Annual tax law 2022 for solar/photovoltaics: 0% - zero percent sales tax, the zero tax rate for solar systems is coming!

Language selection 📢

Published on: December 3, 2022 / update from: December 14, 2022 - Author: Konrad Wolfenstein

Reichstag building – seat of the German Bundestag – Image: EnricoAliberti ItalyPhoto|Shutterstock.com

The fact that sales tax on solar systems in Germany will be reduced to 0% (zero tax rate) from January 1, 2023 is just a mere formality. This applies to both the construction and purchase of photovoltaic systems and electricity storage systems of up to 30 kWp. The VAT exemption for solar systems is good news for the solar industry and climate policy.

The zero percent regulation is an important step to further strengthen photovoltaics in Germany and advance the expansion of renewable energies. Because solar systems are a climate-friendly and clean investment in the future. With the sales tax exemption, photovoltaics will become even more attractive and affordable.

The current course of the federal legislative process

The federal legislative process is a three-stage process in which the draft law is discussed in the Bundestag and then either accepted or rejected.

The first stage, the so-called first reading, serves to debate the political significance of the proposed law and its goals.

➡️ Debate in the Bundestag about the federal government's draft for an annual tax law 2022 - October 14, 2022 (Friday)

In the second stage, the second reading, the bill is referred to the committees for discussion. An intensive discussion of the draft law is taking place here. The lead committee then presents a version of the bill, which is discussed in the plenary session in the third and final stage, the third reading. Any MP can table further amendments at this stage.

➡️ The Finance Committee passed the Annual Tax Act 2022 at its meeting on Wednesday (November 30th, 2022).

Third reading is the last chance for amendments to bills. Only political groups or at least five percent of MPs can submit an application. The amendments may only concern provisions that were changed or added in the second reading. After the third reading, the Bundestag votes on the bill.

➡️ In its third reading on December 2nd, 2022 (Friday), the German Bundestag finally discussed the annual tax law.

If a law has been approved in the Bundestag, it must be sent to the Bundesrat immediately.

In the Basic Law, consent laws and objection laws differ fundamentally from one another. If the Federal Council refuses to give its consent to approval laws, the legislative project has failed. Under certain conditions, the Bundestag can also overrule an objection from the Bundesrat in the case of objection laws.

➡️ The approval of the Federal Council on December 16th (Friday) is considered certain. Especially when it comes to income tax, the federal government took up the state's appeal to legally exempt the operation of small PV systems from tax.

If the last stage of the legislative procedure has been successfully completed, the Federal Government only has to counter and be confirmed by the Federal President again. After that, it is “announced” in the Federal Law Gazette.

The current development

Tax exemption: Tax hammer for solar expansion now approved by the Bundestag!

Suitable for:

Top selling point for solar installers: No more tax on solar systems

Suitable for:

Zero tax rate: 0% sales tax offset equals sales tax exemption?

The planned zero tax rate is something completely new in German sales tax law. This means that deliveries and installations of these systems will be taxed at a 0% tax rate from next year. So there is no more sales tax here or the sales tax is 0%. We know something similar (but something completely different) from the reduced tax rate of 7% in the area of food and books such as newspapers.

Background knowledge:

The normal tax rate is 19 percent. Certain services are taxed at a reduced tax rate of 7 percent in accordance with Section 12 (2) UStG or are tax-exempt in accordance with Section 4 UStG. The standard rate of 19 percent has been in effect since January 1, 2007, the reduced tax rate of 7 percent since July 1, 1983. In addition, Section 24 UStG contains average rates for agricultural and forestry businesses, whose tax rate is 5.5% or can be 10.7%. In addition, according to Section 23 UStG, there are average tax rates from the two tax rates for agricultural and forestry businesses as well as certain companies and corporations.

The zero tax rate will now apply from 2023 to installations and deliveries of solar modules, including electricity storage, to operators if the PV system is installed on or near private homes, public and other buildings.

In the future, it will be the responsibility of the solar installer or seller to determine whether the 0% or 19% sales tax regulation will be used. Either via a written advance confirmation from the customer not to operate a system larger than 30 kWp and/or proof must be provided via the market master register:

⚠️ A solar system, an electricity storage system or a completed installation that has already been purchased can no longer be subsequently billed using the zero tax rate of sales tax. Logically, with the zero tax rate there is no longer any possibility or need to have VAT refunded.

⚠️ If the purchase and commissioning via a specialist company for 2022 has not yet been completed and advance payments have already been made, the commissioned company can correct the 19% VAT calculated from 2022 accordingly in the final invoice for 2023.

⚠️ In addition to the confirmation from the solar installer, the fixed time for commissioning is the note in the market master data register.

For the market master data register, there is an obligation to report both solar systems and electricity storage systems - each separately

Every new system must be entered into the market master data register within one month of commissioning.

You must register each electricity-generating system individually. This also includes battery storage . If you operate a photovoltaic system with battery storage, then you must enter both the solar system and the battery storage individually in the register .

More about this here:

📣 Solar solutions for industry, retail and municipalities

Everything from a single source, specially designed for solar solutions for large parking areas. You refinance or counterfinance into the future with your own electricity generation.

👨🏻 👩🏻 👴🏻 👵🏻 For private households

We are from the region! We advise, plan and take care of the installation. We have interesting solar solutions for you. From the roof to the terrace to your car parking space

🎯 For solar engineers, plumbers, electricians and roofers

Advice and planning including a non-binding cost estimate. We bring you together with strong photovoltaic partners.

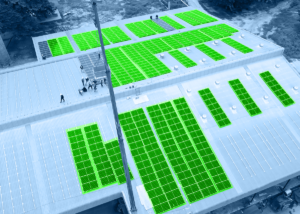

- Warehouses, production halls and industrial halls with their own power source from a photovoltaic roof system - Image: NavinTar|Shutterstock.com

- Industrial plant with its own power source from an outdoor photovoltaic system - Image: Peteri|Shutterstock.com

- Plan solar systems with photovoltaic solutions for freight forwarding and contract logistics

- B2B solar systems and photovoltaic solutions & advice

- Plan photovoltaics for warehouses, commercial halls and industrial halls

- Industrial plant: Plan a photovoltaic open-air system or open-space system

- Plan solar systems with photovoltaic solutions for freight forwarding and contract logistics

- B2B solar systems and photovoltaic solutions & advice

That's why with Xpert.Solar your photovoltaic system advice, planning and installation: The roof solar system with electricity storage, solar terraces and/or solar carports!

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 .

I'm looking forward to our joint project.

Xpert.Digital – Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital – www.xpert.solar – www.xpert.plus