China's germanium embargo and the consequences for Germany's industry: Price explosion by 165% – This metal is becoming a nightmare

Language selection 📢

Published on: October 11, 2025 / Updated on: October 11, 2025 – Author: Konrad Wolfenstein

China's germanium embargo and the consequences for Germany's industry: Price explosion by 165% – This metal is a nightmare – Image: Xpert.Digital

After China's export ban: price shock and chaos – is Congo now Germany's salvation?

Price explosion by 165%: Tanks without night vision? How China's germanium ban plunges the Bundeswehr into crisis

A virtually unknown metal called germanium is plunging German industry into a serious crisis and exposing its dangerous dependence on China. When Beijing drastically restricted its exports of this strategically important raw material in August 2023, it was more than just an economic measure—it was the use of a geopolitical weapon in the global technology conflict. The consequences are dramatic: The price of the silvery-lustrous semi-metal has more than doubled within two years and is approaching the €4,000 mark per kilogram.

Germany's key technological and military sectors are particularly affected. Without germanium, neither modern night-vision devices for tanks like the Leopard 2 nor highly efficient fiber optic cables for broadband expansion function. The arms industry is alarmed, NATO is concerned, and companies have to pay "virtually any price" to maintain production. The dependence is sobering: Over 60 percent of Germany's demand has previously come from China, which controls around 85 percent of global production. Now Germany faces the pressing question: How can this critical supply gap be closed? What alternatives, from domestic mining to deliveries from the Congo, really exist? And what lessons must policymakers learn from this raw materials shock?

Why is the entire German industry suddenly involved with a metal called germanium? China has drastically reduced its germanium exports to Germany, creating a problem that extends far beyond the raw materials markets. As an expert in strategic materials and industrial dependencies, I explain the most important aspects of this development to myself.

Suitable for:

The basics of the germanium problem

What exactly is germanium and why is it so important?

Germanium is a silvery metalloid with atomic number 32 in the periodic table. It was discovered in 1886 by the German chemist Clemens Winkler in Freiberg and named after Germania, the Latin name for Germany. The irony of the story: Today, this "German" element is mainly produced in China.

What makes germanium special are its unique physical properties. It exhibits excellent semiconductor properties, good thermal conductivity, and is transparent to infrared light. These properties make it virtually indispensable for modern technologies. With a melting point of 937.4°C and its semiconductor properties, germanium finds applications in various high-tech fields.

In which areas is germanium actually used?

Germanium's use is concentrated in three main areas: infrared optics, where it accounts for 72 percent of consumption, fiber optics, 19 percent, and other applications, 9 percent. These figures illustrate the specialized nature of these applications.

Specifically, germanium is found in fiber optic cables, where it improves the efficiency of light transmission. In semiconductor technology, it is used for specialized applications such as radio-frequency and infrared technologies. Its role in the defense industry is particularly critical: germanium is essential for night vision devices, thermal imaging cameras, sensors, and high-tech lenses, for example, in drones and satellites. It is also used in X-ray detectors and as a catalyst for PET plastic production.

How dependent is Germany on Chinese germanium?

The figures are sobering. Until the Chinese export restrictions in August 2023, around 60 percent of the germanium imported into Germany came from China. China controls approximately 80 to 85 percent of global germanium production. This extreme concentration makes the global supply extremely vulnerable.

German import statistics clearly demonstrate the extent of this dependence: Germany imported 10.5 tons of germanium in 2022, 8.3 tons in 2023, and only 5.3 tons in 2024. Of all imports into Germany in 2024, almost 45 percent came from China, 23 percent from Denmark, 15 percent from South Korea, and 11 percent from Belgium. However, it remains unclear whether the imports from Denmark or Belgium are re-exports of Chinese germanium.

China's strategic raw materials policy

Why has China restricted germanium exports?

China introduced export controls on gallium and germanium in August 2023, officially citing national security concerns. These raw materials are dual-use goods, meaning they can be used for both civilian and military purposes. The measure was a direct response to US restrictions on the Chinese semiconductor industry.

Export controls operate through a licensing system: Chinese companies must apply for a permit to export germanium, which officially takes 45 business days. In practice, this led to a drastic decline in exports. In December 2024, China then imposed a complete ban on exports of germanium to the United States.

How drastic is the decline in exports really?

The numbers speak for themselves. According to raw materials expert Justus Brinkmann, while China exported 28 tons of germanium in the first half of 2023, the figure for the full year 2024 fell to just 12.4 tons. In the first half of 2025, the figure was just 5 tons.

The decline is particularly drastic for Germany: Germany's share of Chinese exports fell from about half in 2024 to less than a fifth recently. Specifically, Germany has received only 902 kilograms from China so far in 2025. Compared to the same period last year, exports from China to Europe plummeted by almost 60 percent in the first half of the year.

Which other raw materials are affected by Chinese export restrictions?

Germanium is part of a broader Chinese strategy. Gallium has been subject to similar export controls since August 2023, and graphite since December 2023. Restrictions on antimony followed in September 2024. At the beginning of 2025, China announced further export restrictions on tungsten, tellurium, bismuth, indium, and molybdenum.

These raw materials are all critical for future technologies: Gallium is used in semiconductor production and solar cells, graphite is a key raw material for lithium-ion batteries, and antimony plays an important role in the solar industry and for military applications. China systematically uses its dominant position in these materials as a geopolitical weapon.

The impact on German industry

How much are the price increases?

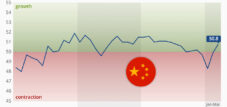

The price of germanium has risen dramatically. While the price per kilogram of 99.99 percent grade was still around €1,500 in 2023, by October 2025 the price had already reached just under €4,000 – to be precise, €3,983.70. This represents an increase of more than 165 percent.

The price trend demonstrates the dramatic nature of the situation: from around 2,600 euros per kilogram in 2022 to over 3,400 euros in 2024. In the first months of 2025, total imports already averaged almost 3,800 euros per kilogram. World market prices for high-purity germanium have more than doubled within two years.

Which sectors are particularly affected?

The arms industry is particularly alarmed. Germanium is essential for numerous military applications: night vision devices, infrared systems, sensors, high-tech lenses for drones, satellites, and specialized electronics. NATO is concerned about supply shortages, as modern weapons systems cannot function without these materials.

The telecommunications industry is also severely affected. Germanium is used in fiber optic cables to improve the efficiency of light transmission. The semiconductor industry uses germanium for specialized applications, even though the majority of production is based on silicon. However, the German electrical and digital industries are relatively relaxed: germanium is not one of the semi-metals widely used by industry.

What specific problems arise in production?

So far, companies haven't had to slow down their production, according to the consulting firm Inverto. Instead, purchasing teams are working hard on customized solutions to procure the material—they simply have to accept the drastically rising prices. Companies are showing themselves willing to "pay almost any price," as germanium expert Christian Hell of Tradium reports.

The problem lies not only in the higher costs, but also in the uncertainty of supply. The long processing times for Chinese export permits of 45 working days make planning significantly more difficult. Companies with larger stocks of germanium are holding them back and waiting to see how the market develops, which is driving prices even higher.

Alternative sources of supply and their limitations

Which other countries produce germanium?

Besides China, there are other supplier countries: Belgium, Finland, Canada, and the USA. However, these Western alternatives face the same problems and needs as Germany. Available quantities are limited and cannot compensate for the loss of Chinese supplies.

An interesting development is taking place in the Democratic Republic of Congo. The Belgian plant of the raw materials group Umicore has been supplied from there since 2024. The germanium comes from the recycling of mining waste—specifically from the "Big Hill" tailings dump in Lubumbashi, which contains an estimated 14 million tons of metal-bearing slag. STL, a subsidiary of Gecamines, aims for an annual germanium production of 30 tons.

How realistic is diversification of supply sources?

Diversification is difficult because germanium is usually extracted as a byproduct. As raw materials expert Justus Brinkmann explains: "Germanium is usually extracted as a byproduct from zinc production. Extraction from lignite ash or copper production is also technically feasible." This means that germanium availability depends on the production of these primary raw materials.

Peter Buchholz, head of the German Raw Materials Agency, warns: "With germanium, we are not as flexible as with gallium – even in the medium term, there are only a few alternative sources of supply." He argues that the markets are "highly concentrated," and the industry therefore urgently needs to develop other sources of supply. Other countries can also only step in to a limited extent, as China has established a virtual monopoly on critical raw materials.

What role does Congo play as an alternative?

Congo is emerging as an important alternative source. The agreement between Umicore and STL was welcomed by the Minerals Security Partnership (MSP), which comprises 14 nations and the European Union and aims to connect industrialized countries with resource-rich states. Umicore refined the first test quantities of germanium concentrates in the last quarter of 2024.

However, the German Federal Ministry for Economic Cooperation and Development (BMZ) warns about the Congo: "Rich raw material deposits, poor business climate." The country is politically unstable and its infrastructure is inadequate. Chinese companies have already secured access to Africa's most important raw material sources, as a recent analysis shows. Moreover, the Congolese quantities cannot fully compensate for the Chinese shortfalls.

Suitable for:

- EU-Mercosur Agreement: Latin America as the EU's mineral wealth? Lithium, copper, and other resources – Gold Rush 2.0?

Germanium in the German arms industry

Why is germanium so critical for the Bundeswehr?

Germanium is indispensable for modern weapons systems. The metal is found in various systems in Leopard tanks and Eurofighter fighter jets. The Bundeswehr uses germanium in third-generation thermal imaging devices, which provide high-resolution vision even at night and in adverse weather conditions.

Specifically, germanium is used in night vision devices, infrared systems, sensors, and high-tech lenses. Modern main battle tanks like the Leopard 2A8 are equipped with Atia thermal imaging devices, which require germanium. Germanium-based systems are also installed in Eurofighter fighter jets. NATO is concerned that a shortage of germanium could severely impact arms production.

What quantities does the arms industry need?

The exact quantities are mostly secret, but the magnitudes are considerable. A single F-35 fighter jet contains 420 kilograms of rare earths and critical materials. A large portion of this comes from China. Germanium is practically indispensable for modern night-vision devices and infrared systems.

The Bundeswehr recently ordered 16,041 additional night-vision devices, which also require germanium. Given the planned rearmament and the changing times, demand will continue to rise. Germany is planning massive investments in new tanks, modernized infantry fighting vehicles, and armed drones—all of which rely on germanium.

How is NATO responding to the supply shortages?

NATO is alarmed by the germanium shortage, as various media reports confirm. The shortage of this critical material is causing the alliance concern, as modern weapons systems cannot function without it. "Germanium is currently a huge problem," n-tv quoted the manager of a German defense company as saying.

The Alliance is working on solutions, but short-term alternatives are limited. Strategic stockpiling is becoming a key issue, but China is currently no longer exporting germanium for storage. NATO countries must fundamentally rethink their procurement strategies and develop alternative sources of supply.

Hub for security and defense - advice and information

The hub for security and defense offers well-founded advice and current information in order to effectively support companies and organizations in strengthening their role in European security and defense policy. In close connection to the SME Connect working group, he promotes small and medium -sized companies (SMEs) in particular that want to further expand their innovative strength and competitiveness in the field of defense. As a central point of contact, the hub creates a decisive bridge between SME and European defense strategy.

Suitable for:

Germanium Shortage: Can Germany Build Its Own Supply? Strategies for the Future – How Germany Can Achieve Raw Material Resilience

Possibilities for domestic production

Can Germany produce its own germanium?

Theoretically, yes, but practically it's difficult. Germany has zinc, copper, and lignite deposits from which germanium could be extracted as a byproduct. Research is already underway into the feasibility of such post-mining. Trace metals such as germanium, gallium, and indium could be extracted from residual deposits from old mines or from new deposits.

Until now, this hasn't been economically viable, but the scarcity is shifting the economic coordinates. The Federal Institute for Geosciences and Natural Resources describes significant raw material potential in Germany's geological subsurface. Several dozen exploration projects are currently underway in Saxony, including metals such as indium, silver, zinc, and other raw materials relevant to germanium.

What are the challenges facing domestic mining?

The challenges are diverse. First, significant investments are required: "Investments in raw material production and recycling are high and long-term," explains raw materials expert Brinkmann. Purchase guarantees are crucial, because without planning security, such investments are too risky.

The approval procedures are lengthy and complex. Starting raw material extraction in the heart of densely populated Germany is not only technically challenging but also associated with complex approval procedures. While the EU aims to shorten the approval procedures—reducing environmental impact assessments from one year to 90 days, and approval procedures to a maximum of two years—implementation is taking time.

What role can recycling play?

Recycling could play an important role, but is currently limited. The recycling rate for germanium is only two percent in the EU. Part of the supply already comes from factory scrap, while germanium scrap is also recovered from the windows of decommissioned tanks and other military vehicles.

However, the recyclability of germanium is limited. For most critical raw materials—such as rare earths, indium, or germanium—recycling rates remain negligible. This is because germanium is often present in very small quantities in products, and its recovery is technically difficult and economically unattractive.

Suitable for:

- Rare earths: China's raw material dominance-with recycling, research and new mines out of raw material dependency?

Substitution options and technical alternatives

Can germanium be replaced by other materials?

In principle, both materials can be replaced, explains raw materials expert Justus Brinkmann, but this would reduce the conductivity of the products. "Due to its exceptional conductivity, germanium is difficult to substitute," he confirms. In most applications, germanium cannot be replaced without significantly compromising the functionality of the products.

There are alternatives for some specific applications: Substituting germanium with silicon is partially possible, and zinc selenide is a possible alternative for infrared devices. However, this usually results in a deterioration in performance. Germanium-free thermal imaging lenses, for example, are now available, but such innovations take time.

What are the technical challenges of substitution?

Substitution is a long-term strategy. Unless you happen to be researching alternative materials and are already relatively advanced in development, you can't quickly replace germanium with less critical materials. The special properties of germanium—its transparency to infrared light, its excellent thermal conductivity, and its semiconductor properties—are difficult to replicate.

Barium fluoride is being discussed as an interesting alternative to germanium for use at higher temperatures. Germanium is already viewed with skepticism for optics larger than 100 millimeters in diameter due to its limited supply and high cost. However, these alternatives cannot completely replace germanium's unique properties.

How realistic are short-term technical solutions?

Short-term solutions are unrealistic. The development of substitute materials or alternative technologies takes years or even decades. The specialist literature repeatedly points out that substitutions are associated with performance losses. Companies must therefore live with high prices and uncertain supplies in the medium term.

The industry is therefore primarily relying on proven measures: improved material efficiency, long-term supply contracts, and supplier diversification. However, more innovative measures such as recycling and research and development remain the preserve of large companies. Most companies are unprepared for short-term solutions.

The role of politics and strategic consequences

What can German politicians do?

Politicians have a duty to provide the raw materials industry with greater planning security. Raw materials expert Brinkmann sees a clear mandate here: "Purchase guarantees would be important, because investments in raw material production and recycling are high and long-term." Without government support, private investments in domestic raw material extraction are too risky.

Raw material extraction should be given legal priority so that needs can be met in a timely manner and legal and planning certainty can be increased. The German government has already developed a raw materials strategy, but implementation is slow. Germany must reduce its dependence on unreliable suppliers like China and diversify supply chains.

What European initiatives are there?

With the Critical Raw Materials Act (CRMA), the EU has presented a strategy for 34 critical raw materials. Germanium and gallium are among the raw materials classified as particularly critical. The EU aims to mine 10 percent of these strategically important raw materials within the EU in the future – currently, the figure is just 3 percent.

Approval procedures are to be significantly accelerated: environmental impact assessments will be reduced from one year to 90 days, and approval procedures will be reduced to a maximum of two years. Brussels is supporting the extraction of domestic raw materials with investment incentives and accelerated procedures. The goal is to reduce dependence on individual supplier countries and promote domestic production.

How should Germany change its raw materials policy?

Germany needs a comprehensive raw materials strategy that goes beyond previous approaches. Current political initiatives provide important impetus, but they are not sufficient. The dependence on the supply of key raw materials can be alleviated by rapidly building up domestic refining and processing capacities within the EU, as well as through recycling.

Germany should enter into strategic partnerships with resource-rich countries and promote domestic raw material extraction. The EU should have begun building strategic stockpiles as early as 2023, warns expert Christian Hell. It is now too late, as China no longer exports germanium for storage. New recycling options and investments in research and development are also needed.

Suitable for:

- Mega deal nearing completion: World's largest free trade zone – The EU-Mercosur agreement

- EU-India-free trade agreements-opportunities and advantages for German companies-ambitious agreements for 2025 planned planned

- The modernized free trade agreement between the EU and Mexico: a comprehensive analysis of the Agreement of 2025

Long-term prospects and market development

How will the germanium market develop?

The forecasts are bleak. At the beginning of the year, management consultancy Deloitte predicted a supply shortage for 2024, a prediction that has now been confirmed. Experts expect prices to continue rising as long as China maintains its export restrictions. The market is extremely volatile and sensitive to geopolitical developments.

Matthias Rüth of Tradium explains the ongoing problems: The legally mandated stockpiling of important raw materials in China has led to a shortage in the market. In addition, global demand for germanium is increasing, especially in the infrared industry. Companies with larger germanium stocks are holding onto them and waiting, which is driving prices even higher.

What geopolitical consequences can be expected?

The germanium shortage is just a foretaste of coming geopolitical raw material wars. China is using its dominance in supplying the global market with many critical raw materials as an effective geopolitical weapon. The world is evolving from an open global economy into a multipolar world with intensified resource conflicts.

Europe and the US must learn that raw materials have long since become a tactical weapon. China systematically responds to Western technological restrictions with raw material embargoes. This strategy is likely to expand to include other critical materials. The battle for metals like germanium heralds a new era of geopolitical raw material wars.

What does this mean for German companies?

German companies must fundamentally rethink their procurement strategies. The days of cheap and reliable supplies from China are over. Companies are willing to pay "almost any price," but this is not a sustainable solution. In the long term, they must invest in alternative supply sources, recycling, and substitution research.

The primary measures used are still comparatively uninnovative – and even these are only found in half of all companies. More comprehensive precautions appear necessary, including strategic warehousing, long-term supply contracts, and the development of substitute materials. Smaller companies in particular are often inadequately prepared and dependent on political support.

Lessons for the future

What can be learned from the germanium crisis?

The germanium crisis reveals the dangerous dependence on individual supplier countries for critical raw materials. It demonstrates how quickly geopolitical tensions can lead to supply bottlenecks. Germany and Europe have ignored the warning signals for too long and are now in a difficult situation.

The crisis makes it clear that decoupling economic growth from raw material demand is not working. Raw material productivity cannot be increased to a degree that would make raw material imports unnecessary. Germany, as a highly developed and export-oriented economy, will continue to rely on critical raw materials in the future.

What structural changes are necessary?

Germany and Europe must develop a sustainable circular economy for mineral and metallic raw materials. Domestic primary raw materials and efficient recycling must be developed as complementary sources of supply. Metals are ideal candidates for this, as they are only used, not consumed.

Diversifying supply sources is essential, but not sufficient. Germany must invest in domestic raw material extraction, even if complete self-sufficiency is unrealistic. Rather, it is about achieving resilience and no longer being completely dependent on individual supplier countries. Building strategic reserves, promoting recycling technologies, and developing substitution options are essential.

What could a resilient raw material supply look like?

A resilient raw material supply requires a mix of different strategies. First, domestic raw material sources must be developed, even if this entails higher costs. Second, strategic partnerships with reliable supplier countries outside of China must be established. Third, recycling and the circular economy must be massively expanded.

Fourth, investments in research and development for substitute materials are necessary. Fifth, strategic reserves must be built up to cushion short-term supply disruptions. All of these measures require long-term planning, significant investments, and political support. The germanium crisis demonstrates: those who react too late pay a high price.

Your global marketing and business development partner

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development / Marketing / PR / Trade Fairs

Our EU and Germany expertise in business development, sales and marketing

Industry focus: B2B, digitalization (from AI to XR), mechanical engineering, logistics, renewable energies and industry

More about it here:

A topic hub with insights and expertise:

- Knowledge platform on the global and regional economy, innovation and industry-specific trends

- Collection of analyses, impulses and background information from our focus areas

- A place for expertise and information on current developments in business and technology

- Topic hub for companies that want to learn about markets, digitalization and industry innovations