Published on: June 20, 2025 / update from: June 20, 2025 - Author: Konrad Wolfenstein

Social stability over everything: China supports loss companies and the costs of political priorities-creative image: Xpert.digital

China's dilemma: Why Beijing is artificially alive

Zombie company in China between collapse and control: How China is politically controls its economy:

The People's Republic of China faces a fundamental economic policy dilemma: In order to ensure social stability, the government systematically maintains unprofitable companies that have long been closed under normal market conditions. This support policy for needy companies clearly shows the priorities of the Chinese leadership - social calm stands above economic efficiency.

Suitable for:

The extent of the problem of unprofitable companies

Dramatic increase in inefficient companies

The dimension of the problem is illustrated by current data: The proportion of loss companies in China rose from 8 percent in 2023 to 13 percent in the first half of 2024. This development clearly exceeds the global trend, where the proportion increased from 4 to 6 percent in the same period. It is particularly alarming that even when the real estate sector is excluded, the proportion increases from 7 to 11 percent.

Especially affected industries

The automotive industry is an example of this development. The proportion of loss -making industrial companies has reached the highest level since 2001. In the province of Shanxi, which is reorganized as a center for clean energy, almost 40 percent of industrial companies record losses - twice as much as the national average.

The example of Daun Automobile in Shanxi illustrates the problem: Despite the failed switch to premium electric cars and a judicial restructuring in 2024, the company continues to produce trucks. This shows the reluctance of local authorities to allow market industries.

The mechanisms of state intervention

Comprehensive subsidy policy

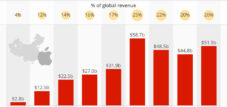

The Chinese government uses a wide arsenal of support measures. More than 99 percent of the listed companies received direct state subsidies in 2022. This becomes particularly clear using the example of the electric car manufacturer BYD, whose direct subsidies from 220 million euros in 2020 climbed to 2.1 billion euros in 2022.

State support not only includes direct subsidies, but also tax relief, cheap loans, discounted electricity tariffs and subsidized building plots. From 2021 to 2023, the Chinese automotive industry flowed direct funding of over 5.7 billion euros.

Institutional obstacles to market adjustment

The Chinese bankruptcy system significantly complicates the necessary market adjustment. Deals hesitate to approve closures, since judges can be held liable for potential social unrest. A legal paper from 2021 shows that courts are often obliged to defuse protests in advance before bankruptcies are approved.

Social tensions despite low unemployment

Deceptive stability of the labor market data

The officially low unemployment rate of an average of 5.2 percent in 2024 gives the impression of economic stability. However, this number obscures the actual problems: youth unemployment reached 18.8 percent in August 2024, increasing from 17.1 percent in July. The unemployment rate for 25 to 29 year olds was 6.9 percent.

Suitable for:

Increasing protests and social unrest

Despite the state efforts for stability, social tensions increase. The China Dissent Monitor documented a total of 937 protest events in the third quarter of 2024, which corresponds to an increase of 27 percent compared to the same period in the previous year. The majority of these protests are listed by workers (41 percent), property owners (28 percent) and rural residents (12 percent).

Another sign of the government's concern is the creation of the publication of wage data by the large recruitment platform 51.com, presumably to disguise the weakness of the labor market.

Economic consequences of this support policy

Deflationary tendencies and weak domestic demand

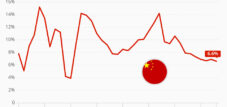

Politicians to artificially keep inefficient companies alive contribute to deflationary tendencies. In November 2024, consumer prices only rose by 0.2 percent, while in the month comparison they even fell by 0.6 percent. The producer prices fell by 2.5 percent, which reflects the continued Defland pressure in industry.

The internal demand is stagnating and consumer trust suffers from the collapse of the real estate sector. This weak domestic demand increases China's dependence on exports and leads to structural imbalances.

Overcapacity and trade conflicts

Subscribing non -viable companies leads to massive overcapacity. According to estimates, the overcapacity for electric vehicles and lithium batteries are sufficiently large to double exports in these areas. Even with an increase in production utilization to 80 percent, exports of electric vehicles would have to increase by around 30 percent and lithium batteries by around 70 percent.

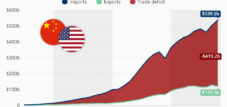

This overproduction leads to international trade conflicts. In October 2024, the EU imposed punitive tariffs of up to 35 percent on Chinese electric cars. The United States set the import duties for Chinese goods to 125 percent, while China responded with retaliation tariffs of 84 percent.

Expert opinions and reform proposals

Criticism of the lack of market discipline

Shaun Roache, chief economist for Asia-Pacific at S&P Global Ratings, criticizes the effects of politics: "The lack of market discipline harms healthy companies". The inefficient resource allocation hinders the economic development and weakens competitiveness.

Structural reform proposals

The renowned economist David Li Daokui proposes a quota system in which companies can sell production rights to reduce overcapacity in the market -oriented. Such market -based mechanisms could be an alternative to direct state intervention.

Michael Pettis, financial professor at the Beijing University, emphasizes the global effects: “Political measures to reduce workplace and revenue losses for companies may appear like a purely domestic problem, but since these politics lead to a faster increase in production as the associated consumption, they are also effectively trading policy.

Historical perspective and current challenges

Differences to previous reforms

In the 1990s Premier Zhu Rongji closed thousands of inefficient state -owned companies, which enabled China's later production boom. Today, however, the overcapacity is mainly due to private companies, through which local governments have less direct influence.

XI Jinping Prioritization of national security and technological self -sufficiency leaves little space for market economy volatility. Local civil servants are primarily measured by growth and employment, which prevents them from closing unprofitable businesses.

Weak implementation of reform efforts

Although the State Council issued guidelines in 2023 to limit local subsidies, and banks have been instructed to establish loans to companies at risk of insolvency, the implementation remains weak. This shows the difficulty of enforcing central reform specifications at the local level if they contradict local interests.

An unsustainable balance

China's politics of artificially keeping unprecedented companies, reveals a fundamental field of tension between short -term social stability and long -term economic health. The low unemployment rate is bought by inefficient resource use and growing trade voltages.

Without fundamental reforms, China threatens to stagnate that even the Communist Party cannot ignore. The government is faced with a difficult choice: either it risks social unrest through necessary market adjustments or it continues to sacrifice economic efficiency for short -term stability. The time for half -hearted measures is running, and the costs of this policy are becoming increasingly clear for both China and the global economy.

Suitable for:

Your global marketing and business development partner

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.