Financial planning: Independent advice – looking for financial advice or investment advice in Bellenberg, Vöhringen, Illerrieden or Illertissen?

Language selection 📢

Published on: October 23, 2021 / update from: February 1, 2024 - Author: Konrad Wolfenstein

Financial development and financial planning

At the end of 2020, the financial assets of German citizens amounted to almost 7 trillion euros. This consists of private insurance and securities assets as well as bank deposits. Despite the current low level of interest rates, private households' savings deposits make up a not insignificant part of the total private assets invested in banks in Germany.

Around 42 percent of the population in Germany rate the current financial situation as good or very good. Only 22 percent of Germans rate the level of information about financial matters and investments as good.

Do you know how the population in Germany thinks about saving money or living a nice life? Only 22% of Germans rate their knowledge of financial topics as good. In Austria it is 36%. Why is this so, on such an important topic? Do you know how much private household wealth is managed worldwide? How does the population assess the current financial situation? What is the development of the financial assets of private households in Germany?

You can find an independent overview here:

Free PDF download of 'Saving behavior of private households'

Important note: The PDF is password protected.

Please get in contact with me. Of course, the PDF is free of charge. Important note: The PDF is password protected. Please contact me. Of course the PDF is free of charge.

German version – To see the PDF, please click on the image below.

German Version – To view the PDF, please click on the image below.

👨🏻 👩🏻 👴🏻 👵🏻 For private households

Xpert.Digital helps you choose your independent financial service provider. With our AI-supported digital know-how, we provide you with current data and figures.

Financial planning is worthwhile for everyone, regardless of income and assets. It doesn't always have to be a complete and elaborate financial plan. Depending on the situation, special topic plans such as: B. retirement provision.

📣 For entrepreneurs such as founders and start-ups

The financial plan is the basis for the business plan. It should be updated regularly. Clearly defined corporate goals help with this.

With over 1,000 specialist articles, we cannot present all topics here. Therefore, you will find a small excerpt from our work here and we would be pleased if we have piqued your interest in getting to know us better:

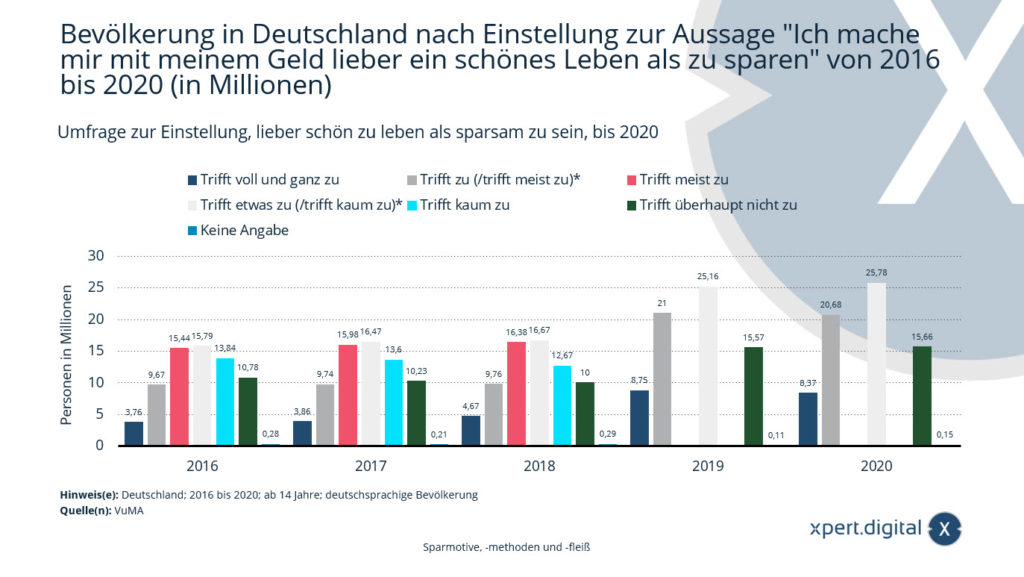

Survey on the attitude towards living well rather than being frugal

In 2020 there were around 8.37 million people in the German -speaking population from the age of 14 who, "I prefer to make a good life than to save" with my money.

Population in Germany according to the attitude to the statement “I prefer to make a good life with my money than to save” from 2016 to 2020 (in millions)

That is completely right

- 2016 – 3.76 million

- 2017 – 3.86 million

- 2018 – 4.67 million

- 2019 – 8.75 million

- 2020 – 8.37 million

Applies (/mostly applies)*

- 2016 – 9.67 million

- 2017 – 9.74 million

- 2018 – 9.76 million

- 2019 – 21 million

- 2020 – 20.68 million

Mostly true

- 2016 – 15.44 million

- 2017 – 15.98 million

- 2018 – 16.38 million

Slightly true (/hardly true)*

- 2016 – 15.79 million

- 2017 – 16.47 million

- 2018 – 16.67 million

- 2019 – 25.16 million

- 2020 – 25.78 million

Hardly true

- 2016 – 13.84 million

- 2017 – 13.60 million

- 2018 – 12.67 million

Not correct at all

- 2016 – 10.78 million

- 2017 – 10.23 million

- 2018 – 10 million

- 2019 – 15.57 million

- 2020 – 15.66 million

Not specified

- 2016 – 0.28 million

- 2017 – 0.21 million

- 2018 – 0.29 million

- 2019 – 0.11 million

- 2020 – 0.15 million

* Change of the query: From 2019 the gradations were “met” and “usually applies” and “applies something” and “hardly applies” were also combined with each other.

Information on the population: The basis is the German-speaking population aged 14 and over. Information on the entire sample:

2016: 23,102 respondents, extrapolation to 69.56 million people

2017: 23,106 respondents, extrapolation to 70.09 million people

2018: 23,086 respondents, extrapolation to 70.45 million people

2019: 23,120 respondents, extrapolation to 70.60 million people

2020: 23,138 respondents, extrapolation to 70.63 million people

The values shown refer to the following studies: 2016: VuMA 2017; 2017: VuMA 2018; 2018: VuMA 2019; 2019: VuMA 2020; 2020: VuMA 2021

Values were rounded to for a better understanding of the statistics.

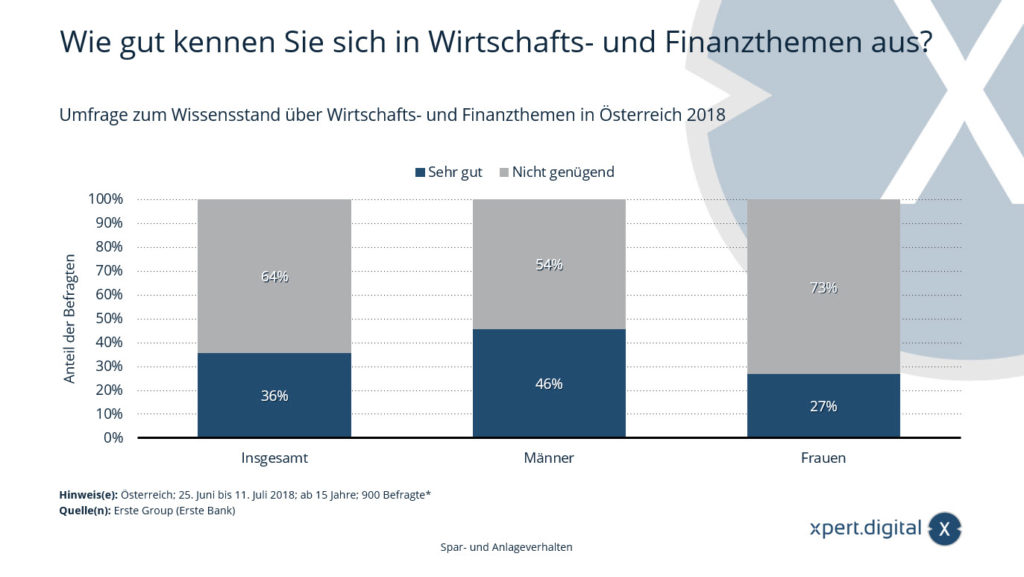

Survey on the level of knowledge about economic and financial topics

The statistics show the results of a survey on the level of knowledge about economic and financial topics in Austria in 2018. 36 percent of those surveyed said they were very knowledgeable about economic and financial topics.

How well do you know about economic and financial topics?

Very good

- Total 36%

- Men 46%

- Women 27%

Not enough

- Total 64%

- Men 54%

- Women 73%

* 100 interviews were conducted per federal state to enable separate evaluation. For the overall analysis, the federal states were weighted to their representative level.

The source does not provide any precise information about the question. The wording chosen here may therefore differ slightly from the survey.

Type of survey: Computer-assisted telephone interviews (CATI)

Number of respondents: 900 respondents*

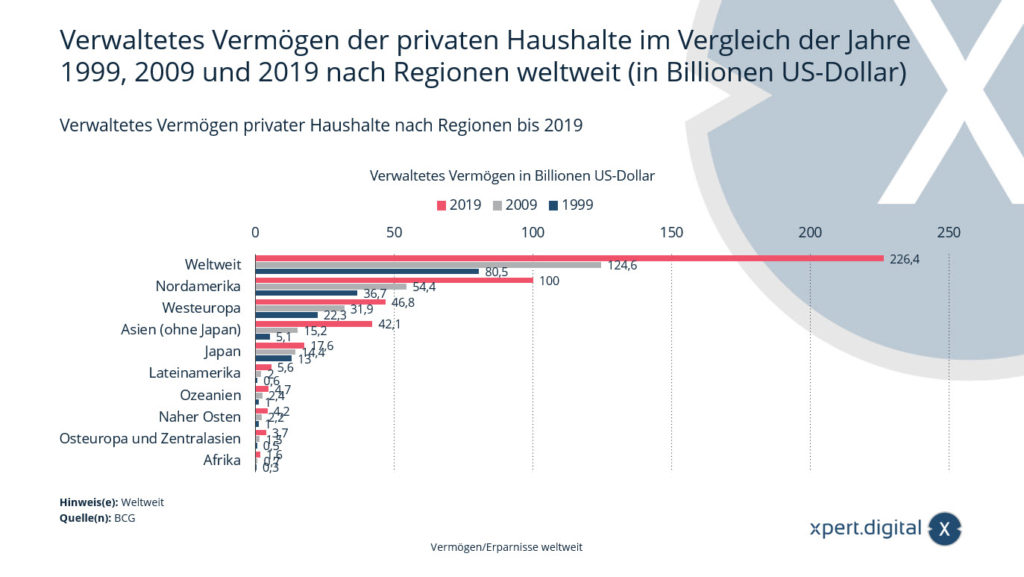

Assets under management of private households by region

This statistic shows the assets under management of private households worldwide compared to the years 1999, 2009 and 2019, broken down by region.

In 2019, household wealth in Latin America totaled around $5.6 trillion. Twenty years ago, private wealth was still $0.6 trillion.

Private household assets under management in 1999, 2009 and 2019 by region worldwide (in trillion US dollars)

Assets under management of private households by region 2019

- Worldwide – $226.40 trillion

- North America – $100 trillion

- Western Europe – $46.80 trillion

- Asia (excluding Japan) – $42.10 trillion

- Japan – $17.60 trillion

- Latin America – $5.60 trillion

- Oceania – $4.70 trillion

- Middle East – $4.20 trillion

- Eastern Europe and Central Asia – $3.70 trillion

- Africa – $1.60 trillion

Assets under management of private households by region 2009

- Worldwide – $124.60 trillion

- North America – $54.40 trillion

- Western Europe – $31.90 trillion

- Asia (excluding Japan) – $15.20 trillion

- Japan – $14.40 trillion

- Latin America – $2 trillion

- Oceania – $2.40 trillion

- Middle East – $2.20 trillion

- Eastern Europe and Central Asia – $1.50 trillion

- Africa – $0.70 trillion

Assets under management of private households by region 1999

- Worldwide – $80.50 trillion

- North America – $36.70 trillion

- Western Europe – $22.30 trillion

- Asia (excluding Japan) – $5.10 trillion

- Japan – $13 trillion

- Latin America – $0.60 trillion

- Oceania – $1 trillion

- Middle East – $1 trillion

- Eastern Europe and Central Asia – $0.50 trillion

- Africa – $0.30 trillion

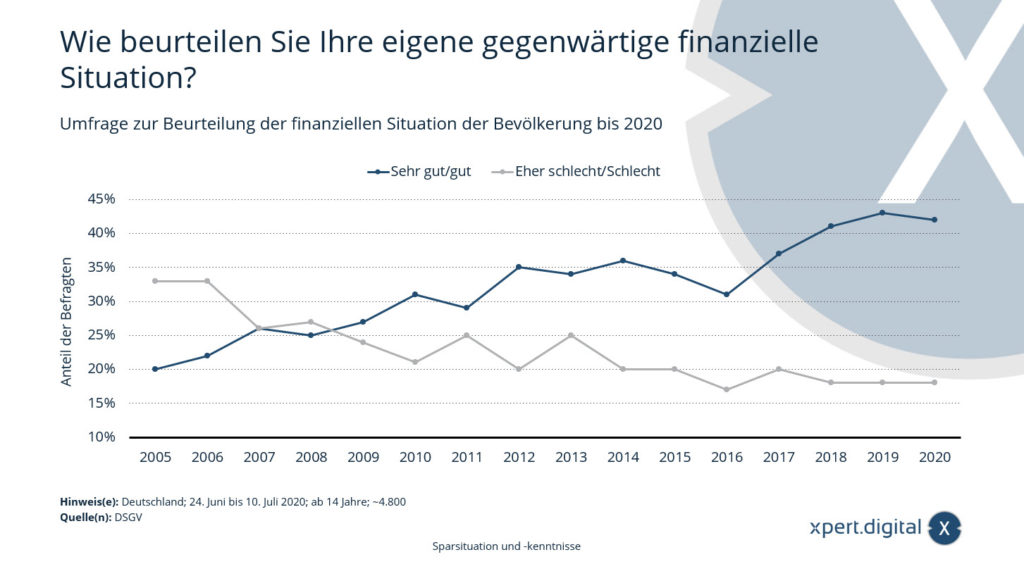

Survey to assess the financial situation of the population in Germany

Germans' satisfaction with their finances is declining slightly - according to the 2020 wealth barometer from the German Savings Banks and Giro Association, around 42 percent of Germans rate their current financial situation as very good to good. Last year it was 43 percent. Overall, however, the proportion of people who are satisfied with their financial situation has more than doubled in the past 15 years.

Survey to assess the financial situation of the population until 2020

How do you assess your own current financial situation?

Very good good

- 2005 – 20 %

- 2006 – 22 %

- 2007 – 26 %

- 2008 – 25 %

- 2009 – 27 %

- 2010 – 31 %

- 2011 – 29 %

- 2012 – 35 %

- 2013 – 34 %

- 2014 – 36 %

- 2015 – 34 %

- 2016 – 31 %

- 2017 – 37 %

- 2018 – 41 %

- 2019 – 43 %

- 2020 – 42 %

Rather bad/bad

- 2005 – 33 %

- 2006 – 33 %

- 2007 – 26 %

- 2008 – 27 %

- 2009 – 24 %

- 2010 – 21 %

- 2011 – 25 %

- 2012 – 20 %

- 2013 – 25 %

- 2014 – 20 %

- 2015 – 20 %

- 2016 – 17 %

- 2017 – 20 %

- 2018 – 18 %

- 2019 – 18 %

- 2020 – 18 %

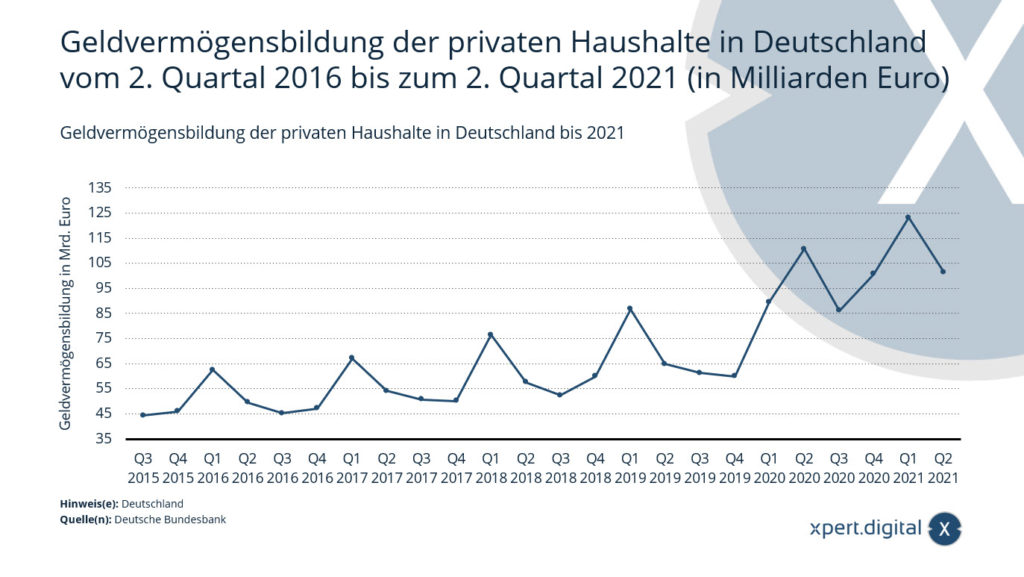

Financial asset formation by private households in Germany

These statistics show the development of the financial asset formation of private households in Germany in the period from the second quarter of 2016 to the second quarter of 2021. The transaction-related financial asset formation of private households in the second quarter of 2021 amounted to around 101.4 billion euros on balance.

Financial asset formation by private households in Germany from the second quarter of 2016 to the second quarter of 2021 (in billion euros)

- Q2 2021 – 101.4 billion euros

- Q1 2021 – 123.2 billion euros

- Q4 2020 – 100.7 billion euros

- Q3 2020 – 86.1 billion euros

- Q2 2020 – 110.6 billion euros

- Q1 2020 – 89.5 billion euros

- Q4 2019 – 59.9 billion euros

- Q3 2019 – 61.3 billion euros

- Q2 2019 – 64.9 billion euros

- Q1 2019 – 86.7 billion euros

- Q4 2018 – 60 billion euros

- Q3 2018 – 52.4 billion euros

- Q2 2018 – 57.6 billion euros

- Q1 2018 – 76.5 billion euros

- Q4 2017 – 50.1 billion euros

- Q3 2017 – 50.7 billion euros

- Q2 2017 – 54.1 billion euros

- Q1 2017 – 67.1 billion euros

- Q4 2016 – 47.2 billion euros

- Q3 2016 – 45.2 billion euros

- Q2 2016 – 49.5 billion euros

- Q1 2016 – 62.4 billion euros

- Q4 2015 – 46 billion euros

- Q3 2015 – 44.3 billion euros

- Q2 2015 – 47.1 billion euros

- Q1 2015 – 54.2 billion euros

- Q4 2014 – 40.8 billion euros

- Q3 2014 – 35.9 billion euros

- Q2 2014 – 37.7 billion euros

- Q1 2014 – 47.8 billion euros

- Q4 2013 – 34.3 billion euros

- Q3 2013 – 30.1 billion euros

- Q2 2013 – 35.6 billion euros

- Q1 2013 – 41.5 billion euros

- Q4 2012 – 35.5 billion euros

- Q3 2012 – 29.6 billion euros

- Q2 2012 – 37.3 billion euros

- Q1 2012 – 44.4 billion euros

- Q4 2011 – 34.6 billion euros

- Q3 2011 – 29 billion euros

- Q2 2011 – 31.7 billion euros

- Q1 2011 – 43.5 billion euros

Financial assets of private households at a new high

The financial assets of private households grew by 192 billion euros to 7,143 billion euros in the first quarter of 2021. It exceeded the 7 trillion euro mark for the first time. In addition to the purchase of financial assets, valuation gains on stocks and investment fund shares in particular contributed to the increase in financial assets.

The financial asset formation of private households amounted to a net amount of 129 billion euros, which was noticeably higher than in the previous quarters. A strong increase in claims against insurance companies contributed 27 billion euros to this. 47 billion euros flowed into cash and sight deposits, less than in the previous quarter. Overall, private households continue to show a strong preference for liquid or perceived low-risk forms of investment. At the same time, the increasing involvement in the capital market indicates an increased awareness of returns. Private households bought shares in investment funds for 25 billion euros - more than ever before. They also purchased a net amount of shares and other equity rights worth 3 billion euros. They invested primarily in domestic companies. The stock of bonds, however, was reduced on balance by 3 billion euros. The valuation-related increase in financial assets of 63 billion euros in the first quarter of 2021 resulted primarily from price gains in stocks and investment fund shares.

Due to the transaction, private household debt rose by 17 billion euros and was therefore weaker than before. At the end of the first quarter, their liabilities stood at 1,978 billion euros. The debt ratio of private households was 59.5 percent, the highest level since 2010. It is defined as the sum of liabilities in relation to nominal gross domestic product (moving four-quarter total). This means the upward trend continues. Recently, this development can be attributed to both the increasing debt of private households and the continued decline in nominal gross domestic product over the course of the year.

The net financial assets of private households amounted to 5,165 billion euros at the end of the first quarter.

Strong external financing is causing companies' debt ratios to rise significantly again

The external financing of non-financial companies has reached its highest value since 2018 at 90 billion euros. The main reason for this development was other liabilities, which mainly consist of trade payables and were increased by 54 billion euros. Borrowing also gained importance again after two weak quarters and amounted to 20 billion euros. Shares and shares worth 15 billion euros were issued, slightly more than the average for the previous four quarters.

Due to dynamic external financing and significant valuation effects, the liabilities of non-financial companies increased significantly. At the end of the first quarter of 2021 they amounted to 7,734 billion euros. The debt ratio of non-financial companies was 82.2 percent. It is calculated as the sum of loans, bonds and pension provisions in relation to nominal gross domestic product (moving four-quarter total). After only increasing by 0.3 percentage points in the fourth quarter of 2020, the increase in the reporting quarter was significantly higher again at 0.9 percentage points.

Taking all transactions and valuation effects into account, the financial assets of non-financial companies grew by 262 billion euros in the first quarter of 2021, which is as strong as in 2015. It reached 5,565 billion euros. The transaction-related financial asset formation makes a not insignificant contribution of 86 billion euros. After four quarters of continuous liquidation, non-financial companies have now significantly increased their financial derivatives and employee stock options by 22 billion euros. Other receivables, including trade credits and down payments, were also important for financial asset formation with a similar contribution. Receivables from cash and deposits also increased significantly again, reaching 20 billion euros. Valuation gains, on the other hand, were primarily observed for shares and other equity securities.

However, since liabilities rose even faster than financial assets, net financial assets fell more significantly on balance than in the previous period and amounted to minus 2,169 billion euros.

Due to revisions to the macroeconomic financial accounts and the national accounts that have since been carried out, the information in this press release is not comparable to that of previous press releases.

Xpert.Digital for Bellenberg, Vöhringen, Illerrieden and Illertissen. Support for your independent financial planning advice, wealth advice and investment advice

I would be happy to answer any further questions or help you may have.

You can contact me by filling out the contact form below or simply call me on 0731 550 40 117 .

I'm looking forward to our joint project.

Xpert.Digital – Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital – www.xpert.solar – www.xpert.plus