Overview: Top ten foreign direct investments (FDI) in China – risks and opportunities

Language selection 📢

Published on: December 3, 2024 / Update from: December 3, 2024 - Author: Konrad Wolfenstein

Overview: Top ten foreign direct investments (FDI) in China – risks and opportunities – Image: Xpert.Digital

🌏💰 Top 10 countries: Who invests the most in China – an eye on opportunities and risks

🏗️📈 Rapid growth: These countries are betting on China's market potential - risks and trends

China has become one of the most attractive destinations for foreign direct investment in recent decades. With its rapid economic growth and enormous market potential, the country attracts investors from all over the world. Below is an overview of the top ten countries making the largest investments in China, as well as an analysis of the associated risks and opportunities.

🚗⚙️🧪 1. Germany – approx. 12.70 billion USD

Germany is at the forefront of European investors in China. German companies such as Volkswagen, Siemens and BASF have long had a strong presence in China and are continually investing in expanding their businesses. German investments are primarily concentrated in the automotive, mechanical engineering and chemical sectors. These industries benefit from China's industrialization and urbanization, which brings with it increasing demand for high-quality products and technologies.

🏗️💳🌏 2. Singapore – $9.78 billion

Singapore serves as a major financial center in Asia and often serves as a bridge for investment into the region. Singaporean companies and investment funds are leveraging their strategic location and close economic ties with China to benefit from its growth. Investments span a variety of sectors including real estate, finance and technology.

🏦📃💸 3. British Virgin Islands – $6.86 billion

The British Virgin Islands are internationally known as an offshore financial center. Many multinational companies use this location for company formation and tax planning. The high investment figures from the British Virgin Islands therefore often do not reflect actual economic activity, but are the result of financial structures and tax optimization strategies.

🚢🍽️🔬 4. Netherlands – $5.36 billion

The Netherlands plays an important role as a financial hub in Europe. Many companies use the Dutch tax structures to channel investments efficiently. Dutch investments in China often focus on the logistics, food and high-tech industries.

🖥️🚙🔧 5. Japan – $3.89 billion

Japanese companies have a long history of investing in China, particularly in electronics, automobiles and engineering. Despite political tensions, Japanese companies are betting on the economic opportunities that the Chinese market offers. Geographical proximity and cultural connections also facilitate business relationships.

🏝️💹📊 6. Cayman Islands – $3.52 billion

Similar to the British Virgin Islands, the Cayman Islands are a popular offshore financial center. They serve as a location for holding companies and investment funds investing in China. These structures are often used to optimize capital flows and take advantage of regulatory advantages.

📱🚗🤝 7. South Korea – $3.51 billion

South Korean companies have a strong presence in China, particularly in the electronics and automotive industries. Companies such as Samsung, LG and Hyundai have established major manufacturing facilities and research centers in China. The investments promote technology transfer and strengthen economic cooperation between the two countries.

💷🏛️📱 8. United Kingdom – $3.41 billion

The UK sees China as an important partner for trade and investment. British companies are investing in areas such as financial services, education, retail and technology. The City of London and financial centers in China such as Shanghai are linked by close ties, facilitating the flow of capital.

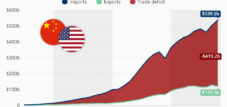

🍎☕🚙 9. United States – $3.36 billion

Despite trade tensions, the US remains a significant investor in China. American companies such as Apple, Starbucks and General Motors have made significant investments to enter the Chinese market. However, investments are influenced by geopolitical factors, which can lead to uncertainty.

🌍🏙️⚡ 10. United Arab Emirates – $2.20 billion

The United Arab Emirates has significantly increased their investments in China in recent years. The focus is on energy, real estate and technology. The strategic partnership between the two countries promotes bilateral investments and strengthens economic relationships as part of the “Belt and Road Initiative”.

🌉💹🗺️ Hong Kong – A special position

Not listed is Hong Kong, with investments of $111.18 billion. As a Special Administrative Region (SAR) of China, Hong Kong enjoys a high degree of autonomy, particularly in economic matters. It serves as an important financial center and gateway for investment to and from China. Many international companies use Hong Kong as a base for their activities in mainland China, which explains the huge investment figures.

🏖️🏢📑 The role of offshore financial centers

The British Virgin Islands and the Cayman Islands are known for their role as offshore financial centers. They offer tax advantages and flexible regulatory frameworks that companies use for international investments. While these investments appear in the statistics, they often reflect complex financial structures and not necessarily direct economic activity in China.

🚀📈🌐 Risks and opportunities

Opportunities:

- Market access: China, with its large population and growing middle class, offers enormous sales markets. Companies can benefit from increasing demand for consumer goods, services and technologies.

- Infrastructure development: China's focus on infrastructure and urbanization opens up opportunities in construction, transportation and sustainable development.

- Innovation and technology: By investing in research and development, China is positioning itself as a technology leader in areas such as artificial intelligence, renewable energy and biotechnology.

Risks:

- Regulatory uncertainty: China's legal framework can be complex and opaque. Changes in laws and regulations may affect investments.

- Geopolitical tensions: International conflicts and trade wars, particularly between China and the US, can exacerbate business conditions.

- Intellectual property protection: Despite improvements, concerns remain regarding intellectual property protection, which can lead to competitive disadvantages.

- Economic slowdown: A slowdown in economic growth or financial instability may affect the returns on investments.

🌟🎯📌 Strategies for successful investments

- Local partnerships: Collaborating with Chinese companies or joint ventures can facilitate market entry and overcome cultural and regulatory barriers.

- Diversification: Spreading investments across different sectors and regions within China can minimize risks.

- Compliance and Due Diligence: Careful review and compliance with local laws and regulations are essential to avoid legal issues.

- Adaptability: Flexibility and the willingness to adapt business models to local conditions increase the chances of success.

🎢🏆🌍 Immense opportunities, but also significant risks

Foreign direct investment in China offers immense opportunities, but is also associated with significant risks. The top investors come from different parts of the world and reflect China's global importance. While countries such as Germany and Singapore make direct investments, others such as the British Virgin Islands use offshore structures for capital flows.

Investors should conduct careful analysis and act strategically to take advantage of the Chinese market. The right balance of risk and return, coupled with local understanding and compliance, can make the difference between success and failure.

Despite challenges, China remains a key market in the global economy. With its growing innovative strength and progressive integration into the global economy, the country will continue to be an important recipient of foreign direct investment in the future.

📣 Similar topics

- 📣 The largest investors in China: numbers and background

- 🌍 Germany as a leading European investor in China

- 🔍 Offshore financial centers: British Virgin Islands and Cayman Islands in focus

- 📈 Singapore: A key player in China's economic growth

- 🚗 Japan and South Korea: technology leaders in the Chinese market

- 💼 Risks and opportunities for foreign investment in China

- 🌐 Geopolitical tensions and their impact on FDIs

- 🏗️ China's infrastructure and its importance for investors

- 🎯 Strategies for successful investments in China

- 💡 Innovation and technology: China's role as a global driving force

#️⃣ Hashtags: #FDIChina #ForeignInvestment #OpportunitiesandRisks #GlobalMarketAccess #OffshoreInvestment

Our recommendation: 🌍 Limitless reach 🔗 Networked 🌐 Multilingual 💪 Strong sales: 💡 Authentic with strategy 🚀 Innovation meets 🧠 Intuition

At a time when a company's digital presence determines its success, the challenge is how to make this presence authentic, individual and far-reaching. Xpert.Digital offers an innovative solution that positions itself as an intersection between an industry hub, a blog and a brand ambassador. It combines the advantages of communication and sales channels in a single platform and enables publication in 18 different languages. The cooperation with partner portals and the possibility of publishing articles on Google News and a press distribution list with around 8,000 journalists and readers maximize the reach and visibility of the content. This represents an essential factor in external sales & marketing (SMarketing).

More about it here:

We are there for you - advice - planning - implementation - project management

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital - Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital - www.xpert.solar - www.xpert.plus