Financial technology, or fintech, is a new financial industry.

Language selection 📢

Published on: August 24, 2018 / Updated on: August 30, 2024 – Author: Konrad Wolfenstein

According to the report, a new revolution is underway in the financial services industry. However, blockchain is not the new “revolutionary”, but rather artificial intelligence, big data and the Internet of Things.

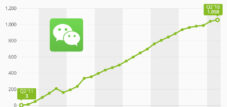

Who doesn't know PayPal, Alipay, WeChat Pay, Venmo, and many more? Therefore, in addition to blockchain cryptocurrencies, we also pay special attention to fintech technology.

+++ Fintech in Germany +++ FinTechs are gaining importance +++ FinTech is big in China, not in Japan +++ Mobile Payments – this is going to be something +++ German skepticism is holding back mobile payments +++ Mobile payment isn't working in Germany yet +++ Smart payments +++ Smartphones are ready, the markets less so +++ You can pay with Google Pay here +++ Consumers are moving more and more money digitally +++ Germans trust online banking the least +++

Fintech, or financial technology, is a collective term for technologies related to the financial services industry. The focus here is on modern technologies used by non-banks or bank-like service providers to offer financial services. These are often young companies or startups that attempt to operate without a banking license and secure market share from established competitors. This enables consumers to invest money, take out loans, make payments, or seek financial advice more independently online, without relying on traditional banks.

These technologies are primarily used in e-commerce and mobile applications. Mobile payment encompasses all forms of mobile cashless payment.

Advances in the electronics industry and the increasing prevalence of mobile devices with internet connectivity, such as smartphones, laptops, and tablets, are driving the growth of the fintech market. These technological advancements have led to a transformation, particularly in the banking sector, from traditional to modern online banking. In Germany alone, there were approximately 54.3 million online checking accounts in 2013. Surveys indicate a growing willingness to use online banking. Furthermore, mobile payment applications such as PayPal and Bitcoin are enjoying increasing popularity.

Fintech in Germany

Fintech is a term derived from the words "financial" and "tech." It encompasses companies specializing in new technologies and web-based services related to financial services, such as mobile payment systems, online payment platforms, and crowdfunding websites. In 2015, the strategy consultancy LSP Digital counted 139 fintech companies headquartered in Germany, 49 of which were located in Berlin. Fintech has thus already arrived in the German business world. However, according to a Statista survey, the majority of average consumers are unfamiliar with the term.

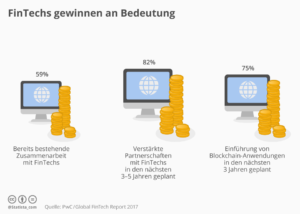

FinTechs are gaining in importance

“FinTech” is a buzzword frequently used in the Swiss financial industry – and rightly so, as the Global FinTech Report 2017 published last week by PwC shows. According to the report, established financial service providers in Switzerland are increasingly focusing on young online companies and are prioritizing cooperation over competition: 59 percent of the surveyed financial companies are already working with FinTechs, and 82 percent aim to strengthen such partnerships over the next three to five years.

They also intend to utilize a technology considered the future of financial flows, on which, among other things, the cryptocurrency Bitcoin is based: blockchain. 75 percent of financial service providers plan to introduce such applications within the next three years. This represents a significant shift in the Swiss financial sector, as Dr. Daniel Diemers of PwC Strategy& Switzerland confirms: “It is clear that the trends in the next five to ten years will lead to disruption in all areas of the financial services sector, including Swiss private banking and wealth management. Blockchain is transitioning from hype to reality. Ongoing collaboration between Swiss companies and FinTechs is the key to future success.”

FinTech big in China, not in Japan

35 percent of adult online users in Germany utilize FinTech services. This is according to the recently published FinTech Adoption Index 2017 by EY. These services include offerings in the areas of money transfers and payments, financial planning, savings and investments, loans, and insurance. FinTech is significantly more popular in China, with an adoption rate of 69 percent. In contrast, the high-tech nation of Japan is more reserved, with only 13 percent of its digitally active population using FinTech.

Mobile payments – this is going to be something!

Mobile payment means paying without cash, for example with a smartphone or even a smartwatch. It's a payment method that is steadily gaining in importance; nearly 664 million users worldwide are projected for 2021. Our infographic, created in cooperation with Concardis , introduces the topic and shows how Apple is gradually conquering the global market with its innovative solution, "Apple Pay."

German skepticism is slowing down mobile payments.

Germans are attached to cash. While countries like Sweden and Great Britain are rapidly moving away from physical money, coins and banknotes still account for over 50 percent of retail sales in Germany, according to an EHI study. Nevertheless, businesses are preparing for the future: two-thirds of major retailers in Germany plan to offer contactless payment by the end of the year – including Aldi and Lidl.

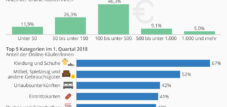

Now, consumers just need to get on board. According to a Statista survey, the majority are still skeptical. But at least 46 percent of adults in Germany are open to mobile payment. Statista analysts predict that the number of users will grow to 6.1 million within the next five years.

However, several things still need to happen. Currently, neither Apple Pay, Android Pay, nor Samsung Pay are available in this country. Rumors suggest that all three could be available this year. The introduction of mobile payments won't fail due to a lack of consumers with the necessary hardware. Market researchers at IHS Markit predict that there will be 3.4 billion compatible smartphones worldwide by the end of 2017.

Mobile payment is not yet available in Germany

According to Statista's Digital Market Outlook, around 2.2 million people in Germany will use mobile payment at the point of sale this year. This includes payments via mobile wallets, app-based transactions with a suitable merchant payment terminal, and NFC, QR code, or Bluetooth-based payments. However, even those who use such services tend to do so rather cautiously, as evidenced by the low average transaction volume of just over €80 per user. The situation is quite different in countries like the USA (€1,838 per user) or the UK (€1,683 per user).

Smart payment

Paying at the corner store is also becoming increasingly digital. This is shown in a recent study by the auditing and consulting firm Deloitte on payment behavior in the retail sector. According to the study, while the majority of Swiss shoppers still prefer card payments or cash when shopping in physical stores, 17 percent have already used their smartphones for payments, and the study expects this figure to almost double within the next twelve months. As with many digital technologies, the younger generation between 16 and 29 years old is significantly more active in this regard (25 percent) than older generations (11 percent among 50- to 69-year-olds).

27 percent of Swiss mobile payment users only use the app of the respective retailer when shopping in stores, but the majority also use third-party payment systems. Here, the domestic provider TWINT clearly leads with 40 percent of third-party users, ahead of the apps from Apple (33 percent) and Samsung (17 percent).

Smartphones are ready to take over the markets less

Neither Apple Pay, Samsung Pay, nor Android Pay are currently available in Germany. However, Germans are not alone in their lack of mobile payment options, as an analysis by IHS Markit shows. Apple's mobile payment system is currently only available in 15 international markets – and the situation is similar for its competitors. The infrastructure is already in place on the consumer side. By the end of 2017, 3.4 billion smartphones worldwide were expected to be compatible with one of the three major payment providers.

You can pay with Google Pay here

Google Pay is now available in Germany. Among the participating retailers at launch are Adidas, Lidl Süd, and Media Markt. Consumers can Google Pay wherever the corresponding symbol is displayed. The mobile payment service is now available in 19 countries and regions worldwide. By comparison, Apple Pay is currently available in 27 countries and regions – including small territories such as the Channel Islands and San Marino.

Consumers are increasingly moving more money digitally.

The global transaction volume of digital payments will reach US$4.6 trillion in 2021, according to the new Statista Fintech Report 2017. This includes all online payments initiated by consumers for products and services, mobile payments at the point of sale via smartphone apps, and cross-border peer-to-peer transfers between private users. The majority of this digitally moved money will be in China (US$1.5 trillion) and the USA (US$1.2 trillion). Analysts estimate the transaction volume for Germany at US$153 billion.

Germans trust online banking the least

Germans are not very trusting – at least when it comes to digital technologies. They are particularly fearful of the risks associated with online banking. Nearly three-quarters of respondents in a study by tns-Infratest believe that conducting financial transactions online is dangerous. They are also cautious when it comes to online shopping: only slightly more than 40 percent believe that ordering goods via the internet poses little or no risk.