Government in China: Electric cars, a key industry, are missing from China's new five-year plan.

Xpert pre-release

Language selection 📢

Published on: November 4, 2025 / Updated on: November 4, 2025 – Author: Konrad Wolfenstein

Government in China: Electric cars, a key industry, are missing from China's new five-year plan – Image: Xpert.Digital

Price war, overcapacity, wave of bankruptcies: The hidden crisis behind China's electric car boom

First billions in subsidies, now a drastic cut: Beijing's radical U-turn on electric cars

China, the undisputed giant of global electric mobility, is undergoing a strategic about-face with far-reaching consequences. Beijing's decision to no longer include electric vehicles as a key strategic industry in its upcoming five-year plan is far more than a bureaucratic formality – it marks the end of an era and a tacit admission that the massive, decade-long subsidy policy has reached its limits. While the industry has risen to the top of the technological world, state-directed support has triggered a profound crisis hidden beneath the impressive sales figures.

The consequences of this policy are severe: Gigantic overcapacities, exceeding actual demand by a factor of two, have ignited a ruinous price war (“Neijuan”) that is wiping out the profits of most manufacturers. A massive wave of bankruptcies has already swept over 400 companies from the market, and analysts predict the demise of 80 percent of the remaining startups. Even product quality is suffering under the pressure of mass production. This homegrown crisis has long since spilled over beyond China's borders. The overproduction is being exported to the global market in the form of extremely cheap electric cars, putting established manufacturers like VW, BMW, and Mercedes under immense pressure, which in turn jeopardizes jobs in Europe. Beijing's course correction is therefore not only a sign of the maturity of the electric car industry, but above all, a sign of the need to redirect resources to new technological fields such as AI, quantum computing, and nuclear fusion, and to manage a bubble created by subsidies before it destabilizes the entire economy.

Suitable for:

- China's "disorderly competition" – The fight against self-destructive economic dynamics (Politburo meeting on July 30, 2025)

A silent admission of industrial maturity and the limits of state-planned economies

China's decision to remove electric vehicles from its strategic key industry list for 2026-2030 marks a fundamental turning point in Chinese economic policy. This move ends over a decade of intensive state-sponsored promotion and reveals deep-seated structural problems that cannot be solved simply by promises of subsidies. The removal from the strategic catalog does not mean that electric mobility is losing importance, but rather that Beijing is acknowledging that the industry has matured enough to allow its further development to be driven by market mechanisms. At the same time, this step signals the need to focus limited state resources on newly prioritized areas such as quantum technology, bioproduction, hydrogen and nuclear fusion energy, and artificial intelligence.

The development of subsidized overinvestment: How government industrial policy led to economic distortions

The previous promotion of electromobility was based on a strategic rationale that has proven problematic. In the 1990s, China's leadership recognized that domestic automakers had an insurmountable technological disadvantage compared to established Western manufacturers in the field of conventional combustion engines. Electromobility was thus perceived as an opportunity to circumvent this competitive disadvantage. A first comprehensive support program was launched in 2009. However, the real intensification of subsidies only followed later, when Beijing realized that the decentralized structure of the Chinese economy led to a mass establishment of manufacturers that would not be viable without state transfer payments. The available data demonstrates the scale of these transfers: According to Handelsblatt, more than a dozen Chinese automakers received approximately €5.7 billion in direct subsidies between 2021 and 2023. The Kiel Institute for the World Economy estimates purchase premiums for new energy vehicles at approximately 5.3 billion euros by 2022. Even the Chinese Ministry of Industry and Information Technology reports subsidies of around 197 million euros for the years 2016 to 2020, a significantly lower sum that illustrates the difficulty of capturing the total amount of support measures.

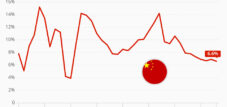

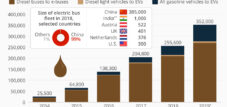

This subsidy policy initially had the intended effect. Within just a few years, China developed into the world's leading nation in electromobility. The market penetration of electric vehicles significantly surpassed all other regions of the world. In 2024, around 10.6 million electric vehicles were sold in China, more than the rest of the world produced combined. The market share of these new energy vehicles already exceeded 60 percent of new registrations. However, these impressive figures mask a systematic misallocation of resources, which is increasingly having problematic consequences.

Matches:

- China's electric car industry is heading for historic consolidation – and is even forcing market leader BYD to flee

The overcapacity crisis: How financial incentives led to industrial overproduction

The central pathology of the Chinese electric vehicle market can be expressed in a simple formula: production capacity is twice as high as actual demand. While passenger car sales in China amounted to approximately 24 million units in 2024, all Chinese manufacturers combined can produce roughly 50 million vehicles per year. This overcapacity is not the result of unfavorable market developments, but rather the direct consequence of a subsidy policy that provided perverse incentives for local governments and manufacturers.

The decentralized structure of the Chinese state played a key role here. Local governments pursued their own economic interests and saw the electric vehicle industry as an opportunity to increase tax revenues and create jobs. Without central coordination, this led to a massive overproduction of manufacturing capacity. As long as state subsidies flowed and purchase incentives were paid to consumers, this system could function. However, with the reduction and eventual cessation of these payments in 2022, the structural weakness of the model became apparent.

The statistical reality is telling. According to data from Jato Dynamics, 93 of the 169 automakers operating in China have a market share of less than 0.1 percent. Particularly in the segment of so-called new energy vehicle startups, market share is fragmented to fractions of a percentage point. These companies owe their existence primarily to subsidies. Without government support, the vast majority of these manufacturers would not be viable at all. The industry has undergone a massive consolidation process, which is far from stabilizing. Over 400 electric vehicle companies have disappeared from the market. Between 2015 and 2020, there were at times over 500 different electric vehicle brands in China. Today, industry analysts estimate that over 80 percent of the remaining startups will exit the market in the coming years. Some high-profile companies, such as WM Motor, have already filed for bankruptcy.

The price war spiral: How overcapacity leads to deflation

With the reduction and eventual phasing out of subsidies, the Chinese automotive industry faced a new reality. Manufacturers had to lower their prices to maintain factory capacity and defend market share. This led to a ruinous price war, which Xi Jinping publicly criticized and which the Chinese describe as "neijuan," literally meaning involution or internal winding. This term describes a destructive competitive situation in which competitor-driven price cuts reinforce each other without creating added value, but rather destroying profitability.

The extent of the price reduction is unprecedented. BYD, the company that leads the Chinese electric vehicle industry economically, offered electric car models for under €7,000 during periods of this price war. This pricing strategy can only be justified by marginal profit margins or even losses per vehicle. What is particularly problematic is that not only marginal but also established manufacturers are suffering under the pressure. Data from the consulting firm AlixPartners and experts surveyed by Reuters show that even large manufacturers like NIO, XPeng, and SAIC are experiencing significant operational difficulties. NIO, for example, is still posting massive losses despite increased delivery figures. In the second quarter of 2025, the company's net loss amounted to approximately $576 million. BYD, the only Chinese electric vehicle manufacturer besides Tesla to report significant profits, nevertheless faces enormous pressure.

This deflationary dynamic is spreading beyond the automotive industry. China's industrial profits fell by 9.1 percent year-on-year in May 2025. In June, the decline was still 4.3 percent. The mining sector, an indicator of investment in infrastructure and production, saw profits fall by over 31 percent. These figures point to an economic situation approaching the classic deflationary spiral experienced by Japan in the 1990s. Xi Jinping and the Chinese leadership have recognized this trend and are attempting to counteract it by warning against excessive investment in overcapacity industries and directing governments to pursue less risky investment plans.

Suitable for:

- China and the Neijuan of systematic overinvestment: State capitalism as a growth accelerator and structural trap

The quality crisis behind the brilliant growth figures

One aspect often overlooked in discussions about China's electric vehicle crisis is the issue of quality and reliability. While Chinese manufacturers have made real progress in battery technology and innovative vehicle concepts, significant shortcomings are evident in the overall quality of their vehicles. JD Power, a leading data analytics and consumer research company, documents that electric vehicles and plug-in hybrids in China currently exhibit 226 problems per 100 vehicles, compared to only 212 problems per 100 units for conventional vehicles. This rate even worsened by 37 percent between 2023 and 2024. The sophisticated infotainment systems are particularly problematic, generating approximately 31 issues per 100 vehicles. This reveals a strategy in which manufacturers have pursued aggressive technological advancements at the expense of fundamental quality standards.

The insurance industry is also suffering from this development. Car insurers in China are posting losses on electric vehicles, even though they charge premiums 20 to 100 percent higher than for conventional vehicles. This means that, despite premium increases, loss ratios are still above sustainable levels. The model of subsidized mass production has not only led to overcapacity and price deflation, but also to a decline in quality, which jeopardizes profitability in the long term.

Our China expertise in business development, sales and marketing

Industry focus: B2B, digitalization (from AI to XR), mechanical engineering, logistics, renewable energies and industry

More about it here:

A topic hub with insights and expertise:

- Knowledge platform on the global and regional economy, innovation and industry-specific trends

- Collection of analyses, impulses and background information from our focus areas

- A place for expertise and information on current developments in business and technology

- Topic hub for companies that want to learn about markets, digitalization and industry innovations

Why China's auto industry is at a crossroads: End of the subsidy era?

The failed consolidation attempt: The state's attempt to correct its own failure

Particularly revealing is the failure of the planned merger between the two major state-owned automakers, Dongfeng and Changan (later SAIC), in the spring of 2025. This merger was intended to be a massive amalgamation of two state-owned enterprises, creating, on paper, a company capable of competing with BYD. For many observers, this was a sign that Beijing's central government had finally recognized the need to reduce overcapacity through consolidation. However, the merger plans were abruptly abandoned.

The reason for the failure lies in China's own political structure. Mergers of state-owned enterprises lead to job losses and the closure of plants in some provinces. Since local governments are measured by the economic activity in their regions, massive political resistance arises against such measures. The companies involved would also have faced complex legal problems with their joint ventures with international partners like Ford, Mazda, Nissan, and Honda as a result of the planned merger. Ultimately, similar product ranges and customer groups would have led to cannibalization and a streamlined product portfolio, resulting in further job losses. What is revealed here is a dilemma of the Chinese planned economy: While the state can mobilize massive resources to create industries, it finds it difficult to divest itself of its own creations when they become too economically unviable.

Yang Xuejo, the powerful chairman of China's state-owned holding company SRS SAC, which manages state assets, voiced open criticism in the spring of 2025 that state-owned enterprises had lagged too far behind in the transformation to electric mobility. These are strong words from a top manager educated in both the UK and the US, and they suggest that even within the party apparatus, dissatisfaction is growing with the inability to address structural problems. If the central government cannot even merge two directly state-owned companies to reduce overcapacity in a controlled manner, it bodes ill for China's ability to tackle the larger structural problems of its economy.

Suitable for:

The extent of the lost profits: The financial crisis beneath the surface

Behind the headlines about record-high deliveries lie deep financial problems. The total net working capital of China's 16 largest publicly traded automakers amounted to approximately $14.5 billion at the beginning of 2025. This marks a 62 percent decline from the peak of $290.5 billion at the beginning of 2021. BYD, although considered relatively profitable compared to its competitors, faces the most severe working capital pressure of all the major manufacturers. It is followed by Geely, Nio, Seres, and the state-owned companies BAIC and JAC. A Financial Times report from July 2025 documented that major suppliers and business partners of these companies are accumulating unpaid invoices. This means that the financial stress is spreading from the vehicle manufacturers to the entire supply chain.

The profitability of leading electric vehicle manufacturers paints a mixed but largely bleak picture. BYD and Tesla achieve substantial operating profit margins that set them apart from the competition. However, the operating profit margins of NIO, XPeng, and Polestar are 14 to 74 percentage points lower than those of Tesla. The cash flow gap is even more concerning, with differences of $16 to $20 billion between Tesla and its Chinese alternatives. Tesla also has the ability to expand its production while maintaining profitability. Chinese manufacturers, on the other hand, often have to choose between price reductions to maintain sales volumes or accepting lower sales. According to BYD representatives, over 80 percent of the 120 electric vehicle manufacturers in China will go bankrupt in the coming years.

Technological leadership and the strategy of resource diversion

Despite all the criticism of the economic and social consequences of subsidy policies, it must be acknowledged that China has indeed achieved a leading position in pure battery technology and innovative vehicle concepts. Battery cell manufacturer CATL, the world's largest battery supplier, unveiled several new technologies in 2025 that set global benchmarks. The second-generation Shenxing battery promises a maximum charging capacity of over 1,300 kilowatts, enabling a range of 520 kilometers with a charging time of just five minutes. BYD, for its part, announced its Super e platform, which achieves peak charging capacities of 1,000 kilowatts. These are advancements that make the current European and American infrastructure seem outdated.

China has also made progress in the development of sodium-ion batteries, which are more cost-effective than lithium-ion technology. In 2025, CATL presented the Naxtra battery with an energy density of 175 watt-hours per kilogram, supporting over 10,000 charging cycles and retaining 90 percent of its capacity even at minus 40 degrees Celsius. Such technologies could democratize access to electric mobility in poorer countries in the future.

China currently holds a 70 percent share of global battery production. In the first two months of 2025 alone, China sold 1.4 million electric vehicles, representing 58 percent of the world market. China's market share in lithium chemical production is approximately 68 percent. This makes the global electric mobility value chain permanently dependent on China. For Beijing, it therefore makes strategic sense to reduce subsidies for electric mobility as an established industry and concentrate available resources on emerging technologies where China has not yet achieved a dominant position.

The new focus on quantum technology, bioproduction, hydrogen and nuclear fusion energy, and artificial intelligence reflects a longer-term strategic consideration. China aims not only to compete in more mature industries like electromobility but also to establish a leading position in future technology fields. In artificial intelligence, particularly in large language models and generative systems, China has made significant progress in recent years through intensive investment. Quantum technology is considered a key technology for the future of information technology. Hydrogen and nuclear fusion are seen as promising energy carriers for a decarbonized global economy.

The global context: How China's electromobility strategy is changing the world

The significance of China's subsidy policy for electromobility cannot be understood without considering the global context. Through its massive support, China has not only built one of the world's largest electromobility industries but has also fundamentally altered the global pricing structure for electric vehicles. European and American manufacturers must now compete with Chinese imports, whose prices are often a third or even half lower than their European counterparts.

According to PwC forecasts, Europe will become a net importer of automobiles as early as 2025. Nearly 800,000 cars produced in China could be sold in Europe in 2025, over 330,000 of them from European manufacturers that have shifted their production to China. This marks a dramatic shift: in 2015, Europe still had an export surplus of 1.7 million vehicles per year. By 2030, the Chinese market share in the Western European electric car market is projected to rise to over 12 percent, double its current level. Only a few European models are among the top five best-selling electric vehicles worldwide.

The tariffs imposed by the European Union on Chinese electric vehicles are an attempt to curb this trend. However, the politically and economically destructive nature of Chinese pricing means that even with tariffs, European manufacturers suffer from increased competitive pressure. If Chinese vehicles are so cheap that even with tariffs they remain less expensive than European models, European producers are forced to lower their own prices, thereby jeopardizing their profitability. Volkswagen, BMW, and Mercedes saw their market shares in China erode dramatically between 2020 and 2024. This leads to investment uncertainty and job losses in Europe and the US as well.

This also reveals the perverse dynamic: The German automotive industry now has to invest in China to participate in the production of electric vehicles there, while simultaneously reducing jobs at home. Volkswagen announced plans to cut 35,000 jobs, Mercedes 20,000, and Audi is planning extensive reductions. These job losses are partly a result of the price dynamics induced by Chinese subsidies.

The lost potential: Why higher subsidies are not the solution

An instructive aspect of the Chinese experience is the demonstration that state subsidies alone are insufficient to create sustainably profitable industries. While the Chinese state was able to mobilize massive amounts of capital and resources, this resulted in overcapacity that cannot be absorbed economically. The centrally planned administration system failed to react quickly enough to halt the creation of new capacity once oversupply had already emerged.

The lesson is profound: An industry entirely dependent on subsidies is not a true industry. Rather, it is an administrative rent that consumes itself when transfer payments are reduced. Genuine profitability arises only through efficiency, innovation, and optimal resource allocation. The state can hardly enforce these, even with unlimited resources. Instead, in an environment with many complementary private or semi-public actors, government subsidies create distortions that lead to overinvestment.

The extent of this loss becomes apparent when one considers the real allocation of resources. Had the capital that flowed into electric vehicle subsidies been invested in other areas such as education, infrastructure, or research, the overall economic return might have been higher. This is partly why Xi Jinping and other top Chinese leaders have recognized the dangers of persistent overinvestment.

Suitable for:

- Beijing's new five-year plan and massive investment program: How China is challenging the global economic order

The restructuring of the global automotive industry

China's strategy of eliminating subsidies for electric vehicles is accompanied by a restructuring of the global automotive industry. China will not stop producing and exporting electric vehicles. But going forward, manufacturers will have to achieve profitability through efficiency, cost leadership, and technological superiority, not through subsidies. This will lead to another market consolidation, from which only the strongest and best-managed companies will benefit.

Further battery technology development will remain in Chinese hands. BYD's position will continue to consolidate as hundreds of weaker competitors disappear from the market. The global automotive industry will therefore become not less, but rather more dependent on China, as battery production remains a bottleneck and China retains its technological and manufacturing leadership.

For Europe and the US, this means that the window for technological catch-up is limited. The European battery industry lags behind China by about ten years. Without massive investments in research, infrastructure, and manufacturing, Europe will not be able to become independent of the Chinese battery sector. The pursuit of self-sufficient European value chains in the field of electromobility therefore remains not only an economic but also a security policy imperative. The path to achieving this will be difficult and involve substantial investments, sometimes requiring uncomfortable structural adjustments.

Your global marketing and business development partner

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development / Marketing / PR / Trade Fairs

🎯🎯🎯 Benefit from Xpert.Digital's extensive, five-fold expertise in a comprehensive service package | BD, R&D, XR, PR & Digital Visibility Optimization

Benefit from Xpert.Digital's extensive, fivefold expertise in a comprehensive service package | R&D, XR, PR & Digital Visibility Optimization - Image: Xpert.Digital

Xpert.Digital has in-depth knowledge of various industries. This allows us to develop tailor-made strategies that are tailored precisely to the requirements and challenges of your specific market segment. By continually analyzing market trends and following industry developments, we can act with foresight and offer innovative solutions. Through the combination of experience and knowledge, we generate added value and give our customers a decisive competitive advantage.

More about it here: