China's electric car industry is heading for historic consolidation – and is even forcing market leader BYD to flee

Xpert pre-release

Language selection 📢

Published on: October 19, 2025 / Updated on: October 19, 2025 – Author: Konrad Wolfenstein

China's electric car industry is heading for historic consolidation – and is even forcing market leader BYD to flee – Image: Xpert.Digital

Struggle for survival in the Middle Kingdom: When the home market becomes a battlefield

BYD's strategic retreat: When expansion becomes a question of survival

The announcement by the Chinese electric car manufacturer BYD to build around 300 fast-charging stations in South Africa by the end of 2026 appears, at first glance, to be an ambitious expansion move by a confident market leader. But behind this offensive lies a far more complex economic reality: The world's largest manufacturer of electric vehicles is fleeing its home market because a brutal price war there is challenging even profitable business models. The expansion into Africa is less an expression of strength than a strategic way out of an existential crisis facing the Chinese automotive industry.

The global automotive industry is currently undergoing one of the most profound transformations in its history. At the center of this upheaval is China, which has risen from a laggard to the dominant player in the electric vehicle sector within just a few years. With a market share of over 50 percent of new vehicles, electric and plug-in hybrid vehicles have surpassed conventional combustion engines in China for six consecutive months. But this unprecedented success has created a dark side: massive overcapacity, leading to a self-destructive competition that Chinese authorities refer to as "neijuan"—a senseless, mutually consuming rivalry without real progress.

BYD exemplifies this paradox. While the company sold more all-electric vehicles than Tesla in the second quarter of 2025, consolidating its global leadership, it simultaneously reported a 29.9 percent year-on-year profit decline for the first time in over three years. The group's gross margins shrank to 16.3 percent, while aggressive price cuts of up to 34 percent on 22 models put pressure on the entire industry. This development raises fundamental questions about the sustainability of China's growth model and illustrates how state-sponsored overinvestment can lead to structural distortions that endanger even the most successful players.

This analysis examines the complex economic mechanisms forcing BYD's strategic realignment. It first illuminates the historical roots of the current crisis, then analyzes the key drivers and market dynamics, assesses the current situation using quantitative indicators, and contrasts various international expansion strategies. Finally, the long-term implications for the global automotive industry and the associated geopolitical tensions are discussed.

Suitable for:

From subsidized advancement to self-destructive competition

The development of the current overcapacity crisis in China's electric vehicle industry can be traced back to a series of strategic decisions that began over a decade and a half ago. In 2010, the Chinese government declared the development of electric vehicles a strategic priority and initiated a comprehensive subsidy program. This policy was based on the recognition that China was technologically lagging behind Western and Japanese manufacturers in the field of conventional internal combustion engines, but that a technological leap to electric drivetrains could bridge this gap.

Government support manifested itself in several dimensions. Between 2010 and 2023, an estimated $200 billion flowed into the sector in the form of direct purchase incentives, tax exemptions, infrastructure funding, and research subsidies. Electric vehicle buyers received rebates of up to $15,000 per vehicle, while a ten-year exemption from the 10 percent sales tax further depressed prices. At the same time, provincial and local governments invested billions in establishing production capacity, often without regard for actual demand or long-term profitability.

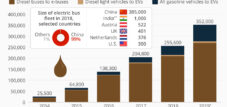

This policy initially yielded impressive results. The number of Chinese electric vehicle manufacturers exploded from a handful in 2010 to over 500 in 2018. The market share of electric and plug-in hybrid vehicles rose from virtually zero to over 50 percent in 2025. China emerged as the world's largest producer of lithium-ion batteries, controlling approximately 75 percent of global manufacturing capacity and more than half of the processing of critical raw materials such as lithium, cobalt, and graphite by 2023.

However, parallel to this quantitative growth, structural imbalances built up. Although central government subsidies officially ended in 2022, they were partially offset by regional subsidies and generous government lending. More importantly, the production capacities built up over the years grew far faster than actual demand. According to the Gao Gong Industry Research Institute, the Chinese automotive industry has the capacity to produce 55.6 million vehicles annually, while only 27.5 million units were sold in 2024. Capacity utilization for electric vehicles averaged 64.5 percent.

This overcapacity escalated into a brutal price war starting in 2023. Tesla kicked things off with price cuts of up to 13 percent in January 2023, forcing virtually all Chinese manufacturers to follow suit. BYD, as the market leader with a roughly 40 percent share of the domestic electric vehicle market, played an ambivalent role: The company leveraged its cost advantages from vertical integration and economies of scale to put pressure on competitors through aggressive price cuts. At the same time, this strategy undermined its own profitability and led to industry-wide margin compression.

Historical developments reveal a pattern of government-induced overinvestment that is characteristic of centrally controlled economies. The incentive structures encouraged local governments to invest in production capacity, regardless of macroeconomic rationality, because it promised jobs and tax revenues. Only when the overcapacity created systemic risks for the entire automotive supply chain and profitability became the exception did central authorities react with warnings of "disorderly competition."

Anatomy of predatory competition: actors, mechanisms and power

The market dynamics in China's electric vehicle sector are shaped by a complex interplay between several categories of players whose interests only partially coincide. At the forefront are the large, vertically integrated manufacturers such as BYD, Geely, and SAIC, which operate complete value chains from battery cell production to vehicle assembly. These companies benefit from significant cost advantages: BYD manufactures approximately 75 percent of its components itself, including its proprietary blade battery, semiconductors, and electric motors. This control over critical supplies not only reduces costs by an estimated 30 percent compared to competitors but also provides strategic flexibility in pricing.

A second group consists of specialized premium manufacturers such as NIO, XPeng, and Li Auto, which focus on technological leadership and higher-priced segments. These companies invest disproportionately in autonomous driving systems, battery-swapping technology, or range-extender hybrids. Their business model is based on the assumption that technological differentiation justifies sufficient price premiums. However, the reality is different: While XPeng reached a new record of 37,709 deliveries in August 2025, recording annual growth of 169 percent, Li Auto is struggling with sharp sales declines. NIO, in turn, generated a negative net profit of $19,141 per vehicle in 2022 and had to diversify its business model with lower-cost sub-brands such as Onvo.

The third category includes a variety of small and medium-sized manufacturers, as well as state-owned automotive companies such as Changan, Dongfeng, and FAW, which are lagging behind in the electric vehicle segment. Many of these players produce fewer than 5,000 units per month and operate well below profitable utilization rates. Nevertheless, they survive in part because local governments support them due to their importance to regional employment and supply chains.

The central economic driver of the current price war is the classic problem of overcapacity in industries with high fixed costs. Automotive production is characterized by significant investments in equipment, tooling, and development, while variable costs per additional vehicle are relatively low. In a situation of structural overcapacity, any additional sales, as long as they exceed variable costs, become a contribution margin for fixed costs. This creates an incentive for aggressive price reductions, even if this erodes the overall profitability of the industry.

BYD's strategy exemplifies this mechanism. In March 2025, the company drastically reduced the prices of its entry-level models – the Seagull model was reduced from 69,800 to 55,800 yuan (approximately $7,600). This pricing policy wiped out approximately $22 billion in market capitalization within a few weeks. Nevertheless, it followed an economic logic: With estimated variable costs of approximately 60 percent of the sales price, each vehicle sold still generates a positive contribution margin. The alternative – production cuts with corresponding fixed cost burdens and market share losses – appears less attractive in the short term, even if the strategy is not sustainable in the long term.

The regulatory framework is exacerbating this dynamic. After direct purchase subsidies expired in 2022, the government introduced a trade-in program in 2024 that provides buyers with up to 20,000 yuan (US$2,730) when purchasing a new electric vehicle in exchange for scrapping an old combustion engine. This program, for which the equivalent of US$11 billion was budgeted for 2025, stimulates demand but simultaneously increases price pressure, as manufacturers must offer additional rebates to benefit from the incentive.

Another critical factor is the concentration in the battery supply chain. CATL, the world's largest battery cell manufacturer, controls approximately 38 percent of the global market, while BYD ranks second with 17.8 percent. This concentration gives vertically integrated manufacturers significant negotiating power over pure-play vehicle manufacturers that rely on external battery supplies. The cost differences in batteries—often 30 to 40 percent of total vehicle costs—thus become a decisive competitive advantage.

Market mechanisms thus follow a logic that economist Michael Spence has described as "signaling through burning money": Companies with deep pockets and cost advantages use price reductions as a signal of their strength and force less capital-rich competitors to exit the market. BYD Executive Vice President Stella Li expressed this reality bluntly: "Competition in China is fierce. Therefore, we must develop new markets where we can achieve sustainable growth." This statement reveals that even the industry leader considers the domestic market dynamics to be unsustainable.

Data and Dilemmas: The Current State of an Overheated Industry

The quantitative indicators for China's electric vehicle sector paint a picture of extreme contrasts between macroeconomic successes and microeconomic disruptions. In September 2025, the Chinese market reached a historic milestone: For the first time, monthly sales of electric and plug-in hybrid vehicles exceeded the 1.6 million mark, with battery-electric vehicles alone setting a new record at 1.058 million units. The penetration rate of electrified drive systems climbed to 49.7 percent – almost every second new vehicle sold is equipped with a plug-in connector.

Cumulatively, over 9.6 million electric and plug-in hybrid vehicles were sold in China in the first eight months of 2025, an increase of 36.7 percent over the same period last year. Projections indicate that annual sales could exceed the 13 million mark for the first time in 2025. These figures underscore the transformation of a market in which electric vehicles were a niche phenomenon less than ten years ago.

But these impressive growth figures conceal alarming profitability trends. The average net profit margin of the Chinese automotive industry fell to just 4.3 percent in 2024, compared to 5.0 percent the previous year and significantly below the over 10 percent in North America. For the full year 2024, the industry recorded a profit decline of 8 percent despite revenue growth of 4 percent. This gap between revenue and profit development signals a fundamental deterioration in pricing power.

BYD, as the industry leader, exemplifies this dichotomy. In the first half of 2025, the group increased its revenue by 23.3 percent to 371.28 billion yuan (approximately 51 billion US dollars). However, the gross profit margin fell to 16.3 percent in the second quarter, a decline of 3.8 percentage points year-on-year. Net profit fell even more dramatically in the second quarter, falling 29.9 percent to 6.4 billion yuan. This first profit decline since the first quarter of 2022 marks a turning point: Even the most efficient and cost-leading producer can no longer escape margin erosion.

The impact on competitors is even more drastic. Tesla, which produces in China and sold approximately 460,000 vehicles in the Chinese market in 2024, has had to repeatedly cut its prices and now offers five-year zero-interest financing as well as free charging and insurance subsidies. NIO reported a net loss of $2.38 billion on revenue of $7.3 billion for fiscal year 2022—a loss margin of 32.6 percent. XPeng only achieved positive cash flow from operating activities for the first time in the fourth quarter of 2024.

The overcapacity situation is reflected in hard numbers: China's automotive industry has the capacity to produce 55.6 million vehicles annually, but sold only 27.5 million in 2024. Especially for electric vehicles, there is a production capacity of over 20 million units annually, with actual sales of approximately 13 million. This structural overcapacity of around 50 percent forces the observed price competition.

The international dimension further exacerbates the dilemma. China's automobile exports rose to 5.86 million units in 2024, of which 1.28 million (22 percent) were electric vehicles. BYD exported approximately 464,000 vehicles in the first eight months of 2025, an increase of 128 percent. However, this export offensive is increasingly encountering protectionist resistance: Since October 2024, the European Union has imposed additional tariffs of 17.0 percent on BYD, 18.8 percent on Geely, and up to 35.3 percent on SAIC, in addition to the regular import tariff of 10 percent. The United States has effectively excluded Chinese electric vehicles from the market with tariffs of over 100 percent.

These trade barriers mean that BYD and its competitors cannot simply reduce their excess capacity by exporting to developed markets. The remaining export markets—Latin America, Southeast Asia, and Africa—show growth potential, but significantly lower purchasing power and smaller market volumes. Brazil, the largest Latin American automotive market, sold approximately 125,000 electric vehicles in 2024, while Africa as a whole sold fewer than 50,000 units.

The current situation thus reveals a classic prisoner's dilemma: Each individual manufacturer is acting rationally by lowering prices to defend or expand market share. Collectively, however, this behavior leads to a situation in which virtually all players are disadvantaged. The Chinese government has recognized this and, in May 2025, persuaded 17 manufacturers to sign a voluntary commitment to avoid "abnormal pricing practices." However, this agreement collapsed within a few weeks when BYD announced further price cuts.

Diverging paths: strategic options in global competition

The reactions to domestic market saturation and margin pressure follow very different patterns among different players, which can be illustrated by three exemplary case studies: BYD's diversified globalization, Tesla's quality-oriented focus, and NIO's technological niche strategy.

BYD is pursuing the most aggressive internationalization strategy among Chinese manufacturers. The company aims to generate 20 percent of its sales abroad by 2025, corresponding to 800,000 to one million vehicles. This strategy is based on three pillars: First, the development of local production capacity to circumvent import tariffs. A factory with a planned annual capacity of 150,000 vehicles is being built in Hungary and is scheduled to begin production at the end of 2025. Another factory with similar capacity will be completed in Turkey in 2026. In Brazil, production began in July 2025 at a facility with an initial capacity of 150,000 units, which is scheduled to be expanded to 600,000 by 2031. Thailand, Indonesia, and Cambodia will follow with factories of varying sizes.

Second, BYD is strategically diversifying its product portfolio according to regional preferences. While pure electric vehicles dominate in China, the company is increasingly focusing on plug-in hybrids in Europe, which are not subject to increased tariffs. In the first half of 2025, BYD tripled its European sales to 84,400 units, with plug-in hybrids accounting for a growing share. For Latin America, BYD is developing an ethanol-gasoline hybrid engine that takes local fuel preferences into account.

Third, BYD is investing heavily in charging infrastructure as a strategic barrier to entry. In China, the company has already installed several hundred of its "flash charging" stations with up to 1,000 kilowatts of charging power, which theoretically enable a range of 400 kilometers in five minutes. In Europe, BYD plans to install between 200 and 300 such stations by the end of the second quarter of 2026. In South Africa, 200 to 300 fast-charging stations are also to be built by the end of 2026, some of which will be equipped with solar panels and battery storage to reduce grid dependency.

This strategy aims to create competitive advantages through proprietary networks in markets with underdeveloped charging infrastructure. However, the associated investments—BYD Executive Vice President Stella Li referred to them as "big money"—tie up significant capital and increase entrepreneurial risk. The amortization of this infrastructure requires BYD to capture significant market share in the relevant markets.

Tesla is pursuing a fundamentally different approach. The company is focusing on its established core markets – the US, China, and Europe – without aggressive geographic expansion. In China, where Tesla sold approximately 460,000 vehicles in 2024, the company is struggling with shrinking market share. Sales in the US in the first half of 2025 fell by 15 percent, while in Europe they plunged by 43 percent between January and August. In August 2025, Tesla's EU market share fell below BYD's for the first time.

Tesla's response is not geographical diversification, but product innovation and cost reduction. The company has announced lower-priced models and is offering aggressive financing terms. At the same time, Tesla is shifting its strategic focus to autonomous driving and artificial intelligence, as its "Master Plan 4" illustrates. This strategy carries significant risks: If the autonomous driving promises are delayed, Tesla will lack new products to defend its market share in the short term. Analysts are already warning that the lack of new models will inevitably lead to further market share losses.

NIO represents a third strategic path: technological differentiation through battery swapping technology. By 2025, the company will operate over 1,200 battery swapping stations in China, enabling a full battery swap in approximately three minutes. This infrastructure theoretically gives NIO a competitive advantage over time-based charging systems. In addition, in 2025, NIO launched sub-brands in lower price segments with Onvo and Firefly to expand its target audience.

Despite this innovation, NIO remains unprofitable and heavily dependent on capital injections. The battery-swapping technology requires massive infrastructure investments, the scalability of which outside of China appears questionable. Expansion into Europe is progressing slowly, while Southeast Asia and the Middle East have so far made marginal contributions.

The comparison reveals fundamental differences in their business models. BYD's vertical integration and cost leadership enable aggressive pricing and geographical diversification. However, the associated capital requirements and operational complexities are enormous. Tesla relies on brand power, technological excellence, and operational efficiency, but is increasingly losing price-sensitive market share. NIO is attempting to occupy a niche through technological differentiation, but its scalability and global transferability remain questionable.

From a regulatory perspective, target markets react very differently to Chinese investments. While Hungary and Turkey actively support BYD factories, other EU countries block Chinese acquisitions due to safety concerns. Brazil investigates BYD for labor abuses at construction companies, while the US effectively excludes Chinese electric vehicles from the market. This fragmented regulatory landscape significantly increases transaction costs and uncertainty for international expansion.

Our China expertise in business development, sales and marketing

Industry focus: B2B, digitalization (from AI to XR), mechanical engineering, logistics, renewable energies and industry

More about it here:

A topic hub with insights and expertise:

- Knowledge platform on the global and regional economy, innovation and industry-specific trends

- Collection of analyses, impulses and background information from our focus areas

- A place for expertise and information on current developments in business and technology

- Topic hub for companies that want to learn about markets, digitalization and industry innovations

Growth at any price? Why BYD's expansion strategy is dangerous

The dark side of growth: risks and controversies

The aggressive expansion strategy of Chinese electric vehicle manufacturers in general and BYD in particular raises a number of critical economic, social and geopolitical questions that are increasingly receiving attention in the public debate.

The key economic risk lies in the sustainability of the business model in the face of structurally insufficient profitability. BYD's operating profit margin was only 6.29 percent in 2024, while the net profit margin continued to shrink in the second quarter of 2025. A debt ratio of 71.1 percent (debt to assets) creates vulnerabilities in the event of rising interest rates or economic downturns. The company invested 54.2 billion yuan in research and development in the first half of 2025—a 53 percent increase over the previous year and more than double its net profit. This aggressive reinvestment strategy is only sustainable in the long term if margins expand.

Consulting firm AlixPartners predicts that of the 129 electric vehicle brands operating in China, only 15 will be financially viable by 2030. This expected consolidation implies massive capital destruction and potential systemic risks for the Chinese financial system, which has financed many of today's manufacturers through state-owned banks. Should BYD further expand its dominance, this could lead to quasi-monopolistic structures – a development that Chinese authorities have explicitly warned against.

A second risk area concerns social and labor policy dimensions. BYD's Brazilian plant came under fire in 2024 for serious labor violations, prompting Brazilian prosecutors to file charges against the company. Reports of inadequate working conditions and wage dumping at Chinese production facilities raise questions about the compatibility of BYD's cost leadership with international labor standards. The rapid production ramp-up—BYD needed only 15 months from groundbreaking to first production in Brazil—suggests that labor and safety standards may have been compromised.

Geopolitical tensions represent a third critical dimension. The European Union explicitly justified its punitive tariffs on Chinese electric vehicles with "unfair state subsidies." Studies by Western think tanks estimate cumulative Chinese subsidies for the electric vehicle industry at over $200 billion, which they claim leads to distortions of competition. China rejects these allegations, arguing that Western governments also massively subsidize their automotive industries—the US Inflation Reduction Act, for example, provides $369 billion for climate-friendly technologies.

Beyond the subsidy debate, Chinese electric vehicles raise data protection and security concerns. Under China's National Intelligence Law, Chinese companies can be required to cooperate with security authorities. Modern electric vehicles collect extensive data on locations, driving behavior, and—with integrated communication systems—potentially even conversations. Some European companies are already advising their employees not to connect mobile phones to Chinese electric vehicles or to discuss work-related matters in them.

Another controversial aspect concerns environmental impacts. While electric vehicles are locally emission-free during operation, their overall environmental footprint depends heavily on power generation and production processes. China generates approximately 60 percent of its electricity from coal, which puts the carbon footprint of Chinese electric vehicles into perspective. While BYD has announced plans to partially power its South African charging stations with solar energy, no comparable Scope 3 emissions disclosures exist for its main production in China.

Battery material supply chains raise additional ethical questions. Over 70 percent of the cobalt mined worldwide comes from the Democratic Republic of Congo, where 10 to 20 percent of production is carried out by small-scale artisanal mining operations with problematic working conditions. Eighty percent of lithium comes from Australia and Chile, where water consumption in arid regions leads to environmental conflicts. China controls over 50 percent of the global refining of these critical raw materials, which Western governments view as a strategic dependency.

There is a controversial debate among experts as to whether the observed price reductions should be viewed as legitimate competition or strategic dumping to clear the market. Critics argue that BYD is using accumulated profits and access to state-subsidized financing to systematically squeeze competitors out of the market—a strategy that could lead to higher prices and reduced competition in the long term. Proponents, however, argue that cost advantages from vertical integration and economies of scale represent genuine competitive advantages that benefit consumers through lower prices.

These controversies result in a conflict between different political priorities. On the one hand, Western governments strive for accelerated electrification of transport to achieve climate goals. Affordable Chinese electric vehicles would accelerate this transition. On the other hand, these same governments want to protect domestic automotive industries and jobs and avoid strategic dependencies. This conflict manifests itself in contradictory policy measures: While the EU is tightening climate targets, it is simultaneously raising import tariffs, which make electric vehicles more expensive.

Suitable for:

- China | Beijing's dilemma between export boom and domestic market stagnation: Structural export dependence as a growth trap

Future scenarios: consolidation, fragmentation or coexistence

The future development of the global electric vehicle industry in general and BYD in particular can be outlined along several plausible scenarios, each of which makes different assumptions about technological, regulatory and geopolitical developments.

The consolidation scenario continues current trends: China will experience a brutal market shakeout by 2030, with 114 of the 129 current brands disappearing or being absorbed. The remaining 15 players—dominated by BYD, Geely, Chery, and possibly NIO, XPeng, and Li Auto—control 75 percent of the market. Each of these survivors sells an average of over one million vehicles annually, thereby achieving critical economies of scale for profitability.

In this scenario, BYD leverages its cost advantages and vertical integration to further gain market share. The group achieves a global market share of over 20 percent in electric vehicles by 2030, supported by production bases in Asia, Europe, Latin America, and Africa. Profitability recovers from 2027 onwards, after weaker competitors are eliminated and pricing pressure eases. BYD's European plants produce over 500,000 vehicles annually in 2030, while the Brazilian plant actually achieves the targeted 600,000 units.

In this scenario, Tesla continues to lose market share in the volume segment, but establishes itself as a premium brand with a focus on autonomous driving and artificial intelligence. The company sells approximately 2.5 million vehicles annually in 2030—fewer than in 2024—but with higher margins due to a focus on software revenue and technology licensing. Traditional automakers such as Volkswagen, Stellantis, and General Motors are struggling with overcapacity in their European and American plants, closing production sites, and continuing to lose market capitalization.

An alternative fragmentation scenario assumes increased protectionism and geopolitical bloc formation. The US and EU further increase tariffs on Chinese electric vehicles or impose quantitative import restrictions. China responds with retaliatory measures against European and American automotive exports and restrictions on critical raw materials. The global automotive market is fragmenting into largely separate blocs: China and allied states, the West (US, EU, Japan, South Korea), and a contested middle segment (Southeast Asia, Latin America, Africa, Middle East).

In this scenario, BYD can expand its dominance in China and emerging markets, but remains marginalized in Western markets. The company concentrates local production in markets in the Global South, where lower incomes mean high price sensitivity. Global electric vehicle production is splitting into two technological ecosystems with incompatible standards for charging technology, software, and connectivity. This fragmentation reduces economies of scale, slows innovation, and delays the global decarbonization of the transportation sector.

A third coexistence scenario is based on a pragmatic convergence of interests. Western governments recognize that aggressive tariff policies jeopardize their own climate goals and burden domestic consumers with higher prices. China accepts international transparency requirements and data localization to address security concerns. The EU and China agree on minimum price agreements as an alternative to tariffs, while multilateral agreements on labor standards and subsidy discipline are emerging.

In this scenario, BYD operates as a truly global company with regionally adapted business models. European factories produce for Europe, Latin American factories for America, with local suppliers involved in each case. BYD cooperates with European and Japanese partners on battery technology and charging infrastructure, while Western manufacturers retain access to Chinese markets. The global market remains competitive, with three to four large Chinese companies (BYD, Geely, possibly NIO), two to three Western champions (possibly a consolidated European company, Tesla, a Korean manufacturer), and specialized niche players.

Technological disruptions could fundamentally change these scenarios. If solid-state batteries reach market maturity before 2030 and truly double energy densities while simultaneously reducing costs, this would invalidate established competitive advantages from lithium-ion battery production capacities. BYD and CATL are investing heavily in solid-state technology, but Japanese and European companies hold significant patent portfolios in this area.

The development of autonomous driving technology could fundamentally transform business models. If fully autonomous driving (Level 5) becomes a reality in the 2030s, value creation will shift from hardware products to software platforms and services (Mobility-as-a-Service). In such a scenario, software-focused players like Tesla or Chinese tech companies like Baidu could enjoy systematic advantages over traditional manufacturers.

Regulatory developments regarding emissions standards will significantly influence the speed and direction of the transformation. The EU has adopted sales bans for new combustion vehicles starting in 2035, while California is pursuing similar goals. China mandates that at least 48 percent of new vehicles sold must be electrified by 2026 and at least 58 percent by 2027. These requirements will force massive investments and could push capital-weak manufacturers into liquidity crises.

The critical question for BYD is whether the company can survive the next three to five years of structural unprofitability in its home market, while simultaneously requiring massive investments in international expansion. Cumulative foreign investments estimated at $5 billion to $10 billion for factories in Europe, Latin America, Africa, and Asia, plus additional billions for charging infrastructure, create significant liquidity requirements. While the company has strong cash flows from its Chinese business and access to government-backed financing, its financial cushion is dwindling as margins continue to erosion.

Strategic direction in a fragmented world order

The analysis reveals BYD's expansion strategy as a complex response to a structural overcapacity crisis resulting from years of government overinvestment. The Chinese electric vehicle market has crossed a critical threshold beyond which even the most cost-efficient producer can no longer grow profitably. This constellation forces international expansion as a strategic imperative, not an opportunistic choice.

Three key findings emerge. First, the BYD case demonstrates the limits of state-directed industrial policy in the absence of market-based capital allocation. While coordinated subsidies created impressive production capacities and accelerated technological progress, they simultaneously generated systemic overinvestment with destructive consequences for profitability. The Chinese model may be effective in mobilizing resources in the short term, but it carries risks of massive capital destruction in the medium term.

Second, BYD's vertical integration strategy illustrates both the strengths and limitations of this approach. Control over battery cells, semiconductors, and other critical components provides cost advantages and resilience to supply chain disruptions. At the same time, this strategy ties up enormous capital and reduces flexibility in the face of technological paradigm shifts. Should a new battery technology render BYD's massive investments in lithium-ion capacity obsolete, the perceived advantage would become a liability.

Third, the fragmentation of the global automotive market along geopolitical fault lines highlights a fundamental conflict between economic efficiency and strategic autonomy. From a purely economic perspective, free trade and international division of labor would be optimal—Chinese manufacturers could leverage their cost advantages while Western companies focus on premium segments and software. However, geopolitical and security considerations create incentives for protectionism and regionalization, even if this sacrifices efficiency gains.

This creates complex trade-offs for policymakers. Aggressive tariff policies protect domestic jobs and industrial capacity in the short term, but delay the decarbonization of the transportation sector and burden consumers with higher prices. They also provoke retaliatory measures that could harm other industries. A more balanced approach could be to strengthen strategic industries through innovation support and infrastructure investments, while simultaneously establishing international standards for subsidy discipline, labor rights, and data protection.

For business leaders outside China, BYD's strategy highlights the need for fundamental business model innovation. Traditional automakers cannot compete with vertically integrated Chinese competitors in either production costs or development speed. Their chances of survival depend on their ability to achieve differentiation through superior software integration, service quality, or brand prestige—factors that are less scalable but more difficult to imitate.

For investors, the electric vehicle industry presents a paradoxical outlook. Market growth remains robust, with global sales projected to triple by 2035. At the same time, massive overcapacity points to continued weak profitability, possibly for another decade. Value creation could shift from hardware products to software, battery technology, and charging infrastructure—segments where players other than traditional automakers could dominate.

BYD's foray into Africa ultimately symbolizes a larger transformation: the shift of economic centers of gravity from the Global North to emerging markets. While Western markets are saturated and regulatory fragmented, Africa, Southeast Asia, and Latin America still offer growth potential, albeit with lower margins. The question is not whether Chinese manufacturers will expand into these markets—that is economically imperative—but under what conditions and with what consequences for local industries and societies.

The long-term significance of these developments extends beyond the automotive sector. The Chinese model of state-directed industrial policy with massive subsidies and overcapacities is being replicated in solar technology, wind energy, shipbuilding, and other sectors. Should this model ultimately succeed through global market conquest, despite temporary setbacks, it could become a template for other emerging economies. If, however, it fails due to structural unprofitability problems and geopolitical backlash, this would confirm the thesis that market-based allocation mechanisms are superior in the long term.

For the global decarbonization of the transportation sector—the ultimate goal behind electrification—the current situation represents a delay. While the price war in China is accelerating adoption there in the short term, the protectionist backlash in Western markets is slowing the transition elsewhere. A constructive solution would require compromises: China would have to accept transparency about subsidies and respect labor standards, while the West would have to acknowledge that affordable electric mobility is partly based on Chinese manufacturing efficiency. Current geopolitical tensions make such compromises unlikely, jeopardizing the achievement of global climate goals.

BYD's fate will serve as a model for whether economic globalization can persist despite political fragmentation. If the company succeeds in building profitable local ecosystems in Europe, Latin America, and Africa, this will demonstrate the resilience of multinational business models. If expansion fails due to protectionist barriers or operational challenges, this will reinforce the thesis of an increasingly fragmented global economy with separate, incompatible economic blocs—a scenario with significant negative welfare effects for all involved.

Your global marketing and business development partner

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development / Marketing / PR / Trade Fairs

🎯🎯🎯 Benefit from Xpert.Digital's extensive, five-fold expertise in a comprehensive service package | BD, R&D, XR, PR & Digital Visibility Optimization

Benefit from Xpert.Digital's extensive, fivefold expertise in a comprehensive service package | R&D, XR, PR & Digital Visibility Optimization - Image: Xpert.Digital

Xpert.Digital has in-depth knowledge of various industries. This allows us to develop tailor-made strategies that are tailored precisely to the requirements and challenges of your specific market segment. By continually analyzing market trends and following industry developments, we can act with foresight and offer innovative solutions. Through the combination of experience and knowledge, we generate added value and give our customers a decisive competitive advantage.

More about it here: