KEP industry: Expansion of DHL packing stations

Language selection 📢

Published on: October 29, 2021 / update from: October 29, 2021 - Author: Konrad Wolfenstein

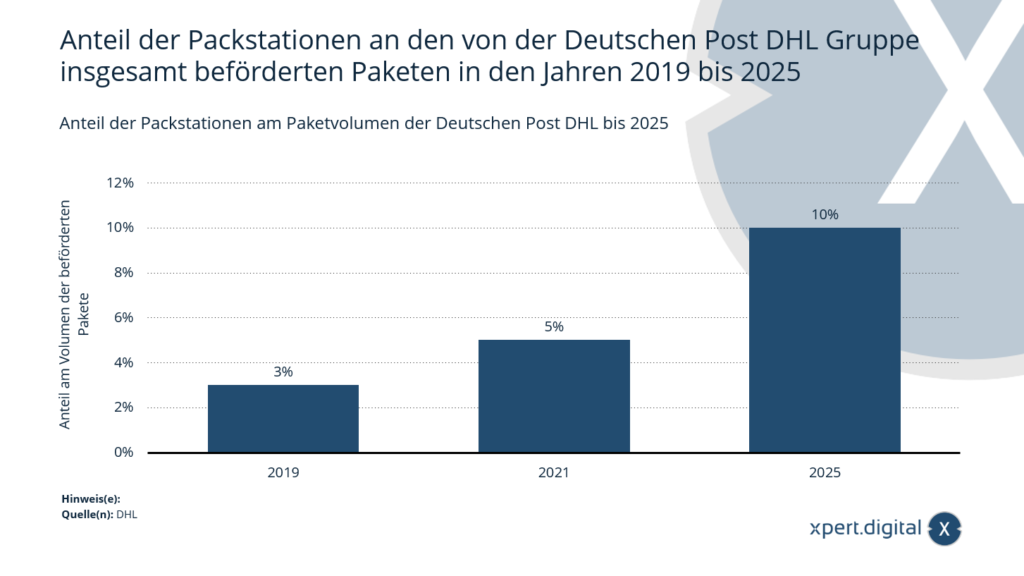

Share of packing stations in Deutsche Post DHL’s parcel volume by 2025

By 2025, Deutsche Post DHL wants to achieve that 10 percent of the parcel volume it transports will be delivered to customers via packing stations. In 2019 it was 3 percent. A so-called packing station is a machine where customers can pick up or send packages independently 24 hours a day. With Packstations, deliverers can save time and money.

Share of packing stations in the total parcels transported by the Deutsche Post DHL Group from 2019 to 2025

- 2019 – 3 %

- 2021 – 5 %

- 2025 – 10 %

The values for 2021 and 2025 are forecasts/planned values from Deutsche Post DHL.

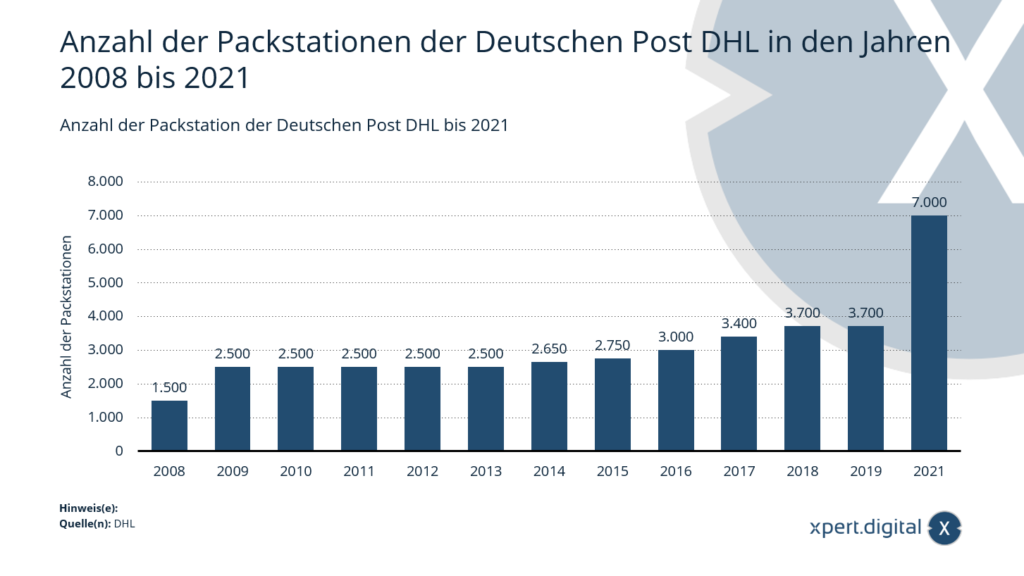

Number of Deutsche Post DHL packing stations

By 2021, Deutsche Post DHL wants to have around 7,000 packing stations with which they can save time and costs in delivery. A so-called packing station is a machine where customers can pick up or send packages independently 24 hours a day.

Number of Deutsche Post DHL packing stations from 2008 to 2021

- 2008 – 1,500 DHL Packstations

- 2009 – 2,500 DHL Packstations

- 2010 – 2,500 DHL Packstations

- 2011 – 2,500 DHL Packstations

- 2012 – 2,500 DHL Packstations

- 2013 – 2,500 DHL Packstations

- 2014 – 2,650 DHL Packstations

- 2015 – 2,750 DHL Packstations

- 2016 – 3,000 DHL Packstations

- 2017 – 3,400 DHL Packstations

- 2018 – 3,700 DHL Packstations

- 2019 – 3,700 DHL Packstations

- 2021 – 7,000 DHL Packstations

The value for 2021 is a forecast/planned value from Deutsche Post DHL.

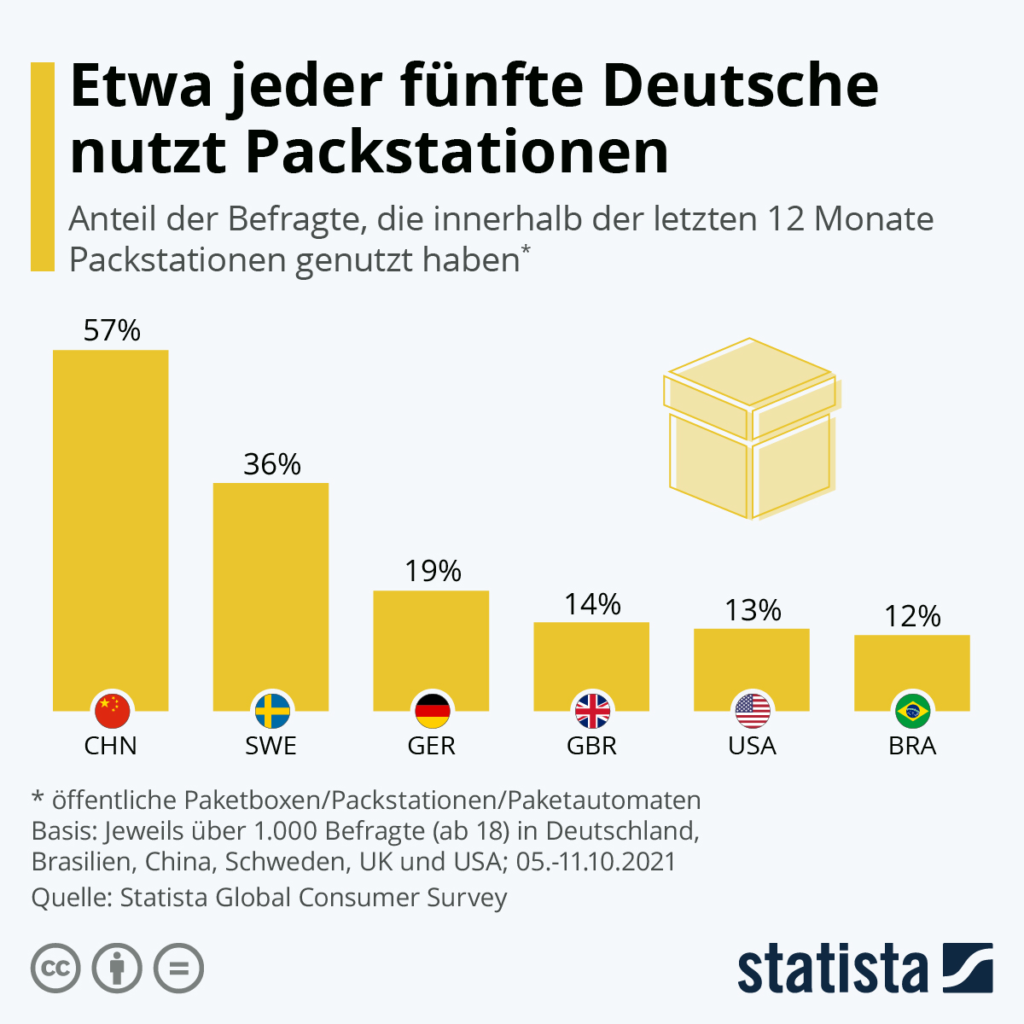

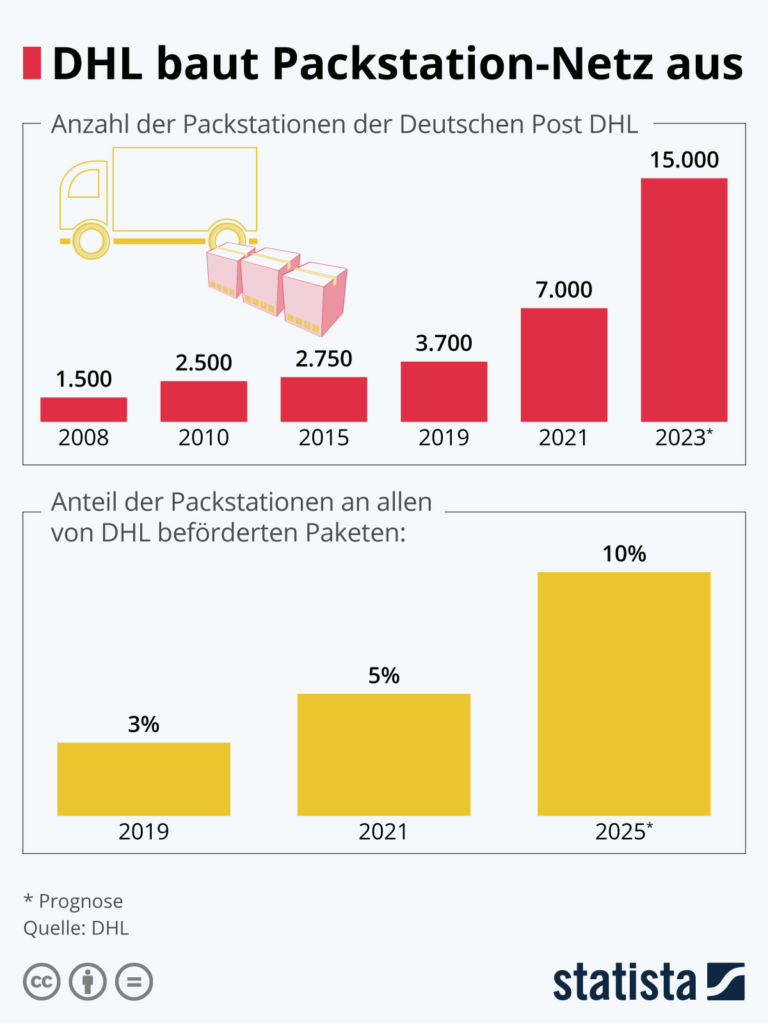

Popularity of packing stations: Around one in five Germans uses packing stations

The Deutsche Post DHL Group wants to expand its packing station network in Germany and plans to have around 15,000 of these public parcel boxes by 2023. A current survey shows that the parcel service provider is in tune with the times. As a result, around 19 percent of the Germans surveyed had used such a packing station at least once in the past 12 months prior to the survey. This means that reliable delivery locations in Germany are significantly more popular than, for example, in Great Britain (14 percent), the USA (13 percent) or Brazil (12 percent). The use of parcel machines is even more widespread in Sweden and China. Around 36 percent of Scandinavians said they received packages via public stations last year - in China this figure is even more than half of the survey participants.

Round-the-clock parcel service - DHL expands Packstation network

The DHL attracts a lot of packing stations in Germany when you expand your network. Within the next two years, the number of publicly accessible parcel machines should more than double. The DHL currently operates an estimated 7,000 packing stations all over Germany. The extension plans of the parcel service provider come at the right time, because more and more German use the safe and contactless way to receive packages - the pandemic also has its share in the user growth. A survey shows that around 19 percent of those surveyed in Germany use the “round-the-clock package service” and thus underlines the industry trend. According to the company, around five percent of all package shipments ended up in a packing station in 2021, and this will increase to around 10 percent by 2025. According to Tobias Meyer, packing stations also offer an environmentally friendly aspect: the delivery to parcel machines reduces travel routes and delivery attempts at private apartments.

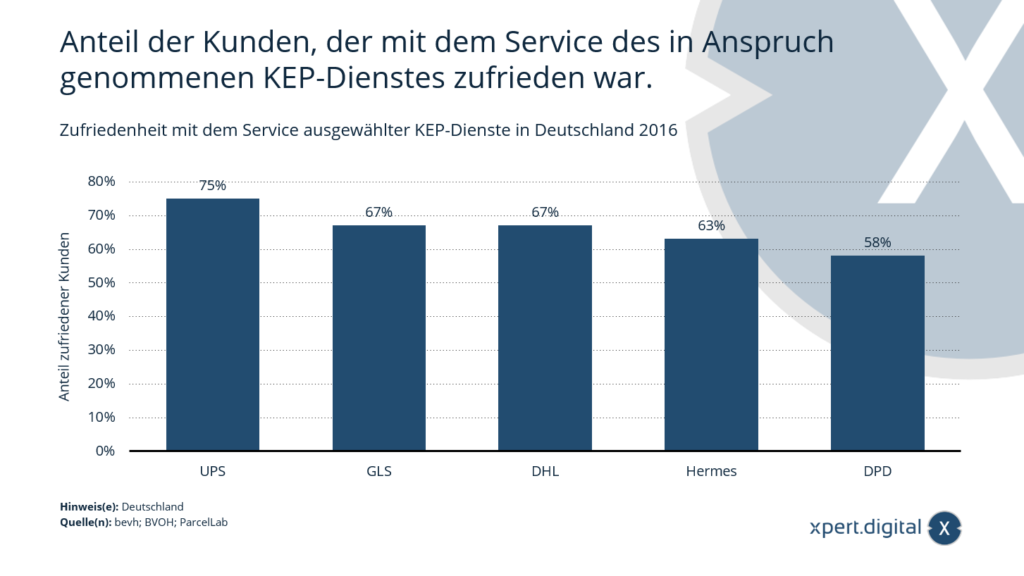

Satisfaction with the service of selected KEP services in Germany

The statistics show the proportion of customers of selected courier, express and parcel services (CEP) in Germany in 2016 (period August to November) who were satisfied with the service of the CEP service they used. The data was calculated by parcelLab. The service from the provider UPS was rated most positively. 75 percent of customers said they were satisfied with the service.

Proportion of customers who were satisfied with the service of the CEP service used

- UPS – 75%

- GLS – 67%

- DHL – 67%

- Hermes – 63%

- DPD – 58%

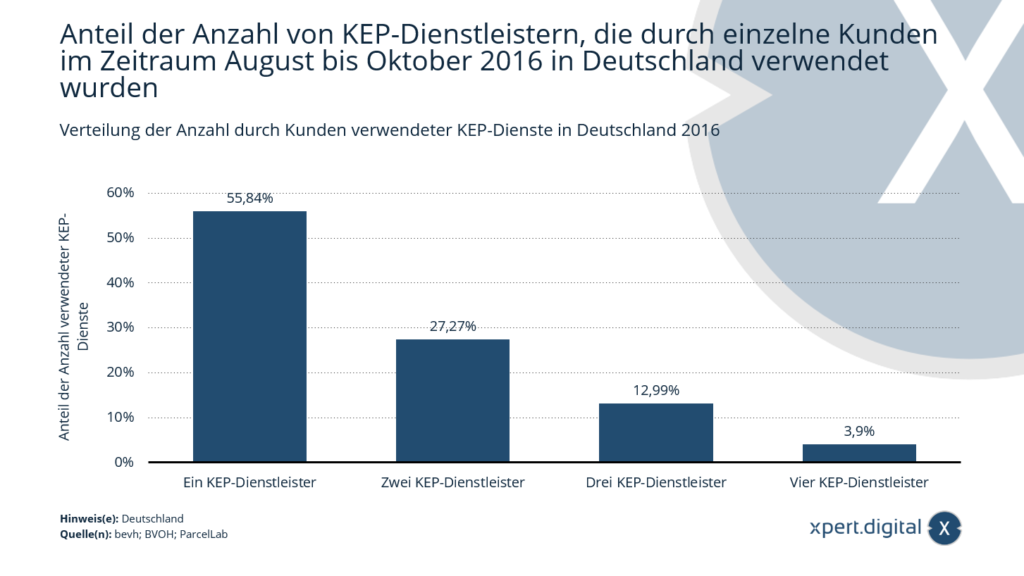

Distribution of the number of CEP services used by customers in Germany

The statistics show the proportion of the number of different courier, express and parcel service providers that were used at least once by customers from the retail and service sectors between August and October 2016. The values were calculated by parcelLab. The service provider DHL was used most frequently. More than half of the customers used a service provider from the CEP sector.

The basis for the calculation was a total of around 35 million shipping events by trading and service companies in various sectors in Germany in the period August to October 2016.

Proportion of the number of CEP service providers used by individual customers in the period August to October 2016 in Germany

- A CEP service provider – 55.84%

- Two CEP service providers – 27.27%

- Three CEP service providers – 12.99%

- Four CEP service providers – 3.9%

Satisfaction with the service of selected KEP services in Germany

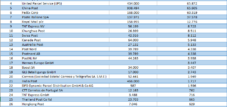

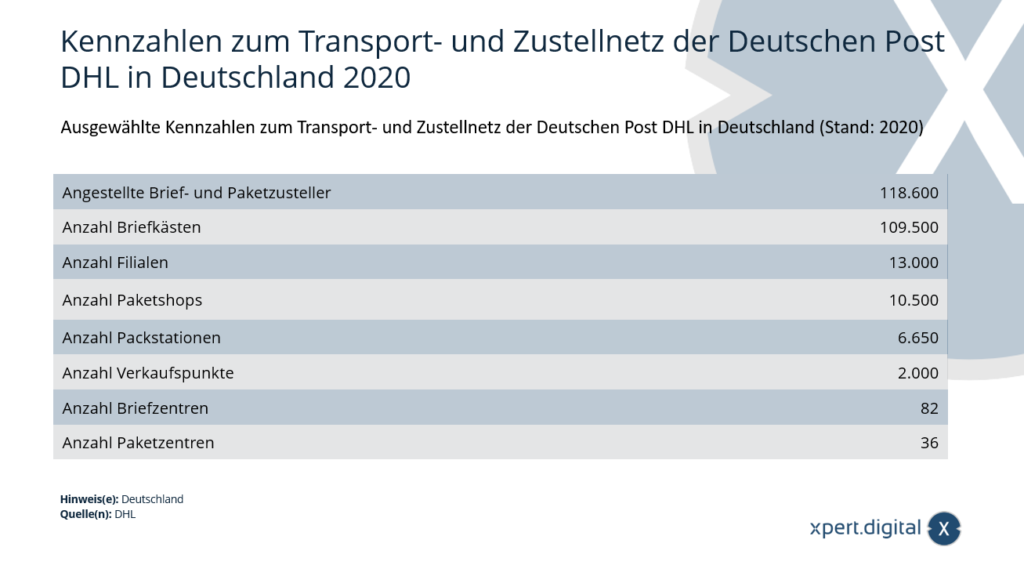

Key figures for the transport and delivery network of Deutsche Post DHL in Germany – Image: Xpert.Digital

In Germany, Deutsche Post DHL operated around 109,500 mailboxes and 82 mail centers in which letters are sorted and distributed in 2020. In the same year, there were 10,500 parcel shops in Germany and 36 parcel centers that sort and distribute parcels.

Selected key figures on the transport and delivery network of Deutsche Post DHL in Germany (as of 2020)

- Employed letter and parcel deliverers – 118600

- Number of mailboxes – 109,500

- Number of branches – 13,000

- Number of parcel shops – 10,500

- Number of packing stations – 6,650

- Number of points of sale – 2,000

- Number of letter centers – 82

- Number of parcel centers – 36

Notes and comments: These are approximate values.

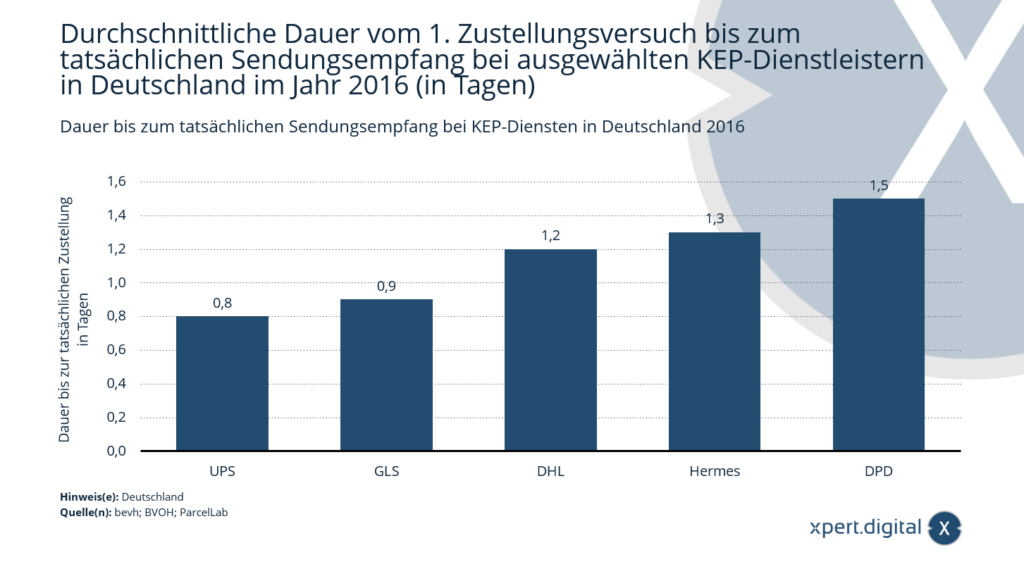

Duration until the actual shipment is received by CEP services in Germany

The statistics show the average duration from the first delivery attempt to the actual receipt of the shipment by the customer of selected courier, express and parcel services (CEP) in Germany in 2016 (period August to November). The data was calculated by parcelLab as part of the BVOH parcel study 2016. With the Hermes CEP service, it took an average of 1.3 days for the customer to receive their shipment after the first delivery attempt.

The time was measured from the first delivery attempt to the actual delivery or collection by the customer. Source's note: The basis was actual shipping data from over 100 German online shops. In the period August to October 2016, more than 35 million shipping events for standard parcel shipments were evaluated.

Average duration from the first delivery attempt to the actual receipt of the shipment by selected CEP service providers in Germany in 2016 (in days)

- UPS – 0.8 days

- GLS – 0.9 days

- DHL – 1.2 days

- Hermes – 1.3 days

- DPD – 1.5 days

More about CEP services - useful information & PDF downloads

- Courier, express and parcel industry – KEP – PDF download

- Trends in the courier, express and parcel industry (CEP) – PDF download

- CEP Market Europe – PDF Download

- CEP Market USA – PDF Download

Since early human civilizations, people have had to transport objects from one place to another. The growth in economic performance and industrial specialization led to the establishment of larger transport routes. Better use of technology with advances in science allowed us to deliver to multiple locations much faster with less effort. The logistics industry connects the business world, and this connection is evolving in response to the changing needs of the market.

More about it here:

Sales in the courier, express and parcel industry in Germany rose steadily between 2009 and 2019, which is mainly due to the boom in online trading. In 2019, the turnover of the CEP industry in Germany was around 21.3 billion euros. In the CEP end customer market in Germany, Deutsche Post DHL had the highest share of sales in the 2017/2018 financial year at 69 percent.

More about it here:

Xpert.Digital – Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital – www.xpert.solar – www.xpert.plus