Platform economy in transition: Developments from September 2018 to September 2025

Xpert pre-release

Language selection 📢

Published on: September 8, 2025 / Updated on: September 8, 2025 – Author: Konrad Wolfenstein

Platform economy in transition: Developments from September 2018 to September 2025 – Image: Xpert.Digital

Europe and Africa continue to play no significant role in the platform world

### Germany's digital paradox: From "new territory" to laggard - with a surprising forecast ### The silent revolution: How AI has completely turned the platform giants upside down since 2018 ### More than just Amazon: Why new players like Temu and B2B are now completely changing the rules of the game ### 40 trillion dollar market: Who are the winners and losers of the new platform era?

Forget 2018: That's why everything is different today in the platform world, from AI to regulation

What could happen in seven years? In the world of digital platforms, it's tantamount to a revolution. A market that was already valued at a remarkable $7 trillion in 2018 has grown into a $40 trillion colossus by 2025 – a virtually unimaginable explosion of digital capital. Back in 2018, we analyzed the emerging platform economy as a model in which digital marketplaces like Amazon, Uber, and app stores were reorganizing the economy. The prediction was: They would fundamentally revolutionize markets. Today we know: This prediction was an understatement.

However, a current look at the landscape reveals more than just exponential growth. The rules of the game have fundamentally changed, and the balance of power has shifted dramatically. While US and Asian tech giants are breaking valuation records, Europe and Africa are in danger of becoming digital colonies whose share of this future market remains marginal. At the same time, a technology that barely played a role in the analysis in 2018 has changed everything: Artificial intelligence has become the new engine of the platform world, redefining efficiency, personalization, and entire business models. This transformation is accompanied by a growing concentration of market power, the rise of new, aggressive players like Temu, and political attempts to end the digital Wild West phase with regulations like the DMA and DSA. The following analysis delves deep into these developments and shows who the winners and losers of this new era are and why, despite progress, Germany is in danger of finally falling behind.

Suitable for:

From 7 to 40 trillion: How the tech world exploded – and Europe lost its way

In September 2018, we analyzed the emerging new area of the platform economy. Platform economy refers to an economic model in which digital platforms act as intermediaries between suppliers and consumers. Instead of producing products or services themselves, platforms create a digital marketplace where different actors can interact with each other.

Examples:

- Amazon, eBay → connect sellers and buyers.

- Uber, Airbnb → connect service providers (drivers, landlords) and customers.

- App stores → connect developers and users.

Mark:

- Network effects: The more participants, the more attractive the platform becomes.

- Data as a central asset: Platforms gain advantages through user data.

- Low transaction costs: Brokerage is digital and efficient.

In short: the platform economy creates markets without necessarily being a producer or supplier itself, but rather through the organization and control of interactions.

A comparison with the current situation reveals dramatic changes in almost all areas analyzed.

Market growth and valuations

2018

In 2018, approximately 500 existing digital platforms were documented, with annual growth rates of over 20 percent. The value of the 60 most valuable platforms was $7 trillion, and all platform companies combined reached $8.5 billion.

2025

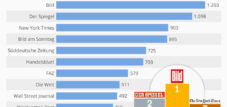

The development has accelerated exponentially. The world's 100 most valuable companies reached the $40 trillion mark for the first time, with a market capitalization of $42.6 trillion, as of March 31, 2025. The tech giants alone are showing impressive growth rates: Apple leads with a market capitalization of $3.3 trillion, followed by Microsoft ($2.8 trillion), Nvidia ($2.6 trillion), and Amazon (over $2 trillion).

Europe's position in the platform economy

2018

Europe was already lagging dramatically behind, with only 3 percent of global platform value, while the US controlled 67 percent and Asia 30 percent.

2025

The situation has barely improved. Europe and Africa continue to play a minor role in the platform world – Europe's share remains unchanged at just 2 percent. Despite the Digital Markets Act (DMA) and Digital Services Act (DSA), Europe remains dangerously behind. The digital economy's share of gross domestic product is almost 10 percent in the US, while in Europe it is only around 6 percent.

Using AI agents for strategic purchasing: Opportunities for SMEs and large companies

Germany: From new territory to digital backwardness

2018

The website cited a frightening Bitkom study: 54 percent of the German companies surveyed had never heard of the term “digital platform.”

2025

Although Germany has improved, it still ranks only 14th in the EU-wide digitalization comparison. In the digital economy segment, Germany ranks 8th in the EU, 9th in network quality, and only 15th in digital skills. At the same time, according to Forrester, Germany is forecast to be the "most digitally advanced market in Europe" by 2029, with e-commerce growth of 50 percent to 146 billion euros.

B2B platforms: From niche segment to mainstream

2018

B2B platforms were still an underrepresented segment, although China was already considered a driver of innovation in this area.

2025

B2B marketplaces in Germany are experiencing annual growth of 17.5 percent—significantly more than the overall e-commerce market at 11 percent. In 2018, 30 percent of industrial companies used transaction platforms, and another 15 percent plan to use such systems by 2025. Despite macroeconomic challenges, B2B e-commerce is growing steadily by 8.1 percent.

Artificial intelligence as a gamechanger

2018

AI did not play an explicit role in platform business models in the original analysis.

2025

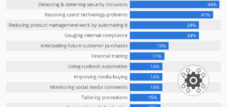

AI has revolutionized the platform economy. Digital platforms are increasingly integrating artificial intelligence to improve brokerage processes and achieve a significant increase in brokerage efficiency and quality. 92 percent of brands use AI for personalized product suggestions and chatbots. AI integration platforms will become indispensable tools in modern IT by 2025.

Mobility and Logistics: New Dimensions

2018

Uber was cited as an example with a market value of over 70 billion US dollars, while Europcar was under 3 billion.

2025

Uber is currently trading at around $79 per share. Logistics platforms have evolved – Amazon AWS is recording growth rates of 19 percent and could reach approximately $130 billion in revenue from AWS alone by 2025.

Marketplaces and e-commerce: Concentration is increasing

2018

Amazon and other marketplaces already dominated, but concentration was less pronounced.

2025

Marketplaces have reached a 55 percent share of German e-commerce sales. Amazon and eBay continue to dominate, while new players like Temu are disrupting the EU with annual growth rates of 60-100 percent. Online marketplaces remain the growth driver, with an expected 4.7 percent growth to approximately €44 billion.

Suitable for:

Regulation and Governance

2018

Regulatory aspects played a minor role in the original analysis.

2025

The implementation of the Digital Markets Act (DMA) and Digital Services Act (DSA) in Europe has made waves worldwide, leading to significant adjustments in business models and technical architectures. Regulatory complexity is becoming not only a challenge but also a source of innovation.

Accelerated change with persistent problems

While the quantitative dimensions of the platform economy have multiplied since 2018—from $7 trillion to over $40 trillion in total valuation—structural problems remain. Europe's marginal position has barely improved despite regulatory efforts. Germany has made progress but lags behind in international comparison.

The integration of AI, the expansion into B2B markets, and increasing regulation are shaping the new phase of the platform economy. At the same time, market concentration is intensifying, while new Asian players like Temu are challenging the established order. The 2018 prediction that platforms would "transform the economy from the ground up" has proven accurate – with all the opportunities and risks that this transformation entails.

A new dimension of digital transformation with 'Managed AI' (Artificial Intelligence) - Platform & B2B Solution | Xpert Consulting

A new dimension of digital transformation with 'Managed AI' (Artificial Intelligence) – Platform & B2B Solution | Xpert Consulting - Image: Xpert.Digital

Here you will learn how your company can implement customized AI solutions quickly, securely, and without high entry barriers.

A Managed AI Platform is your all-round, worry-free package for artificial intelligence. Instead of dealing with complex technology, expensive infrastructure, and lengthy development processes, you receive a turnkey solution tailored to your needs from a specialized partner – often within a few days.

The key benefits at a glance:

⚡ Fast implementation: From idea to operational application in days, not months. We deliver practical solutions that create immediate value.

🔒 Maximum data security: Your sensitive data remains with you. We guarantee secure and compliant processing without sharing data with third parties.

💸 No financial risk: You only pay for results. High upfront investments in hardware, software, or personnel are completely eliminated.

🎯 Focus on your core business: Concentrate on what you do best. We handle the entire technical implementation, operation, and maintenance of your AI solution.

📈 Future-proof & Scalable: Your AI grows with you. We ensure ongoing optimization and scalability, and flexibly adapt the models to new requirements.

More about it here:

We are there for you - advice - planning - implementation - project management

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the AI strategy

☑️ Pioneer Business Development

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital - Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital - www.xpert.solar - www.xpert.plus