Saudi Arabia: Emerging as an industrial superpower? German engineering expertise and China in key roles

Xpert pre-release

Language selection 📢

Published on: October 23, 2025 / Updated on: October 23, 2025 – Author: Konrad Wolfenstein

Vision 2030 – Paradigm shift or risky tightrope walk in the desert?

Saudi Arabia's industrial revolution as a game changer?

Saudi Arabia is undergoing one of the world's most ambitious industrial transformations, positioning itself at the crossroads of global economic dynamics, geopolitical power shifts, and technology-driven upheavals. The kingdom aims to drastically reduce its dependence on oil by 2035 and transform itself into an international center for manufacturing, raw material processing, and future technologies. The core of this strategy is the goal of establishing more than 36,000 factories in 40 existing industrial zones by 2035. Hardly any other country has initiated such a comprehensive realignment in such a short time. The relevance is enormous: Saudi Arabia's strategic shift influences energy markets, global supply chain innovation, and geopolitical alliances, and requires foreign partners, especially Germany, to adopt a forward-looking innovation and cooperation strategy.

The analysis is divided into key areas: Following the historical derivation, the driving forces and actors are examined, a current status is presented with data and facts, case studies on international interdependence are analyzed, risks and controversial debates are examined, development path and disruption scenarios are discussed, and the strategic implications are finally summarized.

From the oil industry to a major industrial project – stages of a rethink

Economic change cannot be understood without understanding the preceding stages of development. For decades, the Saudi economy was almost entirely focused on oil exports. The oil boom of the 1970s shaped society and politics, while the following decades were characterized by recurring crises, fluctuating production quotas, and an inefficient distribution system. Impulses for diversification have existed since the 1990s, but they remained marginal.

With the collapse of oil prices beginning in 2014 and the growing challenges posed by demographic change, unemployment, and geopolitical uncertainty, fundamental reforms became unavoidable. Vision 2030, launched by Crown Prince Mohammed bin Salman in 2016, marks a turning point: the goal is a flexible, innovative industrial nation with global competitiveness. To achieve this, foreign technology partnerships, government guidance, infrastructure megaprojects, and a new regulatory framework are being used. The "Special Economic Zones" and the centrally managed licensing system, in particular, promise control mechanisms, transparency, and investment security.

Structure and forces: The mechanics of industrial transformation in Saudi Arabia

The transformation is multidimensional. Key actors include the Saudi government, especially the Ministry of Industry and Natural Resources, international and local companies, institutions such as the Saudi Authority for Industrial Cities (MODON), the Public Investment Fund (PIF), and a growing network of service providers, suppliers, and educational institutions.

The main driving force is incentive structures: attractive energy prices, tax advantages, modern license management, and a strategic location between the markets of Africa, Asia, and Central Arabia. Special economic zones and targeted subsidies are accelerating industrialization processes. Universities and research centers are being expanded to train qualified specialists. This is offset by a rapidly growing, young population with a desire to participate, which puts pressure on innovation and job creation.

The focus is on technological innovation fields such as artificial intelligence, automation, green energy technology, and advanced logistics. Synergies between traditional industrial sectors (petrochemicals, basic materials) and new fields (e-mobility, biotechnology, digital platforms) are systematically promoted. Market mechanisms are modified through the targeted management of value chains and the integration of foreign know-how providers and investors.

Status quo: data, indicators and acute challenges

Saudi Arabia is already making significant progress in implementing its strategy. Between 2016 and 2024, the number of industrial facilities increased from around 7,200 to over 12,000, with the target being 36,000 factories by 2035. The non-oil sector's economic output grew by 4.7% in 2025 compared to the previous year, accounting for 2.7 percentage points of total growth. Overall, the country has a GDP of just under $2.8 trillion (purchasing power parity) and is targeting a tripling of industrial value added to approximately $377 billion by 2035.

During the same period, non-oil-based exports increased by around 18%, reaching over $100 billion. Particularly noteworthy are mechanical engineering, the chemical industry, as well as the development of high-tech locations and cluster investments such as in Jeddah and KAEC. The number of employees in the industrial sector is expected to rise from the current level of around 1.5 million to 3.3 million by 2035. Challenges remain in the qualification of local workers, the integration of women (the proportion of women recently rose to 35%), excessive migration, and the efficient use of resources.

Regulatory reforms, such as the introduction of a new investment law, the complete opening to foreign shareholders, and the digitalization of the administration, are ensuring encouraging investment momentum. Foreign direct investment reached approximately SAR 3 trillion in 2025, with continuous inflows, particularly from Europe and Asia.

Our global industry and economic expertise in business development, sales and marketing

Our global industry and business expertise in business development, sales and marketing - Image: Xpert.Digital

Industry focus: B2B, digitalization (from AI to XR), mechanical engineering, logistics, renewable energies and industry

More about it here:

A topic hub with insights and expertise:

- Knowledge platform on the global and regional economy, innovation and industry-specific trends

- Collection of analyses, impulses and background information from our focus areas

- A place for expertise and information on current developments in business and technology

- Topic hub for companies that want to learn about markets, digitalization and industry innovations

Saudi Arabia's industrial offensive: Germany and China in key roles

International Interdependencies: Case Studies on Germany, China and the UAE

Saudi Arabia's industrial development is woven into a complex network of global partnerships, especially with Germany and China.

Germany, with its engineering and manufacturing expertise, is a focus of Saudi recruitment programs. Export volumes of German machinery, vehicles, and pharmaceutical products to Saudi Arabia amounted to almost USD 9 billion in 2024, while imports from Saudi Arabia reached approximately USD 2.5 billion. Extensive cooperation models and technology transfers are emerging, particularly in the areas of green hydrogen, megaprojects (NEOM), medical technology, and automation. New investment laws guarantee up to 100% foreign ownership and attractive tax conditions.

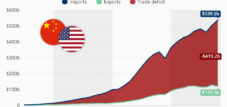

China is both the largest trading partner and a strategic investor. Over 750 Chinese companies now operate in Saudi Arabia, focusing on mining, chemicals, electromobility, and logistics. Bilateral trade totaled over $116 billion in 2025, supported by strategic investments, technology transfers, and joint ventures. Extensive synergies exist, particularly in the areas of Industry 4.0, green energy, and infrastructure, for example, in the development of port and industrial sites such as Oxagon. The strategic partnership with the United Arab Emirates, which compete for the regional industrial and logistics hub, is comparable. Saudi Arabia is increasingly relying on attracting headquarters, tax advantages, and targeted regulation to encourage companies to enter the market.

Controversial aspects: risks, fault lines and open debates

The industrial transformation entails considerable risks and remains the subject of controversial debates. Socioeconomic risks arise from unequal employment structures, skills challenges, the high proportion of migrant workers, and a discrepancy between expectations and reality regarding the integration of Saudi youth. Critics warn that, despite digitalization and automation, many goals, such as a significant reduction in unemployment, diversification, and an increase in the private sector's share of GDP, are being realized only slowly.

The massive investments in megaprojects are being debated in terms of sustainability and ecological impacts. While Saudi Arabia is implementing initiatives such as the "Saudi Green Initiative" and comprehensive ESG programs, and has committed to climate targets, the ecological transformation remains an open question given the scale of resource consumption, urbanization, and emissions. The impacts on flora, fauna, and social sectors have not yet been conclusively analyzed.

Political risks arise from the authoritarian state model, a lack of freedom of expression, and sometimes restrictive regulations regarding social and civic participation. Critics point to repressive measures, low transparency, and persistent human rights problems, which are being debated internationally under accusations of "sportswashing" and PR-driven image-building.

Perspectives: Scenarios and potential disruptions until 2035

The outlook remains uncertain, but several scenarios are conceivable:

- In the baseline scenario, Saudi Arabia continues its industrial expansion, increases the non-oil sector's share of GDP, boosts export volumes, and establishes itself as a leading manufacturing location in the Middle East. However, this will only be achieved with continued opening to foreign skilled workers, innovation transfer, and the stabilization of education and social systems.

- In the innovation scenario, the Kingdom will become a global hub for future technologies such as green energy, autonomous driving, aviation, biotechnology, and digital infrastructure. Strong regulatory frameworks and investment programs promote technology transfer and create an ecosystem of startups, university spin-offs, and multinational corporations.

- Alternatively, there is a risk of a reform backlog due to exogenous shocks such as falling oil prices, geopolitical tensions, or failures in labor market integration. The risk of social unrest increases if the employment, innovation, and diversification goals postulated in Vision 2030 are not achieved.

- Finally, there is the potential for profound ecological and social disruption if sustainability and equality are not systematically integrated into industrial transformation. A course correction – particularly in resource consumption, water and energy management, emission reduction, and social participation – would be necessary.

Long-term relevance and implications for decision-makers

Saudi Arabia's industrial transformation is a key international project with direct implications for German industry, European supply chains, global energy markets, and geopolitical relationships. Decision-makers in business and politics must prepare for a profound realignment of trade, location, and innovation strategies. Targeted addressing of education, skills, investment protection, sustainability, and technology transfer will be a prerequisite for a successful partnership.

In the long term, Saudi Arabia's transformation serves as a blueprint for many resource-rich countries seeking a similar diversification path. The combination of modernization, openness to foreign partners, willingness to innovate, and regulatory flexibility makes the kingdom a geopolitical and economic testing ground for the 21st century. The success or failure of the "industrialization in Saudi Arabia" project will decisively influence the global economic structure in the coming decades and remains a central point of reference for political, industrial, and social decisions far beyond the country's borders.

Your global marketing and business development partner

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development / Marketing / PR / Trade Fairs

🎯🎯🎯 Benefit from Xpert.Digital's extensive, five-fold expertise in a comprehensive service package | BD, R&D, XR, PR & Digital Visibility Optimization

Benefit from Xpert.Digital's extensive, fivefold expertise in a comprehensive service package | R&D, XR, PR & Digital Visibility Optimization - Image: Xpert.Digital

Xpert.Digital has in-depth knowledge of various industries. This allows us to develop tailor-made strategies that are tailored precisely to the requirements and challenges of your specific market segment. By continually analyzing market trends and following industry developments, we can act with foresight and offer innovative solutions. Through the combination of experience and knowledge, we generate added value and give our customers a decisive competitive advantage.

More about it here: