US Government Revenues: The Future of Government Finances - New Ways to Stabilize US Revenues

Language selection 📢

Published on: November 22, 2024 / Update from: November 22, 2024 - Author: Konrad Wolfenstein

US Government Revenue: The Future of Public Finances – New Ways to Stabilize US Revenue – Image: Xpert.Digital

💡 US Government Revenue: An Analysis of Revenue Structure and Its Implications

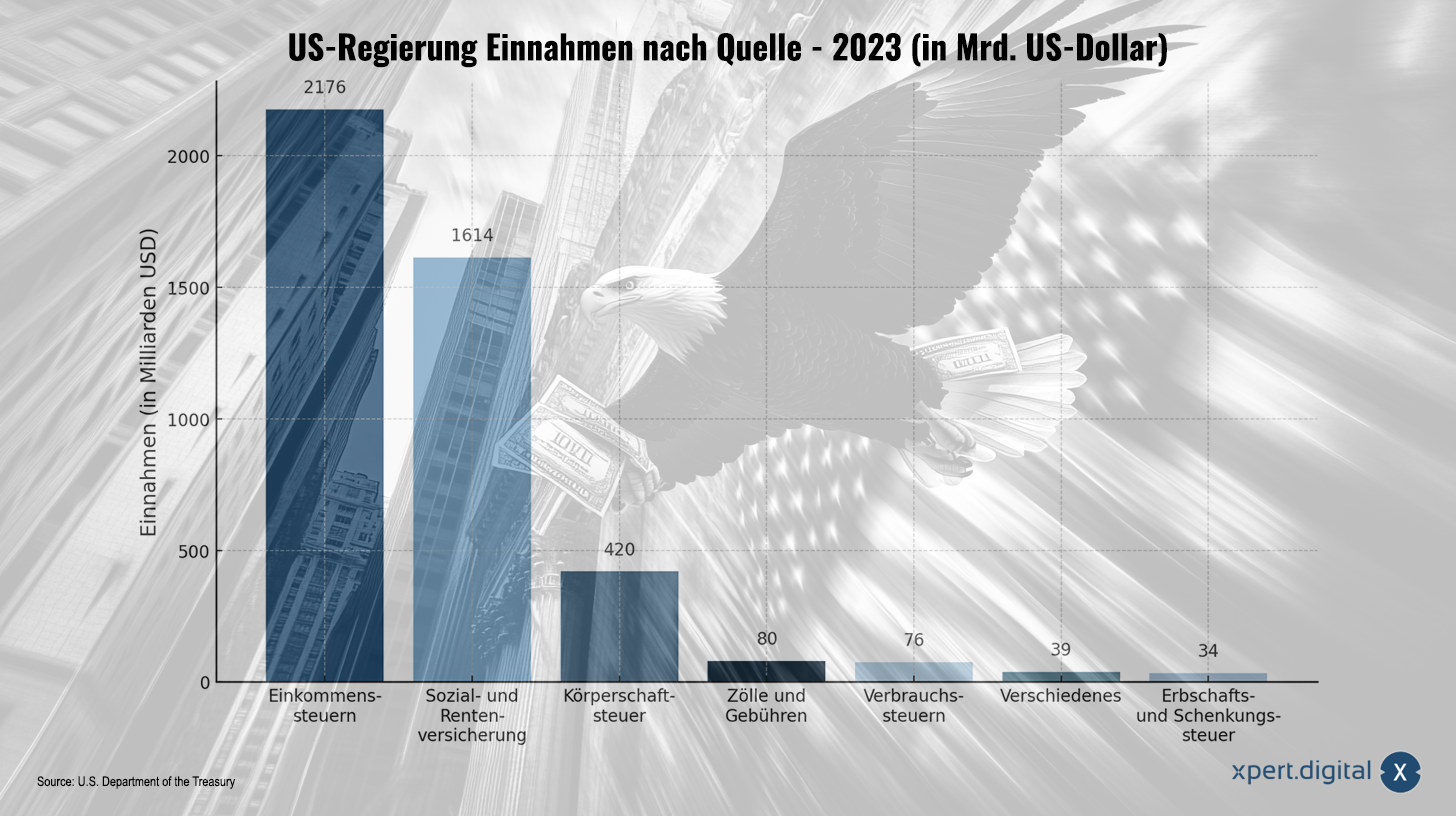

🔍📊 The U.S. government's revenue comes from a variety of different sources that form the basis for financing government spending. Income taxes in particular play a dominant role. In fiscal year 2023, they contributed the largest share of total revenue at $2,176 billion. This represents about half of all US government revenue and highlights the fundamental importance of this type of tax for public financing. But other sources of income such as social and pension insurance contributions, corporate taxes and smaller items such as customs duties, consumption taxes and inheritance taxes also play a role. A differentiated look at the income structure shows the economic dependencies and challenges associated with it.

US Government Revenue 2023 – Tariffs and their limits: How economically sensible are they really? – Image: Xpert.Digital

📊 The role of income taxes as the main source of income

At $2,176 billion, income taxes represent the backbone of the U.S. government's finances. This tax is levied on individuals and households and is designed to be progressive so that higher incomes are taxed proportionately more heavily. This not only helps cover government spending, but also serves as a tool to redistribute income and promote social justice.

However, the high dependence on income taxes poses risks. For example, an economic recession typically results in declining incomes, which can significantly reduce income from this source. Therefore, it is essential for the government to diversify its revenue sources to counteract financial fluctuations.

🏦 Social and pension insurance contributions: A stable second pillar

At $1,614 billion, social and pension insurance contributions are the second largest source of income. These taxes are collected directly from employees and employers and are used to finance social benefits such as pension insurance (Social Security) and health insurance for seniors (Medicare). Since they are usually levied as fixed amounts on wages and salaries, they offer a relatively stable source of income, even in times of economic uncertainty.

However, the system faces long-term challenges. Demographic developments – particularly the aging of the population – mean that spending on pension and health programs is growing faster than revenues. Without reforms, these programs risk funding shortages in the coming decades.

🏢 Corporate taxes: A source of revenue under pressure

The corporate tax generated revenue of $420 billion in 2023. Although this is a significant amount, a look at trends over the last few decades shows that the relative contribution of this type of tax is declining. The main reasons for this are tax relief for companies, international tax competition and the increasing use of tax havens.

While corporate tax is often seen as a way for companies to help finance public goods, critics argue that high tax rates could inhibit investment and innovation. Nevertheless, there is a growing consensus that multinational corporations should be taxed fairly to minimize tax evasion and avoidance.

⚙️ Tariffs and Fees: A marginal source of revenue with political significance

At just $80 billion, tariffs and fees contribute just 1.8% of total revenue. Although they seem small compared to other sources, they still play a significant role in trade policy. Tariffs have traditionally been used as a means of protecting the domestic economy by making foreign goods more expensive, thereby facilitating competition for domestic companies.

The low revenue significance of tariffs becomes clear when you compare them with income taxes. While tariffs are often presented in political debates as an economic panacea, their fiscal contribution remains manageable. While higher tariffs could boost revenues in the short term, they would increase import costs and potentially trigger trade conflicts that could slow economic growth in the long term.

🛢️ Excise taxes: An underestimated instrument

Excise taxes, which generated $76 billion in revenue in 2023, represent another important, if comparatively small, source of revenue. These taxes are levied on certain products such as tobacco, alcohol and gasoline, and are often not just for fiscal purposes, but also the control of consumer behavior. For example, high taxes on tobacco products are intended to reduce consumption and thus promote health policy goals.

Greater use of consumption taxes could be a way to generate additional revenue without increasing the income tax burden. However, possible social consequences must be taken into account, as these taxes can place a disproportionate burden on low-income households.

🏠 Inheritance and gift tax: A controversial instrument

The estate and gift tax brought in just $34 billion in fiscal year 2023. Despite its small contribution, this type of tax is often controversial. Proponents argue that it helps reduce wealth inequality and ensures that large fortunes cannot be passed down untaxed across generations. Critics, on the other hand, see it as double taxation and fear negative effects on medium-sized businesses, especially family businesses.

Reforming this tax could help increase revenue without burdening the broader population. A more progressive approach could be taken, taxing large estates more heavily while leaving small and medium-sized inheritances largely unaffected.

📦 Miscellaneous: Small but diverse sources of income

The miscellaneous category includes $39 billion in revenue and covers a variety of smaller items, including fees, penalties and revenue from government investments. Although its contribution is relatively small, this category shows the versatility of government revenue sources.

📌 Challenges and strategies for a sustainable revenue policy

The U.S. government's revenue structure exhibits both strengths and weaknesses. The dominance of the income tax ensures a strong dependence on the economic performance of the population, while other sources such as corporate taxes and customs duties make comparatively small contributions. To ensure long-term stability, the following strategies could be considered:

1. Diversify revenue streams

Greater use of consumption taxes, carbon taxes or financial transaction taxes could generate new revenue while incentivizing behavior.

2. Corporate tax reform

A global minimum tax, as proposed by the OECD, could reduce tax avoidance and stabilize corporate tax revenues.

3. Modernization of social security

In order to secure the long-term financing of social and pension insurance, measures such as increasing the contribution assessment limit or greater taxation of high incomes could be introduced.

4. More efficient management and control

Improved tax administration could help curb tax evasion and avoidance, thereby increasing revenue.

⚖️ The balance between income and expenses

The analysis of the US government's revenue structure shows the challenges but also the opportunities for sustainable fiscal policy. While some revenue streams are stable and reliable, others need to be reformed or expanded to meet growing demands. A balanced mix of direct and indirect taxes, combined with efficient administration, can help ensure financial stability while promoting social justice.

📣 Similar topics

- 📊 The US government's revenue structure at a glance

- 💰 Income tax: The backbone of government finances

- 🏛️ Social and pension insurance contributions: stable but vulnerable pillar

- 📉 Corporate taxes: Falling revenues and global challenges

- 🌍 Tariffs and trade policy: Fiscal fringe issue with political relevance

- 🚬 Consumption taxes: More than just revenue – controlling consumption

- 🏘️ Inheritance tax: A small but controversial instrument

- 💡 Strategies for a sustainable revenue system of the future

- ♻️ Revenue policy and social justice: Finding the balance

- 📈 Financial reforms: ways to diversify sources of income

#️⃣ Hashtags: #government revenue #income tax #fiscal policy #tax system #socialjustice

Our recommendation: 🌍 Limitless reach 🔗 Networked 🌐 Multilingual 💪 Strong sales: 💡 Authentic with strategy 🚀 Innovation meets 🧠 Intuition

At a time when a company's digital presence determines its success, the challenge is how to make this presence authentic, individual and far-reaching. Xpert.Digital offers an innovative solution that positions itself as an intersection between an industry hub, a blog and a brand ambassador. It combines the advantages of communication and sales channels in a single platform and enables publication in 18 different languages. The cooperation with partner portals and the possibility of publishing articles on Google News and a press distribution list with around 8,000 journalists and readers maximize the reach and visibility of the content. This represents an essential factor in external sales & marketing (SMarketing).

More about it here:

🌍💰📈 Economic impact of high tariffs

🛒📉 Costs for consumers

High tariffs on imported goods are usually passed on to consumers, causing prices to rise. An example of this is the tariffs on washing machines imposed during the Trump administration. These led to an average price increase of 12%, which placed additional strain on US households every year. Higher consumer prices can reduce citizens' purchasing power and thus weaken the domestic economy.

🏭📦 Impact on companies

Companies that rely on imported raw materials or components face increased production costs due to high tariffs. This can affect their competitiveness in both the domestic and international markets. Some companies may be forced to increase their prices, which could reduce demand for their products. Others may move production overseas to save costs, resulting in job losses at home.

⚖️🔄 Economic distortions

High tariffs can lead to distortions in international trade. They reduce import volumes, which in turn reduces the potential revenue from these tariffs. They can also affect the efficiency of the national economy as resources may no longer be distributed optimally. Companies may be forced to use more expensive or less efficient domestic alternatives, increasing production costs and reducing competitiveness.

💥🌏 Retaliation and trade wars

Imposing high tariffs can cause other countries to respond with tariffs of their own, which can lead to a trade war. Such retaliation could hurt U.S. exports, threaten jobs and slow economic growth. Historically, trade wars rarely have winners; they usually lead to worsening economic conditions for all parties involved.

📜🕰️ Historical perspective on tariffs in the USA

In U.S. history, tariffs once played a more prominent role as a source of revenue. In the 19th century, tariffs were one of the main sources of funding for the federal government. However, with the introduction of the income tax in the early 20th century, the focus of government revenue shifted. Globalization and various free trade agreements led to further reductions in tariffs over time.

💡🌟 Alternative approaches and considerations

🏗️📚 Investing in the local economy

Instead of relying on high tariffs, investments in education, infrastructure and technological innovation could strengthen the long-term competitiveness of the US economy. By improving productivity and efficiency, companies can better compete in the global market without relying on protectionist measures.

🤝🌐 Free trade agreements and international cooperation

Free trade agreements can improve access to foreign markets and strengthen the export sector. International cooperation can also better address global challenges such as unfair trade or violations of patent rights. Active participation in multilateral organizations such as the World Trade Organization (WTO) can help resolve trade disputes through diplomatic channels.

🎯💼 Targeted economic policy

Instead of blanket tariffs, targeted economic policy measures could be more effective. Tax incentives for certain industries, investments in research and development or support programs for small and medium-sized companies can support the economy without causing the negative effects of high tariffs.

🔍⚡ The role of tariffs in Donald Trump's economic policy

Donald Trump has repeatedly highlighted tariffs as a key economic and political tool throughout his time in office and in his political campaigns. He argued that tariffs not only provide a source of revenue but could also be used strategically to achieve economic goals, such as promoting domestic industry or reducing the trade deficit. In his proposals, Trump suggested, among other things, using revenue from tariffs to finance tax cuts or pay off debt. One particularly radical proposal even included the idea of completely replacing income tax with tariffs.

Suitable for:

🛑❌ Why tariffs are not a realistic alternative to income tax

The idea of replacing income taxes with tariffs has been widely viewed by economists as unrealistic and economically impractical. The reason for this is the limited amount of customs revenue compared to the significant income tax revenue. To offset the income tax, tariffs of around 58-70% would have to be imposed on all imports. However, such a universal tariff rate would not only drastically increase import prices, but would also have far-reaching negative consequences for the economy.

Such a high tariff rate would significantly affect trade, drastically reduce import volumes and thus reduce the potential revenue from these tariffs. In addition, the consequences for consumers, companies and international trading partners would be serious. Everyday products that rely heavily on imports would become significantly more expensive, which could weaken consumers' purchasing power. At the same time, trade conflicts could arise as affected countries could respond with counter tariffs, which would further burden international trade.

📊🌎 Economic impact of tariffs: Key topics at a glance

Tariffs have not only fiscal but also profound economic impacts. These can be felt at both national and international levels and particularly affect consumers, companies and trading partners. The most important aspects are:

1. Costs for consumers

📈💸 Tariffs typically result in higher prices for imported goods. These costs are often passed on directly to consumers. Studies have shown that tariffs like those imposed during Trump's term had a significant impact on prices. An example of this was the tariffs on washing machines, which led to a price increase of around 12%. This placed an additional financial burden on American households without any immediate benefit.

2. Economic distortions

⚖️🔁 High tariffs can significantly impact trade. When imports become more expensive, the volume of imports often falls, which in turn reduces revenue from tariffs. At the same time, protectionist measures such as high tariffs can weaken the competitiveness of domestic industry by isolating it from necessary international market mechanisms. This can lead to lower efficiency gains and innovation rates in the long term.

3. Trade wars and retaliation

🌐⚔️ Tariffs can also exacerbate geopolitical tensions, especially if affected countries respond with counter-tariffs. This type of “retaliation” was clearly visible during Trump’s trade conflicts with China. Both sides imposed new tariffs on each other, which strained trade relations and slowed economic growth in both the USA and China.

Suitable for:

4. Labor market and economic growth

💼📉 The introduction of tariffs can also have an impact on the labor market. While they can create short-term jobs in certain sectors - such as the steel industry - they endanger jobs in other sectors that are dependent on international supply chains. The higher production costs caused by more expensive imports can force companies to cut jobs or even relocate operations abroad.

⚖️🏢 Political and economic limits on tariffs 🌐📊

🏭🚢 The dependence on international trade

The USA is one of the largest economies in the world and is heavily involved in global trade. Withdrawing from international trade agreements or imposing extremely high tariffs would not only harm trading partners, but also significantly weaken the US economy. Companies that rely on global supply chains could be forced to adapt their business models, which would entail significant costs.

🛍️💵 The role of hypermarkets

A large portion of the U.S. economy is consumption-driven, and higher prices for imported goods could have a lasting impact on consumers' purchasing power. This would not only have an impact on economic growth, but could also exacerbate social inequality, as lower-income households would be disproportionately affected by price increases.

🌎🔍 A limited source of income and the future of economic policy

Tariffs are a limited source of revenue for the U.S. government and cannot replace income taxes. The imposition of extremely high tariffs would cause significant economic disruption, including higher costs for consumers, trade conflicts and reduced economic growth. Although Donald Trump has viewed tariffs as a central element of his economic policy, their actual effectiveness as a source of revenue and an economic control tool remains severely limited.

A sustainable economic policy should be based on a balanced mix of domestic support and international cooperation. By investing in your own economy and constructive trade relations with other countries, stable and positive results can be achieved in the long term. It is important to take into account the complexities of the global economy and to seek solutions that both strengthen the domestic economy and promote international partnerships.

📣 Similar topics

- 📊 Economic consequences of high tariffs

- 🌍 Trade Wars and Global Tensions: The Role of Tariffs

- 🛒 Consumers in focus: How tariffs reduce purchasing power

- 💼 Companies under pressure: tariffs and their economic consequences

- ⚖️ Tariffs versus free trade agreements: A strategic comparison

- 📈 Protectionism and growth: Limits of customs policy

- 🇺🇸 The historical significance of tariffs in the USA

- 💰 Tariffs as a source of income: illusion or viable option?

- 🔄 Production relocations due to tariffs: domestic jobs at risk?

- 🧩 International cooperation instead of isolation: alternatives to high tariffs

#️⃣ Hashtags: #Trade Wars #Economic Policy #Protectionism #Consumer Costs #Free Trade

We are there for you - advice - planning - implementation - project management

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital - Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital - www.xpert.solar - www.xpert.plus