Billions in venture capital gap: Why German ideas thrive in the USA – and die here

Xpert pre-release

Language selection 📢

Published on: December 14, 2025 / Updated on: December 14, 2025 – Author: Konrad Wolfenstein

Billions in venture capital gap: Why German ideas thrive in the USA – and die here – Image: Xpert.Digital

Harsh criticism from Palantir CEO: Why Germany is currently falling behind in the tech competition

Germany in the global technology competition: Critical transformation instead of strategic decline

The diagnosis is painful, but it is necessary: Germany is at a technological crossroads.

When Alex Karp, CEO of the US data company Palantir, criticizes the German technology sector, it might initially sound like Silicon Valley arrogance. But a look at the raw figures reveals that the criticism hits a nerve. Germany, the land of engineers and inventors, is steadily slipping in the crucial rankings of future technologies – most recently, the Federal Republic even fell out of the top 10 worldwide in the Global Innovation Index.

While we remain world leaders in traditional disciplines like mechanical engineering and logistics, a dangerous gap is emerging in digitalization, artificial intelligence, and the scaling of startups. The problem isn't a lack of ideas, but rather a lack of implementation: dramatic capital shortages compared to the US, well-intentioned but innovation-stifling data protection bureaucracy, and a worsening skills shortage create a toxic mix that threatens our prosperity.

This article provides a stark analysis of the current situation. We examine why German startups often fail as soon as they try to grow, why our administration still operates in an analog fashion, and what radical steps are now needed to transform this gradual decline into a strategic transformation. Because the potential is still there – it just needs to be unleashed.

Suitable for:

The inconvenient truth behind Europe's prosperity machine

Palantir CEO Alex Karp's criticism of Germany's technology sector hits a nerve: a country that prides itself on its engineering heritage is steadily losing ground in the crucial technologies of the 21st century. But this statement isn't merely the subjective frustration of an American entrepreneur; it reflects a systemic problem that threatens Germany's economic foundation. The debate deserves a nuanced analysis that acknowledges both the legitimate criticisms and reflects the complex economic realities.

The empirical finding: Germany's gradual decline in the innovation rankings

The latest evidence of Germany's technological weakness comes from the United Nations' Global Innovation Index, one of the most recognized and rigorous measures of international innovation. In the 2025 ranking, Germany slipped from ninth to eleventh place, thus falling out of the group of the world's ten most innovative countries for the first time. This shift is not a cyclical phenomenon of the past year or two, but rather the result of a continuous, years-long erosion of competitiveness in future technologies.

The analysis reveals a heterogeneous picture: Germany retains its strengths in traditional sectors. The country ranks fifth worldwide in the production of high-tech goods, its logistics efficiency is rated third, and its scientific foundation and research and development investments remain internationally respectable. Nevertheless, significant shortcomings are evident precisely where the economic dynamism of the coming decade will emerge. In the area of mobile app development, Germany ranks only forty-eighth, and in terms of the framework conditions for entrepreneurship and a startup culture, only forty-first. These figures are symptomatic of a profound structural problem that extends far beyond isolated weaknesses.

In parallel, the Bitkom DESI index on the digitalization of the EU documents a similar pattern. While Germany still ranks eighth in the digital economy, a more pronounced decline is evident in the segments crucial for social participation and decentralized value creation. Germany ranks fifteenth in the population's digital skills and only twenty-first in the digitalization of public administrations. These figures reveal a country that is only partially and fragmentarily implementing digital transformation, while Scandinavian countries, the Netherlands, and the UK are significantly ahead with digitalization levels of sixty to seventy percent. Germany achieves only fifty to fifty-five percent.

Capital shortages and the venture capital gap: Why German companies remain internationally unrivaled

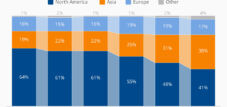

A key reason for Germany's technological weakness lies not in a lack of entrepreneurial spirit or innovative capacity, but in a fundamental undersupply of growth capital. The data is clear and cumulatively striking: While approximately 269 billion US dollars in venture capital were available in the US in 2021, Germany had only 17 billion US dollars at its disposal. The ratio to economic output is even more telling: In America, 35 percent of GDP flowed into venture capital, while in Germany it was only 42 percent. German companies thus invest only one-ninth of the US level in venture capital, measured against their overall economic output.

This capital deficit has immediate consequences. While German startups receive extensive support through government funding in their early stages, they often fail during the critical scaling process. Where American and increasingly Chinese funds finance their portfolio companies with billions of dollars to build them into global market leaders, Germany lacks access to capital sources. The second quarter of 2025 reveals that while approximately 2.4 billion euros flowed into startups in Germany, a third of this volume already came from US investors. The result is paradoxical: Germany either generates innovative ideas that are then financed and appropriated by foreign capital, or shrinks due to a lack of growth financing.

The German government has recognized the problem and responded with measures such as the Future Fund and the so-called WIN initiative. Adjusting the investment regulations to allow insurers and pension funds higher risk capital quotas is a start. However, the scale of these measures is insufficient: In absolute terms, Germany needs to double or even triple its annual venture capital investments from the current fifty-four billion euros to between one hundred and one hundred and fifty billion euros to become competitive with international rivals. This gap remains unfilled, both politically and in terms of market forces.

Regulation as a brake on innovation: The paradox of data protection and digital progress

Besides capital shortages, regulatory overburden significantly contributes to Germany's weak innovation. The General Data Protection Regulation (GDPR), one of the world's most rigorous data protection regulations by international standards, had the legitimate aim of protecting civil liberties. However, its implementation has led to a paradoxical situation: while the regulation strengthens individual rights, it systematically stifles data-driven innovation, which is fundamental to artificial intelligence, platform economies, and many other future technologies.

A representative survey conducted by the Bitkom association in May 2025 vividly documents this reality. Seventy percent of the companies surveyed in Germany stated that they had already halted at least one innovation project due to data protection regulations or uncertainties regarding their application. Compared to the previous year, this figure rose from sixty-one percent, indicating an acceleration of the problem. Particularly noteworthy: while thirty-one percent had only paused projects once, thirty-five percent stated that this had happened multiple times, and eighteen percent said they frequently had to abandon innovations. The figures reveal a pattern not of temporary uncertainty, but of structural paralysis.

The problem lies not only in the GDPR itself, but in its fragmented implementation. Germany has several overarching data protection authorities at the federal level, as well as independent authorities in each federal state. This leads to inconsistent interpretations of European regulations, leaving companies constantly uncertain about their legal position. A company might submit a risk assessment to one data protection authority, but receive a completely different interpretation of the same legal question from another authority. This uncertainty leads most surely to passivity: companies forgo potential innovations to avoid legal risks.

Furthermore, there is a multiplying regulatory problem. The GDPR, along with the AI Act and the Data Act, is now overlapping and influencing the same data processing and business models. Small and medium-sized enterprises (SMEs), the backbone of the German economy, are particularly unable to successfully manage multiple redundant reporting obligations and documentation requirements simultaneously. The resources tied up in compliance departments are then unavailable for research and development.

A pragmatic reform approach, which Bitkom rightly demands, would differentiate between categories: a high level of protection for genuinely sensitive data with a high potential for misuse, combined with more pragmatic, innovation-friendly rules for all other data. The technical possibility of data minimization could be used more extensively as a regulatory tool than is currently the case. Furthermore, consolidating data protection oversight at the federal level, as stipulated in the coalition agreement, could contribute to a uniform interpretation nationwide and thus create legal certainty for companies.

The skills shortage: Demographic brakes and lack of attractiveness for international talent

The third structural crisis area is the shortage of IT specialists, which is increasingly paralyzing Germany. In the spring of 2025, approximately 149,000 IT positions in Germany were vacant, a new record. Although this number fell to around 19,000 in the autumn of 2025, the problem remains fundamental and is exacerbated by demographic trends.

Bitkom predicts that the skills gap could widen to more than 700,000 people by the year 2027. A long-term forecast up to 2040 is even more dramatic: the gap could increase to approximately 663,000 missing IT experts, while at the same time only about 120,000 new skilled workers would enter the labor market. This discrepancy is systemic and cannot be resolved through isolated training measures.

The reasons are multifaceted. First, there's demographic change. Large birth cohorts are retiring, while the younger generations are smaller in number. Second, German universities aren't training enough IT specialists. There are approximately 220 professorships specializing in AI in Germany, which is good internationally, but the graduation rates are insufficient. Third, Germany has extremely high dropout rates in technical degree programs, consistently exceeding 50 percent, significantly higher than in comparable international countries.

Fourth, and perhaps most critically: Germany is not attractive to international talent. While Silicon Valley, New York, and increasingly Singapore and Tokyo magnetically attract talent from around the world, Germany remains relatively unattractive to foreign IT professionals. The reasons are structural: lower salaries than in the US, less salary growth, fewer opportunities for profit-sharing (stock options) from rapidly growing companies, more complex visa and residency regulations, and cultural barriers. Added to this is the language issue: technical work culture is primarily organized in English internationally, yet many German SMEs still operate largely in German.

The immediate consequences are evident: Companies report that even when they hire technically underqualified candidates, they cannot compensate for these gaps through internal training. Thirty-six percent of companies complain about a lack of soft skills among applicants, thirty-five percent about insufficient German language skills, and eighteen percent about insufficient foreign language skills. These seemingly disparate problems all point toward the same diagnosis: Germany has an insufficient supply of talent in the global talent market.

One positive approach to mitigating the skills shortage could lie in the strategic recruitment of foreign specialists. The new Skilled Immigration Ordinance brings some improvements in this regard. However, a hurdle remains: while the USA actively attracts talent with generous visa and residency regulations, Germany remains bureaucratically rigid. At the same time, German companies could invest more strategically in retraining and career-change programs. Statistics show that around a quarter of newly hired IT specialists are career changers, indicating the potential for more diverse talent acquisition.

Our EU and Germany expertise in business development, sales and marketing

Industry focus: B2B, digitalization (from AI to XR), mechanical engineering, logistics, renewable energies and industry

More about it here:

A topic hub with insights and expertise:

- Knowledge platform on the global and regional economy, innovation and industry-specific trends

- Collection of analyses, impulses and background information from our focus areas

- A place for expertise and information on current developments in business and technology

- Topic hub for companies that want to learn about markets, digitalization and industry innovations

From pioneer to obstacle? This is how Palantir CEO Karp explains Germany's loss of importance in the tech world.

Venture ecosystem and scaling gap: The transition from founder to global player

While Germany is becoming increasingly successful in founding startups, crucial weaknesses are emerging in the scaling process. In the first half of 2025, KfW reported approximately four billion euros in venture capital investments for German startups, with 208 funding rounds. Germany now boasts 32 unicorns—companies with a valuation exceeding one billion US dollars—a new record. However, these aggregated figures are misleading: the average funding round remains small. While US venture capital funds regularly conduct Series B and Series C financing rounds in the hundreds of millions of dollars, German funding rounds are significantly smaller.

The problem intensifies when a German startup wants to expand. An example from the industrial sector illustrates this phenomenon: A German robotics startup with promising technology needed capital for its scaling process, which was either unavailable or only available in a fragmented way in Germany. The company therefore had to turn to US investors or received financing tied to conditions that led to the relocation of management and headquarters abroad. This is not an exception, but a pattern: While foreign direct investment is available in Germany, it frequently leads to the erosion of control and intellectual property.

The role of institutional investors is particularly problematic. In the US, pension funds, insurance companies, and other large investors are investing heavily in venture capital because regulations enable and accelerate such investments. In Germany, this capital flow is limited and fragmented by provisions in the investment ordinance. The federal government has begun to improve this by increasing venture capital quotas, but the change is being implemented too slowly.

An additional point of criticism concerns the risk mindset within investor and corporate culture. In the US, and increasingly in China, it's acceptable for startups to fail, even to make mistakes, as long as they learn quickly. In Germany, a rather risk-averse, perfectionistic mindset characterizes both corporate culture and investor activity. This discourages potential founders from undertaking risky ventures and leads investors to evaluate companies with excessively high demands for profitability and security. This stifles innovative potential.

The software industry: Specialization instead of universality

Karpp's assertion that the German tech scene is among the worst in the world misses a crucial point: Germany certainly has strengths in certain software segments, but these are more niche-oriented than universal platform-oriented. SAP is a classic example. The company is the global market leader in enterprise resource planning (ERP) software. With a market share of over 20 percent in the ERP sector and a presence in over 180 countries, SAP is a clear global player, which puts Karpp's sweeping criticism into perspective. Companies like Software AG, TeamViewer, and specialized providers like DATEV are similarly successful.

These companies, however, are exceptions, not the rule. They emerged in a different regulatory and capitalist context and now benefit from their established market position. They are not representative of the current German startup landscape. The typical German software company today is medium-sized, industry-specific, and has little or no global presence.

The larger structural problem lies in the absence of universal platforms. While the US, with Google, Amazon Web Services, Meta, Microsoft, and Apple, dominates global digital platforms that support billions of people and businesses, no comparable platform exists in Germany. This is partly due to historical reasons, but also entrenched in regulations. The European single market is fragmented: differing national interpretations of data protection, different language markets, different business cultures, and differing regulatory requirements make it difficult for European platforms to scale quickly.

Germany could strategically benefit if it concentrated its software specialists on areas where it has an absolute competitive advantage: for example, industrial applications, mechanical engineering software, supply chain management, or security software. However, even in these areas, German solutions are often niche products, not world market leaders.

Artificial Intelligence: The fundamental challenge for Germany's technological future

Artificial intelligence will likely be the most transformative technology of the current decade, and Germany's position in its development and implementation is weak. Germany still possesses solid research strengths: the German Research Center for Artificial Intelligence has existed for thirty-five years, there are approximately two hundred and twenty AI professorships at German universities, and the scientific publication rate in the AI field is respectable.

However, Germany proves weak in the transition from research to commercial application. US companies lead the way in the application of generative AI by overwhelming margins, while German companies remain hesitant. This is partly due to regulatory uncertainty. The European Union's AI Act creates strict regulations for high-risk AI applications, which may be legitimate, but leads to implementation uncertainty and paralysis among innovative companies.

On the other hand, the problem lies in the lack of computing infrastructure. Large language models and other generative AI systems require enormous computing capacity. The US and China massively dominate the data center market by a considerable margin. Germany has comparatively few high-performance computing centers and supercomputers. This means that German companies either have to rent expensive computing capacity from abroad or cannot access AI applications at all. High energy costs in Germany exacerbate this problem, because data centers are energy-intensive and can be operated more economically in countries with lower electricity prices.

The German government has recognized this and increased its AI investments from three to five billion euros between 2020 and 2025. However, compared to US investments, where large tech companies alone invested around four hundred billion US dollars in AI infrastructure in 2025, this is marginal.

Another critical issue is the competition for talent. The US, and increasingly China as well, are attracting AI experts with massive salaries and equity bonuses. Germany cannot compete financially in this market. This is leading to an exodus of German AI talent, who are either moving to the US or to large technology companies like Meta Germany or Google Germany.

The digitalization of public authorities and administration: Slow change with strategic consequences

An often overlooked aspect of Germany's technological weakness lies in the inadequate digitalization of its public administration. Ranking 21st out of 27 EU countries in the Digital Public Services Index, Germany performs shamefully. This is not merely a matter of convenience for citizens who still print and mail forms; it is a profound economic problem.

A modern administration with digital infrastructure could significantly boost business efficiency. Automated approval processes, digital registration, electronic contracts, and seamless digital communication with authorities are standard in countries like Estonia, while Germany remains traditionally fragmented. This increases transaction costs and the time required to implement projects for businesses. Young companies, in particular, suffer under this administrative burden.

Furthermore, it is evident that a country that has not digitized its own public authorities will find it difficult to credibly argue that it has an advanced digital ecosystem. This is off-putting to potential international investors and further contributes to the erosion of confidence in the country as a business location.

Broadband internet and digital infrastructure: Basic services

While Scandinavian countries and the Netherlands have widespread, high-performance broadband infrastructure, Germany remains fragmented. In rural areas, there are still regions without reliable, fast internet. This inequality has significant economic consequences: companies in underserved regions cannot benefit from AI, cloud computing, and other digital services that would enable location independence. At the same time, this exacerbates regional inequality.

The German government has launched programs like the Gigabit Strategy, but implementation is slow. Coordination problems between the federal government, states, and municipalities, insufficient funding for rural areas, and the complexity of the federal system are leading to slow progress. This stands in stark contrast to countries like Singapore or South Korea, where national digital infrastructure programs are being implemented quickly and comprehensively.

The startup culture: acceptance of risk-taking and rapid failure

A frequently overlooked yet fundamental difference between Germany and leading innovation nations lies in the cultural attitude towards entrepreneurship and failure. In the US, it's perfectly normal for founders to launch multiple companies, some failing, learning quickly, and then building the next one on a larger scale. This culture of "fail fast" has led to massive gains in innovation. Entrepreneurs have the network, financial, and social resources to allow for mistakes.

In Germany, the situation is different. The concept of personal bankruptcy was long stigmatized, although this has changed somewhat. At the same time, the cultural expectation of stability and security is stronger. This makes German founders risk-averse, and investors also evaluate companies more conservatively. A founder with a failed pre-launch venture will find it more difficult to obtain new financing in Germany than in the USA.

This cultural difference has a cumulative and structurally detrimental effect on innovation capacity.

What needs to happen: A framework for strategic transformation

Karpp's critique is empirically grounded, but his diagnosis does not automatically lead to sensible solutions. At the same time, it is clear that a "business as usual" approach will further erode Germany's technological and economic position. A reform program would have to address several levels simultaneously.

First: Exponentially expand capital provision. Germany would need to increase venture capital investments to at least one hundred to one hundred and fifty billion euros annually, for example through tax incentives for pension funds and insurance companies, through European funds that link several countries, and through government growth funds that specifically support large financing rounds. This requires a cultural shift away from the traditional bank lending model and towards genuine venture capital.

Second: Make regulation more pragmatic. This doesn't mean abolishing data protection, but rather differentiating between data that actually requires protection and other data. A unification of data protection oversight at the federal level, as planned, could reduce legal uncertainty. The AI Act should be interpreted in a more technology-friendly way, with room for experimentation and regulatory sandboxes where companies can test new AI systems before they are subject to full compliance.

Thirdly: Internationalize talent acquisition. Germany should actively recruit engineers, AI experts and software developers from all over the world by simplifying visa and residence regulations, by offering competitive salaries (partially offset by tax breaks), and by establishing globally renowned technological competence centers in universities and research institutions.

Fourth: Massively expand computing infrastructure. Germany should launch a program for the rapid construction of high-performance computing centers and supercomputers, comparable to large infrastructure projects. This could be achieved in part through public-private partnerships, with a strong focus on energy efficiency and the use of renewable energies, where Germany certainly has a competitive advantage.

Fifth: Accelerate the digitalization of public authorities. A national digitalization plan for public administration could be launched with clear goals and measurable milestones, with sufficient funding and consequences for failures.

Sixth: Complete broadband expansion. It is shameful that after 150 years of electrification and 50 years of computerization, Germany still has rural areas without fast internet. This should be addressed with the resources and urgency of a critical infrastructure project.

Seventh: Transform the startup culture. This is more difficult than regulatory reforms, but could be advanced through educational programs in schools and universities, prominent case studies of successful founders, and a societal re-evaluation of entrepreneurship as an honorable activity.

Eighth: Leverage the European dimension. While national solutions are important, Germany should also promote European coordination. A unified European single market for digital services, coordinated AI infrastructure, and Europe-wide venture capital funds could harness Germany's natural strengths.

Potential versus inertia

Karpp's diagnosis is not merely that Germany is technologically weak, but that it is strategically at a crossroads. A continental economic system that profited for decades from the export success of its mechanical and chemical industries must adapt to a new reality in which digital technologies, platform economies, and artificial intelligence dominate value creation.

Germany has considerable ground to make up, but it also has its strengths. Its scientific landscape is robust, its engineering tradition is respectable, its industrial base remains substantial, and its workforce is highly skilled. The skills shortage is real, but there are ways to address it. Regulation is a hindrance, but it can be reformed. The capital deficit is significant, but it can be resolved through political decision-making.

The central problem lies not in absolute incompetence, but in a relative need to catch up, structural inertia, and a cultural aversion to risk. Karpp's central assertion that Germany is holding itself back hits the nail on the head. The country possesses more potential than most nations in the world, but it is not consistently utilizing it. The coming years will be crucial in determining whether Germany succeeds in this transformation or continues to slip further down the rankings.

Your global marketing and business development partner

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development / Marketing / PR / Trade Fairs

🎯🎯🎯 Benefit from Xpert.Digital's extensive, five-fold expertise in a comprehensive service package | BD, R&D, XR, PR & Digital Visibility Optimization

Benefit from Xpert.Digital's extensive, fivefold expertise in a comprehensive service package | R&D, XR, PR & Digital Visibility Optimization - Image: Xpert.Digital

Xpert.Digital has in-depth knowledge of various industries. This allows us to develop tailor-made strategies that are tailored precisely to the requirements and challenges of your specific market segment. By continually analyzing market trends and following industry developments, we can act with foresight and offer innovative solutions. Through the combination of experience and knowledge, we generate added value and give our customers a decisive competitive advantage.

More about it here: