DAIFUKU's sorting robot Robot S (SOTR-S) and the transformation of the European logistics landscape

Xpert pre-release

Language selection 📢

Published on: October 28, 2025 / Updated on: October 28, 2025 – Author: Konrad Wolfenstein

DAIFUKU's Robot S (SOTR-S) sorting robot and the transformation of the European logistics landscape – Image: Xpert.Digital

Staff shortages paralyze logistics: How this Japanese robot is set to change everything

A $15 billion market is exploding: This robot is reshuffling the cards in e-commerce

The European logistics industry is under massive pressure. The unstoppable advance of e-commerce, constantly rising customer expectations for delivery speed, and a structural labor shortage, particularly noticeable in key markets like Germany, are creating an environment in which automation is shifting from an option to a strategic necessity. In this highly dynamic scenario, the introduction of the Sorting Transfer Robot S (SOTR-S) by Japanese market leader Daifuku marks a decisive turning point. This development is more than just a product launch; it is a symptom of the profound transformation of an entire industry, whose market volume for warehouse automation in Europe is expected to grow from USD 5.46 billion in 2024 to a projected USD 15.35 billion by 2030. The SOTR-S exemplifies a new generation of logistics solutions that deliver answers to the industry's most pressing challenges with impressive speeds of up to 10,000 sortations per hour, revolutionary space efficiency, and modular scalability. The following analysis shows how Daifuku's technology not only optimizes individual warehouse processes, but also fundamentally redefines the competitive dynamics in the European logistics landscape and why investing in such systems determines the future viability of companies.

Suitable for:

- Daifuku and Bendix Commercial Vehicle Systems: A strategic partnership for the future of warehouse automation

When automation becomes a strategic necessity

Daifuku's introduction of the Sorting Transfer Robot S to the UK and European markets marks far more than just another product launch in the intralogistics industry. It represents a turning point in the fundamental reshaping of logistics value chains, driven by the relentless pressure of e-commerce, structural labor shortages, and intensified competitive dynamics. The economic significance of this development can only be understood when viewed in the context of a European warehouse automation market projected to grow from $5.46 billion in 2024 to $15.35 billion by 2030, a compound annual growth rate of 20.1 percent.

The structural transformation of the European logistics industry

The European logistics automation landscape is undergoing a phase of accelerated change, characterized by several intertwined megatrends. The e-commerce boom has radically changed expectations for delivery speed and accuracy. Germany, as the largest European market, already recorded revenues of €8.7 billion in warehouse automation in 2023, corresponding to 35 percent of the overall European market share. With an implementation rate of 72 percent, German logistics companies have significantly exceeded the European average of 54 percent, underscoring the strategic importance of automation as a competitive factor.

The UK e-commerce market, valued at $234.37 billion in 2024, is growing at a projected annual rate of 7.9 percent and is expected to reach $501.32 billion by 2034. This explosive expansion is putting enormous pressure on the fulfillment infrastructure. More than 30.7 percent of all UK retail sales will be generated online by 2025, meaning nearly a third of all transactions will need to pass through highly efficient sortation systems.

The European courier, express, and parcel market, which reached a volume of USD 94.62 billion in 2024 and is expected to grow to USD 118.50 billion by 2033, faces the challenge of managing exponentially increasing parcel volumes while simultaneously shrinking profit margins. The average annual growth rate of 2.41 percent in the CEP sector masks the true intensity of competition, as volumes are growing significantly faster than revenues, indicating significant pricing pressure.

Structural labor shortages are further exacerbating these trends. Germany recorded a difficulty rate of 82 percent in filling vacancies in 2024, among the highest in Europe. The transport and warehousing sector has been particularly hard hit, with the COVID-19 pandemic further exacerbating the situation by disrupting training and certification processes. This shortage not only drives up labor costs but also makes automation an existential necessity for companies that want to maintain their operational capability.

Daifuku's strategic market position and competitive dynamics

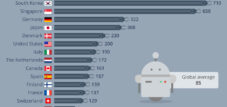

Daifuku has established itself as a global market leader in automated material handling, with revenue of 737.32 billion yen in 2024, an increase of 20.58 percent year-on-year. The company holds a global market share of over 14 percent in logistics automation, jointly with Dematic and Honeywell International. In Singapore, Daifuku has achieved a remarkable market share of 30 percent, demonstrating the company's ability to establish dominant positions in highly competitive markets.

The financial performance for the first half of 2025 underscores the strength of Daifuku's business model. With sales of 326.4 billion yen, an increase of 7.9 percent, and an operating profit of 51.1 billion yen, representing an increase of 34 percent, the company demonstrated impressive profitability development. The operating margin rose to 15.7 percent, an increase of 3.1 percentage points, indicating successful efficiency improvements and cost optimization.

The competitive landscape in the automation industry is characterized by intense rivalry between global corporations. In addition to Daifuku, companies such as Dematic, SSI Schaefer, Körber, and Swisslog compete for market share in a rapidly growing market. Differentiation is primarily achieved through technological innovation, system integration expertise, and the ability to offer scalable, modular solutions that can adapt to changing business requirements.

Daifuku's strategy is based on several pillars. The $35 million investment in doubling U.S. production capacity in 2024 aims to establish local manufacturing for local markets, shortening delivery times and reducing supply chain risks. The company's long-term vision of achieving sales of one trillion yen by 2030 requires continuous investment in research and development and strategic infrastructure investments.

Daifuku's Japanese heritage gives it specific competitive advantages. The Japanese manufacturing philosophy, based on Kaizen, continuous improvement, and zero-defect approaches, is deeply embedded in the company culture. The Toyota Production System, with just-in-time manufacturing and lean principles, has shaped the global manufacturing industry and is reflected in Daifuku's operational processes. This philosophy enables the company to deliver systems with exceptional reliability and quality, a decisive competitive advantage in an industry where downtime is extremely costly.

Technological architecture and economic implications of SOTR-S

The Sorting Transfer Robot S represents a significant technological innovation in the field of automated sorting systems. With a speed of up to 180 meters per minute and a capacity of 10,000 sorts per hour, the system is positioned in the high-performance segment of the market. The two-tier structure ensures smooth traffic flow and eliminates congestion, which often leads to throughput problems with conventional systems.

Space efficiency is a crucial economic factor. The SOTR-S requires less than half the floor space of conventional sorting systems, made possible by the narrow aisle structure achieved by tilting trays. In a market environment where warehouse real estate costs in London reach up to €323 per square meter per year, this space reduction represents a substantial cost advantage. In Germany, leasing costs range between €6 and €10 per square foot, while in the UK they range between £9 and £15 per square foot, with prime locations in the southeast of England reaching over £20.

The modularity and scalability of the system are critical design features that determine its long-term economic value. The ability to add vehicles and slides without major system disruption allows companies to gradually expand their capacity as business volume grows. This incremental scalability significantly reduces capital risk, as investments can be staggered and do not require large upfront expenditures.

The tilt-tray technology underlying the SOTR-S has established itself as one of the most reliable sorting solutions for heterogeneous product mixes. Tilt-tray sorters consist of trays mounted on movable carriages that tilt at the destination point, allowing products to slide by gravity onto the assigned chute. This technology can handle irregularly shaped products and a wide range of package sizes and weights, from small polybags to packages weighing up to 34 kilograms.

Integrating a barcode reader that automatically scans labels while operators simply place products onto the vehicle optimizes ergonomics and reduces cognitive load for staff. This simplification of operator interaction is critical for maintaining high productivity levels over longer shifts and contributes to reducing fatigue-related errors.

The charging stations enable rapid recharging of vehicles, maximizing uptime. The ability to maintain operations nearly 24 hours a day stands in stark contrast to manual labor-based systems limited by shift times, breaks, and human fatigue.

Economic return consideration and investment rationality

The economic justification for investing in high-performance sorting systems like the SOTR-S is based on several value-added dimensions. Labor costs typically represent 50 to 70 percent of total operating costs in modern warehouses. Automation can reduce these costs by 20 to 30 percent while increasing throughput capacity by two to five times.

A mid-sized e-commerce company investing $500,000 in a fulfillment automation system can expect annual benefits of $350,000, consisting of $200,000 in labor cost savings, $50,000 in error reduction, and $150,000 in increased capacity, less $50,000 in operating costs. This results in a payback period of approximately 1.43 years and an annual return on investment of 70 percent.

The typical payback period for warehouse automation is between two and three years, with most systems having a lifespan of more than a decade. According to McKinsey, companies that have implemented advanced automation technologies typically achieve payback within 18 to 36 months. This represents an attractive investment, especially considering that the systems generate value well beyond the payback period.

Robotic automation can reduce picking errors by up to 70 percent and increase inventory accuracy to over 99 percent. Manual data entry has an error rate of up to 4 percent, meaning four errors, such as incorrect item numbers or quantities, can occur in every 100 orders. The costs of these errors quickly add up through returns, reverse logistics, customer compensation, and reputational damage.

Amazon was able to reduce labor costs per unit by 20 percent through comprehensive warehouse automation. This cost advantage is amplified at high volumes and enables the company to maintain low prices while protecting profit margins. The strategic importance of this cost reduction cannot be overstated, as it gives Amazon a sustainable competitive advantage in a market characterized by intense price competition.

Beyond direct cost savings, automation generates significant indirect benefits. Reduced employee turnover, lower injury rates, and improved customer satisfaction all contribute to long-term value creation. In a labor market where warehouse workers are increasingly difficult to recruit and retain, automation reduces dependence on scarce human resources and allows remaining employees to be redirected to higher-value activities.

Calculating the total cost of ownership must consider both acquisition and ongoing lifecycle costs. While the initial investment can be significant, the long-term operating costs of automated systems are typically lower than those of manual alternatives. Energy-efficient motors, low-friction components, and intelligent energy management significantly reduce power consumption.

Market segmentation and application domains

The automated sorting systems market is clearly segmented by application, technology, and industry. The global automated sorting systems market was valued at $4.215 billion in 2024 and is expected to reach $5.737 billion by 2031. North America held the largest market share of over 40 percent in 2024, with $1.686 billion, while Europe had the second-largest share at 30 percent and $1.265 billion.

The e-commerce sector is the dominant driver for sorting system implementations. The need to sort heterogeneous product mixes quickly and accurately makes high-performance systems indispensable. German e-commerce packaging spending reached $3.99 billion in 2025, with an expected 14.03 percent compound annual growth rate through 2034, underscoring the intensity of parcel processing.

The retail sector uses sorting systems for omnichannel fulfillment, which requires managing inventory simultaneously for physical stores and online orders. This complexity requires flexible sorting solutions that can quickly switch between different operating modes. The Otto Group operates a €260 million fulfillment hub in Poland that processes 110 million parcels annually and serves both channels.

The CEP sector uses sorting systems to consolidate parcels by delivery area. FedEx has implemented AI-assisted sorting robots at its sorting facilities in South China and Singapore, which can sort up to 1,000 parcels per hour and serve up to 100 destinations simultaneously. This capacity is crucial for managing peak demand during peak seasons such as Chinese Singles' Day or Christmas.

Returns logistics represents a growing field of application. With return rates of 20 to 30 percent in e-commerce, the efficient processing of returned goods requires specialized sorting capabilities.

Automated systems can quickly identify returned items, verify their condition, update inventory levels in real time, and route the items to the appropriate storage location for resale or disposal.

Xpert partner in warehouse planning and construction

Automation as a competitive advantage: Strategies for logistics companies

Strategic implications and competitive dynamics

The implementation of advanced automation technology such as SOTR-S has far-reaching strategic implications for companies and the competitive structure of the logistics industry. Automation increasingly functions as a differentiation strategy, enabling companies to stand out in a highly competitive market.

Companies that successfully implement automation can offer service levels unattainable for competitors with manual processes. Same-day and next-day delivery, a deciding factor in retailer selection for over 74 percent of online shoppers in the US, require highly efficient sortation systems. The ability to process and ship orders within hours of receipt becomes a critical competitive advantage.

Automation contributes to supply chain resilience by enabling companies to respond quickly to disruptions. Automated systems can monitor operational data in real time, identify potential problems before they escalate, and initiate alternative processes. This agility is critical in an era of increased supply chain volatility.

Deloitte studies show that companies that have adopted advanced automation technologies are 3.5 times more likely to outperform their competitors in supply chain resilience, demonstrating faster recovery times and better overall performance during disruptions. This resilience translates directly into financial performance as supply chain disruptions are avoided or minimized.

The scalability of automated systems allows companies to manage growth without having to invest proportionally in additional labor. As business volume increases, additional robots or sorting modules can be added to expand capacity without requiring extensive retraining or new hires. This flexibility is particularly valuable in industries with seasonal fluctuations in demand.

Automation is also fundamentally changing the cost structure of logistics companies. While traditional warehouses have high variable labor costs, automation shifts the cost structure toward higher fixed costs and lower variable costs. This shift creates economies of scale, where average costs decrease with increasing volume, giving large players a structural advantage.

Suitable for:

- Daifuku Europe: Automation of intralogistics through autonomous mobile robots (AMR) and automated guided vehicle (AGV)

Implementation hurdles and adoption barriers

Despite the compelling economic benefits, companies face significant challenges when implementing warehouse automation. The high initial investment represents a significant barrier for many companies, especially small and medium-sized enterprises. Automated systems often require investments in the millions, requiring careful capital allocation decisions and long-term strategic planning.

Integration with existing legacy systems is a common technical challenge. According to Gartner, 54 percent of warehouse managers cite system incompatibility as the primary reason for delayed automation adoption. Many warehouses operate with outdated warehouse management systems that don't integrate seamlessly with modern automation solutions. API-based solutions and cloud-based platforms can help bridge this gap, but require additional investment and technical expertise.

A lack of expertise in robotics and automation can hinder the adoption process. The successful implementation and operation of automated systems requires a skilled workforce that understands the intricacies of the technology. Companies must invest in comprehensive training programs for existing employees and hire individuals with the necessary skills, which can be challenging in a tight labor market.

Workforce resilience to technological change represents another significant hurdle. Employees may perceive automation as a threat to their jobs, leading to resistance and suboptimal adoption. Change management strategies that include transparent communication, reskilling for higher-value roles, and demonstrating the benefits of automation are critical to overcoming this resistance.

The reliability and maintenance of automated systems are critical considerations. Technical malfunctions or failures can lead to downtime and impact productivity. Robust maintenance protocols, predictive maintenance strategies, and investments in high-quality, durable equipment are essential to mitigating these challenges and maintaining the efficiency of automated processes.

The scalability of automation systems requires careful planning. As business operations grow or change, automated solutions should be flexible enough to adapt to changing requirements. Selecting modular and easily expandable automation technologies enables seamless integration of additional robotic systems or adaptations to accommodate evolving business needs.

Industry consolidation and market concentration

The warehouse automation industry is showing signs of consolidation as larger players strengthen their market positions through acquisitions and strategic partnerships. Daifuku, Dematic, SSI Schaefer, Honeywell, and a handful of other dominant players control a significant share of the global market. This concentration reflects the importance of economies of scale in research and development, global service capabilities, and systems integration expertise.

The development and maintenance of advanced automation technology requires significant investment in research and development. Daifuku plans to invest 80 billion yen in research and development and capacity expansion by 2030. This scale of investment is difficult for smaller players to replicate, giving larger companies a structural advantage.

Global presence is increasingly important for serving multinational customers who require consistent solutions across multiple locations. Daifuku operates in 26 countries and can provide consistent service and support across geographical boundaries. This global reach enables the company to transfer best practices, leverage economies of scale in procurement, and diversify risks across different markets.

Market consolidation impacts customers. On the one hand, they benefit from the technological expertise and financial stability of large providers. On the other hand, reduced competition and vendor lock-in can lead to less favorable terms. Companies must carefully consider these trade-offs when selecting automation partners.

AMRs 2.0 and the warehouse of the future: When AI and IoT work hand in hand

The future of warehouse automation will be shaped by several technological trends. Artificial intelligence and machine learning are increasingly being integrated into automation systems to enable predictive analytics, adaptive control, and autonomous decision-making. AI-powered systems can analyze historical data, predict demand patterns, and optimize operating parameters in real time.

The integration of Internet of Things technology enables comprehensive sensor networks that collect real-time data on every aspect of warehouse operations. This data can be used to monitor machine performance, predict maintenance needs, and continuously optimize processes. Predictive maintenance based on IoT data can reduce unplanned downtime and extend equipment lifespan.

Autonomous mobile robots are evolving from simple, path-guided systems to highly intelligent agents capable of dynamic navigation, collaboration, and complex tasks. The next generation of AMRs will be able to navigate changing environments, avoid obstacles, and safely interact with humans in shared workspaces.

Blockchain technology could improve transparency and security in supply chains by creating tamper-proof records of transactions and product movements. This could be particularly valuable for traceability, anti-counterfeiting, and regulatory compliance.

The trend toward modularity and flexibility will continue. Future automation systems will likely rely even more heavily on plug-and-play architectures that enable rapid reconfiguration and expansion. This flexibility will allow companies to make their automation investments gradually and adapt systems as business needs evolve.

Sustainability is becoming an increasingly important design criterion. Energy-efficient drives, renewable energy integration, and circular economy principles will be embedded in the next generation of automation systems. Companies will consider not only cost efficiency but also environmental impact when making automation decisions.

The role of automation in the overall economic architecture

Daifuku's introduction of the Sorting Transfer Robot S is more than a product launch; it is a symptom of fundamental structural transformations in the global economy. The automation of logistics processes represents the continuation of a centuries-old trend of technological labor substitution, stretching from the Industrial Revolution through assembly line production to today's robotics.

This development raises profound economic questions. Automation shifts the factor proportions in production by substituting capital for labor. This substitution is economically rational if capital costs fall relative to labor costs or if technological progress increases the productivity of capital. In Europe, both rising labor costs and rapidly declining costs for robotics and automation technology are driving this substitution.

The macroeconomic impacts are complex. On the one hand, automation increases the economy's overall productivity, which can lead to higher output, lower prices, and improved living standards. On the other hand, the displacement of workers in routine jobs can lead to job losses and increased income inequality if affected workers cannot successfully transition to higher-value roles.

Historical evidence suggests that technological change creates more jobs than it destroys in the long run, but the adjustment processes can be painful and lengthy. The challenge for companies and societies is to manage these transitions by investing in retraining, providing social safety nets, and ensuring that the benefits of technological progress are widely shared.

The geopolitical dimensions of automation should not be overlooked. The ability to develop and implement advanced automation technology is increasingly becoming a factor of national competitiveness. Countries like Germany and Japan, which are leaders in automation, are securing strategic advantages in globalized value chains. Dependence on foreign technology providers can create risks related to technology transfer, data security, and industrial sovereignty.

The automation of logistics also impacts urban geography and real estate markets. Demand for large, highly automated fulfillment centers near metropolitan areas is driving up logistics real estate prices. This can lead to displacement effects, with warehouses displacing other economic activities from urban peripheries.

How the Sorting Transfer Robot S makes companies more competitive in the long term

Daifuku's introduction of the Sorting Transfer Robot S to the European market is a microcosm of larger economic forces transforming industries globally. Technological innovation enables dramatic efficiency gains, cost reductions, and service improvements that fundamentally change consumer expectations and competitive dynamics.

For companies, automation is increasingly no longer an option, but a necessity for survival in intensely competitive markets. The economic logic is compelling: labor shortages, rising labor costs, exploding e-commerce volumes, and relentless pressure on delivery times are creating an environment in which manual processes are simply not competitive. Those companies that successfully invest in and implement automation will build competitive advantages that laggards will find difficult to catch up with.

For workers, this transformation presents both challenges and opportunities. As routine, repetitive tasks become increasingly automated, new roles in system monitoring, maintenance, programming, and process optimization emerge. The ability to adapt, acquire new skills, and transition to higher-value jobs is becoming increasingly critical to economic success.

For society as a whole, automation poses complex policy challenges. Ensuring that the benefits of technological progress are widely shared, supporting affected workers in the transition, and maintaining social cohesion amid rapid economic change require thoughtful policy interventions.

The Sorting Transfer Robot S is thus far more than a piece of equipment. It is a symbol of the technological revolution that is fundamentally reshaping economic structures, labor market dynamics, and social organizations. Understanding these profound transformations is crucial for all stakeholders who want to successfully navigate the economy of the future.

Xpert.Plus warehouse optimization - high-bay warehouses such as pallet warehouses consulting and planning

We are there for you - advice - planning - implementation - project management

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.