The global market for cold chain logistics is experiencing dynamic growth, whether in Europe, North America or Asia-Pacific

Xpert pre-release

Language selection 📢

Published on: February 8, 2025 / Updated on: February 8, 2025 – Author: Konrad Wolfenstein

The global cold chain logistics market is experiencing dynamic growth, whether in Europe, North America or Asia-Pacific – Image: Xpert.Digital

Innovative technologies are driving the boom in cold chain logistics

Cold chain logistics in focus: Growth at an annual rate of 12-15%

Dynamic growth in cold chain logistics

Cold chain logistics is experiencing strong growth worldwide, driven by increasing demand for temperature-sensitive products, technological advancements, and strategic mergers of large companies. Forecasts predict the market will reach a volume of between USD 1.2 and 1.6 trillion by 2033, with a compound annual growth rate (CAGR) of 12 to 15%. This increase is the result of massive investments in infrastructure, technology, and market consolidation.

Suitable for:

Market growth and key drivers

Forecasts:

- The market is growing from USD 292 billion (2024) to up to USD 1.64 trillion by 2036.

- The pharmaceutical sector will increase its share to USD 23.2 billion (2033) with an expected market expansion in healthcare cold chain logistics.

- The food sector is expanding rapidly due to online food deliveries and the boom in processed products, which will allow it to grow to USD 203 billion by 2033.

Main drivers:

- Technological innovations: The use of IoT sensors for real-time monitoring, blockchain for traceability, and automated cooling systems increase efficiency and transparency.

- Sustainability: Energy-efficient cold storage facilities and the use of electric vehicles contribute to reducing CO₂ emissions.

- Regulatory requirements: Stricter regulations on food safety and drug storage are impacting the market.

Investments and infrastructure development

Key developments:

Investments and infrastructure expansion are showing significant developments. RealCold is building cold storage facilities in Texas and Florida with a capacity of 7,000 pallet spaces, while AIIM is opening a warehouse in South Africa, thereby increasing transport capacity for food and pharmaceuticals. In the technology sector, Sunswap has secured €20 million for solar-powered refrigerated trucks, and DENSO is investing in AI-supported temperature control systems, thereby reducing energy consumption and minimizing supply chain risks. Regarding acquisitions, UPS is taking over Frigo-Trans/BPL in Germany for pharmaceutical logistics, and EQT is acquiring Constellation Cold Logistics with 26 locations in Europe, strengthening its global networks and promoting specialization in refrigerated transport.

Market consolidation

The cold chain logistics market remains fragmented, but mergers and acquisitions are increasing:

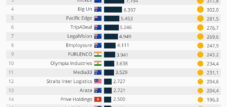

- Lineage Logistics, the world's largest operator of cold storage facilities, is planning an IPO with a valuation of USD 30 billion.

- DSV acquires DB Schenker to strengthen its European land and rail transport operations.

- RLS Logistics rises into the top 10 of North American providers through targeted acquisitions.

This consolidation creates economies of scale and enhanced services in the areas of warehousing, transport and customs clearance.

Regional focus areas

1. Asia-Pacific

- Drivers include increasing meat and milk production as well as the e-commerce boom (CAGR of 15.3% until 2033).

- China and India are investing heavily in automated warehouses and port infrastructure.

2. North America

- Holds a 38.6% market share (2024) due to strong retail networks and high demand for frozen food.

- Renewal of old warehouse structures by companies like Cold Summit.

3. Europe

- Strict environmental regulations are driving the use of green technologies (photovoltaics in warehouses).

- Germany is experiencing 8.5% growth due to the expansion of the pharmaceutical and biotech industries.

Suitable for:

Challenges and future prospects

challenges

- High investment costs: Deep-freeze storage facilities for pharmaceuticals with temperatures down to -196°C require enormous financial resources.

- Fragmented market: Regional providers compete with multinational logistics companies.

Future trends

- AI-powered forecasts help minimize supply chain disruptions.

- Circular economy: Reusable packaging and waste reduction are gaining in importance.

Innovations in cold chain logistics: The Daifuku example

Daifuku, a leading global provider of automated cold chain logistics solutions, has been developing specialized systems for the storage and transport of temperature-sensitive goods since 1973. With a focus on technology, efficiency, and sustainability, the Japanese company helps overcome space constraints, staff shortages, and increasing SKU diversity.

Daifuku's core innovations

1. Automated Storage and Transportation Systems (AS/RS)

- Specializing in deep-freeze storage down to -25°C.

- Pallet shuttle systems to increase throughput rates (e.g. 8,500 storage locations at Blue Bell Creameries).

- AI-controlled system for precise temperature control and inventory optimization.

2. Sustainability as a competitive advantage

- Energy-efficient cold storage technology reduces the CO₂ footprint by up to 30%.

- Solar-powered conveyor systems and recyclable packaging solutions.

3. Global Expansion

- Expansion of production capacities in Hobart/Indiana by 2025.

- 30% market share in Asia thanks to specialized AMHS (Automated Material Handling Systems) solutions.

Successful reference projects

Successful reference projects impressively demonstrate the impact of customized solutions: Blue Bell Creameries increased its warehouse utilization by 40% with a 5-aisle AS/RS system and -25°C storage. Kraft Heinz reduced operating costs by 25% thanks to pallet shuttle systems for frozen products. ICA Sverige achieved an impressive delivery accuracy of 99.8% through fully automated supermarket logistics.

Future strategies of and for Daifuku

- AI integration: Predictive maintenance reduces downtime by 45%.

- Modular systems: Scalable solutions for SMEs and multinational companies.

- Strategic partnerships: Participation in trade fairs such as RILA Link 2025 for further market development.

With over 50 years of experience, Daifuku is shaping the future of cold chain logistics and driving innovation for more sustainable and efficient logistics systems.

Xpert partner in warehouse planning and construction

From food to pharmaceuticals: The future of cold chain logistics with billions in potential - background analysis

Global Trends in Cold Chain Logistics: Growth, Innovation and Investments until 2033

The global cold chain logistics market is experiencing remarkable growth, driven by rising demand for perishable goods, groundbreaking technological innovations, and strategic mergers. Forecasts indicate impressive expansion, with the market volume projected to reach between US$1.2 and US$1.6 trillion by 2033. This equates to a substantial compound annual growth rate (CAGR) of 12 to 15 percent. This development is being fueled by massive investments in infrastructure expansion, the implementation of advanced technologies, and market consolidation.

Cold chain logistics is a complex network encompassing the temperature-controlled storage and transport of goods that require a constant temperature throughout their journey. This applies particularly to food, pharmaceuticals, and chemicals. An intact cold chain is crucial to ensuring the quality, safety, and efficacy of these products, thereby protecting consumer health and well-being.

Suitable for:

Market growth and key factors

Analysts agree that the cold chain logistics market will experience tremendous growth in the coming years. While some sources predict an increase from $292 billion in 2024 to $932 billion in 2033, others forecast a market volume of $1.64 trillion by 2036. This impressive growth is driven by various factors, including:

Growing demand for perishable goods

The growing global population, changing dietary habits, and an increasing awareness of healthy eating are leading to a higher demand for fresh foods, dairy products, meat products, and seafood. These products are highly susceptible to spoilage and therefore require an unbroken cold chain to guarantee their quality and safety.

Expansion of the pharmaceutical sector

The pharmaceutical sector is another key growth driver for cold chain logistics. Many medications, vaccines, and biopharmaceuticals must be stored and transported at specific temperatures to maintain their efficacy. The global market for healthcare cold chain logistics is projected to reach US$23.2 billion by 2033, highlighting the growing importance of this sector.

Boom in e-commerce and online delivery services

E-commerce has revolutionized the way we shop, and this is also true for the food sector. Online delivery services for groceries and ready meals are becoming increasingly popular, leading to a greater need for cold chain logistics for the "last mile." The food sector is projected to grow to $203 billion by 2033, highlighting the growing importance of online retail for cold chain logistics.

Technological innovations

Technological advancements play a crucial role in improving the efficiency, reliability, and sustainability of cold chain logistics. IoT (Internet of Things) sensors enable real-time monitoring of temperature, humidity, and other critical parameters during transport and storage. Blockchain technology ensures transparent and tamper-proof product traceability throughout the entire supply chain. Automated refrigeration systems and robotics improve efficiency and reduce human error in cold storage facilities and distribution centers.

Focus on sustainability

Given the growing awareness of environmental issues, sustainability in cold chain logistics is becoming increasingly important. Companies are investing in energy-efficient cold storage facilities, solar-powered refrigerated trucks, and alternative refrigerants to reduce their carbon footprint. The use of reusable packaging and the reduction of food waste are further key aspects of sustainability efforts in cold chain logistics.

Stricter regulatory requirements

Governments and regulatory bodies worldwide are tightening food and drug safety regulations to protect consumer health. These regulations mandate adherence to specific temperature standards, product traceability, and the implementation of quality management systems. Companies involved in cold chain logistics must comply with these regulations to maintain their operations and retain consumer confidence.

Investments and infrastructure development

To keep pace with the growing demand for cold chain logistics, massive investments are being made in expanding the infrastructure. This includes the construction of new cold storage facilities, the modernization of existing facilities, and the implementation of advanced technologies.

New cold storage facilities

Companies like RealCold are investing in the construction of new cold storage facilities in strategic regions such as Texas and Florida to increase capacity for storing and transporting food and pharmaceuticals. AIIM recently opened a new warehouse in South Africa to meet the growing demand for cold chain logistics in the region.

technology

Significant investments are being made in innovative technologies to improve the efficiency and sustainability of cold chain logistics. Sunswap has received €20 million to develop solar-powered refrigerated trucks designed to reduce fuel consumption and emissions. DENSO is using AI-powered temperature monitoring systems to track temperatures in real time during transport and detect deviations early.

Acquisitions

Corporate acquisitions play a key role in consolidating the market and strengthening global networks. UPS acquired Frigo-Trans/BPL to expand its expertise in pharmaceutical logistics in Germany. EQT acquired Constellation Cold Logistics, a company with 26 locations in Europe, to strengthen its presence in the European market.

Market consolidation

The cold chain logistics industry has traditionally been highly fragmented, with many small and medium-sized enterprises (SMEs) operating in local markets. However, in recent years, the market has consolidated, with major players expanding their market share through acquisitions and strategic partnerships.

Lineage Logistics

Lineage Logistics, the world's largest operator of cold storage facilities, is planning an IPO with a valuation of approximately US$30 billion. This underscores the growing importance of cold chain logistics and investors' confidence in the sector's growth potential.

DSV

DSV, a global transport and logistics group, is acquiring DB Schenker to expand its capacities in European land transport and rail logistics. This will enable DSV to offer its customers more comprehensive solutions for cold chain logistics.

RLS Logistics

RLS Logistics has strengthened its position in the North American market through acquisitions and is now among the top 10 providers in the region.

These consolidation strategies aim to leverage economies of scale, increase efficiency, and offer customers holistic solutions that include warehousing, transportation, customs clearance, and other services.

Suitable for:

Regional focus areas

The global cold chain logistics market is regionally diverse, with each region exhibiting its own growth drivers and challenges.

Asia-Pacific

The Asia-Pacific region is the fastest-growing market for cold chain logistics, driven by high milk and meat production, the booming e-commerce sector, and increasing consumer spending power. China and India are investing heavily in expanding their cold chain infrastructure, including automated warehouses and modern port facilities. A compound annual growth rate (CAGR) of 15.3 percent is projected for the region through 2033.

North America

North America is currently the largest market for cold chain logistics, with a market share of 38.6 percent projected for 2024. This is due to well-organized retail networks, high demand for frozen food, and advanced cold chain infrastructure. However, a large portion of existing cold storage facilities in North America are outdated, with 50 percent of facilities over 40 years old. Companies like Cold Summit are investing in modernizing these facilities to improve their efficiency and sustainability.

Europe

Europe is a mature market for cold chain logistics, driven by stringent sustainability standards and a strong focus on innovation. Companies are increasingly relying on green technologies such as photovoltaic systems in warehouses, energy-efficient refrigerants, and alternative transport solutions. Germany is experiencing strong growth in cold chain logistics, particularly in connection with pharmaceutical and biotech exports.

Cold chain logistics: Where growth meets complex obstacles

Despite its promising growth potential, the cold chain logistics industry faces a number of challenges:

High costs

Investments in refrigeration technology, energy-efficient systems, and advanced technologies are capital-intensive. Cooling products to extremely low temperatures (down to -196 degrees Celsius for certain medications) requires specialized equipment and expertise, further increasing costs.

Fragmentation

In many regions, the market is highly fragmented, with local suppliers competing with global corporations. This is particularly true for emerging markets, where cold chain infrastructure is often inadequate and regulatory frameworks are less stringent.

Shortage of skilled workers

Cold chain logistics requires highly qualified professionals with in-depth knowledge of temperature management, food safety, and logistics. The shortage of skilled workers poses a challenge for companies seeking to expand their operations and implement innovative technologies.

Despite these challenges, the cold chain logistics industry offers enormous potential for innovation and growth. Future trends include:

AI-powered forecasts

Artificial intelligence (AI) is being used to predict and prevent supply chain disruptions. AI algorithms can analyze historical data, weather forecasts, and other relevant information to identify potential risks and take proactive measures.

Circular economy

The principles of the circular economy are becoming increasingly important in cold chain logistics. Companies are relying on reusable packaging, reducing food waste, and looking for ways to conserve resources and minimize environmental impact.

With increasing trade volumes, technological innovations, and a growing awareness of sustainability, cold chain logistics remains a key sector for global supply chains. Strategic alliances, investments in technology, and a strong focus on customer satisfaction will be crucial for success in this dynamic market.

Daifuku: A pioneer in automated cold chain logistics

Daifuku is a leading global provider of automated cold chain logistics solutions, developing customized systems for the storage and transportation of temperature-sensitive goods since 1973. The Japanese company combines technology, efficiency, and sustainability to address challenges such as limited space, labor shortages, and increasing SKU diversity. Daifuku has established a reputation for developing innovative solutions that improve efficiency, reduce costs, and ensure product quality.

Key innovations from Daifuku

Daifuku has developed a number of key technologies and solutions that have revolutionized the cold chain logistics industry:

Automated Storage and Transportation Systems (AS/RS)

Daifuku specializes in the development and implementation of AS/RS systems for deep-freeze warehouses with temperatures as low as -25 degrees Celsius. These systems enable efficient and space-saving storage of goods while reducing energy consumption and operating costs. Daifuku's pallet shuttle systems allow for high throughput rates and are ideal for companies with large turnover volumes. For example, Daifuku installed an 8,500-pallet AS/RS system at Blue Bell Creameries, which significantly improved warehouse efficiency. Daifuku's AI-powered control system ensures precise temperature monitoring and inventory management to guarantee product quality.

Sustainability focus

Daifuku is strongly committed to sustainability and develops energy-efficient cooling technologies that reduce the carbon footprint by up to 30 percent. The company also uses solar-powered conveyor systems and recyclable packaging solutions to minimize its environmental impact. Daifuku strives to help its customers achieve their sustainability goals while simultaneously reducing their operating costs.

Global growth

Daifuku is continuously expanding into new markets and increasing its production capacity. In 2025, Daifuku will double its production capacity in Hobart, Indiana, to meet the growing demand for its solutions in North America. In Asia, Daifuku has achieved a 30 percent market share by providing customized AMHS (Automated Material Handling Systems) solutions.

Reference projects

Daifuku has an impressive list of reference projects with well-known clients in various industries:

Blue Bell Creameries

Daifuku installed a five-aisle AS/RS system with storage at -25 degrees Celsius, resulting in a 40 percent higher storage utilization.

Kraft Heinz

Daifuku implemented pallet shuttle systems for storing frozen food, resulting in a 25 percent reduction in operating costs.

ICA Sweden

Daifuku developed a fully automated supermarket logistics solution that guarantees a delivery accuracy of 99.8 percent.

Market influence

Daifuku has a significant influence on the cold chain logistics market, particularly in the area of automated warehouse solutions. The company supports the boom in online fresh food delivery with last-mile cooling solutions such as insulated packaging and electric vehicle fleets. The global AS/RS cold chain market is projected to grow to US$19.5 billion by 2033, and Daifuku holds a 12 percent market share.

Xpert.Plus warehouse optimization - high-bay warehouses such as pallet warehouses consulting and planning

We are there for you - advice - planning - implementation - project management

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital - Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital - www.xpert.solar - www.xpert.plus