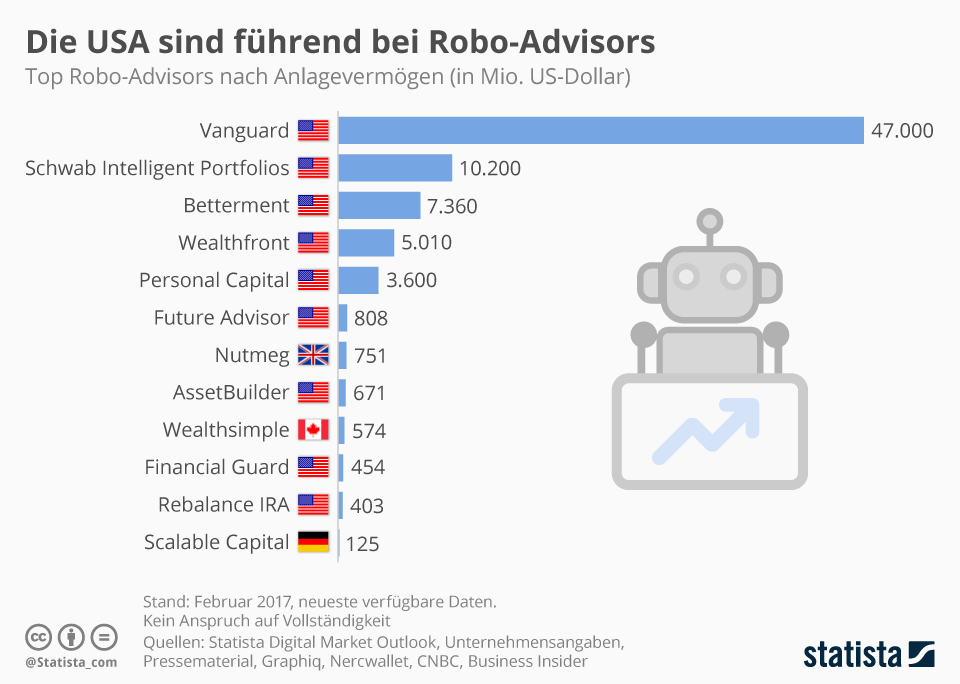

The USA is a leader in robo-advisors

Language selection 📢

Published on: September 5, 2018 / update from: November 5, 2021 - Author: Konrad Wolfenstein

The term Robo-Advisor is made up of the English words Robot and Advisor. Robo-advisors use a systematic, largely automated process to give more people access to professional asset management while protecting investors from emotionally driven and therefore suboptimal investment decisions.

The USA is the world leader in robo-advisors. This is software that digitizes and automates the services of a traditional financial advisor. According to Statista Digital Market Outlook (DMO), of the twelve largest companies in this sector, nine come from the United States alone. The leader is the company Vanguard, whose financial technology, according to Statista estimates, manages $47 billion. Also in the top 5 are the two start-ups Betterments (7.4 billion dollars) and Wealthfront (around 5 billion dollars). The German company Scalable Capital manages at least $125 million. The DMO analysts have summarized the data on the development of the financial technology market in the free Personal Finance Report.