the need for this correction.

Geographical shifts are likely to intensify. Regions with strong technical universities and established tech ecosystems, such as Bavaria or Baden-Württemberg, could continue to gain importance, while traditional startup centers focused on consumer applications could decline.

This opens up important areas of action for policymakers. The proposed AI vouchers and increased support for collaboration between SMEs and startups could help close the financing gap. Without targeted support for smaller innovators, there is a risk that Germany and Europe will fall further behind in the global AI competition.

Sam Altman's warning of an AI bubble should be taken seriously, even if it may be strategically motivated. The parallels to the dot-com bubble are unmistakable: excessive valuations, a lack of business models, and blind faith in technology. A controlled decline in valuations could be beneficial and lead to a more sustainable development of the AI sector.

Ultimately, the AI sector is facing a test. The era of unlimited funding without concrete results is coming to an end. Only companies that solve real problems and create demonstrable value will succeed in the long term. This development may be painful, but it could lead to a more mature and sustainable AI industry that delivers real social and economic benefits.

We are there for you - advice - planning - implementation - project management

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the AI strategy

☑️ Pioneer Business Development

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital - Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital - www.xpert.solar - www.xpert.plus