The top 10 largest construction machinery manufacturers in the world - giants of the construction industry of construction machinery manufacturers

Language selection 📢

Published on: March 8, 2024 / Update from: March 8, 2024 - Author: Konrad Wolfenstein

Largest construction machinery manufacturers worldwide – Image: Xpert.Digial / rtem|Shutterstock.com

Construction machinery, construction machinery construction and construction machinery manufacturers

With its historical roots dating back to the Industrial Revolution, Europe was and still is a leader in the global market for construction and heavy machinery. Growing global economic relations, increasing industrialization and urbanization in all countries contributed significantly to the development of the construction industry worldwide. For example, global construction industry spending increased steadily between 2014 and 2019, reaching $12 trillion by 2019. Sales of construction equipment also reached their highest level in 2018. During this period, over 1.1 million new devices were sold worldwide. The economic rise of the Asia-Pacific region in recent decades has presented a challenge for European companies to assert themselves in global competition. In addition to global business dynamics, companies within Europe also compete fiercely with each other due to the free trade zone within the European Union (EU). While the share of German construction equipment sales increased between 2017 and 2020, the share of France and the United Kingdom fell.

European companies on the global market for construction machinery

Changes in regional economic performance have a significant impact on the overall business performance of some companies in different regions. Although European companies paved the way for the development of construction equipment and the emergence of the heavy construction equipment market, today European companies do not occupy the most important positions in the world market. In 2019, Caterpillar (USA), Komatsu (Japan) and John Deere (USA) are the world's leading construction machinery companies. Three of the twelve largest companies in this market are based in Europe, the largest being Volvo (Sweden). During the same period, Volvo Construction Equipment (Sweden), Liebherr (Germany) and Sandvik Mining and Rock Technology (Sweden) were the largest European companies in terms of sales value. Although Liebherr's global sales stagnated between fiscal years 2008 and 2014, the company gained momentum in 2015. As a result, the company increased its global sales, reaching a peak value of over 11.7 billion euros in 2019.

Outlook for the European market post-COVID-19

According to estimates made before the coronavirus (COVID-19) pandemic, the construction and heavy machinery market in Europe will generate over $40 billion in economic value by 2026.

Construction machinery sales in Europe rose continuously and reached their peak by 2019. However, following the coronavirus pandemic that hit Europe in February 2020, the industry experienced a sharp decline in 2020. It is predicted that sales in this market will not return to 2019 figures until 2025. Most economies in Europe recorded a sharp decline in construction equipment sales. Spain was one of the most affected countries in the second quarter of 2020 compared to the same period in 2019. The decline in construction equipment sales in Spain was almost 52 percent. On the other hand, the Turkish construction equipment market recorded high positive growth rates throughout 2020. In a disaggregated market analysis, almost all submarkets of the European market for light and heavy construction machinery recorded negative development in 2020. Only the light compaction equipment segment recorded positive sales development during this period, with a growth rate of around 5.3 percent. Otherwise, all segments and product groups declined significantly in 2020. For some product lines, the economic damage was more lasting than for others. However, the road construction machinery product groups in the European construction machinery market recovered quickly in 2020. The road construction machinery product groups grew by around 30 percent in the fourth quarter of 2020 compared to the same period in 2019.

Just try out our universally applicable (B2B/Business/Industrial) Metaverse configurator for all CAD / 3D demo options:

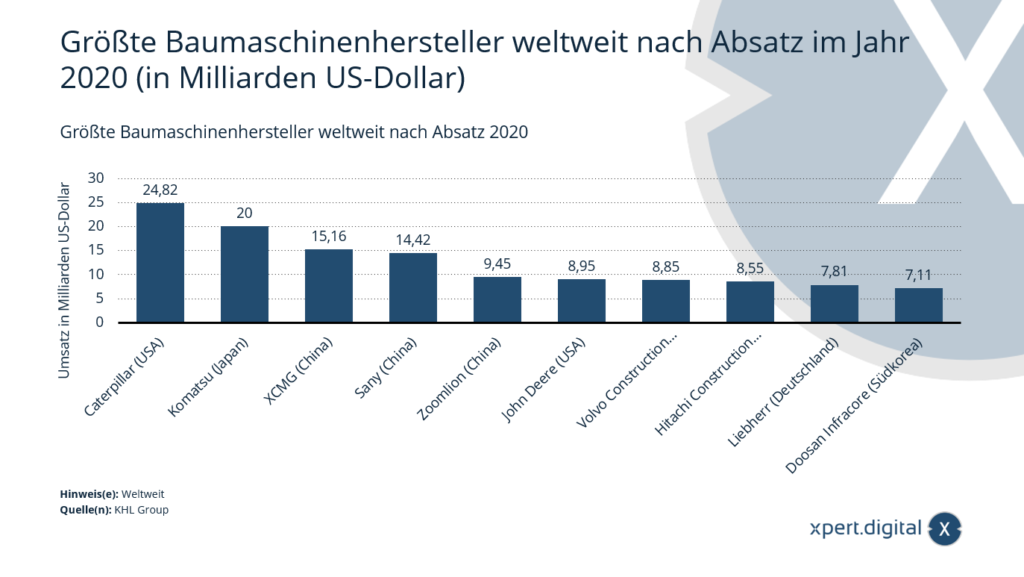

Largest construction machinery manufacturers worldwide by sales in 2020

The statistics show the largest construction machinery manufacturers worldwide by sales in 2020. In 2020, the Japanese mechanical engineering company Komatsu sold construction machinery worth around $20 billion.

Largest construction equipment manufacturers worldwide by sales in 2020 (in billion US dollars)

- Caterpillar (USA) – $24.82 billion

- Komatsu (Japan) – $20 billion

- XCMG (China) – $15.16 billion

- Sany (China) – $14.42 billion

- Zoomlion (China) – $9.45 billion

- John Deere (USA) – $8.95 billion

- Volvo Construction Equipment (Sweden) – $8.85 billion

- Hitachi Construction Machinery (Japan) – $8.55 billion

- Liebherr (Germany) – $7.81 billion

- Doosan Infracore (South Korea) – $7.11 billion

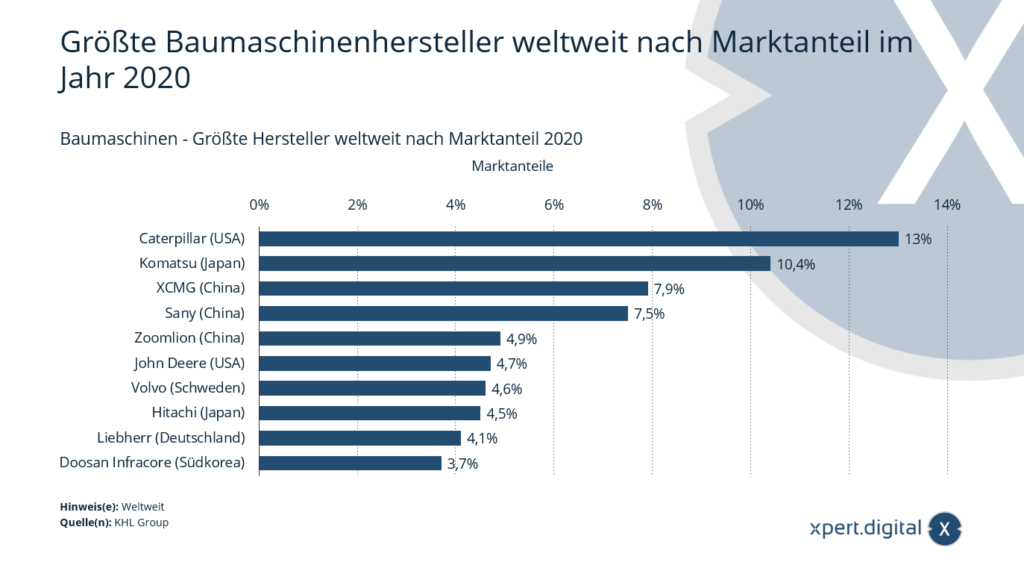

Construction machinery - Largest manufacturers worldwide by market share 2020

Construction machinery - Largest manufacturers worldwide by market share 2020 - Image: Xpert.Digital

With a market share of 13 percent, Caterpillar was the largest construction equipment manufacturer worldwide in 2020. Japanese competitor Komatsu followed in the same year with around 10.4 percent. John Deere and Hitachi, among others, were also among the largest construction machinery manufacturers.

Caterpillar

The US company is a mechanical engineering manufacturer that has been established on the market since 1925. In addition to construction machinery, it recently also produced diesel and gas turbines. Caterpillar's sales have fluctuated between $30 and almost $70 billion in recent years. Most of its sales were generated in North America. The company has previously employed around 100,000 people worldwide every year.

Worldwide construction machinery market

For the next five years, annual sales of construction machinery worldwide are forecast to be just over one million units. According to forecasts, most construction machines will be sold in China and North America. Within Europe, Germany, France and the United Kingdom were recently the largest buyers of construction machinery.

Largest construction equipment manufacturers worldwide by market share in 2020

- Caterpillar (US) – 13%

- Komatsu (Japan) – 10.4%

- XCMG (China) – 7.9%

- Sany (China) – 7.5%

- Zoomlion (China) – 4.9%

- John Deere (USA) – 4.7%

- Volvo (Sweden) – 4.6%

- Hitachi (Japan) – 4.5%

- Liebherr (Germany) – 4.1%

- Doosan Infracore (South Korea) – 3.7%

Construction machinery manufacturers – all data, figures and graphics

- Liebherr – PDF download

- Hitachi – PDF Download

- John Deere – Download

- Komatsu Limited – Download

- Caterpillar – PDF Download

- Volvo Group – PDF Download

More PDF libraries

- Customer Demographics Library – Demographics Knowledge Base (PDF)

- Online Marketing Library – Knowledge Base (PDF)

- E-Commerce Library – Knowledge Base (PDF)

- Social Media Marketing Library – Knowledge Base (PDF)

- SEO Library – SEM knowledge database (PDF)

- Search Engine Advertising / SEA Library – Search Engine Advertising Knowledge Base (PDF)

- Photovoltaic library (PDF)

- Extended Reality (XR) Library (PDF)

- Smart Vision and Trends Library (PDF)

- Corona Library – Covid-19 knowledge database (PDF)

Why Xpert.Plus ?

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital – Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital – www.xpert.solar – www.xpert.plus