Digital platforms are transforming the global economy

Language selection 📢

Published on: September 11, 2018 / update from: August 31, 2021 - Author: Konrad Wolfenstein

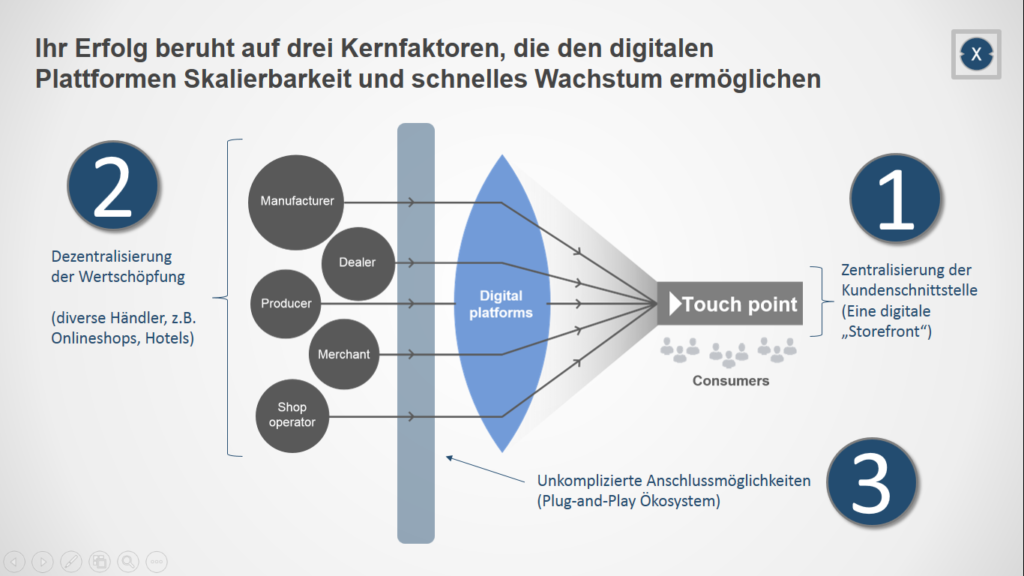

The global economy is booming and most companies can look forward to full order books. However, development is not as dynamic in all areas. For a few years now, companies in the IT sector in particular that have subjected their business model to digital transformation have benefited from above-average growth. They often do not have their own machines or other physical production factors, but rather draw all their strength from brokering services between suppliers and customers. Their efficient performance is based on powerful platforms through which their users exchange services with one another. First and foremost are the e-commerce giants Amazon and Alibaba, which are among the largest developers and beneficiaries of the platform economy. This has the potential to fundamentally transform the economy of tomorrow. Anyone who doesn't prepare for this risks losing touch.

Why the platform economy will prevail

- Would you like a few numbers?

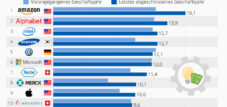

There are now around 500 different digital platforms worldwide; with annual growth rates of 20 and more percent - The 60 most valuable platforms are worth around seven trillion dollars together. All platform companies together reach a total value of over eight billion dollars

- The seven largest B2C platforms have a greater value than all stocks in the Euro Stoxx 50

- Amazon is the second company, after Apple, to break the trillion-dollar mark in value

- While the top 10 platforms grow almost 20% per year, the top 10 of the German DAX only achieve around 10%

Digital platforms spread across all industries

The players in the platform economy are active in almost all industries. Its rise began in the 1990s with e-commerce marketplaces such as Amazon and Ebay. Former startups like Facebook, Airbnb, Uber, Spotify and others followed later and are now worth double-digit billions and more. Your spectrum includes not only B2C but also a wide variety of B2B areas. These include trading platforms such as Alibaba, industry-specific B2B associations such as SAP-Ariba and Wucato, or freelancer platforms such as Upwork, which provide all kinds of services.

The lack of any production capacity is their biggest advantage over conventional industrial and service groups; since their business is based solely on digital data, they can scale their business model much faster. Detached from actual production costs, they usually earn a double-digit percentage from every single transaction that is processed on their platform and also generate high income from advertising that market participants place on their sites.

If problems arise, they can more easily adapt the model, its content and direction if necessary, whereas a manufacturing company incurs very high investments and project durations when changing strategy. It's no wonder that financial analysts believe they have a greater chance of decisively shaping the markets in their areas in the future.

How the platforms depend on classic providers – two examples

Mobility: Traditional car rental companies such as Herz, Avis or Europcar have to maintain hundreds of thousands of cars globally in order to be able to offer their customers a comprehensive service. The result is billions in tied up capital for the vehicles, the value of which decreases with every day and every kilometer driven. In comparison, brokers such as Uber or Lyft do not have their own vehicle fleets, but they benefit from commissions from every trip arranged. The stock market rewards this accordingly and values Uber, for example, at around 75 billion US dollars, while a rental company like Europcar is valued at only two to three billion US dollars.

Hotel industry: Chains like Marriott and Hilton have literally millions of rooms available worldwide. With corresponding fixed and ongoing costs. In contrast, the Airbnb platform providers do not manage a single hotel with a comparable quantity. The market value of Airbnb is higher than that of Hilton, for example.

Europe is lagging behind developments

Platform operators from the USA and China, especially the billion-dollar Silicon Valley companies, are celebrating the successes. Companies from the USA dominate the platform world with a share of 67% (based on company value), while Asia follows with 30%. However, China in particular is catching up, as most of the new platform models, especially in the B2B segment, are being developed there. Europe's share of the booming business? This is a shockingly meager 3%.

A Bitkom study from January 2018, which surveyed 505 companies with more than 20 employees, shows how much the future trend still “uncharted territory” for many in Germany 54% of respondents said they had never heard of the term “digital platform” . These are not exactly signs that the German economy is about to catch up. However, a quick rethink is necessary because the platforms endanger the traditional business models of long-established companies.

The challenges for traditional manufacturers are high, but a step in this direction is unavoidable, as the platform economy shifts essential value creation components to the digital economy and business areas are changed or even replaced. However, many are already despairing of the completely different know-how requirements compared to their core business. But the efforts can be worth it, because the need for platforms is increasing, especially in the B2B sector. The following models conceivable:

- Focus on shared use of resources, capacities and know-how - suitable for companies from industries with overlap. Prerequisite: Allowing a minimum level of knowledge transfer between participants

- Focus on cooperation platform in which the products and services of the participants complement each other (horizontal or vertical cooperation) to offer customers added value

- Focus on digital data and technologies – Partners release their data (e.g. from production, purchasing or logistics) for sharing and analysis to increase know-how and optimize workflows

Depending on their level of knowledge and market power, the companies concerned can choose whether they

- Build your own platform model (for innovators and first movers)

- build a platform with other partners (if greater market power and importance with partners is expected)

- Expand existing platforms for cooperation or as an additional sales channel

Applications in logistics

The logistics industry is predestined for a wide variety of platform models. These include spot marketplaces, eForwarders and SCM platforms. A focus of many companies is currently on establishing shipping platforms. Logistics startups like Shipcloud offer their customers an interface to shipping service providers like DHL or UPS, through which they can process their deliveries without the platform putting a single truck on the road. There are comparable offers for international freight logistics (Freightos) or the affordable organization of sea freight (Flexport).

of creating the next big thing with a platform that offers clear added value Ultimately, many people ask themselves why there is no business model for parcel shipping comparable to Uber, for example.

As the transport volume of goods moved around the world will continue to increase in the future, the demand for platforms that support this cost-effectively is increasing. A smooth organization of the flow of goods is therefore required, which can hardly be carried out efficiently in the future without networked communication and data exchange and analysis in real time.

The boundaries between industries such as retail – whether e-commerce, omnichannel or unified commerce – and logistics are rapidly disappearing. Large platforms such as Amazon or Zalando have long since started to provide their retailers with logistics structures so that the goods can be stored cheaply and can reach customers quickly.

Offer, visibility and transparency

In this promising market, the established top dogs have an advantage, but small companies have a chance. In order to counter the big players, small logistics service providers from the areas of transport, storage and fulfillment could, for example, work together with manufacturers of the necessary hardware and software to form platforms in the future that offer customers their services from a single source at the best possible conditions. Sharedload.com, where shippers place transport orders and receive corresponding offers from logistics providers (and vice versa), is just one example of such collaborative platform models. There is certainly a great opportunity for platforms in this type of booking.com for logistics services.

In addition to a comprehensive offering, a detailed overview and transparency, the customer can also find answers to the reliability of the respective provider in the form of reviews. For them, the platform also has the advantage that they can make better use of their capacities and at the same time gain new customers. Platform operators who manage to create visibility and transparency for both buyers and providers have great chances of successfully implementing the platform economy in logistics. The more suppliers, dealers and manufacturers on his site, the larger the transactions made and thus the commission-based income.