The race in orbit: Project Kuiper from Amazon challenges star links dominance in the satellite internet market

Xpert pre-release

Language selection 📢

Published on: May 6, 2025 / update from: May 6, 2025 - Author: Konrad Wolfenstein

The race in the orbit: Project Kuiper from Amazon challenges star links dominance in the satellite internet market - Image: Xpert.digital

Satellite internet | Project Kuiper started: Amazon invests in global internet care

Starlink vs. Kuiper: Amazon's billion plan for broadband worldwide

With the successful start of the first 27 satellites on April 28, 2025, Amazon officially joined the satellite internet market and positions itself as a serious competitor for Elon Musks Starlink. Project Kuiper's initial phase marks the beginning of an ambitious plan to build a constellation of 3,236 satellites in order to offer global broadband internet services. This step intensifies the competition in a market that is to grow to over $ 54 billion by 2037 and illustrates Amazon's strategy to diversify its services beyond e-commerce. With investments of up to $ 16 billion, the technology giant is based on a market that is characterized by increasing demand for high-speed internet in sub-supplied areas worldwide.

Amazon's Project Kuiper: A new star on the satellite internet market

Project Kuiper is Amazon's ambitious introduction to the world of the satellite internet, named after the Kuiper belt, an area of the solar system beyond the Neptune Railway. The group plans to initially bring 3,236 communication satellites to a low earth orbit, with a possible expansion to up to 7,774 satellites. The constellation is intended to provide broadband internet access in most countries around the world, with a special focus on remote regions that have so far not been supplied by cables or mobile communications.

On April 28, 2025, the start of the first 27 satellites marked the official start of the project. An ATLAS-V winner from the United Launch Alliance (ULA) brought the satellites to a height of around 450 kilometers, from where they will reach their intended orbit at 630 kilometers. According to Amazon's communication, the company has already contacted all 27 satellites and the first provision and activation sequences have been as planned.

The development and operation of the system is the responsibility of the Amazon subsidiary Kuiper Systems based in Washington, DC. Interestingly, Amazon recruited former SpaceX employees for the top management of the company, the operator of the competitive product Starlink. At the end of 2024 Kuiper Systems employed over 2,000 employees, which underlines the importance of the project for Amazon.

According to the license granted in 2020, Amazon must bring half of the satellites into space until July 2026, and the constellation must be complete by July 2029. This requires a tight schedule for the upcoming rocket starts, which is why Amazon has already secured further starts. Ula is to carry out up to five more satellite transports for the group in 2025 alone.

Infrastructure and investments

In order to be able to comply with the ambitious schedule, Amazon invests considerably in its infrastructure. The group is expanding its satellite operations at the Kennedy Space Center in Florida with an investment of $ 19.5 million. This expansion comprises a 42,000 square foot building, which will offer additional space for the processing and storage of flight hardware before the start. The new facility will include temperature -controlled warehouse rooms, maintenance bays, multi -purpose work areas and air load suspension skills for the easy transport of heavy devices.

The total investment for Project Kuiper is assessed differently. While Amazon itself speaks of more than $ 10 billion, an analysis of the Bank of America assumes up to $ 16 billion, with the majority of this sum for rocket start costs. For 2024 and 2025, the bank expects expenditure of around 1 billion or 3.5 billion US dollars for the network.

Amazon works with various rocket providers, including her own sister company Blue Origin, the United Launch Alliance, Arianespace and, interestingly, SpaceX, the operator of the competitive product Starlink. This diversified starting partnership is intended to ensure that the ambitious schedules can be observed.

The booming satellite internet market and its main actors

The global market for satellite internet is located in a phase of rapid growth. The size of this market was estimated at $ 6.19 billion in 2024 and is expected to exceed $ 54.41 billion by 2037. This corresponds to an annual growth of more than 18.2% in the forecast period between 2025 and 2037.

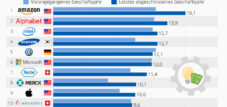

Starlink from SpaceX is currently the dominant player in this market. With 7,302 satellites in the earth orbit (as of the end of April 2025) SpaceX operates the largest satellite constellation by far worldwide. The company has an impressive customer growth: the user base rose from 3 million in May 2024 to 4 million in September 2024, with over 1.4 million customers being in the United States alone. It is particularly noteworthy that Starlink was able to win one million new customers in the four months between May and September 2024 - the fastest growth so far since the start of the service.

In addition to Starlink and the emerging Project Kuiper, there are other providers in the market, including OneWeb and Hughesnet. Interestingly, the disruptive influence of Starlink on established providers is already evident: Hughesnet has lost 117,000 customers in the course of a year, which has dropped the subscribers to 883,000. In December 2020, two months after Starlink started, Hughesnet still had 1.56 million customers.

The attractiveness of Starlink is primarily in the superior performance: the service offers speeds of up to 200 MbPs and low latencies of around 20-30 ms, while traditional satellite internet providers such as Hughesnet have latencies of 700-800 ms. This technological superiority sometimes explains the fast market share of Starlink and represents a bar at which Project Kuiper will have to be measured.

🎯🎯🎯 Benefit from Xpert.Digital's extensive, fivefold expertise in a comprehensive service package | R&D, XR, PR & SEM

AI & XR 3D Rendering Machine: Fivefold expertise from Xpert.Digital in a comprehensive service package, R&D XR, PR & SEM - Image: Xpert.Digital

Xpert.Digital has in-depth knowledge of various industries. This allows us to develop tailor-made strategies that are tailored precisely to the requirements and challenges of your specific market segment. By continually analyzing market trends and following industry developments, we can act with foresight and offer innovative solutions. Through the combination of experience and knowledge, we generate added value and give our customers a decisive competitive advantage.

More about it here:

Amazon against SpaceX: The race for digital development

Market dynamics and future prospects

The commercial sector is expected to keep the most important part in the global satellite internet market in the forecast period. This is due to the increasing digitization of all commercial activities that makes internet access essential for commercial rooms. The introduction of cloud memory in the commercial sector, including hotels, banks and private offices, is also an important factor that should boost market growth.

The demand for satellite internet is also driven by the growing number of internet users worldwide. According to the World Bank, around 56.7% of the entire world population had access to the Internet in 2019. This number increases steadily, whereby satellite internet can play an important role in the supply of regions that are difficult to achieve through terrestrial infrastructure.

Project Kuiper vs. Starlink: A comparison of the technologies and strategies

The competition between Project Kuiper and Starlink is not only a struggle for market shares, but also a technological arms. Both companies pursue similar goals - the provision of fast internet via satellite constellation in low earth orbit - but with different starting positions and strategies.

Starlink has a significant lead in both satellite density and the customer base. With over 7,300 satellites in orbit, Starlink has a significantly larger constellation as a Project Kuiper in the foreseeable future. This enables better coverage and potentially higher speeds. In addition, Starlink offers unlimited high-speed data for private households and is able to deliver speeds of up to 200 MBPs with low latencies.

Project Kuiper, on the other hand, relies on significantly more powerful satellites. The first satellites suitable for regular internet supply were revised in many aspects compared to the prototypes. These technological improvements could enable Amazon to offer competitive services despite the lower number of satellite. In addition, Amazon can use its extensive cloud infrastructure with Amazon Web Services (AWS) in order to build resilient communication infrastructures.

Another important difference is in the corporate strategy: While Starlink is operated as a SpaceX business model, Amazon Project Kuiper could position as part of a larger ecosystem. Integration with AWS and other Amazon services could provide the company Unique Selling Points that go beyond pure internet care.

Target groups and market positioning

Both services primarily aim at sub -supplied areas in which terrestrial broadband options are limited or not available. Starlink has already proven that it can address a broad customer base, from private households to companies, cruise ships and airlines. Starlink's user base now comprises 4 million customers in almost 100 countries.

So far, Amazon has not specifically commented on pricing models or specific target countries for Project Kuiper. According to an Amazon company video, however, the project aims to “bring broadband internet to every point in the world”. Similar to Starlink, Amazon plans to offer various receiving terminals, whereby the standard size should be about 30 cm wide and long and should enable speeds of up to 400 megabits per second. More expensive variants should be able to reach speeds of up to one gigabit per second.

Effects on competition and market dynamics

Amazon's entry into the satellite internet market has the potential to fundamentally change competitive dynamics. While Starlink is currently dominating the market, Amazon brings considerable resources and an established global infrastructure that could help the company.

The growing competition is expected to lead to innovations and possibly also to price reductions, which could ultimately benefit consumers. The Hughesnet case already shows how disruptive new technologies can be in this market: Despite lower prices as Starlink and the introduction of a new satellite at higher speeds, Hughesnet has suffered considerable customer losses. This makes it clear that factors such as speed and latency are often more important to consumers than the price.

The effects will probably also extend to other sectors. Telecommunications companies could consider satellite internet as a supplement to their existing services, especially in remote or sparsely populated areas in which the structure of terrestrial infrastructure is expensive. Airlines and the Maritime industry could also benefit from improved connectivity options.

Another important aspect is the potential socio -economic effect. By providing internet access in currently sub -supplied areas, both services could help reduce the digital gap and to promote economic opportunities in disadvantaged regions. Amazon explicitly emphasizes that Project Kuiper should contribute to “closing the digital gap by providing quick, affordable broadband for a variety of customers”.

Challenges and future prospects for Project Kuiper

Despite the promising prospects, Project Kuiper faces significant challenges. The Bank of America is careful in its analysis regarding the future prospects of the project. She points out that Amazon is faced with an established competition (Starlink), has to make high preliminary investments and have to expect high running costs. The analysts assume that it will take years before Project Kuiper can make a positive contribution to Amazon's market capitalization.

A central challenge for Amazon will be to comply with the ambitious schedule. According to the license requirements, half of the planned satellites must be brought into space by July 2026. This requires a significant acceleration of the starting frequency compared to the previous pace. Delays could not only have regulatory consequences, but also further enlarge Starlink's competitive lead.

The profitability also remains an open question. Economic experts forecast a turnover of $ 6.6 billion for Starlink in the current financial year compared to only $ 1.4 billion in 2022. This indicates considerable sales growth, but says nothing about profitability. In view of the high investments and operating costs, it remains to be seen whether and when both providers can operate profitably.

Another challenge is acceptance among end consumers. While the technical specifications sound promising, success will ultimately depend on factors such as actual performance, reliability, pricing and customer service. Amazon's experience in customer service could be an advantage here, while SpaceX can rely on its proven technical competence.

A new chapter in the race for digital development

With the successful start of the first Project Kuiper satellites, Amazon has taken a significant step into a growing market. The entry of the e-commerce giant into the satellite internet market promises to intensify the competition and could ultimately lead to better services for consumers worldwide.

The rivalry between Amazon and SpaceX - or more precisely between Jeff Bezos and Elon Musk - now extends to another business area. While Starlink has a significant lead in the number of satellite and customer base, Amazon has considerable resources and established global infrastructure. The coming years will show whether Project Kuiper can catch up and become a serious alternative to Starlink.

Regardless of the outcome of this competition, consumers ultimately benefit, especially in sub -supplied areas. The vision of bringing high-speed internet into remote regions has the potential to digitally enable millions of people and to create new economic opportunities. In an increasingly digital world, access to reliable high-speed internet could become a fundamental right-and companies like Amazon and SpaceX play a key role in realizing this vision.

Your AI transformation, AI integration and AI platform industry expert

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.