Economic relations between China and Taiwan: A paradox of interdependence in the shadow of political conflict

Xpert pre-release

Language selection 📢

Published on: October 12, 2025 / Updated on: October 12, 2025 – Author: Konrad Wolfenstein

Economic relations between China and Taiwan: A paradox of interdependence in the shadow of political conflict – Image: Xpert.Digital

Enemies and yet partners: The billion-dollar paradox between China and Taiwan

Foundations and starting point of a unique network of relationships

The economic relationship between the People's Republic of China and Taiwan represents one of the most remarkable paradoxes of the modern global economy. Despite ongoing political tensions and fundamental disagreements over Taiwan's status, both sides of the Taiwan Strait have developed a complex web of economic interdependencies that entails both strategic dependencies and significant risks. These relations are characterized by the dichotomy between political antagonism and economic pragmatism that has defined the bilateral relationship for decades.

Taiwan, officially the Republic of China, and the People's Republic of China do not maintain de facto diplomatic relations, yet the People's Republic is Taiwan's most important trading partner. This apparent contradiction reflects the realities of a globalized world economy in which economic logic often overrides political differences. Bilateral trade volume reached a record $205 billion in 2022, underscoring the immense economic importance of this relationship. At the same time, this figure highlights the complexity of the situation: While China views Taiwan as a renegade province and seeks reunification, both economies are closely intertwined.

The geopolitical dimension adds further urgency to these economic relations. An armed conflict across the Taiwan Strait is considered a major risk to the global economy, underscoring the global importance of bilateral relations. Taiwan's central role in global technology supply chains, particularly in semiconductor production, makes these relations a factor of global strategic importance. Taiwan's Taiwan Semiconductor Manufacturing Company (TSMC) produces approximately 90 percent of the world's cutting-edge logic chips, demonstrating to both China and the rest of the world how vulnerable modern economies are to disruptions in this region.

From hostility to economic cooperation: A shift in paradigms

The historical development of Sino-Taiwanese economic relations is inextricably linked to the political histories of both sides. Following the Kuomintang's defeat in the Chinese Civil War in 1949 and its retreat to Taiwan, a state of military confrontation and economic isolation prevailed for decades. Only in the late 1980s did this situation begin to change fundamentally.

In 1987, Taiwanese were permitted to travel to the People's Republic of China for the first time since 1949. This seemingly small easing marked the beginning of a gradual opening that would have far-reaching economic consequences. The end of martial law in Taiwan in 1991 and the associated unilateral end to the state of war with the People's Republic of China paved the way for further détente. These political changes created the conditions for the first direct talks between the two sides in Singapore in 1993, although these were discontinued in 1995.

The real turning point, however, came in the early 1990s with the gradual opening to indirect trade. Taiwanese businessmen made spectacular use of the opportunity offered by indirect trade, creating economic ties that Beijing deliberately sought to exploit. Between 1991 and 2022, Taiwanese companies invested 203 billion US dollars in the Chinese economy, making them among the most important investors. These investments played a crucial role in the transformation of the Chinese economy, as Taiwan, as a capitalist pioneer, transferred capital and know-how to the People's Republic, which was facilitated by the shared culture and language.

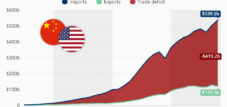

The intensification of trade relations has been remarkable: bilateral trade volume rose from $18 billion in 2002 to $205 billion in 2022. This development demonstrates how economic interests can overcome political barriers, even when fundamental political differences remain. The turning point came in 2008 with the election of Ma Ying-jeou as Taiwanese president, who pursued a pro-China agenda and resumed talks suspended in 1995.

The anatomy of economic interdependence: structures and mechanisms

Today's economic relations between China and Taiwan are characterized by several distinctive structural features that underscore their complexity and strategic importance. The most important institutional framework was the Economic Cooperation Framework Agreement (ECFA), signed in 2010, which provided for the reduction of tariffs and trade restrictions between the two sides.

The ECFA liberalized the movement of people and goods and included provisions for the protection of investments. After a transitional period, 539 Taiwanese products were allowed to be exported duty-free to the mainland. This represented approximately 16 percent of exports to the People's Republic of China at the time and affected goods flows valued at almost 14 billion US dollars. Taiwan's chemical and automotive industries, as well as mechanical engineering, particularly benefited from the new regulations. Conversely, the regulation affected 267 goods exported from the People's Republic of China to Taiwan, valued at almost three billion US dollars.

The structural asymmetry of trade relations is evident in current figures: in 2024, almost 40 percent of all Taiwanese exports still went to the People's Republic or Hong Kong, although this share is declining, falling to 31.7 percent in 2024—the lowest level in 23 years. These figures illustrate both the continued importance of the Chinese market for Taiwan and the increasing efforts to diversify.

The sectoral structure of trade relations reveals a clear division of labor: Taiwan primarily exports high-quality electronic components and semiconductors to China, while importing raw materials such as rare earths and lower-quality electronic components from mass production. Electronics, including semiconductor chips, leads Taiwan's total exports to China. This division of labor highlights the mutual dependence: Taiwan relies on Chinese raw materials, while China cannot do without Taiwanese advanced technology.

The current situation: Between record trading and growing tensions

The current situation of Sino-Taiwanese economic relations is characterized by a paradoxical constellation: On the one hand, trade volumes have reached new record levels, while on the other, political tensions and strategic efforts to minimize risk are increasing. Taiwan recorded its second-best foreign trade figures in history in 2024, with a total export volume of USD 475 billion.

Despite ongoing political tensions, China and Hong Kong remained the leading destination for Taiwanese exports in 2024, although their combined share fell to 31.7 percent. At the same time, exports to the US increased by 46.1 percent to a record $111.4 billion, making the US Taiwan's second-largest export partner, surpassing ASEAN countries. This development reflects Taiwan's deliberate market diversification strategy, known as the "New Southbound Policy."

Investment flows also show significant changes: Taiwan's approved overseas investment (excluding China) amounted to approximately US$44.9 billion in 2024, an increase of 91 percent over 2023. At the same time, Taiwanese investment in China plummeted to a record low of US$3 billion in 2023, signaling a significant shift in the investment strategy of Taiwanese companies.

The technological dimension of the relationship remains particularly sensitive. China is fundamentally dependent on Taiwan's semiconductor industry, while Taiwan is simultaneously seeking to leverage its strategic position in this area. TSMC, for example, has only allowed the export of certain high-performance chips to China with a permit since the end of 2024, highlighting the increasing politicization of economic relations.

Case Study 1: The ECFA Agreement as a Reflection of Bilateral Relations

The 2010 Economic Cooperation Framework Agreement (ECFA) serves as a paradigmatic example of the complexity and contradictions of Chinese-Taiwanese economic relations. The agreement was both a culmination of economic rapprochement and a catalyst for political controversies that continue to resonate today.

The negotiations and signing of the ECFA took place during a period of relative political easing under Taiwanese President Ma Ying-jeou, who pursued a policy of rapprochement with China. The agreement, signed in Chongqing on June 29, 2010, provided, among other things, for the gradual reduction or elimination of tariffs on certain export goods and committed both sides to the mutual opening of certain market sectors, such as banking, insurance, and healthcare.

The economic impact of the ECFA was quite measurable: Taiwan was able to significantly increase its exports in certain sectors, particularly in the chemicals, automotive, and mechanical engineering industries. Trade liberalization led to a further intensification of the already close economic relations. However, it also created new dependencies that were increasingly viewed critically in Taiwan.

The political consequences of the ECFA, however, were controversial and long-lasting. The opposition, particularly the Democratic Progressive Party (DPP), feared excessive economic and political dependence on China and negative consequences for the domestic economy. These concerns materialized in 2014 in the Sunflower Movement protests against a planned follow-up agreement on services, which subsequently remained unsigned and contributed to Ma Ying-jeou's defeat two years later.

The latest development marks the end of an era: China announced in 2024 that it would end tariff concessions on 134 products under the ECFA, effective June 15. This measure was taken in response to President Lai Ching-te's inauguration speech, in which he emphasized that Taiwan and China are equal. Although the affected products only account for about 2 percent of total exports, this decision signals a new phase in relations in which economic instruments will increasingly be used for political purposes.

Case Study 2: Foxconn and the Reorientation of Taiwanese Companies

The development of the Taiwanese electronics giant Foxconn (Hon Hai Precision Industry) exemplifies the strategic challenges and adaptation processes of Taiwanese companies in the context of changing Sino-Taiwanese relations. As the world's largest contract manufacturer of electronics products and Apple's most important iPhone producer, Foxconn embodies the ambivalence of the economic interdependence between both sides of the Taiwan Strait.

Foxconn has built a massive presence in China over decades and employs hundreds of thousands of people in its factories there. The company played a pivotal role in China's transformation into a global manufacturing power for electronics products. At the same time, the company's recent strategic realignment highlights the changing geopolitical and economic environment.

On the one hand, Foxconn is continuing to expand its activities in China: In 2024, the company announced an investment of 1 billion yuan (137.5 million US dollars) to build a new headquarters in Zhengzhou, which already houses the world's largest iPhone factory. Additionally, Foxconn invested 600 million yuan in a new electric vehicle battery factory in the same city, highlighting the company's diversification strategy beyond iPhone production.

On the other hand, Foxconn is pursuing a distinct diversification strategy: The company plans to build an iPhone production facility in southern India, investing between $700 million and $1 billion. Taiwan approved Foxconn's investment plans in India and the US worth over $2.2 billion in 2025. This geographical diversification reflects both efforts to mitigate risk and adapt to changing global supply chain strategies.

Particularly noteworthy is Foxconn's planned $800 million investment in the Chinese chip company Tsinghua Unigroup. This investment demonstrates the continued willingness of Taiwanese companies to invest in Chinese technology companies when profitable business opportunities arise, despite political tensions. At the same time, it highlights the complex trade-offs between economic opportunities and geopolitical risks that Taiwanese companies face.

Our China expertise in business development, sales and marketing

Industry focus: B2B, digitalization (from AI to XR), mechanical engineering, logistics, renewable energies and industry

More about it here:

A topic hub with insights and expertise:

- Knowledge platform on the global and regional economy, innovation and industry-specific trends

- Collection of analyses, impulses and background information from our focus areas

- A place for expertise and information on current developments in business and technology

- Topic hub for companies that want to learn about markets, digitalization and industry innovations

Asymmetric dependence: Who pulls the economic strings?

Structural challenges and systemic risks

Sino-Taiwanese economic relations face a number of structural challenges that call into question both their stability and their future viability. These challenges arise from the unique constellation in which intensive economic interdependence coexists with fundamental political differences.

Asymmetric dependence represents one of the key challenges. While China is Taiwan's largest trading partner, Taiwan accounts for only a small share of China's foreign trade. This asymmetry gives China considerable leverage, which is increasingly being used for political purposes. The partial suspension of the ECFA benefits in 2024 is just one example of this instrumentalization of economic relations.

This technological dependence poses particular risks for both sides. China is fundamentally dependent on Taiwan's semiconductor industry, particularly on cutting-edge chips, which account for approximately 90 percent of global production. At the same time, Taiwan needs Chinese raw materials and intermediate products for its export industry. This mutual technological dependence creates both incentives for stability and the potential for blackmail.

Another structural problem lies in the increasing politicization of economic relations. While bilateral trade and investment flows were once primarily determined by economic considerations, these are increasingly being overshadowed by geopolitical considerations. This leads to uncertainty for companies and can impair the efficiency of economic cooperation in the long term.

Demographic developments in both societies pose additional challenges. Taiwan is facing a rapidly aging population, leading to a shortage of skilled workers and problems with economic adjustment. China, in turn, is in a phase of economic transition, facing challenges such as a weakening real estate market, high youth unemployment, and declining foreign investment.

The external dimension of the challenges is exacerbated by the growing geopolitical tensions between the US and China. Taiwanese companies are increasingly forced to choose sides, complicating their traditional strategy of acting as an economic bridge. US export restrictions on semiconductor technology to China are putting pressure on Taiwanese companies and forcing them to make costly adjustments to their business models.

Strategic realignment and future prospects

The future of Sino-Taiwanese economic relations will be significantly shaped by the strategic realignments of both sides. Taiwan is pursuing a dual strategy of selective decoupling and diversification, while China oscillates between economic incentives and political pressure.

Taiwan's "New Southbound Policy," implemented since 2016, aims to reduce its economic dependence on China through strengthened ties with 18 countries in South and Southeast Asia and Oceania. The successes of this policy are measurable: In 2022, Taiwan's total investments in the target countries of this policy exceeded investments in China for the first time. Exports to ASEAN countries rose to a record level of US$87.8 billion in 2024, underscoring the effectiveness of the diversification strategy.

The technological dimension of future relations will be crucial. Taiwan is investing heavily in research and development and attracted a record $805 million in foreign R&D investment in 2024. German companies such as Infineon, Zeiss, and SAP, as well as US firms such as Nvidia, AMD, and Amazon Web Services, have established R&D centers in Taiwan. This development strengthens Taiwan's position as a technology hub while reducing its dependence on individual markets.

China's strategy remains two-pronged: On the one hand, Beijing continues to rely on economic incentives and integration projects, while on the other, it increases political and military pressure. China continues to favor "peaceful reunification" and is investing in a two-pronged strategy that combines economic incentives with coercive elements. Examples of the economic side include plans to "deepen cross-strait innovation and development cooperation" and new government offices for work with Taiwan.

The medium-term forecasts for 2025 to 2027 are characterized by considerable uncertainty. On the one hand, economic fundamentals remain strong: Taiwan expects GDP growth between 1.6 and 3.6 percent for 2025, with this wide range reflecting uncertainty about the new US administration's trade policy. On the other hand, geopolitical tensions are escalating: Taiwan's government sees 2027 as a critical year for a possible Chinese attack, which could fundamentally impact economic relations.

The long-term outlook depends crucially on the ability of both sides to decouple economic cooperation from political conflict. While the economic incentives for continued cooperation remain strong, rising geopolitical tensions could overshadow this logic. A crucial factor will be the development of alternative trade and investment relationships that allow both sides to pursue their economic goals without excessive interdependence.

Synthesis and assessment of economic interdependence

The economic relations between China and Taiwan represent a unique phenomenon in the international economy: the combination of intense economic interdependence with fundamental political antagonism. This constellation has demonstrated remarkable stability over three decades, but faces increasing structural challenges.

The historic development from complete economic separation in the 1980s to a bilateral trade volume of over $200 billion illustrates the power of economic logic to overcome political barriers. Taiwanese investments of $203 billion between 1991 and 2022 not only contributed to the transformation of the Chinese economy but also created complex dependency structures that pose strategic dilemmas for both sides.

The current phase is characterized by a turning point: While the absolute size of economic relations remains impressive, clear trends toward diversification and risk minimization are emerging. Taiwan's successful implementation of the "New Southbound Policy" and the reduction of China's share of exports to its lowest level in 23 years signal a strategic realignment that goes beyond short-term political fluctuations.

The systematic analysis of the ECFA and Foxconn case studies reveals the complexity of adaptation processes: While institutional frameworks like the ECFA are subject to political fluctuations and can be instrumentalized, companies demonstrate remarkable flexibility in adapting to changing conditions. Foxconn's simultaneous expansion and diversification illustrates how economic actors respond pragmatically to geopolitical uncertainties.

The structural challenges—asymmetric dependencies, technological vulnerabilities, and increasing politicization—are real and are likely to intensify. Nevertheless, several factors argue for continued, albeit modified, economic cooperation: technological complementarity, the high costs of complete decoupling, and the existence of shared economic interests despite political differences.

The future of Sino-Taiwanese economic relations will be shaped less by a binary logic of rapprochement or separation than by a gradual process of rebalancing. While the relative importance of bilateral relations is likely to decline, they will remain significant in absolute terms. The challenge for both sides is to shape this rebalancing in a way that maintains economic efficiency without creating or reinforcing critical dependencies.

Ultimately, Sino-Taiwanese economic relations illustrate both the limits and the possibilities of economic diplomacy in an increasingly politicized world. They demonstrate that intensive economic interdependence does not automatically resolve political conflicts, but can certainly create incentives for stability and make escalations more costly. The trick lies in understanding and exploiting these dynamics without harboring naive expectations about the autonomous power of economic relations.

Your global marketing and business development partner

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development / Marketing / PR / Trade Fairs

B2B support and SaaS for SEO and GEO (AI search) combined: The all-in-one solution for B2B companies

B2B support and SaaS for SEO and GEO (AI search) combined: The all-in-one solution for B2B companies - Image: Xpert.Digital

AI search changes everything: How this SaaS solution is revolutionizing your B2B rankings forever.

The digital landscape for B2B companies is undergoing rapid change. Driven by artificial intelligence, the rules of online visibility are being rewritten. It has always been a challenge for companies to not only be visible in the digital masses, but also to be relevant to the right decision-makers. Traditional SEO strategies and local presence management (geomarketing) are complex, time-consuming, and often a battle against constantly changing algorithms and intense competition.

But what if there were a solution that not only simplifies this process, but makes it smarter, more predictive, and far more effective? This is where the combination of specialized B2B support with a powerful SaaS (Software as a Service) platform, specifically designed for the needs of SEO and GEO in the age of AI search, comes into play.

This new generation of tools no longer relies solely on manual keyword analysis and backlink strategies. Instead, it leverages artificial intelligence to more precisely understand search intent, automatically optimize local ranking factors, and conduct real-time competitive analysis. The result is a proactive, data-driven strategy that gives B2B companies a decisive advantage: They are not only found, but perceived as the authoritative authority in their niche and location.

Here's the symbiosis of B2B support and AI-powered SaaS technology that is transforming SEO and GEO marketing and how your company can benefit from it to grow sustainably in the digital space.

More about it here: