Published on: June 9, 2025 / update from: June 9, 2025 - Author: Konrad Wolfenstein

Two China, two truths: Why you have to see the official economic data critically - Image: Xpert.digital

China economy in a dive? Is China's recovery just a facade? What the official data hide

China's divergent PMI indices: between state narrative and economic reality

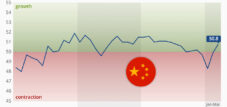

The latest shopping manager indices from China for May 2025 reveal a worrying discrepancy between official and private surveys, which goes beyond methodological differences and raises fundamental questions about the transparency of economic data collection. While the state NBS-PMI signals a moderate weakening with 49.5 points, the Caixin-PMI crashed dramatically to 48.3 points-the lowest level since July 2023. This divergence not only reflects different sample structures, but also indicates a systematic obscure of the precarious situation of the Chinese medium-sized company, which is increasingly under pressure as the background of the economy device.

Suitable for:

Methodological foundations and structural differences

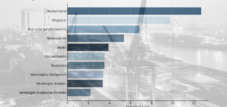

The two most important Chinese PMI indices differ fundamentally in their approach and target group. The official NBS-PMI of the national statistics office primarily focuses on large, often state-managed companies and captures around 3,000 companies. This orientation is reflected in the company size distribution: in May, large companies showed a PMI of 50.7 points -well above the expansion threshold -while medium -sized companies with 47.5 points and small companies with 49.3 points in the contraction area.

In contrast, the PMI raised by Caixin and S&P globally focuses on small and medium -sized companies, predominantly private. The sample comprises around 650 companies that are stratified according to sectors and company size, with the focus on export -oriented and technology -driven companies. These methodical differences are deliberately chosen and reflect on different segments of the Chinese economy, which leads to divergent results.

The calculation methodology follows both indices of international standards: the PMI is a weighted average of five subindices - new orders (30%), production (25%), employment (20%), delivery times (15%) and inventory (10%). Values over 50 signal expansion, including contraction. Despite the identical basis of calculation, the different samples lead to significant deviations in the results.

May 2025 numbers: a dramatic crash

The publication of the May data marked a turning point in the Chinese business view. The CAIXIN PMI unexpectedly fell from 50.4 to 48.3 points and underscore the expectations of 50.6 points. Dr. Wang Zhe from the Caixin Insight Group warned that the “downward spiral tightened”, with falling demand at home and abroad as well as increasing trade voltages, which massively put pressure on medium-sized companies.

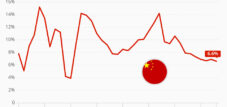

The development of the subindices is particularly alarming: Production has shrank for the first time in 19 months at the fastest speed since November 2022. New orders have been back with the sharpest rate since 2022, while export orders have fallen to the lowest level since July 2023. HR reduction accelerated, especially among investment goods manufacturers, which indicates structural adjustments.

The official NBS PMI, on the other hand, showed a much more moderate development. With an increase from 49.0 to 49.5 points, it was still in the contraction area, but it was much closer to the stability brand. With 50.7 points, the production index achieved the expansion area, supported by a “trade war armor” and Beijing's efforts to boost internal demand.

Staatsgetrieb versus private sector: a growing gap

The divergent PMI values reflect a fundamentally different performance between state and private companies. Large corporations benefit from targeted support from the government, while private small and medium -sized businesses are increasingly under pressure. This development is not new: in previous comparisons it was shown that the NBS PMI identifies more stable values than the Caixin PMI, which is concentrated on the private sector due to its focus on state-supported large companies.

The profit statistics for January to April 2025 illustrate this discrepancy: Private companies report a surprising growth of 4.3 percent, while state businesses collapse by 4.4 percent. However, the profit margin of private companies is a lean 3.59 percent, well below the 6.59 percent foreign companies. High cost rates of 86.87 yuan per 100 yuan sales and claims periods of over 71 days indicate margins and liquidity stress.

The Chinese government confirmed its growth goal for 2025 at 5 percent and raised the budget deficit to 4 percent of GDP. However, these measures primarily aim at large projects and government companies, during medium -sized companies. The temporary customs break between the USA and China has not triggered a noticeable boost of production, which shows that high costs and uncertainties paralyze the order situation.

The precarious location of the Chinese middle class

The Chinese medium -sized company, traditionally the backbone of the economy and the labor market, is in an increasingly precarious situation. The CAIXIN PMI data illustrate the dramatic location: falling orders, collapsing margins and accelerated job cuts shape the picture. Smaller factories, often commissioned by smaller importers, suffer from still relatively high tariffs and increasing transport costs, some of which are passed on to customers, partly the margins.

This development is part of a long -term trend. As early as the end of 2024, it was reported that the prosperity of medium -sized companies waned: property prices fall, debts increase and consumption remains damped. For the Chinese leadership, this is not only an economic, but also a political challenge, since the informal “social contract” - political control against economic prosperity - faltered.

The weak consumption, direct expression of the loss of assets, increases the economic pressure and undermines the government's growth target. Without sustainable reforms and strengthening trust in the financial future, it becomes difficult to stabilize the middle class and thus the economy as a whole. The lack of targeted support such as tax reliefs or liquidity aids increases the pressure on medium -sized companies with noticeable risks for the economy.

Suitable for:

Data manipulation or selective representation?

The systematic divergence between the two PMI indices raises questions about the transparency and credibility of official Chinese economic data. Two interpretations offer: Either the NBS stabilizes the perception through selective data collection - a kind of “cosmetic waste” - or the differences actually reflect the divergent performance of different economic segments.

The evidence indicates that both factors play a role. On the one hand, the methodological differences are real and entitled: Large government companies actually have better access to loans, government orders and political support. On the other hand, the conscious focus of the official statistics on this segment seems to convey a more positive image of the economic situation than the reality of the private sector.

The difference between the suffering of the private sector and the state -based narrative is so great that it suggests a systematic transfiguration. In view of the more common indications of declining demand, price pressure and layoffs in the private sector, the interpretation of a conscious veiling focuses on the focus of the discussion. This does not necessarily mean direct manipulation of the numbers, but rather a strategic weighting of the data collection to support the political narrative.

International classification and comparison perspectives

The Chinese PMI developments are in contrast to other important economies. In the euro zone, the PMI continuously rose from 45.1 in December 2024 to 49.4 in May 2025, while the PMI fell for services from 50.1 to 49.7. In the United States, Manufacturing PMI fell to 48.5 and has been in the 50s mark since March, while the PMI services fell to 49.9-the first time since June 2024 under the expansion threshold.

These international comparisons make it clear that China is not only affected by a weakening in the processing business. However, the extreme divergence between different surveys within the same country is unusual and raises specific questions about the Chinese economic structure and data transparency. The international PMI methodology was developed to create consistent and comparable indicators that identify the turning points in the economic cycle at an early stage.

Structural challenges and future prospects

The divergent PMI values are symptom of deeper structural problems of the Chinese economy. The traditional growth model based on investments, exports and state -controlled major projects reaches its limits. The transition to a consumer -based, innovation -driven model turns out to be more difficult than expected, especially if the private sector is put under pressure at the same time.

The Chinese leadership faces the dilemma of wanting to maintain state control on the one hand, but on the other hand to rely on the dynamics of the private sector. The current data show that this balance is not achieved: While large -state companies are stabilized by massive support, the basis of the economy is eroding - the innovative and flexible medium -sized business.

Chinese politics drives the concern of the “trap of medium -sized incomes” - a longer phase of stagnating economic output. However, previous measures focus on technological development and qualification of workers in large companies, during the middle class is structurally neglected. Paradoxically, this one -sided focus could weaken the dynamics that is necessary for sustainable growth.

Why China's official economic figures only show half the truth

The dramatic divergence between the Chinese PMI indices in May 2025 is more than a statistical phenomenon-it reflects a fundamental rejection in the Chinese economic structure. While the official NBS-PMI conveys a stabilizing narrative through its focus on large-scale companies, the Caixin-PMI reveals the precarious reality of private small and medium-sized businesses. This systematic discrepancy raises justified questions about the transparency and credibility of official economic data.

The development shows the limits of an economic policy strategy that provides state control over market economy dynamics. By focusing on state businesses and neglecting private small and medium -sized businesses, it undermines the basis for a healthy economic future. The “social contract” between political control and economic prosperity falter when large parts of the economy - in particular the employment -intensive medium -sized company - come under pressure.

For international observers and investors, this means that a differentiated view of the Chinese economic data is essential. The official figures alone convey an incomplete picture; Only taking into account private surveys such as the CAIXIN PMI enables a realistic assessment of the economic situation. The question is not whether the numbers are manipulated, but whether the selective representation of reality does justice - and the answer is increasingly negative.

Why do the official Chinese indices show a more stable economic situation than the Caixin PMI?

The official Chinese indices such as the NBS-PMI show a more stable economic situation than the privately raised Caixin-PMI because they differ significantly in focus, methodology and sample:

Focus on large companies and state businesses

The NBS-PMI is collected by the national statistics office and focuses primarily on large, often state-managed companies. These companies benefit from government support, such as subsidies, preferred access to loans and government orders. As a result, they are less susceptible to short -term economic fluctuations and can cushion crises better.

Illustration of state stability policy

The NBS-PMI reflects the economic stability desired by the government. It therefore shows less volatility and often signals a "managing bear" economy, even if parts of the economy - especially private medium -sized companies - are already under pressure.

Caixin-PMI as a mirror of medium-sized businesses

The CAIXIN PMI is levied by a private provider in cooperation with S&P Global and focuses on small and medium-sized, privately managed companies. These are more affected by market fluctuations, global trade conditions and cost increases. The CAIXIN PMI therefore reacts more sensitively to real problems such as falling orders, margin shrinkage and staff reduction in medium-sized companies.

Segmentation and selective data collection

The methodological segmentation of official statistics ensures that the more stable large -scale companies dominate the overall picture. This creates an impression of stability, although the medium -sized company - the backbone of the Chinese economy - is fighting with significantly major problems.

NBS versus Caixin PMI: The hidden struggle between China's state corporations and the private middle class

The NBS-PMI conveys a more positive image of the economic situation through its focus on state-based large companies and the political orientation towards stability. The Caixin PMI, on the other hand, depicts the real challenges of the private sector and shows the growing fragility of the middle class more clearly.

Suitable for:

Xpert comment: China's fear of loss of facial and the "half truth" of the economic figures

1. Fear of facial loss - domestic and foreign policy

China has a great interest in not showing weakness to both their own population and internationally. The decades of impressive economic growth was a central legitimation instrument of the Communist Party. Leaving the growth could not only shake the population's trust in the leadership, but also reinforce critics who have long warned of structural problems and the non -transparency of Chinese economic policy. The party fears that economic weakness could lead to demands for more political participation - a scenario that she absolutely wants to avoid.

2. Why the official economic figures only show half the truth

The official Chinese economic data has been viewed critically by experts for years. There are numerous indications that the numbers are beautified or at least selectively published in order to maintain the image of a stable and growing economy. Even within China, voices that indicate problems or contradictions are censored or credited. The statistics authorities are under political pressure to reach the growth goals specified by the party leadership - and deliver "patriotic" numbers accordingly. This has led to the credibility of the official data has decreased in recent years.

3. Difference between official indices and Caixin-PMI

The discrepancy between the official Chinese shopping manager indices (PMI) and the privately raised Caixin-PMI is another indication of non-transparency. The state PMI is mainly based on large, mostly state companies and often suggests a more stable location. The Caixin PMI, on the other hand, primarily interviews smaller, private companies and regularly shows a much darker picture-with falling orders, shrinking margins and layoffs in the middle class. While the official index conceals the economic difficulties, the Caixin PMI depicts the reality of the private sector, which is the backbone of the Chinese economy, but particularly suffers from the current problems.

4. Political control and data cosmetics

Under XI Jinping, political control over economic reporting and statistics has massively tightened. Data is treated as a political issue, critical analyzes are suppressed, and the publication of numbers that do not fit into the narrative is restricted. The goal: The party should appear as capable of acting and successful in order to secure domestic stability and demonstrate strength from foreign policy.

Suitable for:

Your global marketing and business development partner

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.