Is "Made in Germany" coming to an end? Why nothing fits together in this country anymore – How Germany lost its implementation competence

Xpert pre-release

Language selection 📢

Published on: December 29, 2025 / Updated on: December 29, 2025 – Author: Konrad Wolfenstein

Is "Made in Germany" coming to an end? Why nothing fits together in this country anymore – How Germany lost its implementation expertise – Image: Xpert.Digital

Germany's structural economic crisis: When intermediaries replace infrastructure

Germany is in a crisis of confidence: when service contracts replace the solution and administration stifles craftsmanship.

It's a creeping feeling that's taking hold of many citizens and business owners: nothing in Germany "fits" anymore. What was once considered operational excellence and the reliable promise of "Made in Germany" is increasingly giving way to a frustrating reality of waiting lists, unavailable spare parts, and bureaucratic hurdles. But this isn't just a collection of isolated incidents—it's the symptom of a profound systemic shift.

Intermediaries are facilitators who stand between actors and organize exchanges—in doing so, they often gain power, data, and control over access. They can distort markets (fees, preferential treatment), create dependencies, and, as gatekeepers, decide what becomes visible or possible. Their interests are not always transparent and can conflict with those of the participants. In short, while they facilitate transactions, they simultaneously create dependency, costs, and a concentration of influence.

🌐 Economy

Intermediaries (e.g., platforms, banks, brokers) facilitate transactions—but often control access to markets. They collect fees, gather data, sometimes favor their own offerings, and can create dependency among providers. This leads to efficiency—but also to a concentration of power and a lack of transparency.

📰 Media

Media intermediaries (e.g., publishers, search engines, social networks) filter information and decide what becomes visible. This organizes diversity—but can distort debates, algorithms favor sensationalism, and disinformation spreads faster. Gatekeeping and profit motives influence public opinion.

🏛 Politics

Political intermediaries (parties, interest groups, lobby groups) structure participation—but they also channel interests and can give privileged actors more influence. Citizen engagement is only partially achieved; negotiating power and access are unequally distributed.

The following article unflinchingly analyzes how the German economy has undergone structural change: away from pragmatic "doer-centric" thinking, towards an economy of intermediaries where problems are not solved, but rather converted into lucrative service subscriptions and consulting hours. Using concrete examples – from a broken Viessmann heating system and heat pump in winter to a defective dryer – it demonstrates how the former implementation competence has eroded due to incentive distortions and lock-in models.

We look behind the facade of an economy paralyzed by record tax burdens and rampant bureaucracy, while a shortage of skilled workers is drying up the trades. It's a reckoning with a system that mistakes customer loyalty for restrictive contracts and prioritizes administration over value creation – and a warning about what happens when an industrialized nation forgets how to get things done simply.

The subscription trap: Why service contracts are displacing genuine craftsmanship – Implementation expertise is disappearing and subscription systems are ruling

Germany is undergoing a profound economic transformation that is not immediately apparent in macroeconomic figures but is palpable in the everyday reality of businesses and citizens. The German economy has gradually shifted from a system of value creation based on operational excellence to one dominated by intermediaries, service contract schemes, and lock-in models. This is not the result of conscious decisions but rather the logical consequence of incentive distortions, regulatory burdens, and a fundamental shift in who earns and who works.

The central phenomenon can be described with a precise analogy: Just as at a modern gas station, where profits no longer come from the core business – the actual refueling – but from ancillary sales – snacks, drinks, and impulse purchases – the German economy has also restructured itself. The key functions, which are critical both socially and economically, are no longer the vital lifeblood of the infrastructure economy. Instead, distractions and surrounding noise dominate, noise that could easily be dispensed with. This is not merely a phenomenon of individual sectors, but a systemic problem that has affected the entire economic ecosystem.

Suitable for:

- The consulting industry's involvement in the multi-billion-euro project: How Stuttgart 21 became a money-printing machine and a source of sustained profitability for consultants.

The erosion of implementation competence

Implementation competence is what actually makes things work. It's a tradesperson's ability to quickly diagnose and fix a problem. It's an engineer's ability to solve a problem without first going through a four-week consulting process. It's a company's willingness to deliver quickly and then quickly make improvements if something doesn't work. Implementation competence has become increasingly scarce in Germany, and this is due to systemic reasons.

The problem begins with economic incentives. Countries and companies no longer primarily earn money through effective implementation. They earn money through structural dependencies, service contracts, consulting fees, and managing these dependencies. A German company with high consulting expertise and significant lock-in effects is a successful business model—as long as it doesn't lose its clients entirely. The traditional tradesperson who quickly repairs something and then disappears leaves less of a mark on the company's profit margins. Consulting that operates on a subscription basis and binds the client permanently is significantly more lucrative.

This is particularly evident in the data for the service sector. B2B companies that have significantly increased their service focus regularly achieve margins of 35 to 50 percent in the maintenance, repair, and complementary services business. This is a tremendous incentive to expand the service business beyond the product business. A five percent decrease in the churn rate of an existing customer increases the company's profitability by up to 25 percent. This is a very powerful economic force that pushes toward customer retention rather than just customer satisfaction.

But this structure has a catch. It only works as long as the customer is still there. It doesn't work if the customer is so dissatisfied with the service quality that they switch providers, or if a competitor with genuine implementation expertise emerges. This is precisely what is currently happening in Germany. Chinese and American companies, operating at a higher speed and lower costs, are continuously eroding Germany's market share. Germany's global market share has been steadily declining. The country has been under pressure in global competition for over a decade, and this is no accident.

The lack of trust in practice

The scenario experienced with the Viessmann heating system is not an anecdotal one. It's a symptomatic case that exposes the structural problems of this economy. The oil heating system was getting old. Everything was planned and prepared well in advance. Tradespeople promised to complete the conversion to a heat pump in October. No problem at all. The conversion would only take a few days, they said. In reality, the conversion is now dragging on until the beginning of February. In the old days of Germany, something like this would have been unthinkable. Tradespeople's promises?

Now, just before the New Year, the worst-case scenario has happened. The heating system has stopped working. It keeps breaking down. It's a Viessmann heating system. Quality. Made in Germany. Countless service providers are listed online, thousands of them, promising to help. Eighty percent are unreachable because they're closed for the holidays until January 7th. The few providers you can reach brush you off on the phone: you're not a contracted customer. Viessmann heating system. Quality. Made in Germany. Was that really a thing?

Why not a contract customer? It's a vicious cycle. First, a heat pump should have been installed long ago, which would have included a service contract. Second, it's an old heating system, and during consultations, heating engineers initially wanted to install a new system only to then immediately offer a service contract. Is a service contract really necessary if the system is new and should run without problems for the next few years? Or is a service contract needed so the service provider can make a quick buck?

That's the crucial question. Is it about rip-offs or service? Is it about customer loyalty through trust or contractual constraints through dependency? That's the point: nothing fits together anymore in this country.

A second example illustrates the same problem. A clothes dryer in a five-person household. Purchased a year ago, now broken. A technician came out. He couldn't do anything because, in addition to the heating element, the module was also affected and defective. Delivery time for the replacement module? Six weeks. The family had to actively inquire with the retailer about the status of the replacement. They were informed that the manufacturer, Daewoo, had initiated expedited delivery of the replacement part. It would arrive next week. Can you believe that? Actually, no. Two weeks later, they complained again. This is a five-person household that didn't buy the dryer as a display piece for an art exhibition. Now they were told that they couldn't do anything themselves and that the family should contact them again on December 31st if nothing had happened by then. Who can guess? Nothing further will happen until after January 7th, as everyone is still on holiday. And then the lottery starts all over again.

So the honest question is: What's the point of service contracts when there's a two-year warranty? If, in the end, everyone just does what they interpret their contracts to mean? If nothing fits anymore? If only salespeople and optimizers dominate the market, leaving doers and problem solvers behind? The wrong priorities have been set. The problem with customer retention isn't a lack of competence. It's inherent in the system itself. When only contract customers are given priority, a mechanism is created in which those who need help most urgently are automatically left behind. This isn't a flaw in the system. This is the system. The incentive isn't to satisfy the customer. The incentive is to force them into a service contract.

Bureaucracy as a competitive weapon of the status quo

Bureaucracy is not just a bothersome administrative problem. It is an economic mechanism that imposes costs on functioning businesses and protects established companies with existing compliance infrastructure. This is particularly pronounced in Germany.

According to conservative estimates, the direct costs of bureaucracy amount to around €65 billion per year. If indirect effects – lost growth opportunities, stifling innovation – are taken into account, the total burden rises to as much as €146 billion per year. This is not a marginal inconvenience. This is a structural paralyzing factor.

What is particularly problematic is that these burdens disproportionately affect small and medium-sized enterprises (SMEs). Around 80 percent of businesses report that their bureaucratic costs have increased in the last three years. Over half report declining productivity. This is not cyclical; it is structural.

The problems arise from a collection of EU regulations (which Germany often implements even more strictly) and tightened national laws – in the areas of data protection, supply chain due diligence, labor law, and sustainability. Each one makes sense for some purpose. Collectively, they create a labyrinth that paralyzes small businesses and favors large corporations with dedicated compliance departments. A startup with five employees cannot afford five compliance officers. An established large corporation already has them.

Tax law is also one of the most complex in the world. E-invoicing requirements, expanded auditing standards, and reporting obligations all divert company resources into administration rather than value creation. A medium-sized company operating and aiming for growth in Germany is wasting valuable time on paperwork.

This is what is meant when people say that rip-offs and service are no longer distinguishable. A consulting firm that explains new regulations and sets up compliance processes makes enormous money—not because it creates real value, but because it helps navigate regulatory complexity. This isn't useless, but it's not the kind of value creation that moves an economy forward. It's defensive value creation.

Our EU and Germany expertise in business development, sales and marketing

Industry focus: B2B, digitalization (from AI to XR), mechanical engineering, logistics, renewable energies and industry

More about it here:

A topic hub with insights and expertise:

- Knowledge platform on the global and regional economy, innovation and industry-specific trends

- Collection of analyses, impulses and background information from our focus areas

- A place for expertise and information on current developments in business and technology

- Topic hub for companies that want to learn about markets, digitalization and industry innovations

52.6 percent taxes: How the German state is paralyzing its own economy – The end of "Made in Germany" – A breach of trust with fatal consequences

The skilled worker shortage and the crafts disaster

Germany is losing a critical pillar of its economy: the skilled trades. This is not due to a lack of demand, but rather a lack of supply. Nationwide, the skilled trades are short 113,000 workers. A third of all skilled trades are currently experiencing a shortage. The situation is particularly dire in the electrical construction sector (18,300 skilled workers missing), automotive engineering (16,300), and plumbing, heating, and air conditioning (12,200).

The problem isn't a lack of apprenticeships. The percentage of unfilled apprenticeships in the skilled trades was 38 percent – significantly higher than in industry and commerce (31 percent). Demand exceeds supply, and this situation will worsen. Demographic trends mean that older business owners are becoming more common, while there is a shortage of young people entering the profession.

This has consequences. Businesses are having to cancel orders. Around 40 percent of the affected SMEs consider it likely that they will be able to accept fewer orders in the future. Around 30 percent are planning to reduce production, opening hours, or accessibility. In other words, the skilled trades are withdrawing.

Why did this happen? First, skilled trades are demanding. They lack prestige in a knowledge-based society. Second, skilled trades are under extreme pressure. Energy costs have risen dramatically due to the Ukraine crisis. The tax burden is high. Bureaucracy is oppressive. Today, a young person must not only be skilled in their craft but also manage the administrative apparatus – data protection, accounting, reporting requirements, compliance. That is no longer an attractive value proposition.

Thirdly: Without skilled workers, craft businesses cannot work quickly and reliably. This is precisely the implementation competence that Germany lacks. An electrician with a thousand jobs on the back burner won't be fast. A craft business that is understaffed becomes slower, more expensive, and less reliable. And in a global competition where speed and reliability are crucial, this is a fatal handicap.

Suitable for:

The energy load and tax burden

Germany is one of the countries with the highest overall tax and social security burden. The income tax burden ratio was 52.6 percent in 2024 – more than half of gross income goes to taxes and social security contributions. This is a crippling burden for a country that needs growth.

The energy burden is particularly severe. Following the Russian invasion of Ukraine, energy prices rose dramatically. While they have since fallen somewhat, they are still significantly higher than before. An energy-intensive company in Germany pays not only for the energy itself, but also taxes and levies on it. The energy tax, CO2 levies, and other charges make electricity considerably more expensive for German producers than for their competitors in the USA, France, or Asia.

This is not just a burden for large industrial companies. It is also a burden for craft businesses that need heating, for services that rely on energy. It is a permanent competitive disadvantage.

As mentioned, retrofitting with heat pumps is both modern and necessary. However, if the public and private infrastructure for rapid implementation is lacking, even this modern decision can turn into a nightmare. A conversion that should take only a few days drags on for months. The reason is not sabotage, but rather structural capacity bottlenecks coupled with a lack of coordination.

The continuous loss of market share

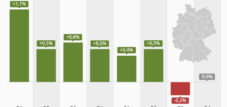

All of this is not happening in a vacuum. Germany is continuously losing market share in global competition. This is not a short-term weakness; it is a decades-long trend. Germany is losing ground worldwide in almost every sector. The most significant driver is the automotive industry, which is under extreme pressure because it was too late in adopting key future trends – alternative drive systems.

This is coupled with high production costs, dependence on international supply chains, and limited flexibility in digital business models. US and Asian suppliers are significantly more dynamic. They can react more quickly to new technologies, new markets, and new business models. Germany, burdened by bureaucracy, a shortage of skilled workers, and established incumbent structures, cannot keep pace.

This is particularly dramatic in semiconductor and computer technology, where Germany is already weak. It is also dramatic in sectors where Germany should still be known: high-quality mechanical engineering, automotive components, and specialty chemicals. In these sectors, Germany is losing market share to China, the USA, and South Korea.

At the same time, Germany has failed to develop a new pillar on which to rely. The German financial sector is weak. German tech companies are globally insignificant. The German biotech sector is small. What remains is engineering excellence – and this is being eroded by higher costs, bureaucracy, and a shortage of skilled workers.

The core trust deficit

The deeper problem isn't technical. It's psychological and structural. It's a lack of trust. If a German buys a product and it breaks, they should be able to expect it to be repaired quickly and easily. Historically, that has been the promise of "Made in Germany": quality that lasts.

Today, this promise has been broken. Instead, a customer is offered a service contract – not because it's necessary, but because this is the new business model. They are strung along, passed back and forth between the installer and the manufacturer, confronted with (increasingly frequent) shutdown dates, confused by the complexity, ultimately frustrated, and give up.

This is a symptom of an economy that no longer trusts itself. It doesn't trust that quick repairs are profitable. It doesn't trust that customer satisfaction is profitable in the long run. It doesn't trust that tradespeople can work quickly and reliably. So it builds structures that turn all of this on its head.

The same phenomenon can be observed in several other areas. Insurance companies, telecommunications providers, banks – they have all transformed themselves into lock-in models. Switching providers is deliberately made difficult, not because a new provider wouldn't be better, but because the established structure has designed it that way. This isn't innovation. This is an attempt to replace competition with bureaucracy.

Suitable for:

The systemic problem

This is what's meant when people say: Nothing works in this country anymore. It's not that individual products are bad. The Viessmann heating system, when it works, is a good heating system. The Daewoo tumble dryer, when it's running, is a usable appliance. The problem is that the surrounding systems aren't working.

And this problem is systemic. It doesn't arise from malicious intent. It arises from flawed rational incentives. If companies can profit through lock-in and customer loyalty rather than genuine performance, they will. If bureaucracy makes it easier for large, established companies to survive while strangling small, agile ones, the large ones will survive and the small ones will disappear. If the skills shortage is widespread, working conditions for the remaining skilled workers will improve—but overall quality will decline because less quality is available.

This cannot be remedied by isolated regulations. This cannot be solved by isolated corporate reforms. This requires a systemic realignment.

The necessary priorities

What will it take to find a way out of this impasse? Four fundamental things are necessary.

Firstly, bureaucracy must not be marginally reduced, but radically simplified

A 25 percent reduction, as currently planned, is a drop in the ocean. A reduction of 50 percent or more is needed. This cannot be achieved through individual deregulation laws. A fundamental reorientation is required. Which regulations are truly necessary? Which are historical artifacts? Which can be replaced by market mechanisms? This must be systematically examined.

Secondly, the tax burden and energy burden must be significantly reduced

A country that takes 52 percent of income in taxes and levies will find it difficult to be dynamic. In particular, the corporate tax burden—which in Germany is almost 30 percent—must be reduced to an internationally competitive level of 25 percent or below. The energy burden must be reduced through a massive expansion of renewable energies.

Thirdly, trust in genuine implementation competence must be restored

This means: Transparent service quality instead of hidden lock-in. It means: Rapid problem resolution instead of dragging out time. It means: Rating systems that measure genuine customer satisfaction instead of hidden retention. It also means: Legal consequences for companies that systematically obstruct customer complaint processes.

Fourthly, skilled trades must be made attractive again

This means better pay, but also better working conditions and higher social standing. It means that the state actively regulates the skilled trades apprenticeship market – for example, through subsidies for training companies. It also means that regulations must not disproportionately burden small and craft businesses.

These are not radical measures. These are the measures that a functioning industrialized nation would take if it wanted to preserve itself.

Trust as a foundation

The bigger problem is trust-based. Germany was built on one idea: if we make high-quality products, if we are reliable, if we react quickly, then we will be successful. This was a functioning business model for much of Germany's post-war history.

Today, this model has eroded. The costs of high quality and reliability have increased due to bureaucracy, taxes, and energy. The skilled workers who make this possible are scarce. Competition from countries with lower costs and new energy sources is brutal. And worse still: German companies themselves have stopped believing in this model.

Instead, they have moved towards models that undermine trust: lock-in, complexity, customer loyalty instead of customer satisfaction. This is understandable from a business perspective. Psychologically and strategically, it is self-destructive. Because it erodes trust, which is the only sustainable source of competitive advantage.

The path back to a functioning economy doesn't lead through more consulting, more contracts, or more bureaucracy. It leads through restoring genuine trust, genuine performance, and genuine implementation skills. This requires unpopular decisions: reducing regulations, cutting taxes, and lowering energy costs. It also requires established players to abandon their defensive positions and return to genuine competition.

The question for Germany is not technical. The question is: Does the country want to sweep away the misguided practices of the 1950s (consulting, contracts, administration) and return to genuine craftsmanship, real implementation, and real performance? Or will it accept the slow decline while competitors with energy and low-cost advantages overtake it? The answer must be radical. The half-hearted reforms of the past have not worked. A complete realignment is necessary.

Your global marketing and business development partner

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development / Marketing / PR / Trade Fairs

🎯🎯🎯 Benefit from Xpert.Digital's extensive, five-fold expertise in a comprehensive service package | BD, R&D, XR, PR & Digital Visibility Optimization

Benefit from Xpert.Digital's extensive, fivefold expertise in a comprehensive service package | R&D, XR, PR & Digital Visibility Optimization - Image: Xpert.Digital

Xpert.Digital has in-depth knowledge of various industries. This allows us to develop tailor-made strategies that are tailored precisely to the requirements and challenges of your specific market segment. By continually analyzing market trends and following industry developments, we can act with foresight and offer innovative solutions. Through the combination of experience and knowledge, we generate added value and give our customers a decisive competitive advantage.

More about it here: