The banks' negative interest rate strategy continues

Language selection 📢

Published on: October 24, 2021 / Updated on: October 24, 2021 – Author: Konrad Wolfenstein

Update – October 24, 2021: At the end of the third quarter, a total of 392 credit institutions their retail customers negative interest rates. Of these, over 200 banks and savings banks introduced negative interest rates this year. Furthermore, an increasing number of financial institutions are tightening their existing negative interest rate policies by reducing tax-free allowances or pushing the interest rate even further into negative territory. This is shown by a Verivox analysis of approximately 1,300 banks.

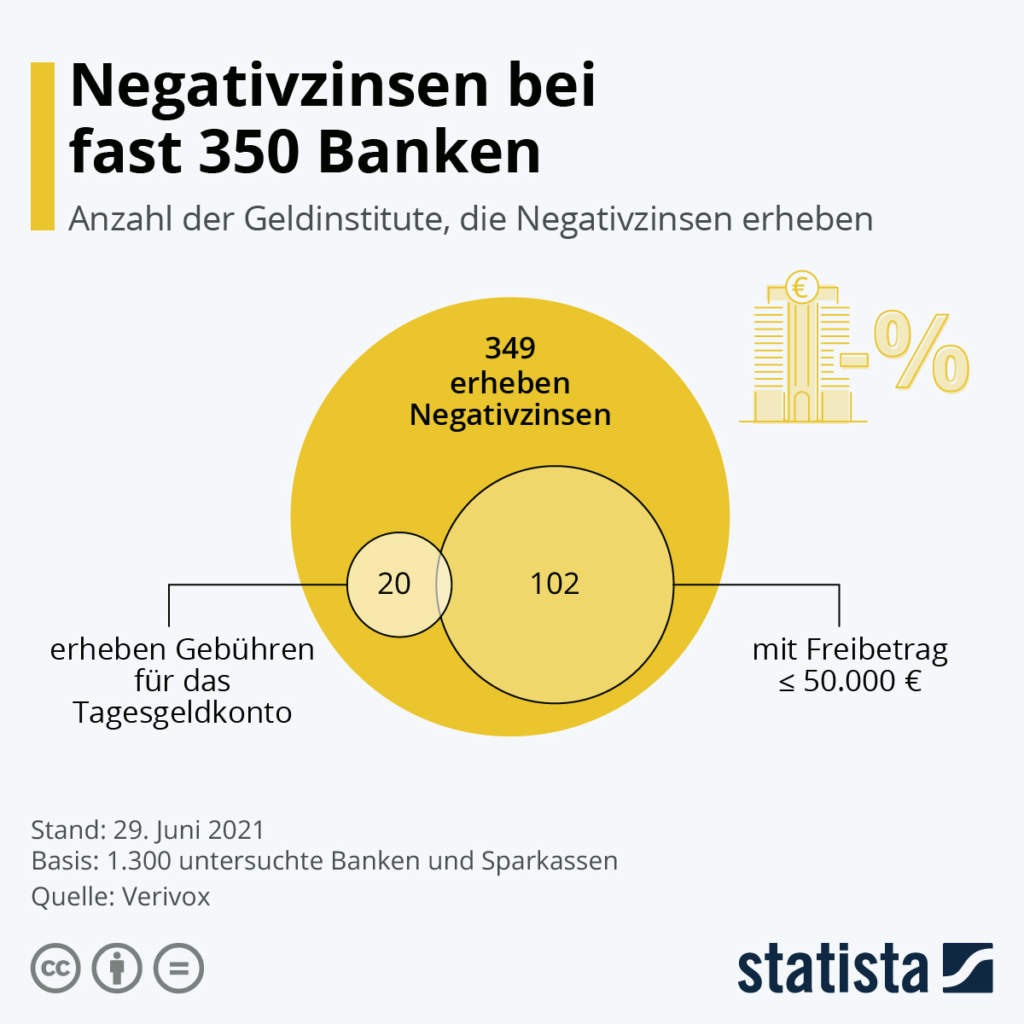

Penalty interest rates for larger sums of money in current accounts are becoming increasingly common practice at banks in Germany. According to a study by the comparison portal Verivox around 349 – an increase of 171 compared to the previous year. An analysis of the price lists published online by approximately 1,300 banks and savings banks reveals that the tax-free allowance is below €50,000 at about 102 banks – a few even have a limit of just €25,000. Also annoying for bank customers: in about 30 cases, fees are charged on the usually free savings account, as the graphic shows.

The situation will likely continue to worsen in the future. The trigger for this development is the monetary policy of the European Central Bank (ECB). Since commercial banks currently have to pay 0.5 percent interest on excess funds deposited with the ECB, the resulting costs are, in a broader sense, passed on to bank customers.

Negative interest rates are already in place at almost 400 banks – many institutions are pushing interest rates and tax-free allowances even lower

At the end of the third quarter, a total of 392 credit institutions were charging their retail customers negative interest rates. Of these, over 200 banks and savings banks introduced negative interest rates this year. Furthermore, an increasing number of financial institutions are tightening their existing negative interest rate policies by reducing tax-free allowances or pushing the interest rate even further into negative territory. This is shown by a Verivox analysis of approximately 1,300 banks.

No end to the negative interest rate trend in sight

Of the banks analyzed, 392 currently charge negative interest rates on balances in private savings, checking, or current accounts. That's 214 more than at the beginning of the year. The number has increased by 43 banks in the last three months; at the end of June, 349 financial institutions were charging negative interest rates.

“We are still seeing strong momentum with negative interest rates, but while new banks were introducing custody fees almost daily in the first half of the year, this development has slowed somewhat at the moment,” says Oliver Maier, Managing Director of Verivox Finanzvergleich GmbH. “However, an end to the negative interest rate trend is not in sight.”

Many banks are tightening their terms and conditions

On the contrary: More and more banks are tightening their existing negative interest rate conditions. They are either lowering the interest rate even further into negative territory or reducing the exemption limits, so that negative interest rates apply to even smaller balances. In the third quarter alone, 30 banks further tightened their existing negative interest rate regulations – 68 institutions have done so so far this year.

For its analysis, Verivox continuously evaluates the terms and conditions displayed on the websites of approximately 1,300 banks and savings banks. "However, not all banks publish negative interest rates transparently and freely on their websites," explains Oliver Maier. "There is therefore a significant number of unreported cases, and in reality, considerably more than 392 banks are likely charging negative interest rates."

Small and medium-sized accounts are also affected

For a long time, only very wealthy savers had to pay negative interest rates. If banks charged custody fees at all, they almost always granted high exemptions of €100,000 or more. But this threshold has fallen. Now, at least 135 banks charge negative interest rates on total account balances of €50,000 or less. In some cases, negative interest rates are even charged on balances as low as €5,000 or €10,000.

Minus 0.5 percent – that's the penalty interest rate banks themselves pay on a portion of their excess deposits parked with the European Central Bank. Most institutions in the Verivox analysis base their custody fees on this rate. Thirteen banks go even further with their negative interest rates, charging their customers penalty interest of 0.55 to 1 percent.

Fees for overnight money accounts: Negative interest rates through the back door

Negative interest rates are not always explicitly stated as such. A total of 21 banks and savings banks charge a fee for their normally free savings accounts. From the customer's perspective, this effectively results in negative interest rates. The money in the account decreases, even if the bank advertises an interest rate of 0.00 or 0.01 percent. Eleven of these 21 banks don't stop at the fee; they also charge nominally negative interest.

Negative interest rates are not a law of nature

Important for savers: Credit institutions cannot unilaterally introduce negative interest rates in existing contracts. Therefore, upon publication in the price list, the custody fees initially only apply to new customers. If a bank wants to charge its existing customers negative interest rates as well, it must reach an individual agreement with them.

In this case, consumers can either spread their money across several banks so that they remain below the tax-free allowances, or they can look for offers without negative interest rates. "Due to the ongoing low-interest-rate policy, credit institutions are in a difficult position, but negative interest rates are not inevitable," says Oliver Maier. "Market comparisons show that it is possible to manage without custody fees." Top banks based in other European countries are currently paying depositors up to 0.3 percent interest on overnight deposits. Providers with German deposit protection offer up to 0.11 percent. Those who invest their money for a fixed term of two years can earn over 1 percent interest.

Xpert.Digital – Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital – www.xpert.solar – www.xpert.plus