The German digital industry with AI, XR, IoT, IT digital media and cloud computing: growth despite crises and challenges

Language selection 📢

Published on: September 20, 2024 / update from: September 20, 2024 - Author: Konrad Wolfenstein

🖥️ The strong digital economy in Germany: resilience and growth defy crises

📈🌐 Short form / Update September 2024: The digital economy in Germany has proven to be remarkably resilient to economic and geopolitical uncertainties in recent years. The IT and telecommunications industry (ITK) in particular is showing impressive growth despite challenging conditions. A look back at the developments of the last few years and the forecasts for 2024 illustrate the robust and future-oriented orientation of the industry.

🚀📉 ICT growth 2024

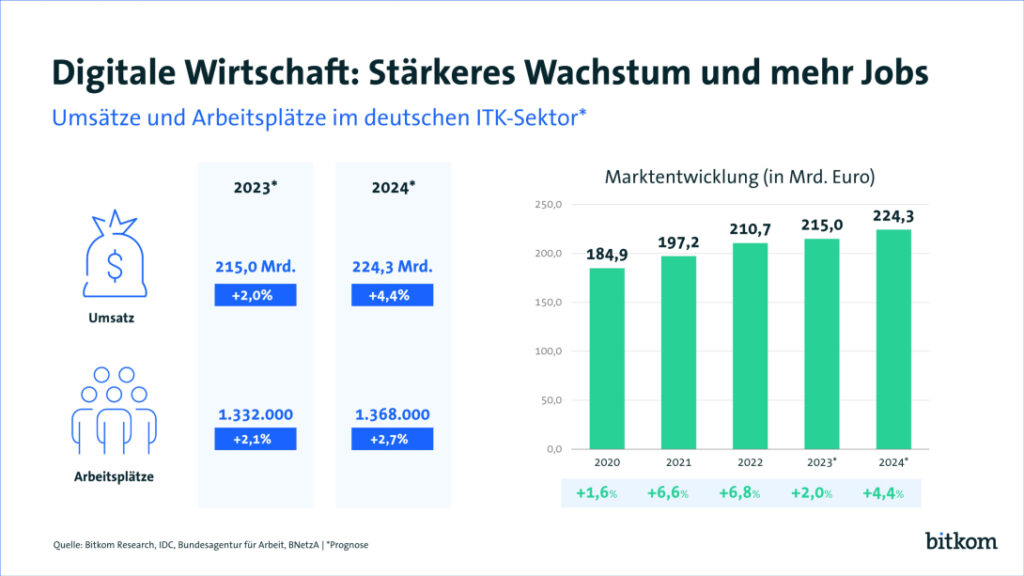

According to current forecasts from the digital association Bitkom, sales in the ICT industry will increase by 4.4% to 224.3 billion euros in 2024. This means that the industry is growing significantly faster than the economy as a whole, which illustrates the continued high demand for digital solutions and services. Especially in economically difficult times, it becomes clear how essential digitalization is for companies, society and the state.

This positive trend is in clear contrast to the overall economy, which, according to the ifo Institute, only expects growth of 0.4% for 2024. This difference highlights the ICT industry as the central growth driver of the German economy.

🛠️💼 Labor market and shortage of skilled workers

The Bitkom forecast also envisages an increase in the number of employees in the ICT industry by 36,000 to a total of 1.368 million by 2024. These figures agree with the forecasts of the ifo Institute, which assumes total employment of 46.071 million people in Germany.

However, the shortage of skilled workers remains a challenge. Despite job growth, the potential for new hires could be even higher if more skilled workers were available. This discrepancy is also reflected in the general labor market development: a slight increase in the unemployment rate to 5.9% is forecast for 2024, which indicates mismatches between supply and demand in sectors such as ICT.

🤖💡 Artificial intelligence as the key to growth

Artificial intelligence (AI) will remain a central topic in 2024. The Bitkom forecast expects the AI platform business to grow by 38.3% to 1.4 billion euros. This dynamic is further accelerated by technological advances from companies such as Google, Microsoft and Meta. At the same time, the EU is intensively discussing the AI Act, which is intended to create a regulatory framework for AI. The final vote in the EU Parliament is planned for the end of 2024, which the industry is following with great interest.

🌍🏆 International competitiveness

A global comparison shows that Germany still has some catching up to do despite the growth in the digital industry. While ICT sales worldwide are expected to grow by 5.6% in 2024, Germany, with growth of 4.4%, lags behind countries such as India (7.9%), the USA (6.3%) and China (5.7%) %) back.

These differences are also reflected in technological developments. Countries like China and the USA are driving progress in areas such as 5G, 6G and AI processors. In order not to lose out in international competition, increased investments in research and development as well as in the digital infrastructure are necessary. The federal government has announced corresponding measures in its digital strategy, which was updated in spring 2024, the implementation of which is now being closely monitored.

Overall, the German digital industry appears to be resilient despite global uncertainties. The ability to adapt to changing market conditions and drive innovation will be crucial to achieving forecast growth and strengthening international competitiveness.

📌 Other suitable topics

🖥️🚀 The digital economy in Germany

🌟 The digital economy in Germany has shown itself to be remarkably resilient to economic crises and geopolitical uncertainties in recent years. The companies in the IT and telecommunications industry (ITK) are defying the challenges and are recording impressive growth despite difficult conditions. A look at the developments of the last few years and the forecasts for 2024 shows how robust and future-oriented the industry is.

📈 Growth of the ICT industry in 2024

According to a current forecast by the digital association Bitkom, sales in the ICT industry will increase by 4.4 percent to a total of 224.3 billion euros in 2024. This means that the ICT economy is growing significantly faster than the overall economy, which is a sign of the continued high demand for digital solutions and services. Especially in economically challenging times, it becomes clear how important digitalization is for companies, society and the state.

“Most companies in the Bitkom industry present themselves as crisis-proof. Even under difficult economic conditions, characterized by geopolitical crises and budget cuts, sales and employment are increasing,” said Dr. Ralf Wintergerst, President of Bitkom. This resilience to crises is also reflected in the development of the labor market: according to Bitkom, a further 36,000 jobs are expected to be created in the ICT industry in 2024, which would increase the number of employees to a total of 1.368 million. 28,000 new jobs were created last year, which underlines the importance of the ICT industry as a job driver.

💼 Investments and business climate in the digital economy

Another sign of the strength of the digital economy is the positive development of the business climate. While the ifo index for the overall economy recently slipped into the red, the Bitkom-ifo digital index rose against the trend. This positive outlook is also reflected in companies' investment plans: around 22 percent of ICT companies plan to increase their investments in 2024, while 61 percent intend to keep their spending at a constant level.

Companies invest particularly heavily in software and research and development. The industry's enthusiasm for innovation and optimism are a key to future success. Wintergerst emphasizes: “The Bitkom industry is starting the new year with confidence. With its solutions, it brings increases in efficiency and productivity for companies and creates a positive atmosphere.”

💻 Information technology as a growth driver

Information technology (IT) is and remains the largest growth engine within the digital economy. Sales growth of 6.1 percent to 151.5 billion euros is expected for 2024. Particularly noteworthy is the software business, which is expected to grow by 9.4 percent to 45.5 billion euros.

One driver of this growth is the increasing importance of platforms for developing, testing and delivering software. A sales increase of 12.3 percent to 12.2 billion euros is forecast here. The boom in artificial intelligence (AI) is also reflected in the numbers: business with AI platforms is expected to increase by a remarkable 38.3 percent to 1.4 billion euros. “Artificial intelligence will remain the top topic in 2024. Companies should now deal with AI, set up corresponding projects and also invest in the technology,” advises Wintergerst.

☁️ IT services and cloud solutions

Another growth area is IT services. According to Bitkom, sales in this segment will increase by 4.8 percent to 51.7 billion euros in 2024. Services related to cloud technologies are developing particularly dynamically. Sales in this area are expected to grow by 17 percent to 17.7 billion euros. These developments show that the German economy has recognized the importance of digitalization and especially cloud technologies.

🖥️ Hardware market is recovering

After a slump last year, the hardware market will recover significantly in 2024. Sales are expected to increase by 4.6 percent to 54.4 billion euros. A key growth driver is the Infrastructure-as-a-Service (IaaS) area, which is expected to grow by 24.5 percent to 5.8 billion euros. Sales of workstations and wearables are developing just as well, each of which will increase by double-digit growth rates. Sales of PCs are also recovering and growing by 4.2 percent to 7.9 billion euros.

🔧 Challenge of a shortage of skilled workers

However, despite these positive developments, there are still challenges that could slow down the industry's growth. One of the biggest hurdles is the shortage of skilled workers. According to Bitkom, significantly more jobs could be created in the ICT industry if there were enough qualified specialists available. This lack of skilled personnel represents a key challenge for companies and limits the potential for further growth.

However, Wintergerst sees digitalization as a solution to many of the current challenges: “Digitalization is the answer to the current challenges for the economy, society and the state. Our resolution for 2024 must be: more determination in digitalization and more freedom for innovation.”

📞 Telecommunications market remains stable

The telecommunications market is also stable, albeit with more moderate growth. For 2024, sales are expected to increase by 1.0 percent to 72.8 billion euros. Telecommunications services account for the largest share of the telecommunications market, with sales increasing by 1.6 percent to 52.6 billion euros.

📺 Consumer electronics continue to decline

One area of the digital industry that continues to be under pressure is classic consumer electronics. A decline in sales is expected for the fourth year in a row. In 2024, sales in this area are expected to fall by 3.4 percent to 7.8 billion euros. The decline is attributed to weak demand for classic consumer electronics products such as televisions and game consoles. However, the industry is hoping for a slight increase in demand due to the European Football Championship, which will take place in 2024.

🌐 Germany's role in international comparison

Despite the positive developments within the German digital economy, the country continues to lag behind in international comparison. While ICT sales worldwide are expected to increase by 5.6 percent to 4.91 trillion euros in 2024, Germany is expected to only record moderate growth. Countries like India, the USA and China are growing significantly faster and are consolidating their position as leading ICT nations.

In order to remain internationally competitive, Bitkom President Wintergerst calls for digitalization to be pushed forward at greater speed in Germany. “In order for Germany to catch up with digitalization, companies and administrations must increase their investments more decisively,” warns Wintergerst.

Digitalization therefore remains a central topic for the German economy. Companies' willingness to invest remains high, and the industry is crisis-proof and innovative. But in order not to lose touch internationally, an increased focus on digital transformation is necessary. The Federal Government is required to create the right framework conditions to ensure Germany's competitiveness in the long term.

📣 Similar topics

- 📊 Growth of the digital economy in Germany

- 🚀 ICT industry on record

- 💼 Investments in the ICT sector for 2024

- 🧠 Artificial intelligence as a growth engine

- ☁️ Boom in cloud technologies

- 💻 Hardware market shows recovery

- 🧑💻 Skilled labor shortage as a central challenge

- 📱 Telecommunications sector remains stable

- 🎮 Decline in the consumer electronics market

- 🌍 Germany's position in an international comparison

#️⃣ Hashtags: #DigitalEconomy #ITKindustry #Digitalization #Investments #Skills shortage

🌐📱 The digital industry: an overview

🌐📊 Information Technology (IT)

- Software development

- System integration

- IT consulting and services

- IT security

📶📡 Telecommunications

- Internet service provider

- Mobile operator

- Broadband services

🛒💳 Ecommerce

- Online trading (B2C, B2B)

- Payment processing

- Logistics services for online trading

📱🎥 Digital Media

- Social media platforms

- Streaming services (video, music)

- Online advertising

🤖🧠 Artificial intelligence and machine learning

- Speech and image recognition

- Automation and robotics

- Data analysis and big data

☁️🖥️ Cloud computing

- SaaS (Software as a Service)

- IaaS (Infrastructure as a Service)

- PaaS (Platform as a Service)

🛡️🔒 Cyber security

- Protection against cyber attacks

- Data protection solutions

- Security monitoring and management

📶🏠 Internet of Things (IoT)

- Connected devices and sensors

- Smart home technologies

- Industrial IoT applications

🔗💰 Blockchain and cryptocurrencies

- Cryptocurrency exchanges

- Blockchain developments and applications

- Smart contracts

🕶️🌟 Augmented Reality (AR) and Virtual Reality (VR)

- Entertainment (games, films, events)

- Training and simulation

- Virtual tours and experiences

💸📈 Fintech (financial technology)

- Mobile banking

- Digital payment solutions

- Robo-advisors and automated investment advice

🎓📚 EduTech (educational technology)

- Online learning and MOOCs (Massive Open Online Courses)

- Learning management systems

- Educational technologies for schools and universities

🩺📲 HealthTech (health technology)

- Telemedicine

- Electronic health records

- Wearables and health apps

🎮🎭 Games and entertainment

- Video games and interactive experiences

- eSports

- Digital content creation

These areas often interact with each other and overlap in some aspects, showing how diverse and dynamic the digital industry is. Not only does it drive technological innovation, but it also changes the way people live and work.

We are there for you - advice - planning - implementation - project management

☑️ Industry expert, here with his own Xpert.Digital industry hub with over 2,500 specialist articles

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital - Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital - www.xpert.solar - www.xpert.plus