OOH Analysis | Out-of-Home Delivery: How crucial the network of parcel shops is for survival

Xpert pre-release

Language selection 📢

Published on: November 5, 2025 / Updated on: November 5, 2025 – Author: Konrad Wolfenstein

Out-of-home delivery: How crucial the network of parcel shops is for survival – Creative image: Xpert.Digital

Hermes Germany has one of the largest out-of-home networks with around 17,000 parcel shops in Germany.

Will Hermes increasingly focus on parcel shops – and what would that mean for online shoppers?

Hermes Germany is in deep crisis: hundreds of millions of euros in losses and massive job cuts dominate the headlines. But while the company is making cuts across the board, one area is being declared its central lifeline: the vast network of around 17,000 parcel shops in Germany. This strategy seems paradoxical at first glance, but it is a clear indication of the future of the entire parcel delivery sector.

Home delivery is becoming increasingly expensive and inefficient for logistics companies. Instead, so-called out-of-home delivery – delivery to parcel shops, automated parcel lockers, or collection points – is gaining traction. It's not only more cost-effective and environmentally friendly, but also increasingly valued by customers as a flexible alternative. However, the competition is fierce: While competitors like DHL and DPD are investing billions to expand their networks, the pressing question is: Can Hermes, with its focus on local kiosks and bakeries, keep up? This shift affects every online shopper and will determine how and where we receive our packages in the future – from major cities to rural communities.

Matches:

Hermes' potential out-of-home strategy: the core of the realignment

Despite massive financial losses of €231 million and drastic job cuts, the parcel shop network remains Hermes Germany's central strategic asset. With approximately 17,000 Hermes ParcelShops nationwide, the company currently operates one of the largest out-of-home networks in Germany. In Dornstadt (population approximately 9,000-11,000), for example, current data indicates at least seven parcel shops directly within the town and over 30 in the wider Dornstadt/Ulm catchment area, including locations in bakeries, bicycle shops, and grocery stores.

As part of its restructuring, Hermes plans to further expand its parcel shop network and strengthen its digital services – despite financial constraints. This may seem paradoxical at first, but it makes strategic sense: out-of-home deliveries are significantly more cost-efficient than traditional doorstep deliveries. Hermes states that consolidated deliveries to a parcel shop generate an average of 25 percent less CO₂ than deliveries to private homes. Economically, this translates into considerable savings in personnel costs and delivery attempts.

Acceptance of out-of-home advertising: Growing demand with regional differences

The acceptance of out-of-home deliveries is measurably increasing in Germany – however, with significant regional and demographic differences:

National Trends

- According to the E-Shopper Barometer by Geopost (DPD parent company), 44 percent of regular e-shoppers in Germany opt for out-of-home delivery solutions.

- A European study by Sendcloud shows that 59 percent of respondents would choose delivery to a parcel shop or parcel station if these were closer to their place of residence.

- The critical distance is on average a maximum of one kilometer – that's how far most customers are willing to walk for their package.

- Particularly interesting: Regular online shoppers (two or more purchases per week) especially appreciate OOH – 44 percent prefer parcel shops, 46 percent parcel stations.

urban-rural divide

- In urban areas, the preference for out-of-home delivery is significantly higher: 36 percent opt for parcel shops, 40 percent for parcel stations.

- In Germany, the OOH share is currently at 20-25 percent – significantly lower than in Eastern Europe, where Poland with 50-60 percent and the Czech Republic with over 40 percent are leading the way.

- Rural regions such as the Uckermark show a relative undersupply with 0.48-0.92 parcel shops per 1,000 inhabitants compared to the national average of 0.69.

For the example region of Dornstadt, this means: As a municipality with approximately 11,000 inhabitants and at least 7 parcel shops, the service density is about 0.64 parcel shops per 1,000 inhabitants – slightly below the national average, but quite respectable for a smaller municipality. The proximity to Ulm, as an urban center, further improves accessibility.

Our EU and Germany expertise in business development, sales and marketing

Industry focus: B2B, digitalization (from AI to XR), mechanical engineering, logistics, renewable energies and industry

More about it here:

A topic hub with insights and expertise:

- Knowledge platform on the global and regional economy, innovation and industry-specific trends

- Collection of analyses, impulses and background information from our focus areas

- A place for expertise and information on current developments in business and technology

- Topic hub for companies that want to learn about markets, digitalization and industry innovations

Who benefits from the decline? Opportunities for DHL, DPD, and others.

What's next? Scenarios for OOH development

1. Massive expansion by competitors – Hermes under pressure

The competition is investing heavily in out-of-home infrastructure:

- DHL plans to double the number of its Packstations from the current 15,000 to 30,000 by 2030. This puts considerable pressure on Hermes, as DHL Packstations are available 24/7 and offer greater flexibility.

- GLS, together with DPD and Myflexbox, plans to expand to 20,000 out-of-home points (currently 8,900 parcel shops + 600 parcel stations). CEO Moritz Eichhöfer describes the OOH strategy as a "game changer" and invests tens of millions of euros annually.

- DPD successfully cooperates with retailers such as NKD (1,300 branches nationwide) and has processed almost 20 million parcels through this cooperation since 2015.

Hermes can hardly keep up financially in this expansion race. The complete outsourcing of its own delivery operations to subcontractors and the reduction of 850 jobs demonstrate that the company is focusing on cost reduction rather than expansion.

2. Digitalization and convenience as decision factors

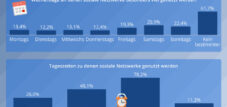

The acceptance of OOH depends heavily on digital integration:

- 88 percent of customers want comprehensive and transparent information during and after the purchase.

- 69 percent expect the possibility to actively intervene in the delivery process if they are unexpectedly not at home.

- 48 percent would use out-of-home advertising more often if online shops offered this option at checkout.

Hermes is lagging behind in digitalization – critics doubt that the company can actually expand its digital services. This could negatively impact the long-term acceptance of Hermes parcel shops, even if the physical network is well-developed.

3. Regional perspective: Baden-Württemberg and Dornstadt

The following perspectives emerge for the example region of Dornstadt:

- The seven existing parcel shops in Dornstadt (located in bakeries, bicycle shops, and grocery stores) offer flexible opening hours – some from 6:00 a.m. to 6:30 p.m. on weekdays. This is a clear advantage over parcel lockers, which, although available 24/7, feel impersonal.

- Hermes already focused on expanding its network in rural areas and small towns in 2018 to achieve the broadest possible network coverage. This strategy could have a stabilizing effect.

- The proximity to Ulm, a strong economic center, ensures a certain parcel volume, which also benefits Hermes.

Risk: Should Hermes continue to lose market share or actually be sold/restructured, individual smaller parcel shops could be closed, especially if they are not profitable. Particularly in smaller communities like Dornstadt, only the highest-grossing locations (e.g., in supermarkets) might then remain.

4. Market consolidation and premium door-to-door delivery

GLS CEO Eichhöfer has already hinted that traditional home delivery could become a "premium product" in the future. This would mean:

- Standard delivery is increasingly being made to OOH points (cheaper for senders and logistics providers).

- Home delivery is offered at an extra charge or is only available for certain product categories.

- By 2030, 25-30 percent of parcels in urban areas and up to 40 percent of private customer parcels in general could be delivered via OOH.

For Hermes, this would mean that the parcel shop network would become vital for survival. Without its own delivery drivers, Hermes is entirely dependent on subcontractors and the parcel shops themselves.

What will the future hold? A realistic assessment.

The acceptance of out-of-home advertising will continue to increase – for several reasons.

- Economic pressure: Online retailers and logistics companies save costs through consolidated deliveries. These savings are passed on to customers through cheaper or free shipping options, making out-of-home advertising more attractive.

- Flexibility: Working professionals especially appreciate the freedom from fixed delivery windows. 60 percent of parcel recipients are not at home between 7 a.m. and 4 p.m. – OOH solves this problem.

- Sustainability: Environmentally conscious customers increasingly prefer lower-CO₂ delivery options. 25-30 percent fewer emissions is a strong argument.

Acceptance depends on three critical factors.

- Network density: Customers only use out-of-home (OOH) regularly if the nearest parcel shop/station is a maximum of 1 km away. This is more difficult to achieve in rural areas.

- Digital integration: Without seamless integration into online shops and transparent shipment tracking, OOH remains a niche solution.

- Service quality: Long opening hours, friendly staff and uncomplicated processing are crucial – here Hermes has an advantage over purely automated shops with its owner-managed shops.

Otto must deliver: Digitalization will determine Hermes' future

The company boasts an excellent physical network of 17,000 parcel shops, but suffers from a lack of digitalization, losses, and dwindling trust. If the Otto Group successfully implements its announced restructuring and invests heavily in digital services, the parcel shop network could become its lifeline. If the restructuring fails, a sale or merger looms – in which case the Hermes network would potentially be integrated into a larger system (DHL, DPD, GLS).

Local parcel shops will remain: Why a change of brand doesn't mean the end

The out-of-home (OOH) infrastructure will remain and grow – possibly under different brands. Local parcel shops are expected to continue operating, as they are economically viable and well-integrated into the community. However, it is uncertain whether they will continue to be called “Hermes ParcelShops”.

🎯🎯🎯 Benefit from Xpert.Digital's extensive, five-fold expertise in a comprehensive service package | BD, R&D, XR, PR & Digital Visibility Optimization

Benefit from Xpert.Digital's extensive, fivefold expertise in a comprehensive service package | R&D, XR, PR & Digital Visibility Optimization - Image: Xpert.Digital

Xpert.Digital has in-depth knowledge of various industries. This allows us to develop tailor-made strategies that are tailored precisely to the requirements and challenges of your specific market segment. By continually analyzing market trends and following industry developments, we can act with foresight and offer innovative solutions. Through the combination of experience and knowledge, we generate added value and give our customers a decisive competitive advantage.

More about it here:

Your global marketing and business development partner

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.