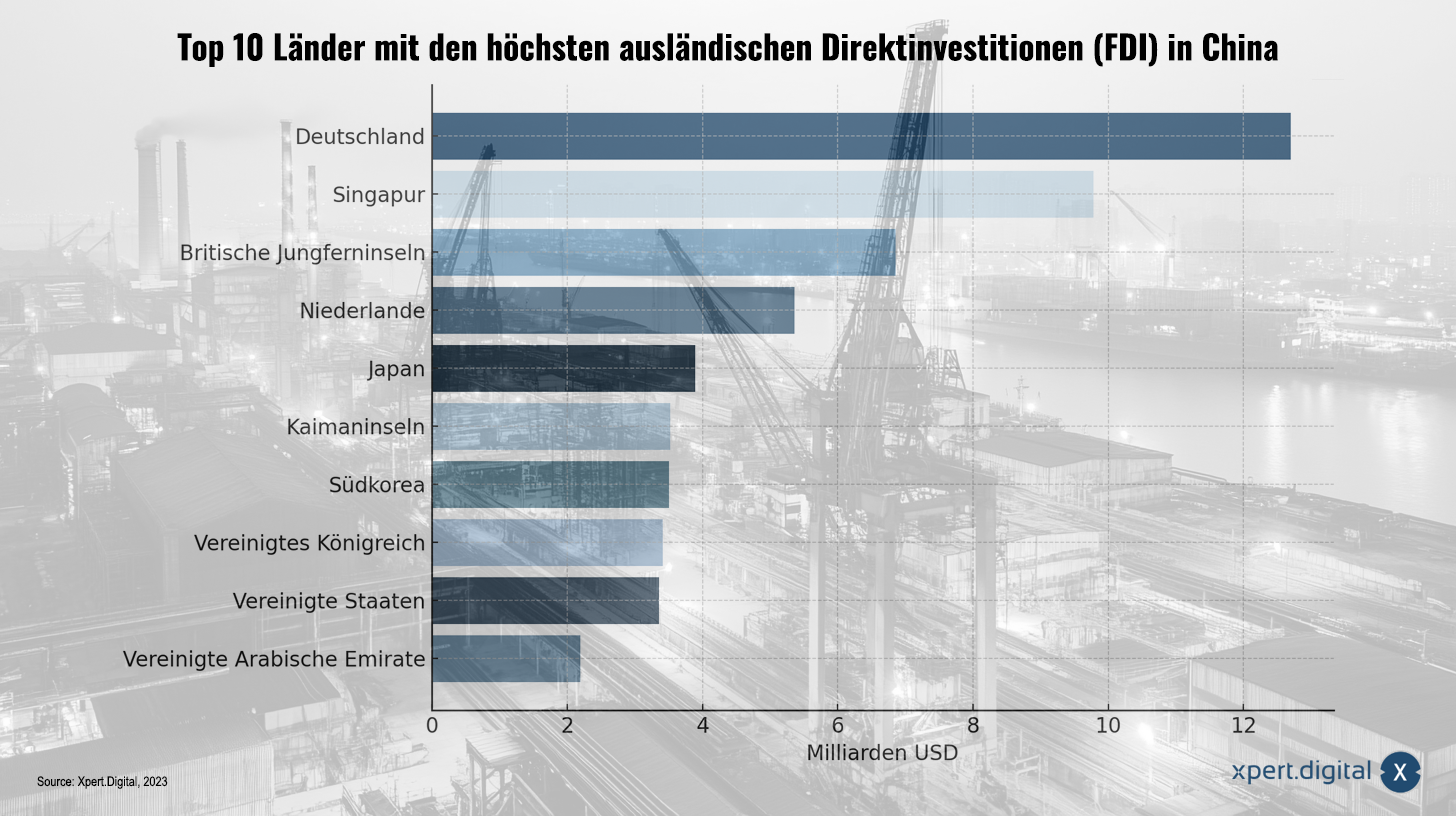

Apart from Germany, other Western countries see significant risks in direct investments in China – Image: Xpert.Digital

📈🛠️ German investments in China are on a record course: What's behind the strategy?

🤝🇩🇪🇨🇳 Economic partner despite risks: Germany's exceptional role in China

Economic relations between Germany and China have been the focus of international attention for years. While many Western countries are reducing their direct investments in China due to various risks, Germany remains an exception. German companies continue to pursue the strategy of "producing in China for China," which means expanding their production capacities in the People's Republic to directly serve the Chinese market. This strategy has led to an increase in German direct investment in China, and this increase is expected to continue.

Here is the list of the top 10 countries with the highest foreign direct investment (FDI) in China, sorted by volume (in billion US dollars):

- Germany – approx. 12.70 billion USD

- Singapore – USD 9.78 billion

- British Virgin Islands – USD 6.86 billion

- Netherlands – USD 5.36 billion

- Japan – USD 3.89 billion

- Cayman Islands – USD 3.52 billion

- South Korea – USD 3.51 billion

- United Kingdom – USD 3.41 billion

- United States – USD 3.36 billion

- United Arab Emirates – USD 2.20 billion

Hong Kong, with a net worth of USD 111.18 billion, is not listed. Hong Kong is a Special Administrative Region (SAR) in China. The British Virgin Islands are internationally known as an offshore financial center, being a popular location for company formation and tax planning.

🚀 Risks and perspectives: The German strategy and its risks

German companies hope to minimize their risks by producing locally in China. The idea behind this is twofold: on the one hand, to reduce dependence on China in global supply chains, and on the other hand, to increase production for the Chinese market. This assumption is based on the hope that Chinese demand will recover strongly and that German companies can profit from this. However, this hope is becoming increasingly fragile as the weakness in Chinese consumer demand persists.

Another risk arises from the unique competitive environment in China. Competition there does not function as it does in typical capitalist markets. The central planning authorities in Beijing favor domestic companies, which also benefit from close ties to the state and party apparatus. These relationships give them a significant information advantage, making it difficult for foreign companies to compete on a fair footing.

⚠️🔍 An ignored danger: Ignorance of a potential China crisis

The behavior of the German automotive and chemical industries is particularly striking. Despite stagnant or even declining sales, they are increasing their investments in China, especially in local research and development centers. This is leading to an increased brain drain and the outflow of German technologies to China. Instead of strengthening Germany's competitive position, this could ultimately undermine it.

German industry appears to be once again pursuing its own course, similar to its energy policy stance before the Ukraine conflict. It is ignoring the German government's new China strategy and rejecting calls for decoupling. Even the concerns of countries like Japan and South Korea, which are well-informed about the situation in China due to their geographical proximity, are being disregarded.

A major crisis in German-Chinese economic relations could erupt at any time, especially if geopolitical tensions escalate. For example, should Donald Trump once again declare a trade war against China, German companies would face the challenge of having to choose between the US and China.

🌐🔒 Cautious Strategies: An International Perspective: Why Other Countries Are More Cautious

Many industrialized nations are hesitant to invest in China for several reasons:

Regulatory and political risks

The Chinese government has tightened its control over the economy. Stricter data security regulations and national security laws make it difficult for foreign companies to operate in China. They are often forced to share technology and work under uncertain legal frameworks.

Geopolitical tensions

The escalating tensions between China and other major economic powers, particularly the US, have worsened the investment climate. The US-China trade war has increased political risks, prompting many companies to reconsider or withdraw their investments in China.

Economic uncertainties

China's economic growth has slowed due to structural problems such as the real estate crisis and weak consumer demand. These challenges make it less attractive for foreign investors to invest capital in China.

Restricted market access

Despite some reforms, access to many sectors remains restricted for foreign investors. The Chinese government continues to promote domestic companies through subsidies and preferential treatment.

These factors are leading many industrialized nations to reduce their direct investments in China or to act very cautiously.

🎲🌟 Weighing the options and betting: A risky bet on the Chinese market

German industry is taking a risky gamble with its strategy. While other countries are acting more cautiously due to regulatory uncertainties and geopolitical tensions, German companies continue to rely heavily on the Chinese market. This strategy could prove to be a double-edged sword: On the one hand, the enormous Chinese market offers tremendous opportunities for growth and profitability; on the other hand, it harbors considerable risks due to political uncertainties and economic challenges.

It remains to be seen whether German industry will be successful with its strategy in the long term, or whether it will ultimately be forced to adapt its course in light of a changing global landscape. In any case, it is crucial that Germany carefully weighs its economic interests and remains flexible enough to react to unforeseen developments.

📣 Similar topics

- 📊 Germany's economy in China: A double-edged strategy

- 🌏 German companies and their risky bet on the Chinese market

- ⚙️ “In China for China”: Risk management or miscalculation?

- 🚦 Geopolitical tensions: Why Germany's China strategy could be dangerous

- 📉 Weak consumer demand: China's slowdown and German investments

- Brain drain and technology transfer: Risks for Germany as a business location

- 🏗️ Billions in investment despite crises: Why German companies are staying in China

- 🌐 International reluctance vs. German determination: A comparison

- 🔒 Regulatory hurdles and competitive disadvantages: German companies under pressure

- 📉 Economic uncertainties in China: Germany's strategic ignorance

#️⃣ Hashtags: #Economy #ChinaStrategy #Geopolitics #GermanIndustry #InvestmentRisk

Our recommendation: 🌍 Limitless reach 🔗 Networked 🌐 Multilingual 💪 Strong sales: 💡 Authentic with strategy 🚀 Innovation meets 🧠 Intuition

At a time when a company's digital presence determines its success, the challenge is how to make this presence authentic, individual and far-reaching. Xpert.Digital offers an innovative solution that positions itself as an intersection between an industry hub, a blog and a brand ambassador. It combines the advantages of communication and sales channels in a single platform and enables publication in 18 different languages. The cooperation with partner portals and the possibility of publishing articles on Google News and a press distribution list with around 8,000 journalists and readers maximize the reach and visibility of the content. This represents an essential factor in external sales & marketing (SMarketing).

More about it here:

🌏 Why are German companies investing so heavily in China?

💼🚀 German companies have been investing heavily in China for years. This trend continues despite increasing geopolitical uncertainties and economic tensions between China and Western countries. These investments are not only strategically important but also reflect economic realities and international competition. The following examines why German companies are investing so heavily in China, the opportunities and challenges this presents, and the potential long-term impact on the German economy.

📈 Reasons for German companies investing in China ⚙️💡

1. Secure competitiveness

A key driver for German companies investing in China is the desire to remain competitive. China is not only the world's second-largest economy, but also a gigantic market with over 1.4 billion people. German companies, particularly in the automotive and mechanical engineering sectors, feel compelled to operate directly on the ground to avoid falling behind their global competitors.

"Those who aren't present in China today will lose touch with international competition tomorrow," could be the credo of many business leaders. The automotive industry in particular, a central pillar of the German economy, is investing heavily, as China is the world's largest market for electric and premium vehicles.

2. Exploit market potential

China offers enormous market potential that extends beyond the automotive sector. Industries such as chemicals, pharmaceuticals, consumer goods, and renewable energies benefit from the growing middle class and the increasing purchasing power of the Chinese population. German companies like BASF and Bayer are capitalizing on this growth and have invested billions in expanding their local production capacities in recent years.

3. Innovation Leadership

China's rapid technological progress is transforming the country not only into a sales market but also into an innovation hub. German companies appreciate the dynamism and agility of Chinese industry. "Made in China 2025," the government's strategy for promoting high technologies, has created an ecosystem that accelerates innovation. German companies see particularly great potential in areas such as artificial intelligence, battery technology, and automation.

Around 37 percent of German companies state that they use China not only as a production location but also as a development location. Many German automotive manufacturers and suppliers now operate research and development centers in China to develop new technologies that can also be applied globally.

4. Reinvestment of profits

A large portion of German direct investment in China consists of reinvested profits. Companies already established locally use their profits to further expand their market position. This indicates that German companies are planning for the long term and have confidence in Chinese economic growth, despite the existing challenges.

⚠️ Challenges for German companies in China

1. Unfair competitive conditions

Many German companies feel disadvantaged in the Chinese market. Unfair competitive conditions, such as informal access restrictions, unequal treatment in public tenders, and state subsidies for local competitors, make business difficult. These restrictions primarily affect medium-sized companies, which, compared to large corporations, have fewer resources for lobbying and legal disputes.

2. Geopolitical Risks

Geopolitical tensions between China and the US, as well as the potential escalation of the Taiwan conflict, pose significant risks. Such tensions can lead to trade barriers, sanctions, or even a complete realignment of global supply chains. In this context, the German Federal Government has presented its "de-risking" strategy to reduce its dependence on China. Nevertheless, many companies still find it difficult to identify alternative markets that are as attractive as China.

3. Dependence on supply chains

Despite efforts to diversify, German companies remain heavily dependent on Chinese supply chains. Many companies pursue a "In China for China" strategy to minimize risks. This strategy means that production and distribution take place directly in China, without relying heavily on exports. However, even this local production carries risks, such as regulatory changes or political tensions.

4. Cultural and legal differences

In addition to economic and geopolitical challenges, German companies also face cultural and legal hurdles. China's business culture differs significantly from that of Europe, and the complexity of local legislation can be opaque for foreign companies. Corruption, bureaucracy, and a lack of legal certainty are often cited as further obstacles.

🌟 Opportunities and future prospects

1. Technological partnerships

Despite the challenges, the Chinese market continues to offer great potential for technological partnerships. German companies can benefit from collaborating with Chinese firms to access new markets and develop innovative technologies. This is particularly true in the field of green technologies such as hydrogen, renewable energies, and electromobility.

2. Diversification of business models

A presence in China allows German companies to diversify their business models. In addition to local production and sales, services, digital platforms, and new sales channels such as e-commerce are becoming increasingly important.

3. Sustainability initiatives

China has made significant progress in sustainability in recent years. German companies can not only strengthen their market position by investing in sustainable technologies and business models, but also contribute to the global energy transition.

⚖️ Balancing act between economic success and political responsibility

German companies' investments in China reflect a long-term strategy that presents both opportunities and risks. While China's enormous market and innovation potential remains a strong incentive, geopolitical tensions and unequal competitive conditions pose serious challenges. The future will show whether German companies can successfully adapt their strategies to capitalize on the advantages of the Chinese market while minimizing risks.

The central question remains: Can German companies reduce their dependence on China without sacrificing their competitiveness? The balancing act between economic success and political responsibility will play a crucial role in the coming years.

📣 Similar topics

- 📌 Why German companies are focusing on China

- 🌏 China: Economic partner or risk?

- 🚀 Investments in China: Opportunity or Risk?

- 💡 Innovation leadership through technical collaborations

- 🌱 Sustainability and business opportunities in China

- 🇨🇳 Balance between China and geopolitical tensions

- 💼 Overcoming challenges in the Chinese market

- ⚙️ How German companies can secure their competitiveness in China

- 🌐 “In China for China”: Supply chain strategy of the future

- 📊 Long-term perspectives of German investments in China

#️⃣ Hashtags: #ChinaInvestments #Competition #Geopolitics #GermanEconomy #Sustainability

We are there for you - advice - planning - implementation - project management

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital - Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital - www.xpert.solar - www.xpert.plus