Understanding the Siemens Gamesa crisis and the collapse in Siemens Energy's share price - the difference in finance. Support and government guarantees

Language selection 📢

Published on: October 30, 2023 / Update from: October 30, 2023 - Author: Konrad Wolfenstein

Siemens Gamesa Renewable Energy – A look at the collapse in Siemens Energy’s share price – Image: T. Schneider|Shutterstock.com

⚡🌍 Siemens Energy and Siemens Gamesa Renewable Energy (SGRE) ⚡

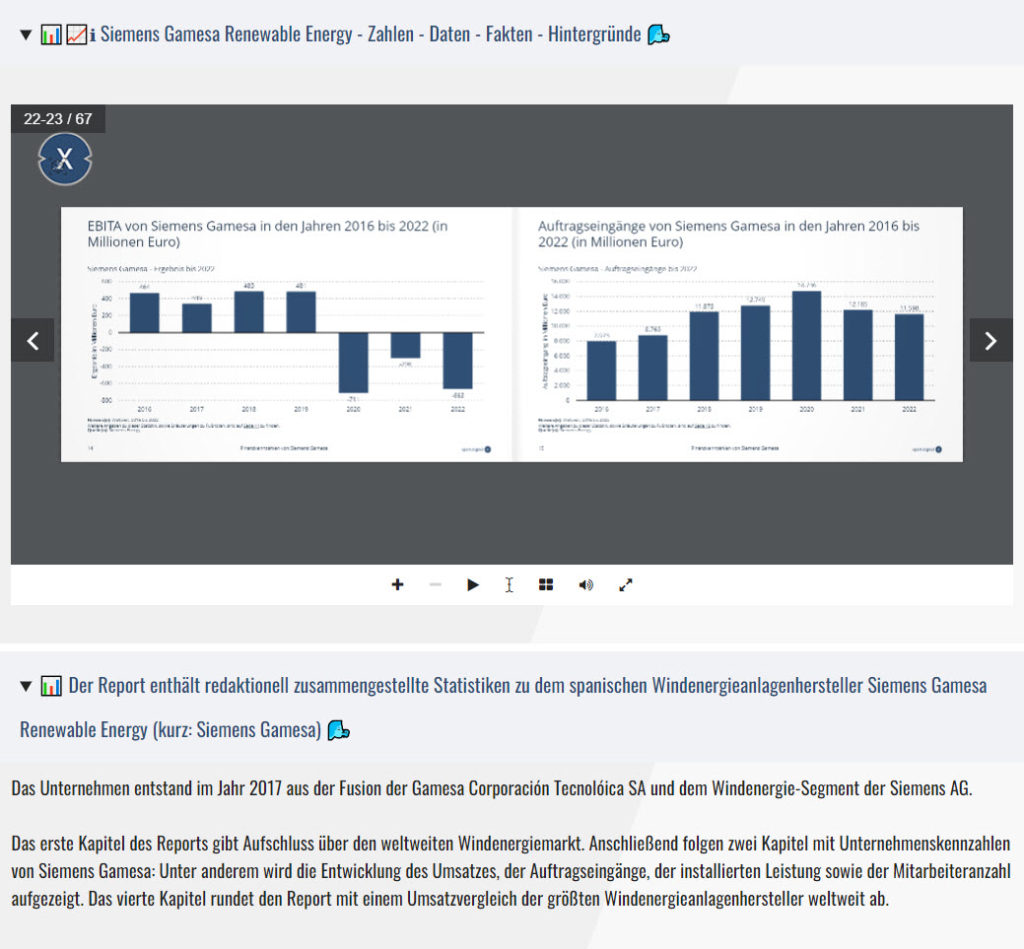

🌬️ Siemens Gamesa is a subsidiary of Siemens Energy. Siemens Gamesa Renewable Energy (SGRE) is a global leader in wind power solutions and was formed in 2017 through the merger of Gamesa Corporación Tecnológica and Siemens' wind energy division. Siemens Energy holds a significant stake in Siemens Gamesa and is responsible for the renewable energy business, particularly in the area of wind energy.

Siemens Garmesa Renewable Energy focuses on the environmentally friendly transformation of industry (decarbonization). It provides renewable energy services, including manufacturing and upgrading gas and wind turbine technologies, as well as innovating grid storage and digital grid technologies. The main focus is on sustainable energy systems, electrification, automation, digitalization and densification.

⚡ Siemens Energy AG is a company in the energy sector that is primarily concerned with the production and expansion of fossil and renewable energy technologies and power grids.

Siemens Energy AG was originally part of Siemens AG. Siemens Energy was separated from Siemens AG in September 2020 and listed on the stock exchange as an independent company. This is the business area that focuses on energy technologies. Despite the spin-off, there are still business relationships between Siemens AG and Siemens Energy AG, but they are now two separate listed companies.

The former parent company Siemens AG still holds 25.1% of the shares in Siemens Energy.

📈 Siemens Gamesa Situation - as of October 30, 2023

🏭 Siemens Energy and the role of the major shareholder Siemens AG: A dilemma

In the effort to free Siemens Energy from its difficult situation, interest is also focused on the main shareholder Siemens AG. However, the company has so far hesitated to provide guarantees because Siemens AG actually intends to cut its shares in Siemens Energy.

🎙️ Interview and guarantees

Joe Kaeser, who holds the role of the chairman of the supervisory board at Siemens Energy, made it clear in an interview with the weekly newspaper “Welt am Sonntag” that the company is not dependent on financial support from the state. Rather, the ongoing talks with the federal government should be concerned with the granting of guarantees. These guarantees should enable Siemens Energy to put the ambitious growth plans into practice.

🌬️ Challenges in the wind energy segment

This step is particularly interesting because there are apparently difficulties in the wind energy segment of the subsidiary Gamesa. This has an impact on the ability of the parent company, Siemens Energy, to provide appropriate guarantees for future major projects. According to insider information, the sum could be up to 15 billion euros.

🌍 Global energy economy

Siemens Energy is a major player in the global energy industry. The company operates in diverse sectors, from conventional energy sources such as gas and coal to renewable energies such as wind and solar power. As the world increasingly shifts to sustainable energy solutions, Siemens Energy's growth plans are extremely important, both for the company itself and for the global energy transition.

🔒 Additional security and hurdles

The guarantees that are being discussed with the federal government would offer the company additional security. They could serve as a lever for accessing financing for large-scale projects without having to rely on direct government funding. However, various hurdles must be overcome, including regulatory approvals and possible concerns from shareholders and the public.

🔄 Current situation at Gamesa

The current difficulties at Gamesa provide valuable context for this discussion. Gamesa specializes in the manufacture of wind turbines and has a history of strong financial results. However, recent issues, perhaps due to supply chain bottlenecks or technological challenges, have limited the company's ability to succeed in this segment. This could be one of the main reasons for Siemens Energy to secure support in the form of guarantees.

💰 Guarantees from Siemens Energy

In light of this, the volume of the promised guarantees – up to 15 billion euros – is particularly remarkable. It reflects the high level of trust that both the company and the federal government have in the long-term potential of Siemens Energy. For the federal government, this could be a strategy to accelerate the transition to renewable energies in Germany and at the same time strengthen the industrial location.

⚠️ Risks of guarantees

However, guarantees of this magnitude are not without risk. If Siemens Energy does not meet expectations, the financial risk for the state would be enormous. Therefore, these negotiations must be conducted with great care and consideration. A close examination of Siemens Energy's business models and future projects is essential in order to correctly assess the extent of the risk. In addition, mechanisms must be implemented to protect the state from possible losses if the guarantees have to be invoked.

📢 Importance of transparent communication

Transparent communication with shareholders and the public is also crucial. With such large sums and the associated public attention, it is necessary to justify the guarantees to the general public. This is the only way to maintain trust in the measures and in the company itself in the long term.

🌟 Future of Siemens Energy

Siemens Energy faces a complex but also promising future. The guarantees sought could take the company into a new phase of expansion and innovation, while paving the way for a more sustainable global energy supply.

📣 Similar topics

- 🌍 Siemens Energy and the global energy transition

- 💡 Siemens Energy's growth plans in action

- 🌬️ Gamesa's challenges in the wind energy segment

- 💶 State guarantees: Up to 15 billion euros for Siemens Energy?

- 🛠️ Siemens Energy: Between expansion and innovation

- 🔄 Accelerate Germany's transition to renewable energy

- ⚖️ Risks and Rewards: The Guarantee Debate

- 🤝 Trust and transparency: Siemens Energy's communication

- 🌟 Future prospects for Siemens Energy

- 🔍 A close examination of the guarantees: security for the state

#️⃣ Hashtags: #SiemensEnergy #Energiewende #Gamesa #StateGuarantees #RenewableEnergy

⚡💰 Difference between government financial support and government guarantees

🌐 Understanding the Siemens Gamesa crisis and the collapse in Siemens Energy's share price

In the context of business, and particularly with large companies such as Siemens Energy, government financial support and guarantees are two different instruments that can be used by the federal government to support companies in times of economic difficulties.

💰 Government financial support

Government financial support refers to direct financial resources transferred by the government to a company to ensure its liquidity in times of crisis or to promote specific projects that are considered economically or socially beneficial. This support can take the form of direct grants, low-interest loans or tax breaks.

🔍 Siemens Gamesa and financial support

In the case of Siemens Gamesa, such financial support could serve to promote research and development in the areas of renewable energy or to secure jobs in regions where the company is of great economic importance. These direct financial contributions allow the company to make investments that it might not have made under normal market conditions or to overcome financial constraints caused by external factors.

🛡️ Granting of guarantees by the federal government

In contrast, guarantees are not direct financial contributions. A guarantee is a contractual commitment by the government to third parties (e.g. banks) that it will step in if the beneficiary company defaults. In other words, for example, if Siemens Gamesa takes a loan from a bank and the federal government guarantees it, this means that the federal government will assume the debt if Siemens Gamesa is unable to repay the loan.

🔑 Key differences in the context of Siemens Gamesa

While both instruments aim to support businesses in difficult economic times, they differ in their nature and impact. While direct financial support provides an immediate cash flow boost, a guarantee allows the company to access external financing options at more favorable terms.

🔎 Analysis from Siemens Gamesa

In the current case of Siemens Gamesa, one would have to carefully examine what form of support the company received and for what reason. It is also important to note that both direct financial support and guarantees are usually subject to certain conditions designed to ensure that the funds are used in accordance with the government's policy objectives.

📣 Similar topics

- 1️⃣ Government support in times of crisis: What companies need to know 🏦

- 2️⃣ Siemens Gamesa and the federal government: A case study for financial aid 🌿

- 3️⃣ Financial resources vs. guarantees: Which support is right for your company? 💼

- 4️⃣ Tax relief as an economic development instrument 📉

- 5️⃣ How guarantees can reduce credit risk 🛡️

- 6️⃣ Funding pots from the federal government: Direct grants and low-interest loans 🎯

- 7️⃣ Research and development in renewable energies: A funding case for Siemens Gamesa 🌞

- 8️⃣ Political conditions: This is how state aid is awarded to companies 📜

- 9️⃣ Effects of state aid on the overall economy 📊

- 🔟 Liquidity in times of crisis: How companies can benefit from government measures 💰

#️⃣ Hashtags: #StateSupport #SiemensGamesa #FinancialFunds #Guarantees #EconomicCrisis

State guarantees as a lifeline? Siemens Energy in negotiations with the federal government

Siemens Energy in negotiations over state guarantees with the federal government – Image: Tobias Arhelger|Shutterstock.com

Siemens Energy experienced significant financial challenges in the third quarter. The net loss was almost 3 billion euros, mainly due to problems at its Spanish wind energy subsidiary, Gamesa. These developments have led the company to expect a significant total loss of around 4.5 billion euros for the current financial year. Gamesa alone contributes around 4.3 billion euros to this loss. These figures illustrate the serious financial situation of Siemens Energy. We reported on it.

More about it here:

📈 Market trends and industry development

An important component of understanding Siemens Energy's share price collapse is analyzing current market trends and developments in the energy industry. Changes in demand for renewable energy, political decisions and global developments can have a significant impact on the share prices of companies in this sector.

📝 Corporate strategy and performance

It is crucial to examine Siemens Energy's strategy and performance in recent quarters. Have you successfully invested in new technologies? Have you responded efficiently to changing market conditions? The financial health and operational efficiency of the company play a crucial role.

🔍 Competitor analysis

A comparison with other companies in the industry can provide valuable insight. How have the stocks of other energy companies performed? Are there specific factors that differentiate Siemens Energy from the competition?

⚖️ Regulatory influences

Changes in the regulatory landscape can have a significant impact on companies in the energy sector. New laws, environmental regulations or subsidy programs can influence profitability and competitiveness.

🌍 Global events and uncertainties

Global events such as geopolitical tensions, economic uncertainties or natural disasters can have a major impact on stock markets. It is important to consider whether such external factors could have contributed to the price collapse.

🛡️ Investment strategies and risk management

It is important to emphasize that the stock market is inherently volatile, and declines in prices are not uncommon. Investors should always consider broad diversification in their portfolio to protect themselves from such risks.

📰 Latest news and company announcements

It is also advisable to pay attention to the latest news and developments related to Siemens Energy, as information and announcements from the company itself can have a significant impact on the share price.

🔮 Complex topic

The collapse in Siemens Energy's share price is a complex issue that is influenced by various factors. A thorough analysis of the mentioned aspects can help to get a comprehensive picture of the situation and help investors make informed decisions. It remains to be seen how Siemens Energy shares will perform in the coming months and whether the company will take measures to mitigate the price decline.

📣 Similar topics

- 📈 Market trends and industry development: analysis of the energy sector

- 💼 Siemens Energy corporate strategy and performance

- 🔍 Competitor analysis in the energy industry

- 📜 Regulatory influences on Siemens Energy

- 🌍 Global events and their influence on stock markets

- 💰 Understanding volatility in the stock market

- 📰 Latest news about Siemens Energy

- 🧐 Causes of the price collapse at Siemens Energy

- 📊 Financial health of Siemens Energy

- 🔄 Investment strategies to reduce risk

#️⃣ Hashtags:

#Market trends #Corporate strategy #Competitive analysis #Regulatory #Global events #Stock market #SiemensEnergy #Finance #Investments #Risk reduction

🌬️ Siemens Gamesa Renewable Energy

We currently no longer offer our newer PDFs for download. These are only available upon direct request.

However, the PDF “Siemens Gamesa Renewable Energy” (67 pages) can be found in our

📜🗺️ Infotainment portal 🌟 (e.xpert.digital)

under

https://xpert.digital/x/siemens-gamesa

with the password: xsiemens

view.

Plan your solar system for the most common applications conveniently online with our solar system planner!

With our user-friendly solar system planner you can plan your individual solar system online. Whether you need a solar system for your home, your business or for agricultural purposes, our planner offers you the opportunity to take your specific requirements into account and develop a tailor-made solution.

The planning process is simple and intuitive. You simply enter relevant information. Our planner takes this information into account and creates a tailor-made solar system that meets your needs. You can try out different options and configurations to find the optimal solar system for your application.

Additionally, you can save your plan to review later or share with others. Our customer service team is also available to answer your questions and provide support to ensure your solar system is optimally planned.

Use our solar system planner to plan your individual solar system for the most common applications and advance the transition to clean energy. Start now and take an important step towards sustainability and energy independence!

The solar system planner for the most common applications: Plan the solar system online here - Image: Xpert.Digital

More about it here:

We are there for you - advice - planning - implementation - project management

☑️ Expert advice on energy-efficient renovation and new construction

☑️ with solar solutions and heat pumps/air conditioning systems

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 157 30 44 9 555 .

I'm looking forward to our joint project.

Xpert.Digital - Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital - www.xpert.solar - www.xpert.plus