The banks' negative interest rate strategy continues

Language selection 📢

Published on: October 24, 2021 / Update from: October 24, 2021 - Author: Konrad Wolfenstein

Update - October 24, 2021: At the end of the third quarter, a total of 392 credit institutions negative interest rates from their private customers. Of these, over 200 banks and savings banks have introduced negative interest rates in the current year. In addition, more and more financial institutions are tightening their existing negative interest rate regulations by reducing allowances or pushing interest rates even further into the red. This is shown by a Verivox evaluation of around 1,300 banks.

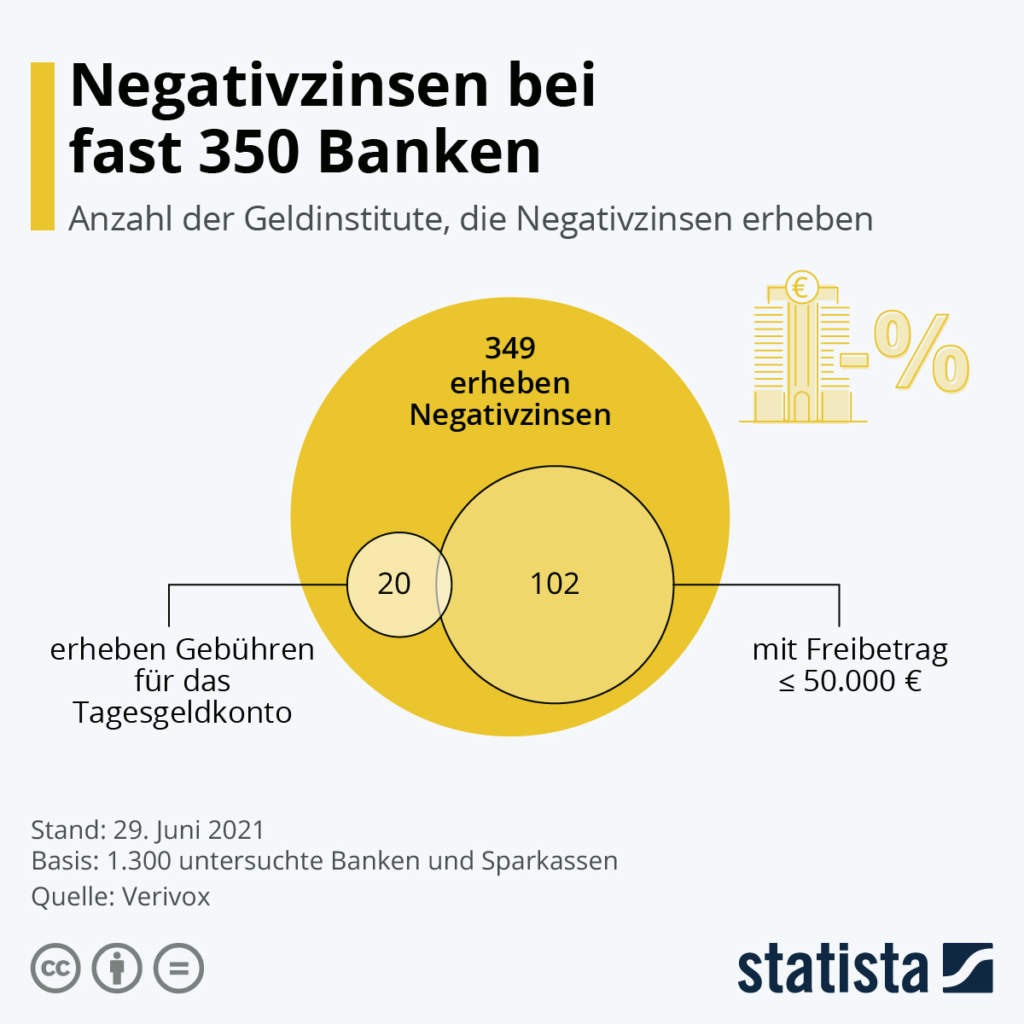

Penalty interest for larger amounts of money in checking accounts is becoming a practice at more and more banks in Germany. comparison portal Verivox, the number of financial institutions that charge negative interest rates is around 349 - an increase of 171 compared to the previous year. The analysis of the price notices published on the Internet by around 1,300 banks and savings banks reveals that the exemption amount at around 102 banks is less than 50,000 euros - a few even have a limit of just 25,000 euros. Also annoying for bank customers: in around 30 cases, fees are charged on the usually free current account, as the graphic shows.

The situation will probably continue to worsen in the future. The trigger for this development is the monetary policy of the European Central Bank (ECB). Since commercial banks currently have to pay 0.5 percent interest on excess funds deposited with the ECB, the resulting costs are passed on to bank customers in the broadest sense.

Negative interest rates are already at almost 400 banks - many institutions are pushing interest rates and allowances even lower

At the end of the third quarter, a total of 392 credit institutions were charging negative interest rates from their private customers. Of these, over 200 banks and savings banks have introduced negative interest rates in the current year. In addition, more and more financial institutions are tightening their existing negative interest rate regulations by reducing allowances or pushing interest rates even further into the red. This is shown by a Verivox evaluation of around 1,300 banks.

There is no end in sight to the negative interest rate trend

Of the banks evaluated, 392 institutions currently charge negative interest rates for balances in private current account, current or clearing accounts. That is 214 more than at the beginning of the year. In the last three months the number increased by 43 banks; At the end of June, 349 financial institutions were charging negative interest rates.

“We are still seeing great momentum in negative interest rates, but while new banks introduced custody fees almost every day in the first half of the year, this development has currently slowed down somewhat,” says Oliver Maier, Managing Director of Verivox Finanzvergleich GmbH. “But there is no end in sight to the negative interest rate trend.”

Many banks are tightening their conditions

On the contrary: more and more banks are tightening their existing negative interest rates. Either they reduce the interest rate even further into the negative or they reduce the allowances so that negative interest is due even with smaller balances. In the third quarter alone, 30 banks further tightened existing negative interest rate regulations - 68 institutions have done so so far throughout the year.

For its analysis, Verivox continuously evaluates the conditions of around 1,300 banks and savings banks shown on the websites. “But not all banks publish negative interest rates transparently and freely accessible on their website,” explains Oliver Maier. “So there is an unreported number and in fact there are probably significantly more than 392 banks charging negative interest rates.”

Small and medium-sized balances are also affected

For a long time, only very wealthy savers had to pay negative interest. If banks charged a custody fee at all, they almost always granted high allowances of 100,000 euros and more. But that limit has fallen. At least 135 banks now charge negative interest for total balances of 50,000 euros or less. In some cases, negative interest is due for as little as 5,000 or 10,000 euros in the account.

Minus 0.5 percent – that is the penalty interest that banks pay on part of their excess deposits that they park with the European Central Bank. Most institutions in the Verivox evaluation base their custody fees on this interest rate. 13 banks go even further with their negative interest rates and charge their customers' balances with 0.55 to 1 percent penalty interest.

Fees for overnight money: negative interest rates through the back door

Negative interest rates are not always shown as such. A total of 21 banks and savings banks charge a fee for the daily money account, which is usually free of charge. From the customer’s perspective, this actually creates negative interest rates. The money in the account becomes less, even if the bank shows an interest rate of 0.00 or 0.01 percent. 11 of these 21 banks do not just charge fees, but also charge nominal negative interest rates.

Negative interest rates are not a law of nature

Important for savers: Credit institutions cannot unilaterally introduce negative interest rates in current contracts. When published in the price list, the custody fees initially only apply to new customers. If a bank also wants to charge its existing customers negative interest rates, it must agree this individually with those affected.

In this case, consumers can either spread their money across several banks so that they remain below the allowances. Or they look for offers without negative interest rates. “The ongoing low interest rate policy puts credit institutions in a difficult situation, but negative interest rates are not a law of nature,” says Oliver Maier. “The market comparison shows that it is also possible without custody fees.” Top banks based in other European countries currently pay investors up to 0.3 percent interest on current deposits. For providers with German deposit insurance, the top rate is 0.11 percent. If you invest your money for two years, you can earn over 1 percent interest.

Xpert.Digital – Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital – www.xpert.solar – www.xpert.plus