Digital economy as a beacon of hope: Growth despite economic downturn - Germany's digital market ranks 4th in a global comparison

Xpert pre-release

Language selection 📢

Published on: January 13, 2025 / Update from: January 13, 2025 - Author: Konrad Wolfenstein

Digital economy as a beacon of hope: Growth despite economic downturn - Germany's digital market ranks 4th in a global comparison - Image: Xpert.Digital

Economy in slump, tech on the rise: The digital lifeline in Germany?

Bright spot in the recession: The digital industry continues to grow

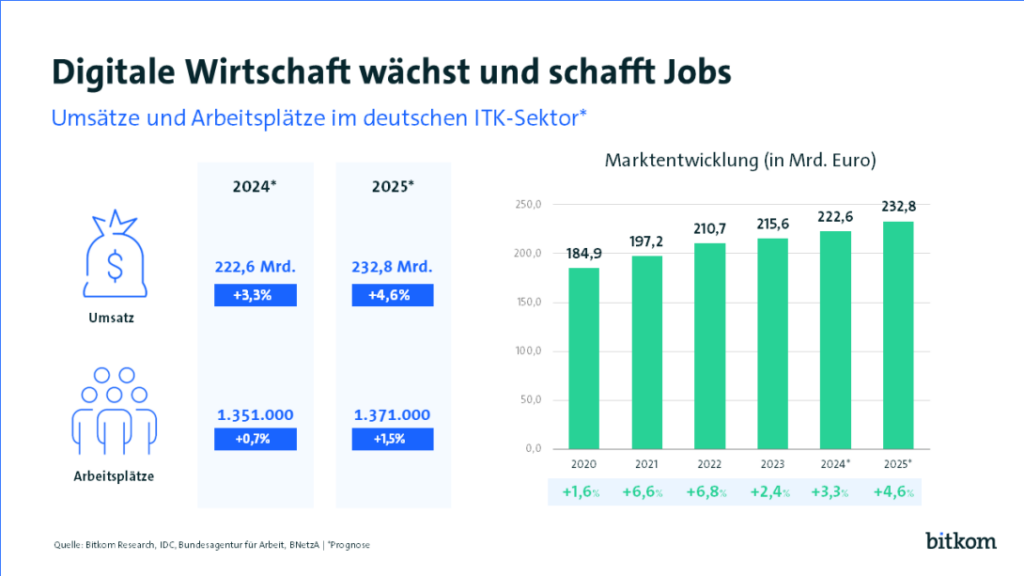

Germany is facing major economic challenges. For the third year in a row, the nation is struggling with a recession that is negatively impacting numerous industries. But in the midst of this economic downturn, the digital economy is emerging as a ray of hope and a driver for growth and innovation. According to the digital association Bitkom, the German market for IT and telecommunications (ITK) is expected to record a sales increase of 4.6 percent to 232.8 billion euros in 2025. As early as 2024, ICT sales increased by 3.3 percent to 222.6 billion euros. This development underlines the relevance and resilience of the industry, which is increasingly becoming a central pillar of the German economy.

In parallel to the increase in sales, numerous new jobs are being created in the industry. According to Bitkom forecasts, the number of employees in the ICT sector is expected to grow by around 20,000 to 1.371 million in 2025. 9,000 new jobs have already been created in 2024. Bitkom President Dr. Ralf Wintergerst emphasizes: “The digital economy offers a ray of hope in difficult times, increases sales and creates new jobs. The ICT sector is now Germany's largest industrial employer. According to forecasts, the business of most companies in the IT and telecommunications industry will be positive in 2025. The direction in IT is right.” At the same time, he demands: “Politicians should do everything they can to increase the pace of growth.”

Artificial intelligence: A boom with 43 percent growth

A key driver of growth is information technology, which continues to act as the core of digital transformation. IT sales in Germany are expected to rise to 158.5 billion euros in 2025, an increase of 5.9 percent. The software segment is particularly outstanding, forecasting growth of 9.8 percent to 51.1 billion euros. The ongoing boom in artificial intelligence (AI) stands out here: sales of AI platforms on which applications can be developed, trained and operated will increase by an impressive 43 percent to 2.3 billion euros. Wintergerst sees enormous opportunities here and demands: “The coming federal government must use the momentum and make Germany an AI country.”

Collaboration tools for mobile working and team collaboration are also recording double-digit growth rates. These software solutions are growing by 12 percent to 1.4 billion euros. Security software, an increasingly critical area, will achieve an 11 percent increase in sales to 5.1 billion euros in 2025. In addition, the market for cloud services will grow by 17 percent to 20 billion euros. Overall, sales of IT services rose by 5 percent to 53.8 billion euros, which underlines the growing importance of digital solutions in all areas of the economy.

IT hardware: infrastructure as a driver of growth

The market for IT hardware is also robust. The forecasts for 2025 expect growth of 3.3 percent to 53.7 billion euros. The biggest growth driver is the area of Infrastructure-as-a-Service (IaaS), i.e. rented server, network and storage capacities. This segment will grow by an impressive 24.4 percent to 6.2 billion euros.

Additional impetus comes from wearables, whose sales rose by 5.1 percent to 2.6 billion euros, and from mobile PCs, which recorded growth of 4.5 percent to 6 billion euros. However, classic consumer electronics continue to decline. Sales in this segment are shrinking for the fifth year in a row, expected to fall by a further 7.5 percent to 7.2 billion euros in 2025. Wintergerst comments: “The consumer electronics business suffers particularly badly in times of high inflation and economic uncertainty - many households pay attention to their money and often forego major purchases.”

Telecommunications: Investments in infrastructure are growing

The telecommunications market also remains on a growth path. An increase of 1.8 percent to 74.3 billion euros is expected for 2025. The largest share is attributable to telecommunications services, which generate sales of 53.5 billion euros, an increase of 1.4 percent. Investments in telecommunications infrastructure increased by 3.5 percent to 8 billion euros, while sales of terminal equipment increased by 2.7 percent to 12.8 billion euros. According to Wintergerst, “network operators are massively accelerating the expansion of gigabit networks and mobile communications.”

Investments by ICT companies remain at a high level overall: 17 percent of companies plan to increase their investments in 2025, while 59 percent want to keep the level constant. However, 23 percent of companies have to reduce their investments. The focus is on software as well as research and development in order to further strengthen the innovative strength of the industry.

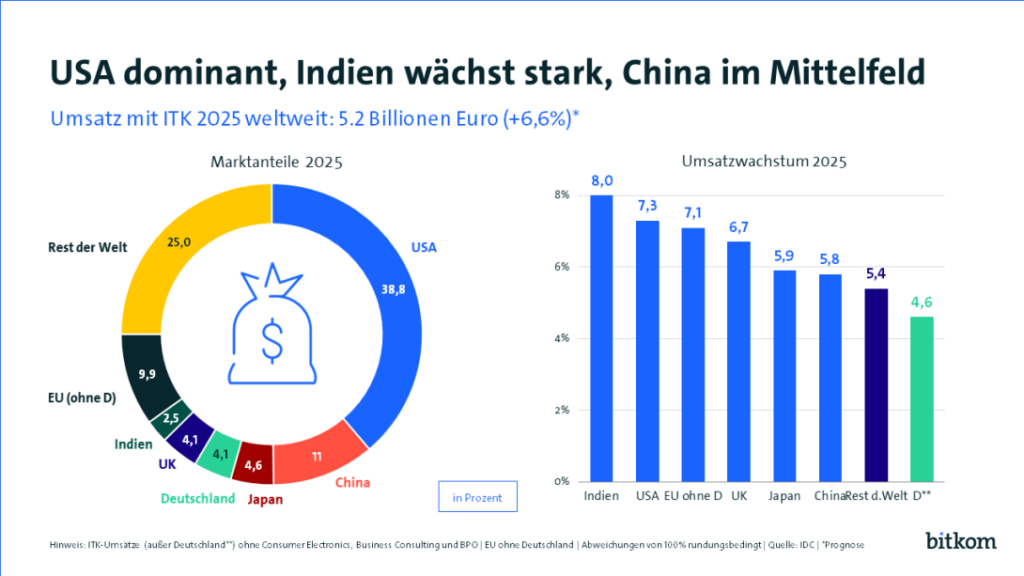

International perspectives: Germany's digital market ranks 4th worldwide

In a global comparison, Germany remains a significant player in the ICT market. However, with sales growth of 4.6 percent, Germany is behind other nations such as the USA (7.3 percent), India (8 percent) and the EU excluding Germany (7.1 percent). The global ICT market will reach a volume of 5.2 trillion euros in 2025, an increase of 6.6 percent. The USA retains its dominance with a global market share of 38.8 percent, followed by China (11 percent) and Japan (4.6 percent). Germany shares fourth place with Great Britain and has a share of 4.1 percent. India is close behind at 2.5 percent.

Wintergerst emphasizes that, despite its strong position in global comparison, Germany must do more to remain competitive. “It is important that the future federal government quickly starts its work after the elections and focuses on digital policy. We need less regulation and instead more investment and innovation.”

Challenges and areas of action for the next federal government

The next federal government is faced with the task of sustainably improving the framework conditions for the digital economy. Bitkom sees four central areas of action:

- Mobilization of capital and skilled workers: In order to stimulate the economy, more investment in companies and measures to combat the shortage of IT skilled workers are required.

- Digitalization of administration: More efficient government structures with modern registers and digital identities are essential.

- Establishment of a digital ministry – Wintergerst demands: “Real progress will only be achieved if there is a driver for digital issues within the next federal government. The time is ripe for an independent digital ministry.”

- Strengthening digital sovereignty:* Germany must break away from one-sided dependencies and build up its own competencies in key technologies such as microelectronics, IT and cyber security, AI, industrial metaverse and quantum computing.

Opportunities and responsibility

The digital economy remains a beacon of hope in difficult times and shows that innovation and growth are possible even under adverse economic conditions. Germany has the opportunity to strengthen its position as one of the world's leading ICT markets, but must create the political and structural conditions to do so. The appeal to politicians is clear: investments, innovations and the

Our recommendation: 🌍 Limitless reach 🔗 Networked 🌐 Multilingual 💪 Strong sales: 💡 Authentic with strategy 🚀 Innovation meets 🧠 Intuition

At a time when a company's digital presence determines its success, the challenge is how to make this presence authentic, individual and far-reaching. Xpert.Digital offers an innovative solution that positions itself as an intersection between an industry hub, a blog and a brand ambassador. It combines the advantages of communication and sales channels in a single platform and enables publication in 18 different languages. The cooperation with partner portals and the possibility of publishing articles on Google News and a press distribution list with around 8,000 journalists and readers maximize the reach and visibility of the content. This represents an essential factor in external sales & marketing (SMarketing).

More about it here:

The stability of the German digital economy as a growth engine

Economic resilience and sales performance

The German digital economy is defying the economic turbulence and proving to be a stable growth driver. Despite the threat of recession for the third year in a row, the digital association Bitkom is forecasting a significant increase in sales of 4.6 percent for the information and telecommunications technology (ITK) market in 2025. This would correspond to a total volume of 232.8 billion euros, according to By 2024, growth of 3.3 percent to 222.6 billion euros had already been achieved. These positive figures illustrate the fundamental importance of digitalization for the economy and society.

Creating new jobs in difficult times

The digital economy not only contributes to increasing sales, but also generates new jobs. According to Bitkom, around 20,000 additional jobs will be created in 2025, so that the total number of employees should increase to 1.371 million. Already in 2024 there was an increase of 9,000 jobs. Dr. Ralf Wintergerst, President of Bitkom, described the digital economy as a “Lichtblick in difficult times” and referred to the positive business prospects of the industry. At the same time, he appealed to the federal government to further promote the pace of growth through targeted measures.

Information technology as a growth engine in the ICT industry

Predictions for the IT sector 2025

Information technology remains the most important growth driver within the ICT industry. Sales of 158.5 billion euros are forecast for 2025, which corresponds to an increase of 5.9 percent. Particularly noteworthy is the software sector, which is expected to grow by 9.8 percent to 51.1 billion euros. The boom in the field of artificial intelligence (AI) plays a central role. Sales of AI platforms used for the development and operation of AI applications are expected to increase by an impressive 43 percent to 2.3 billion euros. Dr. Wintergerst emphasized that Germany must seize the opportunity to become a leading AI location.

Further growth areas in information technology

In addition to software development, other IT areas are also showing strong growth. Collaboration tools that make mobile working easier are expected to grow by 12 percent to 1.4 billion euros, while security software is expected to grow by 11 percent to 5.1 billion euros in the face of increasing cyber threats.

Cloud technology and IT services on the rise

Ten percent growth in cloud services

Cloud services continue to be a rapidly growing segment. Sales are expected to increase by 17 percent to 20 billion euros in 2025. These services enable companies to react flexibly and scalably to market changes. IT services as a whole – including consulting, implementation and maintenance – are also expected to increase by 5.0 percent to 53.8 billion euros.

Growth in the IT hardware market

Positive development despite economic uncertainty

The IT hardware industry is also showing positive trends. In 2025, sales growth of 3.3 percent to 53.7 billion euros is expected. Particularly noteworthy is the Infrastructure-as-a-Service (IaaS) segment, which is expected to grow by 24.4 percent to 6.2 billion euros. Wearables such as smartwatches and fitness trackers, as well as mobile PCs, remain relevant. Sales of mobile PCs are expected to increase by 4.5 percent to 6 billion euros.

Decline in consumer electronics

The only downside remains classic consumer electronics, which have been recording declining sales for five years. A decline of 7.5 percent to 7.2 billion euros is expected for 2025, due to economic uncertainties and high inflation. Dr. Wintergerst explained that many households would forego major purchases.

Growth in the telecommunications sector

In the telecommunications sector, Bitkom expects growth of 1.8 percent to 74.3 billion euros in 2025. Telecommunications services accounted for the largest share of this at 53.5 billion euros, which corresponds to an increase of 1.4 percent. It is encouraging that investments in telecommunications infrastructure are expected to pick up again and increase by 3.5 percent to 8.0 billion euros. Sales of end devices also increased by 2.7 percent to 12.8 billion euros. Dr. Wintergerst emphasized that network operators are massively accelerating the expansion of gigabit networks and mobile communications. These investments are crucial for the future viability of the digital infrastructure and the basis for innovative applications and services.

Investments by ICT companies

Overall, investments by ICT companies remain high. 17 percent plan to increase their investments in 2025, while 59 percent want to keep them constant. However, 23 percent of companies feel forced to reduce their investments. The investments flow primarily into software and research and development, which underlines the importance of innovation for the industry. Despite the positive business outlook, not all companies benefit equally from the forecast market growth. Small and medium-sized companies in particular can only partially benefit from the general upswing, which points to structural challenges and different competitive conditions.

The global digital market in comparison

In a global comparison, Germany ranks fourth in the digital market. Global IT and telecommunications sales are expected to increase by 6.6 percent to 5.2 trillion euros in 2025. India will record the strongest growth with an increase of 8 percent, followed by the USA with a forecast growth of 7.3 percent. The EU (excluding Germany) is expected to achieve an increase of 7.1 percent, while Great Britain expects 6.7 percent and Japan 5.9 percent. Sales growth of 5.8 percent is forecast for China. With its forecast growth of 4.6 percent, Germany is slightly below the global average.

Market shares worldwide

The USA continues to dominate the global market with a share of 38.8 percent in 2025. China (11.0 percent), Japan (4.6 percent) and Germany, which shares fourth place with Great Britain (respectively), follow well behind 4.1 percent). India has a global market share of 2.5 percent. The EU excluding Germany accounts for 9.9 percent of the global ICT market. These figures illustrate the need for Germany to further intensify its efforts in the area of digitalization in order to be able to survive in international competition.

Demands on the future federal government

In view of these developments, Bitkom President Wintergerst demanded a “re-start” for Germany after the Bundestag election. He emphasized that the future federal government quickly started working and digital policy must focus on. Wintergerst spoke for less regulation and instead for more investments and innovations. In order to boost the economy, it is necessary to mobilize more capital for companies and to alleviate the lack of IT specialists. He also called for a revision of state structures and consistent digitization of administrations with modern registers and digital identities.

Establishment of an independent digital ministry

One of Bitkom's central concerns is the establishment of an independent digital ministry in the next legislative period. Wintergerst argued that real progress can only be achieved if there is a central contact and driver for digital issues within the federal government. This ministry should concentrate on the core tasks and cross-sectional issues of digital policy and not be affiliated with another department.

Digital sovereignty of Germany

In addition, Wintergerst called for greater digital sovereignty for Germany. It is important to reduce one-sided dependencies and build up our own capabilities in key technologies such as microelectronics, IT and cybersecurity, AI, the industrial metaverse and quantum computing in order to be able to take a leading position on global markets. He appealed to the next federal government to demonstrate its willingness and ability to act and to recognize and solve challenges in the digital area. Wintergerst emphasized that digital policy must become a focus in the coming legislative period in order to secure Germany's long-term competitiveness and fully exploit the potential of digitalization. The next government's decisions will be crucial to whether Germany can maintain and expand its position in global digital competition.

We are there for you - advice - planning - implementation - project management

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital - Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital - www.xpert.solar - www.xpert.plus