Warehouse automation worldwide: A comparison between Germany, Japan, France, Spain, Italy, Poland and the Czech Republic

Xpert pre-release

Language selection 📢

Published on: January 8, 2025 / Updated on: November 28, 2025 – Author: Konrad Wolfenstein

Warehouse automation worldwide: A comparison between Germany, Japan, France, Spain, Italy, Poland and the Czech Republic - Image: Xpert.Digital

Warehouse automation worldwide: An overview and comparison

The demand for faster and more efficient logistics processes has increased worldwide in recent years. This trend is driven in particular by the strong growth of e-commerce, cost pressure in globalized supply chains and the ongoing shortage of qualified workers. As a result, more and more companies are turning to automating their warehouses. Robots, conveyor technology, artificial intelligence (AI) and other modern technologies help to accelerate processes, reduce error rates and use resources more efficiently.

Already in 2024, the market for warehouse automation reached a volume of around 25.74 billion US dollars. According to forecasts, this volume could increase to $105.85 billion by 2032. However, a closer look at the individual countries shows that the extent to which modern storage solutions are used varies: While some regions are quickly upgrading, others are still in their early stages or are specialized in individual sectors.

Below we take a look at the level of automation in various countries, including Germany, Japan, France, Spain, Italy, Poland and the Czech Republic. In addition, it will be discussed which challenges are slowing down progress and which opportunities are opening up through the use of robotics, IT systems and other automation approaches.

Suitable for:

- Competitive advantage through automation: warehouse automation, connected warehouse processes and intelligent automation systems

- Warehouse automation globally: A comparison between the USA, China and South Korea - in the USA there are currently 80% manual warehouses!

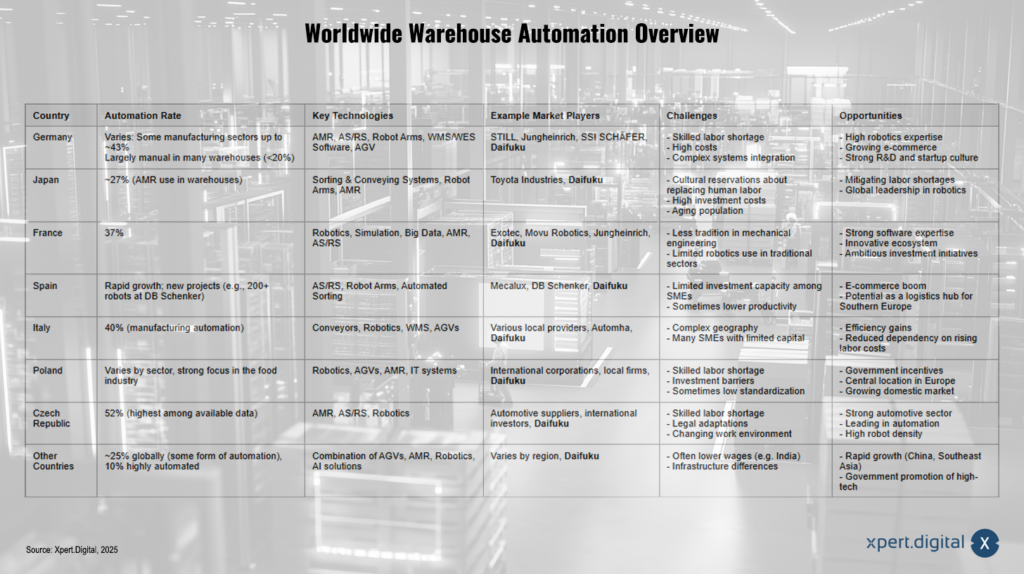

Worldwide Warehouse Automation Overview: Germany, Japan, France, Spain, Italy, Poland, Czech Republic, and other countries – Image: Xpert.Digital

1. Germany: High willingness to automate, but many manual warehouses

For decades, Germany has been considered a highly automated industrial nation with a high density of robots. Automated processes are deeply rooted, particularly in the automotive and mechanical engineering industries. Nevertheless, according to estimates in the area of warehousing, around 80% of the locations are still equipped without extensive automation (varies: production sometimes 43%, warehouse often <20%).

Current situation

Even if individual sectors are pioneers, smaller companies are reluctant to make large investments in new technologies. At the same time, the need for flexibility is high: online retail continues to grow, customers are demanding ever shorter delivery times, and the increasing variety of variants makes responsive storage solutions essential.

Challenges and opportunities

A key obstacle in Germany is the complexity of integrating different systems. “WMS, AMR, robotics and conveyor technology must work together in a uniform IT landscape,” is a frequently expressed motto. Added to this is the shortage of skilled workers: high qualifications in mechatronics, IT and data analysis are required to set up and operate the new systems.

The opportunities lie in the great experience that Germany already has when it comes to robotics and automation. Companies such as DAIFUKU (world market leader in intralogistics), Jungheinrich, STILL and SSI SCHÄFER offer internationally sought-after solutions. Close collaboration between research, industry and start-ups can also advance innovative technologies in order to modernize the status quo, which is still manual in many areas.

2. Japan: Robotics pioneer meets logistics challenges

Japan is one of the world's leading manufacturers of robotics and automation systems. Nevertheless, the comparatively low level of automation in the warehouses is surprising. According to studies, around 27% of warehouse operators currently use autonomous mobile robots (AMR).

Current situation

On the one hand, labor costs in Japan are high, which would actually be a strong incentive for automation. On the other hand, a culture in which human work is valued inhibits rapid replacement by machines. However, there are now signs of change as the aging population and the associated shortage of skilled workers are forcing companies to rethink.

developments

“Japan is increasingly relying on automation to address the labor shortage in the logistics industry.” Many companies are investing in new solutions to speed up processes and reduce dependence on human resources. The demand for robots for picking, palletizing and transporting goods is increasing. Thanks to the high level of expertise in the field of robotics, this trend is likely to accelerate further.

3. France: 37% level of automation and expansion potential

In France, the level of automation is currently 37%, which is lower than in other European countries such as Germany (sometimes 43% in production) or Italy (40%). Nevertheless, there are modern sectors, such as the aviation and automotive industries, that already use highly developed automation concepts.

challenges

The comparatively weaker mechanical engineering tradition in France has meant that there are fewer domestic manufacturers of automation technology. Many companies in traditional industries are not yet consistently using robotics, which lowers the national average.

Current developments and examples

France is striving to catch up. A lively start-up scene and a focus on software, simulation and predictive maintenance are considered drivers of innovation. Companies like Exotec are developing the Skypod system, which is already in use at Hartmann France and is expected to enable storage density to double by 2025. Knorr-Bremse has initiated automation projects at the Lisieux plant in collaboration with Movu Robotics, and Jungheinrich is currently automating the 15,000 square meter Sartorius Stedim Biotech logistics center in Aubagne.

These examples show that France is actively working to increase its level of automation and thereby increase efficiency, flexibility and productivity.

4. Spain: Increasing level of automation thanks to the e-commerce boom

Spain has developed into a rapidly growing market for warehouse automation in recent years. This upward trend is being driven in particular by the flourishing e-commerce sector: more and more consumers are ordering online, forcing companies to make their warehouse processes more efficient.

Current developments

A notable example of this dynamic is DB Schenker's highly automated e-commerce center, which recently went live and includes over 200 robots. These robots are able to transport goods autonomously and support picking processes.

Challenges and opportunities

Spain sometimes suffers from a lower level of innovation momentum among small and medium-sized companies, which often have limited investment capacity. At the same time, the e-commerce growth market offers enormous potential: “Anyone who decides on automation early on in Spain can operate more competitively and achieve faster delivery times.”

5. Italy: 40% level of automation in manufacturing

Italy has around 40% automated processes in the manufacturing industry, according to new data. This figure underlines that, in a European comparison, the country is behind leaders such as the Czech Republic (52%), but is by no means at the bottom.

challenges

Geographical conditions and the diverse SME landscape play a major role in Italy. Small businesses in particular hesitate to make larger investments when capital is scarce and production remains regionally focused. In addition, Italy's complex logistics structure often requires special solutions.

Perspectives

The trend is increasingly towards automated small parts warehouses, automated guided vehicle systems (AGVs) and software-based order picking solutions. These systems help to reduce labor costs and ensure consistently high quality - important factors for remaining internationally competitive in the face of increasing competition.

6. Poland: Sector-dependent differences, strong food industry

Poland has experienced remarkable growth in recent years and has developed into a major hub between Eastern and Western Europe. The willingness to automate is high, but there are clear differences between industries.

Industry-specific developments

The food industry in particular is increasingly investing in automated solutions. Delicate products require precise handling, and the associated hygiene requirements favor the use of robots.

challenges

Despite government funding programs and tax relief, the lack of qualified specialists remains a major hurdle. IT knowledge and technical know-how are essential to master the complexity of modern warehouse technology.

7. Czech Republic: 52% – Highest level of automation among available data

The Czech Republic surprises with a level of automation of 52%, which, according to the available figures, is the highest value among the countries examined. This dominance is primarily due to the highly automated automotive and supplier industries.

Causes of progress

Numerous international automobile manufacturers and suppliers have settled in the country and have highly automated their manufacturing and logistics processes. This pioneering role is increasingly spreading to other areas and is promoting the expansion of modern storage technologies.

challenges

Despite the high level of automation in some industries, there are still companies that prefer manual processes. At the same time, rising wage costs and shortages of skilled workers are important reasons to continue to rely on automation in order to remain competitive in the long term.

8. More countries and global perspective

In many other countries, for example in North America or China, warehouse automation is also progressing rapidly. Although the USA has large, partly manual warehouse space (> 80%), it is experiencing rapid market growth thanks to investments in AI-supported logistics and e-commerce giants such as Amazon. China aims to become global technology leader and is aggressively promoting its robotics and automation industries.

Suitable for:

- Pulse of the Warehouses: A Look at the Automation Challenges in the US

- From manual labor to high-tech: The transformation of warehouse automation in the USA

In general, it can be observed that around 25% of warehouses around the world already use some form of automation, but only around 10% of these operate highly automated systems. The reason for this lies not only in the investment costs, but also in the cultural, political and infrastructural conditions.

Reasons for different automation rates

The variations between countries and industries can be explained by various factors:

- Labor costs: High wages (e.g. in Japan, Germany) promote the amortization of expensive automation solutions.

- Shortage of skilled workers: Where workers are scarce and expensive, the pressure to switch to machines increases.

- Technological background: Regions with strong mechanical engineering and robotics know-how (e.g. Japan, Germany) benefit from short innovation cycles.

- Regulatory framework: Funding programs, tax advantages and investment incentives support modernization.

- Cultural aspects: In some countries there are reservations about the “dehumanization” of the world of work, in others robots are considered an important productivity factor.

Types of automation technologies

A wide variety of technical solutions are used in modern warehouses, which can often be combined with each other:

- Autonomous mobile robots (AMR): They move independently through the warehouse using sensors and AI, transport goods and support picking.

- Automated storage and retrieval systems (AS/RS): These include high-bay warehouses or shuttle systems that store and retrieve goods using storage and retrieval machines. They ensure high storage density and short access times.

- Robot arms: Stationary or semi-mobile gripping systems take care of picking, packing or palletizing. Thanks to image processing and AI, they can also trade sensitive items.

- Conveyor and sorting systems: Roller conveyors, sorters and lifting systems transport goods from A to B automatically, which greatly increases throughput, especially in distribution centers.

- Software solutions: Warehouse management systems (WMS), warehouse execution systems (WES) and AI-supported analysis tools enable optimal control of material and information flows.

- Automatically Guided Vehicles (AGV): Unlike AMR, AGVs follow fixed routes and are particularly popular in stable, recurring processes.

Suitable for:

Impact on employment

The increasing automation of warehouses has an impact on the labor market. On the one hand, jobs for simple, repetitive tasks are being eliminated. On the other hand, the technology creates new jobs in the areas of maintenance, control and IT support. In modern logistics centers, people and robots are increasingly working hand in hand, with physically demanding tasks being taken over by machines.

“Human-robot collaboration” is therefore becoming increasingly important in order to maintain flexibility on the one hand and to keep productivity high on the other. However, employees must acquire new skills so that they can use the systems and exploit their potential.

Challenges and opportunities

opportunities

- Increased efficiency: Faster throughput, lower error rates and better delivery performance.

- Cost reduction: Automation quickly pays off, especially when personnel costs are high and wages are rising.

- Flexibility: Modern systems can be quickly adapted to fluctuating demand.

- Improved working conditions: Heavy or monotonous tasks are no longer required, which increases the attractiveness of the jobs.

challenges

- High investment costs: The purchase of robots, conveyor technology and software is often cost-intensive, especially for small companies.

- Complex integration: Different technologies must work together smoothly.

- Skilled labor shortage: Competent personnel are needed to plan, implement and operate systems.

- IT security and data protection: Networked systems are potentially vulnerable to cyber attacks and must be adequately protected.

Future of warehouse automation

In the coming years, the automation of logistics will continue to gain in importance. More and more companies are realizing that the increasing competitive pressure can only be managed through efficient warehouse processes. New technologies such as cobots (collaborative robots), AI-powered inventory and demand forecasting models, and autonomous delivery systems (e.g. drones) could revolutionize the industry.

Sustainability will also be an essential topic. Smart storage technologies reduce energy consumption by minimizing empty runs and optimally controlling material flows. “The trend is clearly towards more environmentally friendly and resource-saving processes,” explain experts from research and practice. Political requirements regarding CO₂ emissions, for example, also increase the pressure to optimize logistics processes.

The automation of warehouse and logistics processes is a global megatrend driven by skills shortages, rising customer expectations and the boom in e-commerce. While some countries such as the Czech Republic (52%) have a particularly high automation rate, others such as France (37%) or Italy (40%) are working to close their gaps. Interest is also increasing rapidly in Spain and Poland, not least due to new major projects such as the highly automated DB Schenker e-commerce center in Spain or the targeted investments by the food industry in Poland.

Japan, long synonymous with robotics, is increasingly responding to the labor shortage and is particularly upgrading its logistics industry. Germany benefits from its established industrial and research culture, but despite its high level of technological expertise, it still has to bring many manually operated warehouses up to date.

Most important success factors

- Cooperation between humans and machines: Cobots and flexible robot solutions are becoming increasingly important.

- Software-driven control: AI and big data are crucial tools for increasing efficiency.

- Incentives from the state and business: funding programs, tax breaks and targeted educational measures accelerate development.

- Cultural acceptance: In some regions there must be a growing willingness to supplement or replace traditional ways of working with automation.

The wave of automation will continue to gain momentum in the coming years. Those who invest in a timely manner gain competitive advantages by reducing costs, shortening delivery times and better meeting customer requirements. At the same time, automation is changing the world of work: traditional activities are decreasing, while the demand for technical expertise, IT competence and interdisciplinary skills is increasing.

Overall, it is a development process with far-reaching effects on global supply chains and regional labor markets. “Anyone who relies on warehouse automation is investing in the future,” is the conclusion of many experts. Whether Germany, Spain, Japan or Poland – it is clear everywhere that modern and more efficient warehouse processes play a key role in international competitiveness.

LTW Solutions

LTW offers its customers not individual components, but integrated complete solutions. Consulting, planning, mechanical and electrotechnical components, control and automation technology, as well as software and service – everything is networked and precisely coordinated.

In-house production of key components is particularly advantageous. This allows for optimal control of quality, supply chains, and interfaces.

LTW stands for reliability, transparency, and collaborative partnership. Loyalty and honesty are firmly anchored in the company's philosophy – a handshake still means something here.

Suitable for:

We are there for you - advice - planning - implementation - project management

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital - Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital - www.xpert.solar - www.xpert.plus