Less fin, more tech – Less fin, more tech

Language selection 📢

Published on: September 6, 2020 / update from: September 6, 2020 - Author: Konrad Wolfenstein

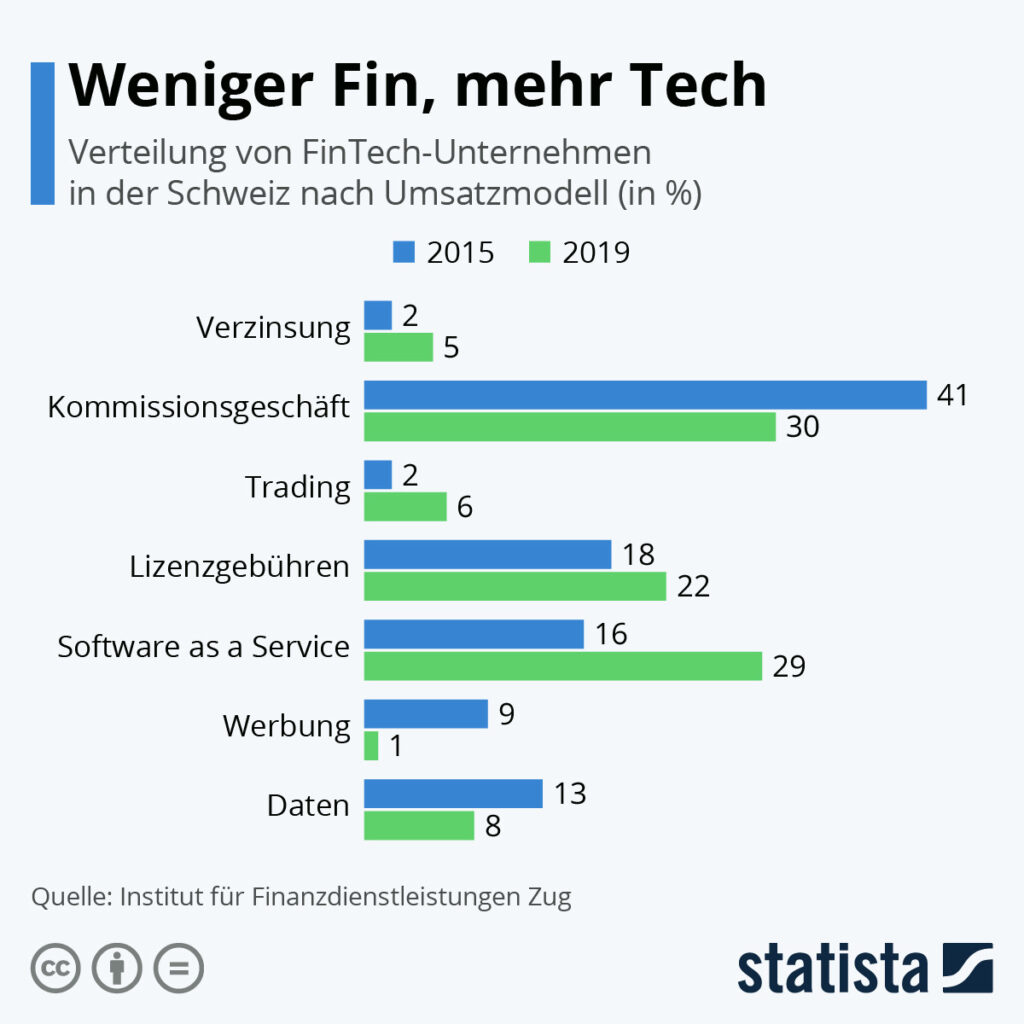

The Swiss FinTech landscape has seen a shift from commission-based to more technology-driven revenue models in recent years. This is what the FinTech Study 2020 by the Institute for Financial Services Zug says, which examines the Alpine republic's FinTech companies every year.

According to the results of the study, the majority of sales in 2019, at around 30 percent, still came from commission transactions - although it was around eleven percent less than in 2015. In particular, sources of sales such as license fees and Software as a Service (SaaS) are becoming significantly more relevant . These revenue models are typically preferred in the IT sector. As the graphic illustrates, advertising and the sale of data have become less important in recent years and only one to eight percent of FinTechs in Switzerland now rely on these sources of income.

In recent years, the Swiss FinTech landscape has experienced a shift from commission-based to more technology-driven revenue models. This is stated in the FinTech Study 2020 of the Institute for Financial Services Zug, which examines the FinTech companies in the Alpine Republic every year.

According to the results of the study, the majority of revenue in 2019 (around 30 percent) was still generated by commission-based business – although it was around eleven percent less than in 2015. Above all, revenue sources such as license fees and software as a Service (SaaS) are becoming increasingly relevant. These revenue models are typically preferred in the IT sector. As the chart illustrates, advertising and the sale of data have become less important in recent years and only one to eight percent of FinTechs in Switzerland rely on these sources of income.

You can find more infographics at Statista