Top Ten: Leading manufacturers of industrial trucks in intralogistics

Language selection 📢

Published on: June 27, 2021 / update from: June 27, 2021 - Author: Konrad Wolfenstein

Industrial trucks are among the most important elements of intralogistics . These are either track-guided or trackless or track-bound conveyor vehicles for the internal transport of goods and goods.

Suitable for:

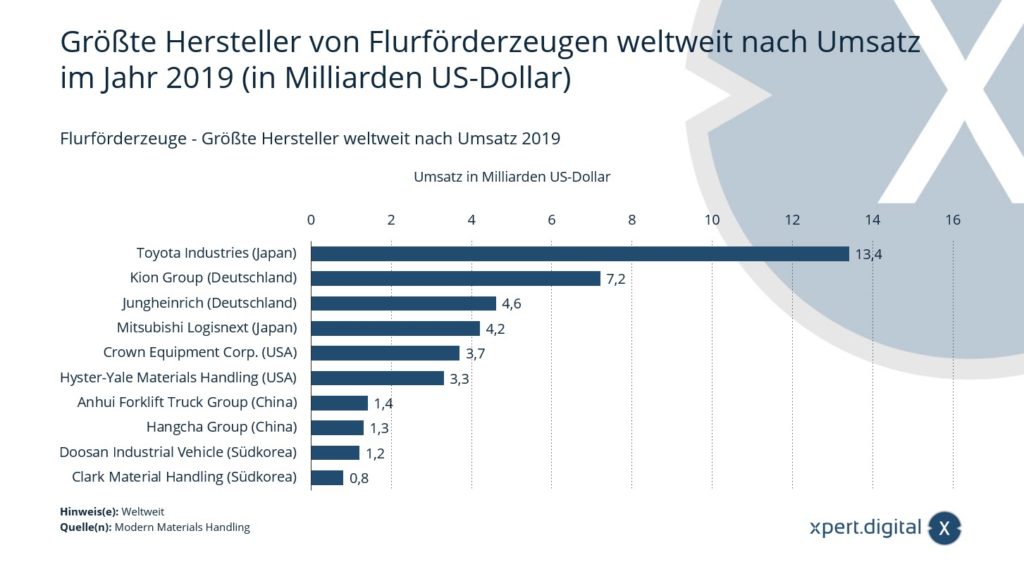

Two important global players in intralogistics for industrial trucks come from Germany. In terms of sales, the KION Group and Jungheinrich AG ranked second and third among the largest manufacturers of industrial trucks worldwide in 2019. First place has belonged to the Japanese giant Toyota for years. Industrial trucks include means of transport for the horizontal transport of goods, which are mostly used internally at ground level. These include forklifts, pallet trucks, order pickers and tractors. Sales of industrial trucks make up almost a fifth of the sales of the German intralogistics industry.

Top ten of the world's largest manufacturers of industrial trucks by sales

The statistics show the largest manufacturers of industrial trucks worldwide by sales in 2019. In 2019, Hamburg-based Jungheinrich AG generated sales of around 4.6 billion US dollars. The information for foreign currencies is based on the exchange rate as of December 31, 2019. The values have been rounded.

Largest manufacturers of industrial trucks worldwide by sales in 2019

- Toyota Industries (Japan) – $13.40 billion

- Kion Group (Germany) – $7.20 billion

- Jungheinrich (Germany) – $4.60 billion

- Mitsubishi Logisnext (Japan) – $4.20 billion

- Crown Equipment Corp. (USA) – $3.70 billion

- Hyster-Yale Materials Handling (USA) – $3.30 billion

- Anhui Forklift Truck Group (China) – $1.40 billion

- Hangcha Group (China) – $1.30 billion

- Doosan Industrial Vehicle (South Korea) – $1.20 billion

- Clark Material Handling (South Korea) – $0.80 billion

Suitable for:

Production volume of the German conveyor technology and intralogistics industry by area

The present statistics show the production volume of the German conveyor technology and intralogistics industry by area in 2017. In 2017, the German intralogistics industry achieved a production volume of around 4.5 billion euros in the area of industrial trucks.

Intralogistics – production volume in Germany by sector 2017

- Industrial trucks – 4.50 billion euros

- Cranes and hoists – 4.10 billion euros

- Series hoists – 3.60 billion euros

- Logistics software & electrical automation (including machine software) – 3.40 billion euros

- Continuous funding – 3.10 billion euros

- Storage facility – 1.30 billion euros (e.g. buffer storage )

- Assemblies, installations and repairs – 1.30 billion euros

The green, emission-free development of conveyor vehicles

From the mid-nineteenth century through the early 20th century, the developments that led to today's modern forklifts took place. The predecessors of the modern forklift were manually operated hoists used to lift loads. In 1906, the Pennsylvania Railroad introduced battery-powered platform cars for luggage transport at its station in Altoona, Pennsylvania. During the First World War various types of material handling equipment were developed in Britain by Ransomes, Sims & Jefferies of Ipswich. This was partly due to the war-related labor shortage. In 1917, Clark began developing and using motor tractors and pallet trucks in their factories in the United States. In 1919 the Towmotor Company and in 1920 Yale & Towne Manufacturing entered the lift truck market in the United States. The continued development and expanded use of the forklift continued throughout the 1920s and 1930s. The introduction of hydraulics and the development of the first electrically powered forklifts, as well as the use of standardized pallets in the late 1930s, helped increase the popularity of forklifts.

The beginning of the Second World War, like the First World War before it, encouraged the use of forklifts in war operations. After the war, more efficient methods of storing products in warehouses were introduced. Warehouses needed more maneuverable forklifts that could reach greater heights, and new models of forklifts were manufactured to meet this need. In 1954, a British company called Lansing Bagnall, now part of the KION Group, developed what is said to be the first electric narrow-aisle reach truck. The development changed the design of warehouses and led to narrower aisles and greater stackability of loads, which increased storage capacity. During the 1950s and 1960s, operator safety became an issue due to increasing lifting heights and capacities. During this time, forklifts were equipped with safety features such as: B. backrests and driver cages, the so-called protective devices. In the late 1980s, new forklifts began to be designed with ergonomics in mind to increase operator comfort, prevent injuries and increase productivity. In the 1990s, attention began to be paid to exhaust emissions from forklift trucks, which led to the introduction of emissions standards for forklift manufacturers in various countries. The introduction of AC forklifts as well as fuel cell technology are also refinements in further forklift development.

Suitable for:

- Networked distribution centers – intralogistics 4.0

- Last mile logistics

- Intralogistics Glossary

- Intralogistics & Logistics Library (PDF)

That's why Xpert.Plus for advice and planning of industrial truck technology in intralogistics

Xpert.Plus is a project from Xpert.Digital. We have many years of experience in supporting and advising on storage solutions and in logistics optimization, which we bundle in a large network Xpert.Plus

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital – Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital – www.xpert.solar – www.xpert.plus