Rürup pension vs. Riester pension: The differences and who they are suitable for | Advice & Financial Advice | Search & Wanted Tips

Language selection 📢

Published on: February 1, 2024 / Update from: February 1, 2024 - Author: Konrad Wolfenstein

🏦💡 Retire safely: The differences between Riester and Rürup pensions explained

📊 Private pension provision in Germany is a complex topic that often causes confusion. Two of the best-known pillars that are repeatedly discussed in this area are the Rürup pension and the Riester pension. Both offer different advantages and are designed for different target groups. In this article we take a detailed look at the differences between the Rürup and the Riester pension and analyze who is suitable for which type of pension.

📈 The Rürup pension

The Rürup pension, also known as the basic pension, was introduced in 2005. It is aimed primarily at self-employed people and freelancers who do not benefit from Riester funding. However, employees can also benefit from this form of pension provision. The Rürup pension is particularly attractive due to its tax advantages. The contributions to the Rürup pension can be claimed as special expenses. This is happening at an increasing rate, which will be raised to 100% by 2025. This means that all contributions from taxed income can be deducted from taxes up to a maximum amount. However, the withdrawals are taxable when you retire.

A central aspect of the Rürup pension is its strict commitment. The capital cannot be inherited, cannot be borrowed against, cannot be sold and cannot be capitalized. This leads to a high level of security because the provision cannot be misused for other purposes. Payment is made for life in the form of a monthly pension, starting at the earliest at the age of 62.

💰 The Riester pension

The Riester pension was launched in response to the reform of the statutory pension system in 2001. It is primarily intended to provide employees with incentives to invest in private pension provision by offering state subsidies and tax advantages. In order to receive full state funding, 4% of the previous year's gross income, up to a maximum of 2,100 euros per year (including allowances), must be paid in.

A main feature of the Riester pension is its flexibility. The capital saved can also be used to purchase a property for your own use. In addition, the assets saved are Hartz IV-safe and can be inherited. Compared to the Rürup pension, the Riester pension is intended for a broader target group, especially for people in dependent employment.

🤔 The comparison

The most obvious difference between the Rürup and the Riester pensions is based on their target group and the tax advantages. While the Rürup pension is particularly attractive for the self-employed and freelancers, the Riester pension is aimed at employees. This also results in the second essential difference: the flexibility in dealing with the saved capital. The Rürup pension is much more rigid in nature and offers hardly any opportunities for flexible use of the capital. The Riester pension, on the other hand, offers a clear advantage for those who do not want self-employment and family planning due to its flexibility, especially with regard to its use for home ownership and Hartz IV security.

👤 Who is which pension suitable for?

🤝 Rürup pension

Ideal for self-employed people and freelancers who are excluded from other forms of government funding. The Rürup pension can also be attractive for high-earning employees because it is tax deductible. Anyone looking for a secure, lifelong pension and willing to forego flexibility will find the Rürup pension a suitable form of provision.

🏡 Riester pension

Perfect for dependent employees who want to benefit from government funding. The Riester pension also offers advantages for families, as additional allowances are provided for every child entitled to child benefit. People who want flexibility in the use of their saved capital, for example to purchase a property, are well advised to take a Riester pension.

🔄 Deciding between the Rürup and the Riester pension

The decision between the Rürup and the Riester pension depends heavily on the individual life situation, professional circumstances and financial planning. While the Rürup pension primarily scores with tax advantages and a high level of security, the Riester pension offers broad support and flexibility. Both systems have their justification and supplement the German pension system with important private pension components. It is important that each individual deals with their own retirement planning early on and develops a strategy tailored to their personal needs.

📣 Similar topics

- 📈 Rürup pension vs. Riester pension: Which retirement provision is the right one?

- 💼 Retirement provision in Germany: Rürup and Riester in comparison

- 💰 Tax advantages: Rürup pension and Riester pension in detail

- 🎯 Target groups in focus: Rürup vs. Riester – who benefits the most?

- 🏡 Capital use and flexibility: Riester pension vs. Rürup pension

- 🤔 Retirement planning decisions: Rürup or Riester – which one is better?

- 👩💼 Self-employed and freelancers: The Rürup pension in focus

- 🌟 State funding: Riester pension as an option for employees

- 🏠 Home ownership and retirement provision: Riester pension as a financing option

- 🤝 Retirement planning: Rürup or Riester – tips for making a decision

#️⃣ Hashtags: #retirement provision #RürupRente #RiesterRente #tax advantages #decision making

🏡💼 Planning for the future: How to choose the right retirement planning for families and working people

In practice, this means that the choice of retirement provision should be carefully considered. Here are some points that can help with the decision:

📈 Long-term planning and flexibility

First of all, it is important to take a long-term view of your own life and professional situation. If you are a young employee and plan to start a family and buy a home in the future, the Riester pension could be particularly interesting due to its flexible use options and state allowances.

On the other hand, self-employed people and freelancers should consider the Rürup pension, especially because of the tax advantages that increase as income increases. The Rürup pension can also be a suitable solution for people who have a high tax burden and are looking for secure investment opportunities.

💰 Tax aspects and subsidies

Another important point is the tax aspects. Since 100% of the contributions to the Rürup pension can be deducted as special expenses, it offers significant advantages, especially for high earners and people in higher tax brackets. In contrast, the Riester pension focuses on state support - basic allowances and child allowances can provide attractive support, especially for families.

🛡️ Security vs. flexibility

Anyone who values security and prefers a guaranteed pension for life will find the Rürup pension a suitable pension option. The rigid conditions, such as subsequent taxation or the non-inheritability of the saved capital, ensure that the pension capital is used exclusively for old age security.

In contrast, the Riester pension focuses on flexibility. The possibility of using the saved capital to buy a property, for example, makes it a versatile retirement planning option that also supports shorter-term life goals.

👨👩👧👦 Securing the family

The Riester pension offers an interesting component for families thanks to the state allowances. There is additional support for every child entitled to child benefit, which can be a financial advantage that should not be underestimated, especially for young families.

🏅 There is no blanket recommendation

Ultimately, there is no blanket recommendation that is equally suitable for everyone. Choosing the right retirement provision is a highly individual decision that must take many factors into account: your personal and professional situation, income, tax burden, family planning and your own risk appetite. Regardless of whether you choose a Rürup or Riester pension, it is crucial to start planning for retirement early. The earlier you start, the greater the benefit of compound interest and the better you can secure your financial future.

A careful comparison of offers, possibly with the help of an independent financial advisor, can help you find the retirement plan that best suits your life situation. Taking the right precautions ultimately means being financially secure in old age and being able to enjoy retirement without having to worry about your financial situation.

📣 Similar topics

- 💭 Retirement planning decision: Rürup or Riester – What is the best choice?

- 💼 Long-term planning: Rürup pension or Riester pension – which suits you?

- 💰 Tax advantages and subsidies: Rürup vs. Riester in comparison

- 🏡 Security or flexibility: Which retirement plan meets your needs?

- 👨👩👧👦 Family security: Riester pension as a financial advantage

- 🧐 Retirement planning decisions: Rürup or Riester – tips for choosing

- 📈 Start early: The key to successful retirement planning

- 👥 Financial advice: Finding the right way to plan for retirement

- 🤔 Riester pension or Rürup pension: Which one suits your risk appetite?

- 💪 Financial future: Understanding the importance of retirement planning

#️⃣ Hashtags: #retirement provision #RürupRente #RiesterRente #tax advantages #financial advice

We are there for you - advice - planning - implementation - project management

☑️ Support for your independent financial planning advice, wealth advice and investment advice

I would be happy to serve as your personal advisor.

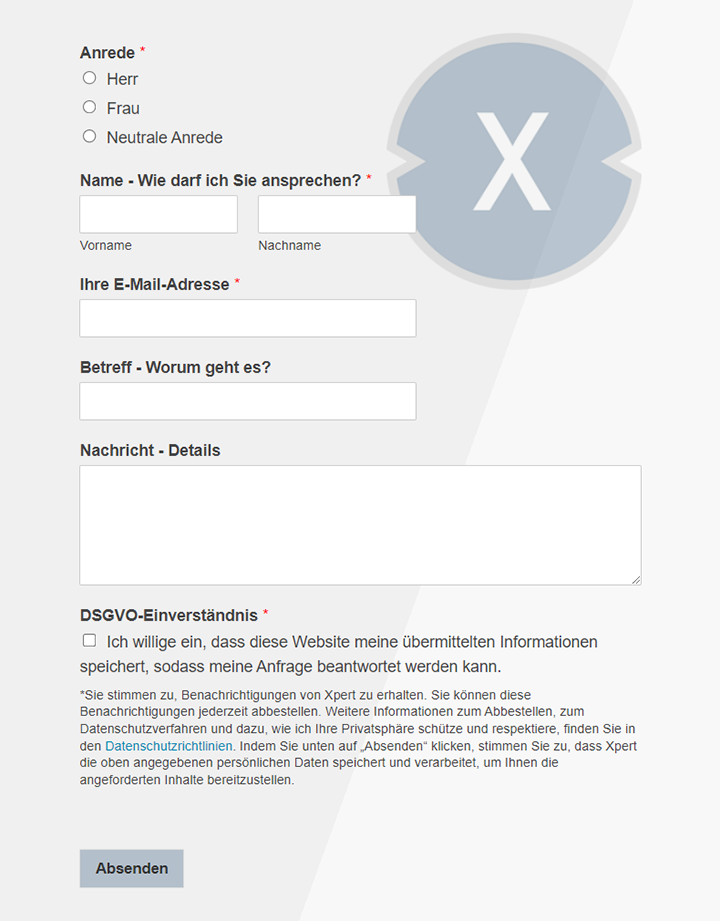

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Independent financial advice - individual and transparent

🌞🏘️🏠⛱️ We deal with construction projects in the real estate and renewable energy sectors every day.

Although we offer a wide range of skills, we also know our limitations. We have set up a dedicated area for independent financial advice, particularly when it comes to finance and financing. The offering also includes comprehensive financial planning, investment advice and investment strategy advice.

The range of offers includes:

- ✅ Retirement provision

- ✅ Holistic financial planning

- ✅ Asset management

- ✅ Loan brokerage and financing solutions

The advisory service extends to:

- ✅ Various financing options (including loans, KfW and L-Bank funding, grants and forward loans)

- ✅ Building savings contracts

- ✅ A wide range of insurance policies (for precautionary purposes, for property and people)

- ✅ Investment opportunities (funds, ETFs, investments, in areas such as solar, logistics and real estate)

- ✅ Investments in daily and fixed-term deposits

- ✅ Investing in currencies, via currency accounts or ETFs

- ✅ Investments in gold, other precious metals and raw materials

- ✅ Solutions for company pension schemes, Riester and Rürup pensions, as well as unit-linked and classic insurance products

- ✅ Real estate investments

- ✅ Optional individual advice on a fee basis

- ✅ An all-in fee structure for maximum cost transparency with no sales surcharges or hidden fees

➡️ For personal advice and tailor-made solutions, please contact me. After an introductory conversation, my team and I will devote ourselves intensively to your concerns.