Why are China's exports weakening and how is trade with the US and the EU developing?

Xpert pre-release

Language selection 📢

Published on: September 8, 2025 / Updated on: September 8, 2025 – Author: Konrad Wolfenstein

Why are China's exports weakening, and how is trade with the US and the EU developing? – Creative image: Xpert.Digital

Weak domestic demand | China exports plummet: What the 4.4% figure really means | US boom over: Why China's exports to the US collapsed by 33%

China's changing trade flows: impact of US tariffs and new markets

The Chinese export industry is under considerable pressure. In August 2025, Chinese exports grew by only 4.4 percent year-on-year, well below Bloomberg's expectations of 5.5 percent. This slowdown marks the lowest export growth in the past six months and reflects the ongoing challenges in international trade.

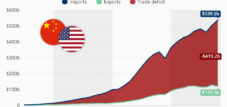

The most dramatic decline was seen in trade with the United States. China's exports to the US plummeted by 33 percent year-on-year in August, following a decline of over 21 percent in July. This massive slump is a direct result of the trade tensions between the two nations that have been simmering for months.

China's trade balance also fell short of expectations in August, at $102 billion, despite being higher than a year earlier. Notably, imports grew by only 1.3 percent, compared to 4.1 percent in July, indicating weak domestic demand.

What role do US tariffs play and how is the trade conflict developing?

The trade dispute between the US and China reached its peak so far in April 2025. US President Donald Trump imposed drastic punitive tariffs on Chinese goods, at times exceeding 145 percent. China responded with retaliatory tariffs of up to 125 percent on US imports.

In mid-May 2025, both countries agreed in Geneva on a temporary easing of tariffs. Tariffs were reduced to 30 percent for Chinese exports to the United States and 10 percent for US goods to China. This tariff pause has already been extended several times, most recently in August 2025 for another 90 days until November 10, 2025.

According to Trump, current negotiations between the two nations are going "quite well," and the relationship with President Xi Jinping is "very good." Nevertheless, the situation remains fragile, as Trump has already threatened 200 percent tariffs on certain Chinese goods.

How is China shifting its trade flows to Europe and Germany?

While exports to the US are collapsing, China is achieving a remarkable redirection of its trade flows. Chinese exports to the European Union increased by more than 10 percent in August. Exports to Germany rose by 7.5 percent, underscoring the growing importance of the European market for Chinese manufacturers.

This development is also reflected in Germany's trade balance. In the first five months of 2025, Germany imported around 10 percent more goods from China, while German exports to China fell by 14 percent. Germany's trade deficit with China has more than tripled compared to 2020.

Trade in metal products developed particularly dramatically: While German exports to China shrank by 25 percent, imports from China rose by the same percentage. German exports of motor vehicles to China even fell by 36 percent, while Chinese imports of machinery and pharmaceutical products to Germany each increased by 19 percent.

What does this development mean for the German economy?

The shift in trade flows is hitting the core of German industry. China is no longer Germany's most important trading partner, having been overtaken by the United States for the first time since 2015. Trade volume between Germany and China amounted to €246 billion in 2024, compared to almost €300 billion in 2022.

This development reveals a problematic asymmetry: German companies are losing market share in China, while Chinese products are increasingly conquering the German market. This trend is exacerbated by the undervaluation of the Chinese yuan against the euro, which gives Chinese manufacturers additional competitive advantages.

IW foreign trade expert Jürgen Matthes warns of a "China shock" and demands that EU trade policy must more comprehensively combat Chinese distortions of competition through subsidies and currency manipulation. The EU's countervailing tariffs on Chinese electric cars are already having an impact: Imports of Chinese electric vehicles have fallen by 38 percent.

Our recommendation: 🌍 Limitless reach 🔗 Networked 🌐 Multilingual 💪 Strong sales: 💡 Authentic with strategy 🚀 Innovation meets 🧠 Intuition

At a time when a company's digital presence determines its success, the challenge is how to make this presence authentic, individual and far-reaching. Xpert.Digital offers an innovative solution that positions itself as an intersection between an industry hub, a blog and a brand ambassador. It combines the advantages of communication and sales channels in a single platform and enables publication in 18 different languages. The cooperation with partner portals and the possibility of publishing articles on Google News and a press distribution list with around 8,000 journalists and readers maximize the reach and visibility of the content. This represents an essential factor in external sales & marketing (SMarketing).

More about it here:

Trade diversion and its consequences: What Germany and Europe can expect now

Where is China shifting its exports as an alternative to the US?

China is pursuing a targeted strategy of geographical diversification of its export markets. This redirection has been particularly successful in Southeast Asia, where exports to ASEAN countries increased by 22.5 percent. Japan recorded a 6.9 percent increase in Chinese imports.

The strategy goes far beyond mere trade relations. Chinese direct investment in the four largest Southeast Asian partner countries – Indonesia, Malaysia, Thailand, and Vietnam – has quadrupled in ten years and now averages $8.8 billion per year. These countries are now so closely intertwined with China that bilateral trade accounts for an average of 19 percent of their gross domestic product.

In Latin America, China is already the second-largest trading partner, with a trade volume of $518 billion in 2024. More than 20 Latin American countries have joined the New Silk Road, including Peru, Chile, and Argentina. China is strategically investing in key sectors such as lithium mining, copper production, and electromobility.

How is China's engagement in Africa developing?

Africa plays a central role in China's global diversification strategy. China is already Africa's largest trading partner, with a trade volume of approximately 152 billion euros. At the 2024 China-Africa Forum in Beijing, President Xi Jinping pledged an additional 360 billion yuan (approximately 45 billion euros) in loans and investments over the next three years.

These funds will flow through various channels: 210 billion yuan in loans, 80 billion in aid, and 70 billion in private Chinese companies. China has built more than 1,000 bridges, nearly 100 ports, and 10,000 kilometers of railway lines in Africa over the past 25 years.

However, the investment strategy has changed. While large-scale infrastructure projects used to be the focus, China is now focusing on "small but powerful" sustainable projects and boosting local economies. At a summit, China announced tariff-free trade with some African countries.

What challenges arise from Chinese expansion?

The massive expansion of Chinese exports to developing countries is increasingly encountering resistance. From Indonesia to Brazil, cheap Chinese goods are flooding markets and damaging local industries still recovering from the COVID-19 pandemic.

Fifty percent of Chinese exports now go to developing countries, leading to significant backlash against Chinese trade and investment practices. Experts warn that China will face increasing pressure to ensure its exports do not become a major nuisance in relations with Latin America, Africa, and Southeast Asia.

However, the relative weakness of Chinese domestic demand and the importance the country attaches to its industrial power mean that the flow of cheap Chinese goods abroad is unlikely to abate any time soon.

How do other markets react to Chinese competition?

The EU has already taken concrete countermeasures. The countervailing tariffs on subsidized Chinese electric cars, which have been in place since autumn 2024, are having an impact: Imports of Chinese electric vehicles to Germany fell by 38 percent, and the number imported fell by 30 percent.

These measures are part of a broader EU strategy to combat Chinese distortions of competition. The German Economic Institute calls for EU trade policy to more comprehensively combat Chinese subsidies and currency manipulation in order to restore a level playing field.

Resistance to Chinese trade practices is also growing in other regions. Several countries are considering or have already introduced safeguards against Chinese imports to protect their domestic industries.

What are the long-term effects of trade diversion?

The diversion of Chinese trade flows is fundamentally changing global economic geography. China is systematically building new dependencies in developing countries, while traditional trade relations with the United States and, to some extent, with Europe are weakening.

This development has far-reaching geopolitical implications. China is strengthening its influence in the so-called "Global South" while simultaneously reducing its dependence on Western markets. The New Silk Road is becoming an instrument of this strategy, even as large-scale infrastructure loans decline.

This creates new challenges for the German and European economy. On the one hand, they benefit in the short term from increased Chinese imports, but on the other, they lose market share in China and must expect increased Chinese competition in third-party markets.

How might the situation develop by the end of 2025?

The coming months will be crucial for the future development of global trade flows. The tariff pause between the US and China, which has been extended until November 2025, offers scope for further negotiations. A meeting between Trump and Xi Jinping is possible, but not yet concretely planned.

If negotiations fail, tariffs could rise above 100 percent again, further accelerating the diversion of Chinese exports. This could further increase pressure on European and other markets.

China is likely to continue its diversification strategy even if a trade deal with the US is reached. Once established, trade relations and investments in Southeast Asia, Latin America, and Africa cannot simply be reversed.

For Germany and Europe, this means they must prepare for a permanent change in the trade landscape. The days when China primarily served as an export destination and a cheap production location are increasingly a thing of the past. Instead, China is increasingly becoming a direct competitor on global markets, requiring new trade policy responses.

Your global marketing and business development partner

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.