Startup funding sources 2023 – The financing of startups in Germany developed positively in 2024

Language selection 📢

Published on: October 1, 2024 / Updated on: October 1, 2024 – Author: Konrad Wolfenstein

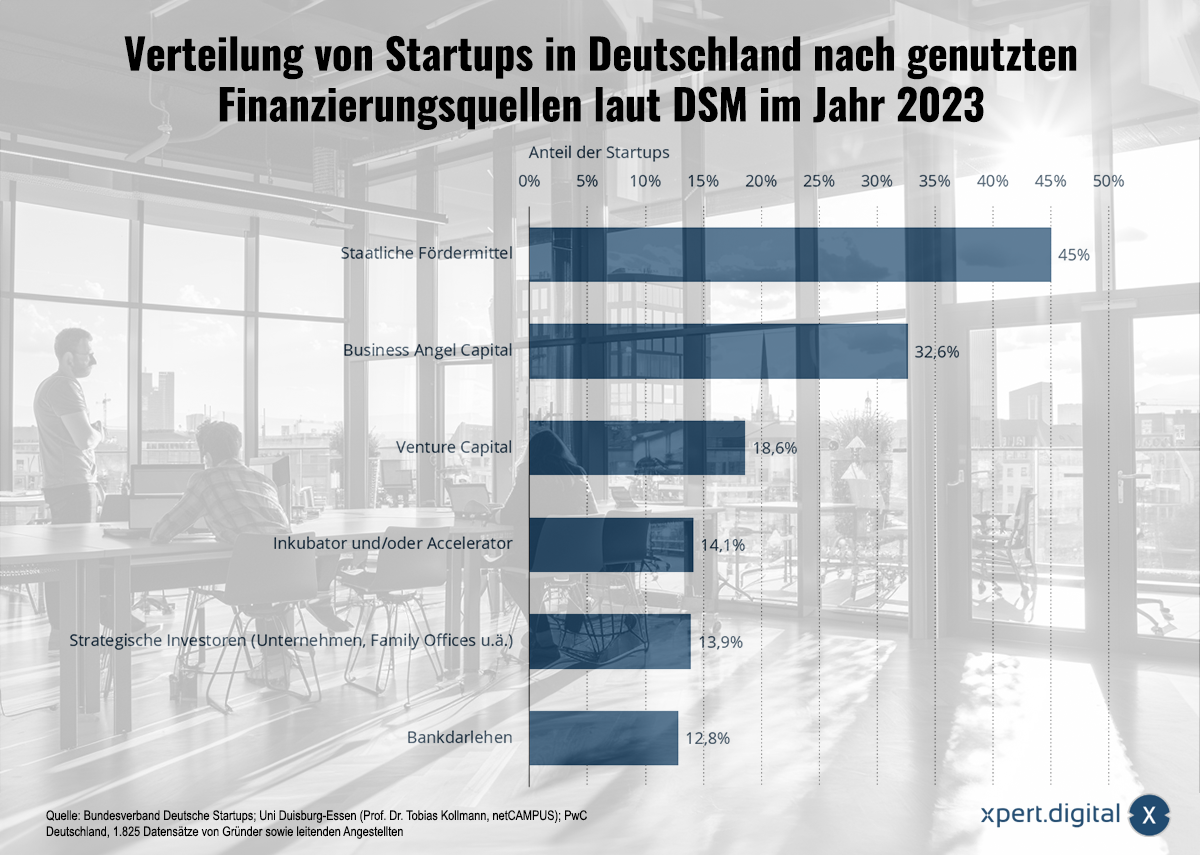

Startup funding sources 2023 – Funding for startups in Germany developed positively in 2024 – Image: Xpert.Digital

🚀💡📊 The financing of start-ups in Germany developed positively in 2024

📈✨ Startup funding in Germany developed positively in 2024, although challenges remain. Here are the key aspects of the current situation:

📈 Investment volume and trends

In the first half of 2024, the volume of venture capital investments in German start-ups rose by 12% to a total of €3.4 billion compared to the same period of the previous year. This marks a turnaround after a decline in 2022 and 2023.

Despite the increase in investment volume, the number of financing rounds decreased by 19%, indicating a focus on larger deals.

Particularly noteworthy is the increase in investments in start-ups from North Rhine-Westphalia, which received significantly more capital in the first half of 2024 (822 million euros) than in the previous year.

💼 Government initiatives and support

The German government has launched several initiatives to support start-ups, including the WIN initiative, which envisages investments of at least 12 billion euros in venture capital by 2030.

The Future Fund will provide ten billion euros for investments by the end of 2030 to strengthen venture capital financing.

The High-Tech Gründerfonds (HTGF) Opportunity was launched in June 2024 with a volume of 660 million euros to support growth financing.

⚠️Challenges

Despite the positive developments, financing remains a key challenge for start-ups, especially during the growth phase.

The venture capital market in Germany is smaller compared to other countries, which continues to be an obstacle.

Overall, there is a positive trend in the financing of start-ups in Germany, supported by government initiatives and a recovery in the venture capital market. Nevertheless, securing sufficient funding remains a challenge, especially for smaller and medium-sized financing rounds.

📣 Similar topics

- 💡 Venture capital market recovery: causes and effects

- 📈 Growth of venture capital investments in German start-ups in 2024

- 🎯 Focus on bigger deals: Analysis of current investment trends

- 🏅 Investments in North Rhine-Westphalia's start-ups: A look at the figures

- 💼 Government initiatives: Support for German start-ups until 2030

- 🔍 The Future Fund: Potential and prospects for venture capital

- 🚀 The High-Tech Gründerfonds (HTGF) Opportunity: New ways of financing growth

- ⚠️ Challenges of start-up financing during the growth phase

- 🌍 Germany in international comparison: The venture capital market

- 🔧 Solutions for financing small and medium-sized financing rounds

#️⃣ Hashtags: #Startups2024 #VentureCapital #GovernmentInitiatives #GrowthFinancing #Germany

💡🚀 Germany's Startup Funding 2023: Diverse Sources of Growth

🚀💡📊 The German startup market in 2023 is more diversified than ever in terms of financing options. This variety of financing methods reflects not only the growing need for capital among young companies, but also the structural support provided by various stakeholders. Both government funding and private investors, from business angels to strategic investors, play a key role in the development of the startup landscape in Germany.

1️⃣💰 Government funding as a central pillar of financing

With 45% of startups utilizing government funding as a source of financing, these programs are clearly at the heart of startup financing in Germany. Government funding programs, such as those offered by the KfW (German Development Bank) or regional development banks, provide startups with grants, loans, or other forms of support. These programs are designed to promote innovation and reduce entrepreneurial risk, particularly in the early stages when startups often struggle to attract private investors.

Another advantage of government funding is its broad availability across a wide range of industries. Technological innovations, sustainability projects, and startups in the field of digitalization particularly benefit from these programs. Funding often has the advantage of being more affordable than private investments and, in some cases, does not need to be repaid, thus reducing the risk for startups. Furthermore, government programs also offer coaching, consulting, and networking opportunities, going far beyond mere financing.

2️⃣👼 Business Angels: Private investors with a strategic function

Around 32.6% of startups in Germany rely on business angel funding. Business angels are typically wealthy individuals who contribute not only capital but also their expertise and networks to a company. They can be crucial, especially in the early stages of a startup, when products and services are not yet fully established in the market. Their investments are often more flexible than those of traditional venture capital funds, and they are willing to take on greater risks to support innovative business ideas.

The role of business angels extends far beyond providing capital. They offer mentoring and strategic advice and are often long-term partners of startups. Their close relationship with the company and their deep understanding of the industry allow them to provide valuable guidance and open doors to other investors or business partners. For many startups, business angels serve as the bridge between the founding phase and later funding rounds, whether from venture capital or strategic investors.

3️⃣📈 Venture Capital: Growth through institutional capital

With 18.6% of startups utilizing venture capital (VC), this form of financing remains a crucial pillar of the German startup ecosystem. VC funds primarily invest in startups with high growth potential. Unlike business angels, venture capitalists contribute larger sums and often have stricter requirements regarding a company's scalability and market size.

Venture capital funds typically expect a significant return within a specific timeframe and therefore play a crucial role in the internationalization and expansion of startups. They are particularly indispensable in technology-intensive sectors such as IT, biotechnology, and artificial intelligence. VC funds offer not only capital for growth but also strategic support, access to global networks, and expertise in scaling business models.

Venture capital (VC) funding is often used in the later stages of a startup, once the business model has been validated and the next stage of growth is being pursued. The relationship between the startup and the VC is often very close, as investors have a significant influence on strategic direction and operational decisions.

4️⃣🏠 Incubators and Accelerators: Support for young startups

With 14.1% of startups utilizing incubators or accelerators, these programs have become firmly established in the German startup ecosystem. Incubators often offer comprehensive support for very young companies still in the ideation or prototyping phase. They provide startups with space, infrastructure, and consulting services, and help them refine their business models and prepare for the market.

Accelerators, on the other hand, are designed to accelerate the growth of startups. They typically offer an intensive, time-limited program in which startups are specifically prepared for growth and market entry. In addition to financial support, accelerators often provide training, workshops, and access to networks and investors. Well-known accelerator programs in Germany include, for example, the TechFounders Accelerator and the Airbus BizLab.

These programs are particularly interesting for startups that want to benefit from experienced mentors and established companies. Incubators and accelerators often have a strong focus on specific industries or technologies, which allows participating startups to receive targeted support.

5️⃣🤝 Strategic Investors: Growth through Partnerships

Approximately 13.9% of startups in Germany had strategic investors on board in 2023. Strategic investors are typically larger companies that seek access to innovative technologies or business models through investments in startups. Unlike purely financially motivated investors, strategic investments often prioritize synergies and long-term collaboration.

One example of this are corporate venture capital (CVC) units, which are specifically designed to make strategic investments in innovative startups. Large corporations like Siemens, Bosch, or Deutsche Telekom have their own CVC units that specifically seek out startups that can complement their existing business or open up new markets.

This type of financing offers startups not only capital but also the opportunity to benefit from the resources, know-how, and networks of the strategic investor. However, it also carries the risk that a startup becomes too closely tied to the interests of the strategic investor and thereby loses its own flexibility and innovative capacity.

6️⃣🏦 Bank loans: Traditional financing remains relevant

Despite the multitude of modern financing methods, 12.8% of startups still rely on traditional bank loans. While this type of financing doesn't offer access to networks or strategic know-how, as is the case with business angels or venture capital, it has the advantage that the founders retain full control over their company.

Banks typically require collateral for their loans, making it more difficult for startups to access this source of financing, especially if they are not yet generating significant revenue. Nevertheless, bank loans can be a useful supplement for startups in later stages, either to cover short-term liquidity needs or to invest in further growth.

📊🔍 What is DSM?

The German Startup Monitor (DSM) is one of the most comprehensive and important studies, providing a detailed annual overview of the German startup landscape. Conducted by the German Startups Association (BVDS) in cooperation with other partners since 2013, the DSM offers current data and trends on a wide range of topics related to startups in Germany, including financing. The study regularly surveys thousands of startups, founders, and ecosystem stakeholders, delivering valuable insights into the challenges, opportunities, and developments within the sector.

The DSM's findings are equally relevant for politics, business, and academia, as they serve as a basis for decisions and measures to promote a startup culture. The monitor also highlights regional differences within Germany, analyzes entrepreneurial behavior in various sectors, and illustrates how the framework for startups in Germany has evolved over the years.

Startup financing in Germany is based on a wide range of options. Government funding, private investors, and strategic partnerships all play an important role. It is this diversity of financing opportunities that enables startups to grow flexibly and scalably, and that simultaneously makes the German startup ecosystem so dynamic and successful.

📣 Similar topics

- 📣 Diversified financing in Germany's startup market

- 📊 Government funding: The backbone of startup financing

- 👼 Business Angels: The strategic supporters

- 🚀 Venture Capital: Growth through large capital

- 🚅 Incubators and accelerators: Start-up support for young companies

- 🤝 Strategic Investors: Partnerships for Innovation

- 🏦 Bank loans: The traditional financing option

- 📈 DSM: The German Startup Monitor at a glance

- 🌍 Internationalization through Venture Capital

- 🧑🏫 Coaching and consulting through government programs

#️⃣ Hashtags: #StartupFinancing #BusinessAngels #VentureCapital #Incubators #StrategicInvestors

We are there for you - advice - planning - implementation - project management

☑️ Start-up and industry expert, here with its own Xpert.Digital industry hub with over 2,500 specialist articles

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital - Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital - www.xpert.solar - www.xpert.plus