Cryptocurrency Blockchains: All information short and compact

Language selection 📢

Published on: August 24, 2018 / update from: August 30, 2024 - Author: Konrad Wolfenstein

The German blockchain ecosystem

Quite a few experts say that blockchain technology is on the way to developing in a similar way to the Internet around 20 years ago. If you follow this thesis, the question arises as to whether the next Google, Amazon or Facebook has already been founded or will only emerge in the coming years. Whether there will be a blockchain champion from Germany is an equally exciting question. LSP Digital examined the startup ecosystem of blockchain-focused business models in Germany. One result of this is that a quarter of companies are currently still concentrating on basic infrastructure issues. The largest application segments are heavily B2B focused with finance and industry. Consumer topics are still rather underrepresented outside of crypto wallets.

Cryptocurrency Blockchains: Supercomputer Power for Security

Blockchains are special databases that can manage transaction data without a central control authority, without the need for mutual trust and with complete transparency. The largest and best-known public blockchain is Bitcoin's - it currently runs on a network of around 5,600 servers on the Internet and carries out over 240,000 transactions per day.

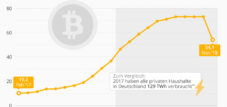

That's not a big deal in the financial world. What is impressive, however, is the computing power required for counterfeit-proof operation: Bitcoin alone uses almost 60,000 times as much computing power as the 500 fastest supercomputers in the world have.

The blockchain is “involuntary” supercomputer - because the energy expenditure is artificially caused. For every “block” of transactions that are written in the blockchain, special arithmetic tasks must be solved. This prevents fraud, although no one has to trust the other. The security principle is called “Proof of Work”. This high effort is also a reason why most of the blockchain initiatives for companies and institutions rely on “private” blockchains: This is the only way to replace the “Proof of Work” using a less complex method of protecting.

The “ Golem Network ”, on the other hand, wants to make the need to virtue: Based on the blockchain principles, a decentralized supercomputer is to be created here, the resources of which should be booked for arithmetic-intensive tasks as required.

Blockchain increasingly popular among investors

The really big cryptocurrency boom seems to be slowly over. Bitcoin and Co. are running out of steam, at least compared to the price developments in the winter. The current price is around $6,500 – at the end of 2017 the digital coin was over $10,000.

But the blockchain principle behind it, i.e. a continuously expandable list of data records, cannot only be used for cryptocurrencies. Accordingly, more and more start-ups are entering the market whose services are based on the blockchain system. As the graphic from Statista shows, this attracts investors. coindesk.com, the total amount of venture capital investments in blockchain technologies in the first half of 2018 is already 1.7 billion US dollars - almost three times as high as the entire annual value in 2017.

2017, the boom year for cryptocoins

2017 was the year in which Bitcoin made the leap into the financial mainstream. The value of the cryptocurrency climbed to dizzying heights.

While Bitcoin was at the center of media attention, other digital currencies benefited significantly more from the current crypto boom, as the graphic from Statista shows. According to coinmarketcap.com, the value of Ripple increased by 36,018 percent. Ethereum – number two behind Bitcoin in terms of market capitalization – rose 9,162 percent.

In total, there were 1,335 different digital currencies with a total value of 572.5 billion US dollars at the end of December. For comparison: a year earlier there were 644 different coins with a total value of 16.1 billion US dollars. Whether this is all sustainable or whether we will soon be hearing about a crypto bubble bursting still seems to be an open question.

However, it is already clear that the crypto boom is not sustainable from an environmental point of view. According to one estimate, around 29 terawatt hours of electricity were needed for Bitcoin mining alone last year - that's more than the electricity consumption of Ireland.

120 blockchain startups in Germany

Blockchain and Initial Coin Offerings (ICO for short) currently dominate the headlines of relevant tech blogs and increasingly also of the business press. An increase in importance that can be proven: The global financing volume through ICOs, at 6.3 billion US dollars in the first quarter of 2018, already exceeds the volume for the entire year 2017 (5.3 billion US dollars). LSP Digital has analyzed the German blockchain market in detail and has come to the conclusion that there are a total of 120 startups in this country whose core business model is based on the topic of blockchain. Only the underlying technology is decentralized; over half of the companies concentrate on the Berlin location. 45 percent of companies were able to secure financing via ICO.

New crypto projects will soon be as efficient as Visa

In contrast to digital currencies such as Bitcoin, Ethereum, Dash, Litecoin, Nano and Ripple, Visa, as a long-established payment system, offers energy-efficient transactions and has the largest transaction capacity. This emerges from a study by the strategic management consultancy LSP Digital . The crypto coins considered here are mostly far from being as attractive for customer transactions as Visa. Bitcoin and Ethereum in particular – after all, the coins with the highest market capitalization – are currently hardly scalable and therefore unattractive for customer transactions. This is reflected in the low transaction capacity and high energy consumption of the transactions: Bitcoin's transaction capacity is 8,000 times lower compared to Visa, while the energy consumption per transaction is 46,000 times higher. Ripple and Nano (formerly Raiblocks), on the other hand, have a much higher transaction capacity and lower energy consumption than Bitcoin. The underlying technologies from Ripple or Nano have the potential to seriously compete with Visa.

From bits to cash at the ATM

While the cryptocurrency Bitcoin rose rapidly in value this year, driven by speculative transactions, the number of ATMs where consumers can have their Internet money paid out in cash has also increased.

As our infographic shows, the United States remains the leader. There, as in Canada and Great Britain, the number of ATMs more than doubled from January to January year-on-year. The increase is notable in Austria, where the number rose from 15 to 96 machines. Coin ATM Radar, there are still no such converter machines in Germany.

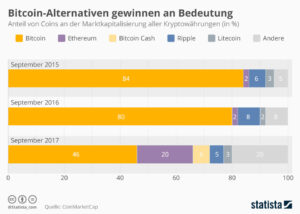

Bitcoin alternatives are gaining importance

The Bitcoin is almost the mother of all cryptocurrencies and the most successful so far. A Bitcoin is currently being traded for over $ 4,500. For comparison: a really more than $ 1,300 US dollar is currently worth it. But other digital currencies are also booming. Coinmarketcap, Bitcoin and Bitcoin Cash are still “only” together for a little more than half of the market capitalization of all cryptocurrencies. It was different in previous years, as the view of the distribution in previous years shows. For the rise of the new internet currencies, a whole range of reasons are called capital escape in the media due to political and economic uncertainties as well as the zero or low interest rate policy of important central banks.

Crypto coins are booming like never before

coinmarketcap.com, there were 1,334 different cryptocurrencies with a market capitalization of around $411 billion. A single Bitcoin is currently worth over $15,000. Just a few years ago, crypto coins were only for internet nerds. In mid-2013, just 26 different digital currencies were active with a total value of $1.1 billion. And while some are already talking about a bubble, others believe that Bitcoin could rise to $100,000. The most valuable crypto coin is already an issue for criminals. 4,700 Bitcoins worth the equivalent of around $68 million were recently stolen from the Nice Hash online exchange.

Investors are investing billions in new crypto coins

The really big crypto coin hype is over. At least that's what it looks like at first glance. Bitcoin, for example, is currently worth just over $6,000 and is therefore over $13,000 away from its all-time high from December 2017. On the other hand, cryptocurrencies continue to be very attractive to investors. According to coindesk , a total of around 5.4 billion US dollars were raised in so-called Initial Coin Offerings (ICO) in 2017, but in the first seven months of the current year it has already risen to more than 14 billion US dollars. EOS alone raised over four billion US dollars in June. An ICO works similarly to a company's IPO - except that instead of shares, units of a digital currency are sold to investors. According to the coinmarketcap.com website, there are now 1,833 different coins.

Initial Coin Offerings: ICOs are primarily self-employment within the crypto bubble

Initial Coin Offerings (ICO) replaced the “classic” financing channels in 2017 in the area of blockchain and cryptocurrencies. But what is the content of these ICOs about? LSP Digital analyzed the top 5 categories of current ICOS. The evaluation shows that there is a significant proportion of “self-employment”-that means: projects whose ICO is aiming to benefit directly or indirectly from speculation, trade and financing with cryptocurrencies and crypto tokens.

Unfortunately, this picture fits well with the current warning that BaFin spent on the subject of ICO: by no means behind each of these projects there is actually a solid undertaking, which would also attract interested parties and funds outside the “crypto bubble”. Anyone who puts their money in such ICOS increases the risk of total loss that already exists anyway. It can be assumed that only a burst of the “crypto bubble”-in particular the ever higher ratings of the great cryptocurrencies such as Bitcoin, Ethereum and Litecoin-will also be used to clean up the market of ICOS for such projects.

Text and graphics by Florian Hollender (LSP Digital)

The biggest initial coin offerings of 2017

Filecoin is the project that has raised the most money through the initial coin offering so far in 2017: a total of $257 million was raised by the startup Protocol Labs, which is behind it and is working on decentralized cloud storage. This knocks the previous record holder Tezos out of first place. The crypto funding round raised $232 million in July.

The “Initial Coin Offering” – ICO for short – is the financing model for cryptocurrencies. Similar to the “Initial Public Offering (IPO)” when going public, cryptocurrencies issue so-called tokens, digital coupons so to speak, usually for the project’s currency. The principle is similar to crowdfunding, as you invest in a project that doesn't yet exist. Investors can invest in cryptocurrencies at an early stage.

In contrast to the classic capital markets, this form of raising capital is unregulated, which is the great advantage of ICOs, but can also be a disadvantage for investors. Investors have just filed a lawsuit against the blockchain company Tezos because the acquired tokens, the “Tezzies”, have still not been issued.

The big crypto theft

The Japan-based cryptocurrency exchange Coincheck has admitted that it was the target of a digital robbery. Hackers stole half a billion dollars worth of crypto coins. As our infographic shows, this wasn't the first such robbery, but it was the largest - at least of the incidents known to date.

According to the Bloomberg news agency, crypto money worth $480 million was lost from the Mt. Gox Bitcoin exchange in Tokyo in 2014. The company assumed theft and shortly afterwards had to file for bankruptcy in Japan and the United States.

As the value of cryptocurrencies continues to rise, they are also becoming more attractive to digital bandits. Values in the most popular currencies Bitcoin and Ether are mostly stolen. The incident last Friday sent the digital currency Bitcoin into a temporary decline, although coins of the NEM currency were stolen from Coincheck. The Bitcoin price recovered a little later.

Cryptocurrencies most widespread in Japan

While the term cryptocurrency was only known to fintech experts a few years ago, today digital money is also known to ordinary citizens. However, this does not mean that digital thalers, such as Bitcoin, Ethereum or Ripple, are already used by a large part of the population.

According to a survey by the survey company Dalia Research, Japan is home to the largest number of crypto owners at eleven percent. As our infographic from Statista shows, the proportion in Germany is just six percent. While the Chinese now compete with the United States in many aspects of the digital economy, ownership of Bitcoins is less widespread.

Bitcoin hype continues unabated in Switzerland too

The Swiss' enthusiasm for cryptocurrencies remains unbroken. This is shown by an Innofact study commissioned by the comparison platform Comparis.

92 percent of those surveyed said they could imagine trying out buying cryptocurrencies. 9 percent had already made purchases, and 11 percent had firm plans to invest in Bitcoins in the next year. The young generation in particular is not averse to cryptocurrencies.

One in five people under the age of 36 have plans in this direction. In the age group 55 and over it is only 5 percent. Differences can also be seen between the genders: 15 percent of men plan to buy Bitcoins this year, while the figure for women is only eight percent.

Bitcoin, a small fish in comparison

Bitcoin is currently experiencing a boom of unprecedented proportions. The value of the digital currency is currently well over 1,000 US dollars. According to calculations by Coinometrics, the daily transaction volume is around 289 million US dollars. That sounds impressive, but compared to the big credit card companies, Bitcoin is still a pretty small fish, as our infographic shows.