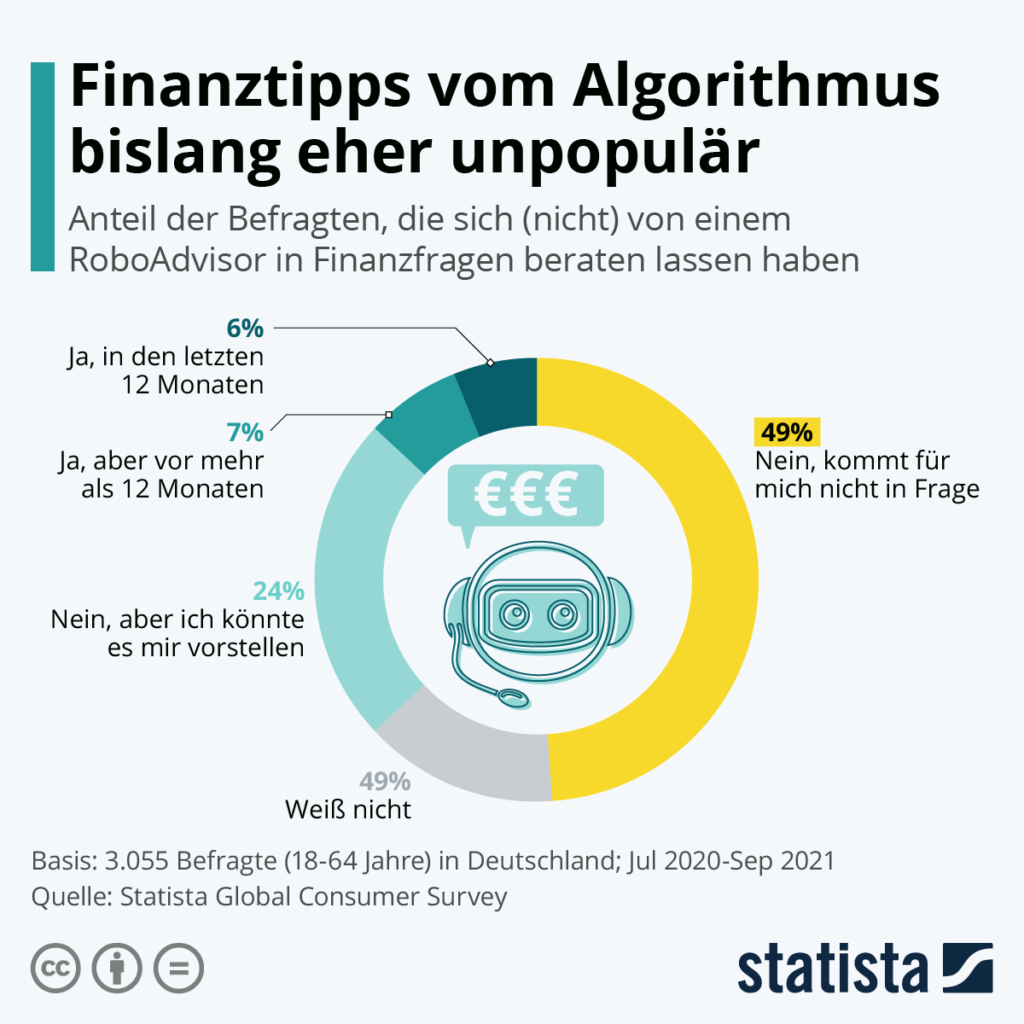

Financial tips from the robo-advisor algorithm are rather unpopular

Language selection 📢

Published on: November 5th, 2021 / Update from: November 5th, 2021 - Author: Konrad Wolfenstein

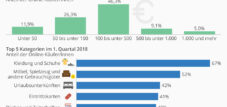

13 percent of people surveyed in Germany (3,055 respondents between the ages of 18 and 64) have already sought advice from a financial roboadvisor - but only a little less than half of them within the last twelve months. This means that digital investment advice and portfolio management based on algorithms is rather unpopular in this country.

Suitable for:

The situation is different, for example, in India, China and Russia (over 30 percent each). But there is still room for improvement on the German market, as a look at the graphic shows: one in four respondents can imagine getting advice on financial matters from a robo-advisor in the future. And the analysts are also expecting a positive development. They assume that the investment volume of automated online portfolios could increase to around 35 billion euros by 2025. But nothing works without personal contact. The combination of personal advice and advisory assistance with the algorithms is crucial.

Digital financial service with robo-advisor

Fintech Software, Modern Digital Global Business and Market Analysis, Online Stock Trading and Investment Helper Apps, Robo Advisor Concept Design – Image: Jozsef Bagota|Shutterstock.com

Robo-advisors are a type of digital financial advisor that provides financial advice or investment management with moderate to minimal human intervention. They offer digital financial advice based on mathematical rules or algorithms. These algorithms are developed by financial advisors, investment managers and data scientists and coded into software by programmers. These algorithms are run by software and do not require a human advisor to provide financial advice to a customer.

The software uses its algorithms to automatically allocate, manage and optimize clients' assets for either short-term or long-term investments. Robo-advisors are categorized based on the level of personalization, discretion, involvement and human interaction.

There are over 100 robo-advisory services. Robo-advice in wealth management is considered a breakthrough in previously exclusive wealth management services, offering it to a wider audience at a lower cost than traditional human advice. Robo-advisors typically allocate a client's assets based on risk preferences and desired target return. Although robo-advisors are able to invest client assets in many investment products such as stocks, bonds, futures, commodities and real estate, the funds are often invested in ETF portfolios. Customers can choose between offerings using passive asset allocation techniques or active asset management styles.

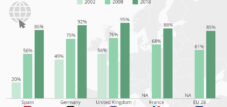

While Robo-Advisors are most widespread in the United States, they also exist in Europe, Australia, India, Canada and Asia. The first robo advisors were introduced in 2008 during the financial crisis. In 2010, 30-year-old entrepreneur Jon Stein 'Betterment' launched, and robo-advisors became increasingly popular. The first robo-advisors were used as an online interface for the administration and the balance of customer assets by financial managers. Robo-advisor technology was not new in this area, since this type of software has been used by financial advisors and managers since the early 2000s. But in 2008 they were made accessible to the general public for the first time, which urgently had to manage their assets themselves. At the end of 2015, Robo-Advisors from almost 100 companies managed $ 60 billion in customer assets worldwide, and it will be $ 2 trillion by the end of 2020. In June 2016, the Robo-Advisor WEALTHFRONT announced a partnership with the treasurer of the state of Nevada to offer a 529 plan for college savings.

In 2015, Hong Kong-based 8 Securities launched one of Asia's first robo-advisors in Japan, followed in 2016 by Money Design Co. under the brand name THEO and WealthNavi. In 2017, Singapore-based StashAway received a capital markets services license from the Monetary Authority of Singapore. In May 2020, Webull received SEC approval to launch a robo-advisor.

A robo-advisor can be defined as “a self-directed asset management service that offers automated investment advice at low costs and with low minimum amounts and uses portfolio management algorithms”. Some robo-advisors have a certain level of human interference and supervision. Robo advice is also referred to as digital advice.

From a legal point of view, the term “financial advisor” applies to each facility that grants advice on securities. Instead, most robo-advisor services are limited to portfolio management (i.e. the distribution of the systems to the various investment classes), without dealing with topics such as estate and retirement planning and cash flow management that also fall into the area of financial planning.

Other names for these financial technology companies are “automated asset consultants”, “automated investment management”, “online investment consultant” and “digital investment consultant”.

The robo-advisor tools they use to manage customer portfolios hardly differ from the portfolio management software that is already widely used in the industry. The main difference lies in the distribution channel. Until recently, portfolio management was carried out almost exclusively by human advisors and sold as a package with other services. Now consumers have direct access to portfolio management tools, just as they gained access to brokerage houses like Charles Schwab and stock trading services with the advent of the Internet. Robo-advisors are penetrating newer business areas such as: B. consumption-saving decisions by retailers and planning for retirement and decumulation.

The portfolios that robo-advisors offer are usually exchange-traded funds. However, some also offer pure stock portfolios.

Due to the cost of client acquisition and the time pressures faced by traditional advisors, many middle-class investors in the U.S. are under-advised or unable to access portfolio management services due to minimum investable asset requirements. The average financial planner has a minimum investment amount of $50,000, while minimum investment amounts for robo-advisors start at $500 in the United States and £1 in the United Kingdom. In addition to lower minimum investable asset amounts compared to traditional human advisors, robo-advisors charge fees between 0.2% and 1.0% of assets under management, while traditional financial planners average fees of 1.35%, according to a survey conducted by AdvisoryHQ News of assets under management.

The costs in Germany for robo-advisors can be divided into costs for asset management, i.e. the actual robo-service, and - in the case of fund-based robo-advisors - the ongoing costs for the funds.

According to a study by Stiftung Warentest in August 2018, the total costs for a model investor for the cheapest providers amount to around 0.6 percent of the investment amount annually. The most expensive robo in the test even costs 1.87 percent per year. For comparison: According to Stiftung Warentest, balanced mixed funds cost an average of 1.92 percent per year. The robo service alone costs between 0.39 and 1.2 percent of the investment amount per year and usually also includes custody and switching costs.

The ongoing fund costs depend primarily on the type of funds that the robo-advisors use to invest. ETFs are significantly cheaper than actively managed funds.

In the United States, robo-advisors must be registered investment advisers regulated by the Securities and Exchange Commission; in the United Kingdom, they are regulated by the Financial Conduct Authority.

In Australia, robo-advisors manage client funds via the Managed Discretionary Account (MDA) structure.

In Germany, a distinction is made between financial investment intermediaries and asset managers. Most robo-advisors act as financial investment intermediaries in accordance with Section 34 et seq. of the Commercial Code (GewO). You may not reallocate client portfolios without the client's permission. The stricter Section 34h of the Commercial Code (GewO) regulates the nature of fee-based financial investment advice. Robo-advisors with this permission may not bind themselves to individual providers and may not accept commissions or other benefits from product providers or banks. Some providers are regulated asset managers and meet the stricter requirements of Section 32 of the Banking Act (KWG). They are allowed to implement investment decisions directly without being requested to do so by the customer or having to obtain approval in advance.

Launch of the first robo-advisor with Betterment

Betterment is an American financial advisory company that offers robo-advising and cash management services.

The company is based in New York City, registered with the Securities and Exchange Commission and a member of the Financial Industry Regulatory Authority. It is a registered investment advisor and broker-dealer.

The company's core service is automated targeted investing, which manages a portfolio of passive index-tracking equity and bond funds. It offers taxable and tax-deferred investment accounts, including traditional and Roth individual retirement accounts (IRAs). More recently, Betterment has also offered financial advisors and checking and savings accounts as additional services.

As of April 2021, Betterment had $29 billion in assets under management and over 650,000 customer accounts.

Betterment was founded in New York City in 2008 by Jon Stein, an MBA graduate from Columbia Business School, and Eli Broverman, an attorney from NYU School of Law. Stein and his roommate Sean Owen, a software engineer at Google, began building the first online platform for Betterment in 2008. To do this, they used a Java application and a MySQL database on Apache Tomcat servers with an Adobe Flash and Flex based front-end design. Initial prototype designs were provided by Stein's then-girlfriend Polina Khentov. Faced with the regulation involved in starting a financial firm, Stein began negotiations in 2008 to recruit Eli Broverman, a securities lawyer he had met through regular poker games, as a co-founder.

Broverman and Stein were ready to offer finance consultants online as SEC-registered investment consultants and decided to also offer broker dealer services for the advice of customers. Ryan O'Sullivan, a “serial entrepreneur”, added a "serial entrepreneur" to build the broker dealer business of betterment.

From 2008 to 2010, the founding team further developed the platform until it was launched on the market. Betterment received approval for membership from FINRA. In 2009, Anthony Schrauth, a former colleague of Stein, joined Betterment as chief product officer, and Owen was replaced by Kiran Keshav from Columbia University's Center for Computational Biology. O'Sullivan left his role as president in 2010.

Betterment, LLC was incorporated as a Delaware corporation on April 7, 2009. The parent company of Betterment LLC and Betterment Securities, Betterment Holdings, Inc., was incorporated in Delaware on January 29, 2008.

The company was presented at Techcrunch Disrupt New York in June 2010 and won the “Biggest New York Disruptor” award. Betterment had won almost 400 first customers within 24 hours, and the company started talks with the first investors.

In December 2010, Betterment received a Series A round of funding from Bessemer Venture Partners. In October 2012, Menlo Ventures raised Series B funding alongside Bessemer Venture Partners and Anthemis Group. By 2012, the company had introduced product offerings such as IRAs, automatic deposits, automatic rebalancing and targeted investment advice.

Xpert.Digital – Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital – www.xpert.solar – www.xpert.plus