Italians make your Industry 4.0 ready! With up to 250% depreciation option!

Language selection 📢

Published on: December 3, 2018 / update from: December 12, 2018 - Author: Konrad Wolfenstein

Update: Delivery is also possible within December 31, 2019 if the order from suppliers has been accepted and an advance payment of 20% of the purchase price has been made within December 31, 2018.

From January 1, 2017 to December 31, 2018, the Italians have the opportunity to use a “hyper depreciation” of 250%. Investment goods (machines, storage systems, etc.), which are connected to a cloud or the like, can be copied with 250 % instead of 100 % of the acquisition value.

The relevant legal provisions can be found as follows:

- Budget Law 2016 – No. 208/2015 Art. 1, Paragraph 91

- Budget Law 2017 – No. 232/2016 Art. 1, paragraphs 8-13

- Budget Law 2018 – No. 205/2017 Art. 1, paragraphs 30-36

New depreciable assets that are used for business purposes are supported:

- Used as production goods

- The goods must be used from the point of view “Industry 4.0”

2 out of 3 characters must be fulfilled:

- Capital goods for remote maintenance and/or telediagnosis and/or remote control systems

- Continuous monitoring of working conditions and process parameters through appropriate sets of sensors and corrections of process deviations in the cloud

- Integration properties between the physical machine and/or the system with the model and/or the simulation of the behavior when carrying out the process (cyberphysical system)

Which capital goods?

- Machines and devices that are controlled by IT systems and/or controlled by corresponding sensors and actuators

- Systems for quality assurance and sustainability

- Devices for interactive human machine and for improving ergonomics or occupational safety according to the logic “4.0”.

Requirements/Conditions

- Controlled by CNS (Computer Numerical) Control) and/or PLC (Programmable Logic Controller)

- Networking with the IT systems of the company, with the implementation of instructions and/or the charging of “Part Program” from a distance

- Automated connection with the company's logistics system or with the supply chain and/or with other machines in the production cycle

- Simple and intuitive interface between man and machine

- Compliance with the latest parameters in terms of safety, health and occupational hygiene

Further information is available upon request.

Addendum:

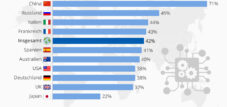

Tax system makes Germany unattractive for IT companies. Last place in the location index.

“In addition, there are only a few tax incentives in this country that are tailored to companies’ digital business models”