Japan is already working on the future of tomorrow

Language selection 📢

Published on: August 31, 2020 / update from: September 12, 2020 - Author: Konrad Wolfenstein

What this means for Germany and for Europe

In the 20th century, Japan's demographic development was determined by urbanization. In the 1980s, government policy encouraged the development of new urban structures away from major cities and supported regional centers in attracting young people to live and work there. These cities offered those coming from the surrounding areas a familiar environment, a lower cost of living, shorter commutes and a generally more relaxed lifestyle than in the big cities.

By international standards, the Japanese have a high standard of living and almost 90% of the population consider themselves to be middle class.

Japan is now an urban society where only 5% of the workforce works in agriculture. Many farmers supplement their income with part-time jobs in nearby cities.

Due to the high land prices in metropolitan areas, many families cannot afford an apartment in larger cities. That's why many Japanese have to commute long distances every day. In the Tokyo area, daily trips of up to 2 hours one way are not uncommon. But on average, the others, like the Germans, have the shortest routes to work. According to market research firm Dalia, commuting in Japan is incredibly efficient and punctual. But not necessarily comfortable when you think of the images of trains being forced to be jammed, which is certainly reflected in the comparatively high level of job dissatisfaction .

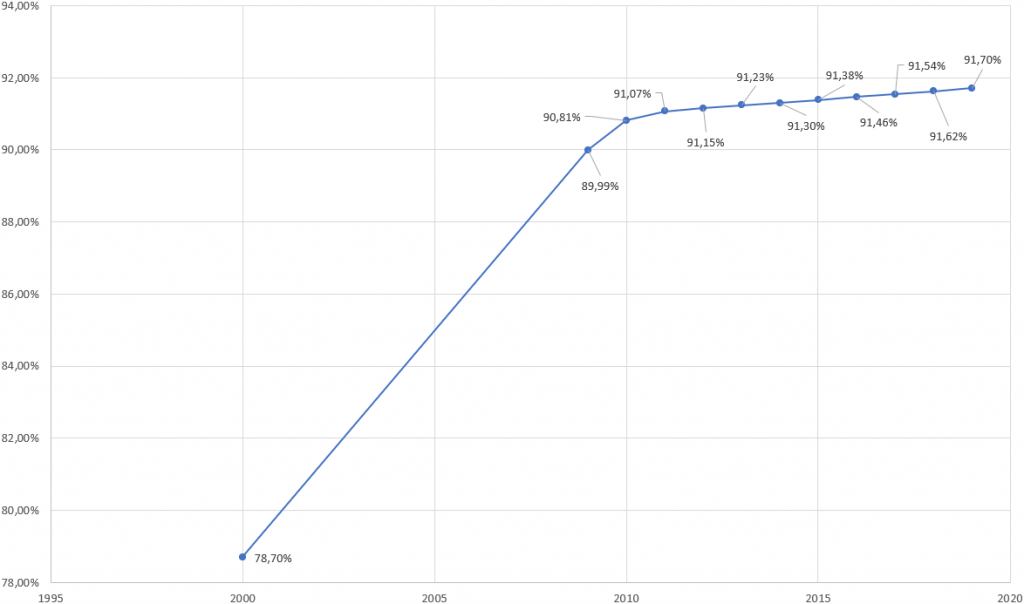

While 78.7% of Japan's population lived in cities in 2000, in 2019 it is around 91.7% of the total population. However, the Japanese population is aging and shrinking at a record pace. The cause is increasing life expectancy and the low birth rate. The economy is particularly affected by the consequences. Nevertheless, Japan has no intention of introducing a so-called immigration policy and is trying to solve the social challenge in other ways.

Germany and Japan are completely different in terms of population distribution. While over 90% of the Japanese population lives in urban areas, in Germany this is less than 50%. Germany is working on the challenges of providing uninterrupted supplies in the rural region, while Japan is acutely struggling with a labor shortage and an increasingly aging society. This is basically a similar situation to the rural regions in Germany. This is an opportunity for the Germans to learn from and imitate the urban experiences and developments of the Japanese.

automation

Japan is fully committed to automation. For example, all emissions and waste products should be recycled by 2050. By 2040, the plan is to fully automate fishing, agriculture and forestry so that human help is no longer necessary.

Another step by the government is to automate all 50,000 general stores (Familymart, Lawson, 7-Elves, New Days, Ministop) in the country by 2025. The RFID technology should be used for this. This is essential for full automation. The goods can be billed automatically at a self -service fund without the need for staff. The Minimarkt chain Lawson, as one of the first for this, successfully put into operation in a test phase. So it doesn't always have to be Amazon. According to media reports, Amazon plans 3000 shops “without health insurance” compared to 2021 compared to the USA.

Automatic delivery robots are also already being tested in Japan by Yamato Transport and Rakuten. The project is similar to Amazon Scout's delivery robot. And delivery by drone, which Rakuten is testing in Japan, also sounds very familiar. As early as 2016, there were initial approaches to alternative last -mile .

heise online , one of the most visited German-language IT news sites, reported in its online edition from February 2019 that the fashion group Fast Retailing is working on fully automating its warehouses. The central warehouses in Tokyo are now all equipped with robots and intelligent systems (AI).

Here Fast Retailing is working with the intralogistics world market leader DAIFUKU , with the aim of fully automating all 78 warehouses in Japan and overseas. Investments of 917 million US dollars are planned for this.

Fast Retailing is a listed stock corporation with a group turnover of 7.7 billion euros and over 34,000 employees.

Solve the supply gaps in Germany with know-how from Japan

As a global market leader with over 80 years of experience in multi-material handling, DAIFUKU has the experts worldwide for the most diverse challenges. Food, service and logistics companies have trusted DAIFUKU’s know-how for many years. In addition to automated applications for the manufacturing industry, its focus areas include logistics solutions of all kinds. Systems for the secure storage and provision of sensitive items under clean room conditions are just one example. In addition, state-of-the-art solutions for trade and e-commerce are part of DAIFUKU's core competencies.

► Contact me or discuss with me on LinkedIn

What will be crucial for the future will be how we secure the infrastructure of our key industries!

Three areas are of particular importance here:

- Digital Intelligence (Digital Transformation, Internet Access, Industry 4.0 and Internet of Things)

- Autonomous power supply (CO2 neutrality, planning security, safety for the environment)

- Intralogistics/logistics (full automation, mobility of goods and people)

Xpert.Digital delivers you here from the Smart AUDA series

- Autonomization of energy supply

- urbanization

- Digital transformation

- Automation of processes

always new information that is updated regularly.