Financial technology or Fintech, a new financial industry

Language selection 📢

Published on: August 24, 2018 / update from: August 30, 2024 - Author: Konrad Wolfenstein

According to the report, a new revolution is underway in the financial services industry. However, not blockchain is the new “revolutionary”, but artificial intelligence, big data and internet of things.

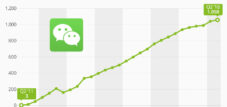

Who doesn't know PayPal, Alipay, WeChat Pay, Venmo and many more? Therefore, in addition to Blockhain cryptocurrencies, we also pay particular attention to fintech technology.

+++ Fintech in Germany +++ FinTechs are gaining in importance +++ FinTech big in China, not in Japan +++ Mobile payments – that will happen +++ German skepticism is slowing down mobile payments +++ Mobile payments are still running in Germany not +++ Smart payment +++ The smartphones are ready, the markets are less +++ Here you can pay with Google Pay +++ Consumers are moving more and more money digitally +++ Germans trust online banking the least +++

Fintech or financial technology is a collective term for technologies related to the financial services industry. The focus here is on modern technologies for the provision of financial services by non-banks or bank-like service providers. These are often young companies or startups that are trying to operate their business without a banking license and secure market share from already established competitors. This enables consumers to invest money, take out loans, complete payment transactions or seek financial advice more independently, ie without traditional banking, via the Internet.

The technologies are mainly used in the areas of e-commerce and mobile. Mobile payment includes all forms of mobile cashless payment.

Progress in the electrical industry and the increased spread of mobile devices with an Internet connection such as smartphones, laptops and tablets are driving the growth of the fintech market. Due to the technical possibilities, there has been a change from classic to modern online-based banking, particularly in the banking business. In Germany alone there were around 54.3 million online checking accounts in 2013. Surveys show that the willingness to use online banking is increasing. Mobile payment applications such as Paypal and Bitcoin are also enjoying increasing popularity.

Fintech in Germany

Fintech is a term made up of the words financial and tech. This includes companies that specialize in new technologies and web offerings related to financial services, such as mobile payment systems, online payments or crowdfunding websites. In 2015, the strategy consultancy LSP Digital counted 139 fintech companies headquartered in Germany, 49 of which were in Berlin. Fintech has already arrived in the German business world. According to a Statista survey, the majority of average consumers have no use for the term.

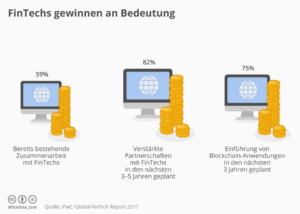

FinTechs are becoming increasingly important

“FinTech” is a keyword that is often mentioned in the Swiss financial industry - and rightly so, as the Global Fintech Report 2017 of PWC published last week shows. According to this, the established financial service providers in Switzerland have increasingly in sight the young online companies and rely on cooperation instead of competition: 59 percent of the financial companies surveyed are already working with fintechs, 82 percent are aiming for reinforcement of such partnerships for the next three to five years.

They also want to use a technology that is traded as the future of financial flows and on which, among other things, the cryptocurrency Bitcoin is based: blockchain. 75 percent of financial service providers plan to introduce such applications in the next three years. So a lot of fresh wind at the Switzerland financial center, as well as Dr. Daniel Diemers from PWC Strategy & Switzerland says: “It is clear that the trends will lead to disruption over the next five to ten years in all areas of the financial services sector, also in Swiss private banking and wealth management. Blockchain becomes a reality from the hype. The constant cooperation between Swiss companies and fintechs is the key to future success. ”

FinTech big in China, not in Japan

35 percent of adult online users in Germany use FinTech services. This emerges from the recently published FinTech Adoption Index 2017 by EY. This includes offers from the areas of transfers & payments, financial planning, savings & investments, loans and insurance. FinTech is significantly more popular in China with an adoption rate of 69 percent. In contrast, the high-tech nation of Japan is exercising restraint. Only 13 percent of the digitally active population use FinTech.

Mobile payments – that will be something

Mobile payment means paying without cash, for example with a smartphone or even a smartwatch. A payment method that is constantly gaining in importance; Almost 664 million users are forecast worldwide for 2021. Our infographic, which was created in cooperation with Concardis , introduces the topic and shows how Apple is gradually conquering the global market with its innovative “Apple Pay” solution.

German skepticism is slowing down mobile payments

The Germans depend on cash. While countries like Sweden and Great Britain are quickly moving away from analogue money, coins and notes still make up over 50 percent of retail sales in this country, according to an EHI study. Nevertheless, stores are preparing for the future: Two thirds of large retailers in Germany want to offer contactless payment by the end of the year - including Aldi and LIDL.

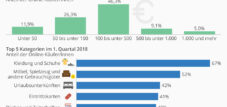

Now all that's left is for consumers to follow suit. According to a Statista survey, the majority have so far been skeptical. But at least 46 percent of adults in Germany are open to mobile payment. Statista analysts predict that the number of users will grow to 6.1 million in the next five years.

But a lot still has to happen. Neither Apple Pay, Android Pay nor Samsung Pay are currently available in this country. According to rumors, all three could be ready this year. The introduction of mobile payment will not fail if consumers are equipped with the appropriate hardware. The market researchers at IHS Markit expect there to be 3.4 billion compatible smartphones worldwide by the end of 2017.

Mobile payment is not yet available in Germany

According to the Statista Digital Market Outlook, around 2.2 million people in Germany will use mobile payment at the point of sale this year. This includes payments via mobile wallets, app-based transactions with a suitable merchant payment terminal and NFC, QR code or Bluetooth-based payment processes. But even those who use such services tend to do so cautiously, as the average transaction volume per user shows, which is just over 80 euros. The situation is different, for example, in the USA (€1,838/user) or Great Britain (€1,683/user).

Smart payment

Paying in the corner store is also becoming increasingly digital. This is shown by a current study by the auditing and consulting company Deloitte on payment behavior in the retail sector. According to this, the majority of Swiss still prefer card payments or cash when shopping in-store. However, 17 percent have already used their smartphone to pay, and the study expects this proportion to almost double over the next twelve months. As with many digital technologies, the younger generation between the ages of 16 and 29 is significantly more active at 25 percent than the older generation (11 percent for those aged 50 to 69).

27 percent of Swiss mobile payment users only use the relevant retailer's app when shopping smartly in-store, but the majority also use third-party payment systems. Here, the domestic provider TWINT, with 40 percent of third-party users, is clearly ahead of the applications from Apple (33 percent) and Samsung (17 percent).

The smartphones are ready, the markets less so

Neither Apple Pay, Samsung Pay nor Android Pay are currently available in this country. However, the Germans are not alone with their mobile payment undersupply, as an analysis by analysts at IHS Markit shows. Apple's mobile payment system is currently only available in 15 international markets - the spread of the competition is similar. The infrastructure is already in place on the consumer side. By the end of 2017, 3.4 billion smartphones worldwide are expected to be compatible with one of the three major payment providers.

You can pay with Google Pay here

Google Pay is available in Germany. At the start, Adidas, Lidl Süd and Media Markt will be there, among others. Consumers can Google Pay wherever the corresponding symbol is displayed. The mobile payment service is now available in 19 countries and regions worldwide. For comparison: Apple Pay can currently be used in 27 countries and regions - including small areas such as the Channel Islands or San Marino.

Consumers are moving more and more money digitally

The global digital payments transaction volume will reach $4.6 trillion in 2021. This emerges from the new Statista Fintech Report 2017. This includes all online payments made by consumers for products and services, mobile payments at the POS via smartphone app and cross-border P2P transfers between private users. The majority of the money moved digitally comes from China (1.5 trillion US dollars) and the USA (1.2 trillion US dollars). For Germany, analysts estimate the transaction volume to be $153 billion.

Germans trust online banking the least

Germans are not very trusting – at least when it comes to digital technologies. German citizens are particularly afraid of dangers when it comes to online banking. Almost three quarters of those surveyed in a study by tns-Infratest believe that it is dangerous to conduct financial transactions online. People are also still cautious when shopping online: only a little more than 40 percent believe that there is little or no risk of danger when ordering goods over the Internet.