Robotics and automation in France: France's robot future between ambitions and reality

Xpert pre-release

Language selection 📢

Published on: January 21, 2025 / Update from: January 21, 2025 - Author: Konrad Wolfenstein

Robotics and automation in France: France's robot future between ambitions and reality - Image: Xpert.Digital

Robotics in Europe: How France is catching up – or lagging behind – compared to Germany

France's science in robotics is soaring - but the industry is struggling with backlogs

France, a country with a rich tradition in science and technology, aims to be a leader in robotics and automation. Globally recognized research in the field of robotics shows the country's potential, but industrial implementation falls short of expectations. The following article highlights the challenges facing France, analyzes the progress and deficits in automation and draws comparisons to other European countries such as Germany.

Suitable for:

Challenges of robotics in France

Social skepticism and acceptance

A key challenge is the negative image of robots in public perception. Many French people see robots as a threat to jobs and fear increasing dependence on technology. This distrust can hinder the adoption and implementation of robotics, especially in traditional industries. To counteract this, targeted educational work and campaigns are needed that highlight the advantages of robotics for the economy and society.

Education and skills shortages

Strengthening robot competence and training qualified specialists are crucial for the further development of the industry. Despite existing initiatives, such as the integration of robotics into curricula and competitions such as the “Coupe de France de Robotique”, there is a lack of sufficient programs that sustainably inspire young people and specialists in robotics. Additional educational offerings and specialized study programs could help solve this bottleneck.

Protecting the national robotics ecosystem

France faces the challenge of protecting its robotics industry from foreign competition without neglecting international cooperation. This requires a balanced strategy that ensures access to global markets while promoting local innovation. France could strengthen its domestic industry through targeted support programs and protective mechanisms.

Development of innovative applications

The development of new applications that offer added value both economically and socially is another key aspect. France needs to increase research and development (R&D) support to produce innovative robotic technologies. This includes support for start-ups as well as collaboration between companies, universities and research institutions.

Advances in automation

France has made significant progress in automation in recent years. The industrial process automation market is estimated to be worth $2.54 billion by 2030, growing at a compound annual growth rate of 6.5%. The developments in the area of automated road transport, where vehicles up to autonomy level 4 are permitted, are particularly noteworthy. These technologies could make France a pioneer in future mobility.

Automated vehicles

Automated vehicles are used in France at different stages:

- Partially automated vehicles: These systems require a request from the driver to take over in the event of specific dangers or technical problems.

- Highly automated vehicles: They can react to dangers independently without the need for manual takeover.

- Fully automated vehicles: These vehicles operate autonomously and are equipped with remote control capabilities to provide an additional layer of safety.

Robotics investments

Between 2014 and 2019, investment in robotics in France increased by an average of 20% per year. This development is primarily driven by advances in collaborative robots and polyarticular systems specifically tailored to the needs of industry and services.

Comparison with other European countries

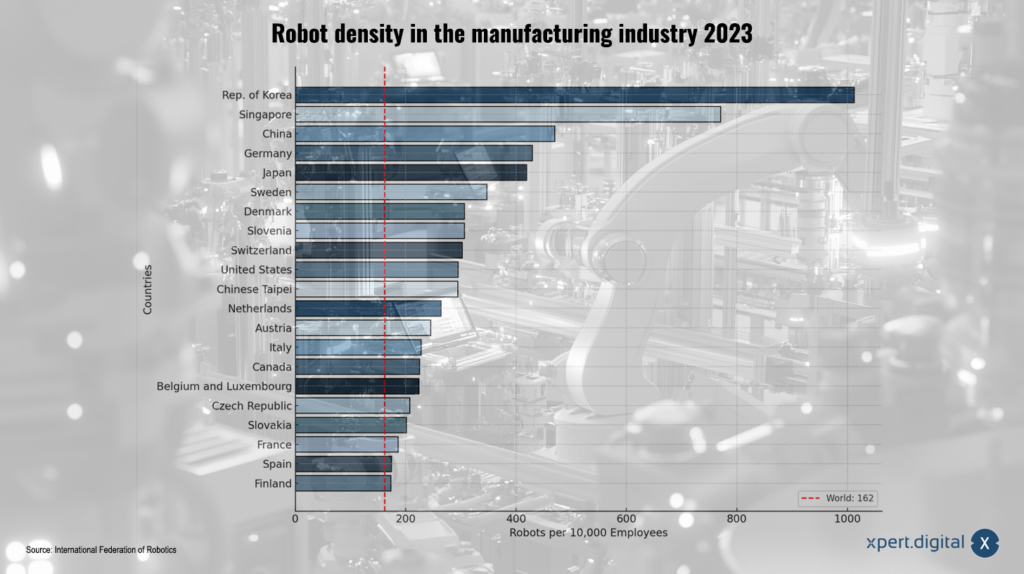

In a European comparison, France lags behind countries like Germany when it comes to automation. A key indicator is robot density, the number of industrial robots per 10,000 workers. France has a density of 194, while Germany has a density of 429. Nevertheless, France ranks second in the EU in the automotive sector, with 940 robots per 10,000 workers.

The differences are due to various factors:

- Industrial structure: Germany has a stronger industrial base with a high rate of automation.

- Social acceptance: Robots are perceived more positively in Germany, which makes their integration easier.

- Government strategies: Initiatives such as Germany’s “Industry 4.0” rely earlier and more intensively on automation.

In addition, Brexit could lead to car manufacturers relocating their production facilities to more automation-friendly countries such as France.

Key players in robotics in France

France has numerous important companies and research institutes in the field of robotics:

- Companies: International giants such as ABB, FANUC and YASKAWA as well as French start-ups such as Azur Drones and MainBot shape the industry.

- Research institutes: Institutions such as the “Institute of Movement Sciences” in Marseille and the “Institut des Systèmes Intelligents et de Robotique” (ISIR) in Paris advance basic research.

State funding programs

The government has launched various programs to support the development of robotics:

- Robolution Plan (2013): The aim is to promote R&D and build a national network of robotics centers.

- France AI (2018): This initiative focuses on artificial intelligence and includes training programs to prepare the workforce for automation.

- France 2030: A budget of 54 billion euros is intended to promote innovations in robotics and AI.

Despite these programs, there is criticism of their implementation, particularly with regard to the high level of bureaucracy and lack of flexibility for companies.

Important application areas of robotics

The main areas of application of robotics in France include:

- Automotive industry: The most important buyer of robots.

- Metal and mechanical engineering: A growing area for collaborative robotics.

- Food and pharmaceutical industries: Robots are used here for packaging and quality control.

In addition, drones and service robots are becoming increasingly important. They find application in agriculture, surveillance and logistics.

Suitable for:

Strengths and weaknesses of France

Strengthen

- Research landscape: France has a strong scientific base with globally recognized institutions.

- Innovative power: The growing number of start-ups shows the potential of the industry.

- Automated mobility: France has pioneered automated vehicles.

Weaken

- Negative image: Skepticism among the population remains an obstacle.

- Low robot density: Compared to other countries, there is a lack of comprehensive automation.

- Shortage of skilled workers: The demand for qualified workers exceeds the supply.

Future of robotics in France

The French robotics market will continue to grow in the coming years. According to forecasts, around 7,000 new robots will be installed every year from 2024. France has the potential to become a leader in areas such as collaborative robotics and service robotics. The prerequisite for this is the targeted promotion of innovations, the strengthening of research and the improvement of social acceptance.

France faces complex challenges, but also great opportunities. The combination of strong research, government funding and innovative companies provides a solid foundation for the further development of robotics. However, to take a leading position, France must strengthen social acceptance, promote training and intensify cooperation between science, industry and politics. With a strategic focus, France could become a global pioneer in robotics.

Our recommendation: 🌍 Limitless reach 🔗 Networked 🌐 Multilingual 💪 Strong sales: 💡 Authentic with strategy 🚀 Innovation meets 🧠 Intuition

At a time when a company's digital presence determines its success, the challenge is how to make this presence authentic, individual and far-reaching. Xpert.Digital offers an innovative solution that positions itself as an intersection between an industry hub, a blog and a brand ambassador. It combines the advantages of communication and sales channels in a single platform and enables publication in 18 different languages. The cooperation with partner portals and the possibility of publishing articles on Google News and a press distribution list with around 8,000 journalists and readers maximize the reach and visibility of the content. This represents an essential factor in external sales & marketing (SMarketing).

More about it here:

Between science and business: How France wants to catch up with Germany's automation - background analysis

Robotics in France: Challenges and opportunities on the path to technological sovereignty

France has a long and distinguished tradition in science and technology and today is determined to be a leader in robotics and automation. French robotics research enjoys an excellent international reputation, which is reflected in numerous high-profile publications and innovative projects. However, a closer look reveals that the industrial implementation and widespread acceptance of robotics still lags behind expectations compared to other European nations, especially Germany. This article highlights the diverse challenges facing robotics in France, analyzes the current state of automation in various economic sectors and draws a detailed comparison with other European pioneers, most notably Germany. Not only technological aspects, but also social, economic and political conditions are taken into account.

The complex challenges of robotics in France

France's path to becoming a leading robotics nation is fraught with a number of complex challenges. A central problem that is deeply rooted in French society is the often negative public image of robots. Many French people primarily associate robots with potential job losses and an increasing, potentially uncontrollable dependence on technology. This profound skepticism, which manifests itself in surveys and public discussions, can significantly hinder the acceptance and thus the successful introduction of robotics in various areas of life and work. This negative attitude is often fueled by historical fears of the loss of human work through automation, which already found expression in the 19th century in the wake of the Industrial Revolution. The media portrayal of robots, which is often characterized by science fiction scenarios and the image of the “job killer,” also contributes to this skepticism.

In order to promote the robotics in France sustainably, it is essential to promote robotic skills at all levels and to intensify the training of highly qualified specialists in this promising area. This requires early integration of robotics topics into the curricula of schools and universities as well as the targeted support of practice-oriented training and further education programs. Initiatives such as the “Coupe de France de Robotique”, a national robotics competition for young people, play a crucial role in arousing interest in robotics in the next generation and promoting the development of important technical and programming skills in a playful way. Such competitions offer a platform on which young talents can demonstrate their creativity and technical know-how and at the same time are enthusiastic about the diverse possibilities of robotics.

Another important concern is the strategic protection and strengthening of the national robotics ecosystem. In a globalized world, France must protect its domestic robotics industry from increasing competitive pressure from abroad while maintaining and expanding constructive collaboration with international partners. This requires a coordinated industrial policy that supports both established companies and innovative start-ups and makes the framework conditions for research, development and production in France attractive.

Furthermore, it is crucial that France actively promotes the development of innovative robotics applications that create concrete added value for society and the national economy. This includes the targeted promotion of interdisciplinary research and development at the interfaces of robotics, artificial intelligence, sensor technology and materials science as well as the unbureaucratic support of start-ups and established companies that develop new and future-oriented robot technologies and bring them to market maturity. The focus should not only be on industrial applications, but also on areas such as healthcare, agriculture, logistics and public safety.

In order to inspire young people at an early stage for the fascinating field of robotics and to promote the necessary training in this area, a variety of initiatives are carried out in France at national and regional level. A remarkable example is the “Globeducate France Robotics Challenge”, which is organized by the international Globeducate Education Group in France. This competition aims to promote the so-called Steam learning (science, technology, engineering, arts and mathematics) in a playful way and to give students the opportunity to use and deepen their acquired knowledge in robotics and programming. As part of this challenge, the students work with LEGO® Education Spike ™ Prime resources to construct their own robots, program and optimize them for various tasks. Such initiatives help to reduce fear of contact and to train the next generation of robotics experts.

State of automation in France: A nuanced picture

France has made remarkable progress in automation in recent years, although the pace could still be increased compared to other countries. The French industrial process automation market was valued at a sizeable $1.57 billion in 2023. Experts predict significant growth for this sector to an estimated $2.54 billion by 2030, which corresponds to an average annual growth rate of around 6.5%. The factory automation and industrial control systems market in France is also showing dynamic development and is expected to record an annual growth rate of over 8.47% during the forecast period from 2021 to 2026. These figures underline the growing interest and willingness of French industry to invest in automation technologies.

Particularly noteworthy are the significant advances in the field of automated road transport, a field in which France is a pioneer in Europe. Since September 2022, automated vehicles up to autonomy level 4 (i.e. vehicles that can operate without a driver on board) have been permitted to transport people on public roads. However, it is important to emphasize that fully automated vehicles can currently only operate within the framework of a clearly defined and officially approved automated road transport system, which must meet a number of strict safety precautions and operational requirements. A distinction is made between internationally recognized levels of automation for vehicles, ranging from partial automation to complete autonomy:

Partially automated vehicles: These vehicles are capable of carrying out certain driving tasks independently, but require the constant attention and intervention of a human driver who must take control if necessary, for example to react to unexpected traffic situations or technical malfunctions.

Highly automated vehicles: In contrast, highly automated vehicles can respond independently to most traffic situations and technical failures within their defined operational design domain (ODD) without requiring immediate driver intervention while driving. However, the driver must still be able to take over the vehicle if necessary.

Fully automated vehicles: These vehicles represent the highest level of automation. They are able to handle all driving tasks within their operating range completely autonomously and can also react to complex traffic situations and unexpected events without human intervention. Fully automated vehicles are typically used in automated road traffic systems that have a remote control or monitoring capability to intervene remotely if necessary.

Between 2014 and 2019, investment in robotics in France recorded an impressive average increase of around 20% per year. This significant increase is primarily due to the rapid development and increasing spread of so-called polyarticular robots (industrial robots with multiple articulated arms) and collaborative robots (cobots). Cobots, which were specifically designed to work with people, open up completely new possibilities for automating production processes and are increasingly being used in small and medium-sized companies.

Comparison with other European countries: Germany as a benchmark

However, a direct comparison with other leading European industrial nations, especially Germany, shows that France still has some catching up to do when it comes to the widespread implementation of automation technologies. An important and internationally recognized indicator of the level of automation of an economy is the so-called robot density, which indicates the number of industrial robots installed per 10,000 employees in the manufacturing sector.

Robot density in the manufacturing industry shows a clear picture of advancing automation worldwide. The number of robots installed per 10,000 employees is an indicator not only of a country's technological progress, but also of its ability to harness innovation to increase efficiency and competitiveness in manufacturing.

More about it here:

We are there for you - advice - planning - implementation - project management

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital - Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital - www.xpert.solar - www.xpert.plus