Consumer prices are rising, the current development: interest rate policy of the European Central Bank (ECB)

Language selection 📢

Published on: November 14, 2021 / update from: November 14, 2021 - Author: Konrad Wolfenstein

In many countries, consumer prices are rising significantly

Central banks have the monetary policy funds in hand to counteract here: they could end the flood of money, increase the key interest rates and thus reduce the demand for credit and money. However, as the graphic shows based on the last forecast on the central bank interest of Bloomberg , not all central banks believe that timely countermeasures are necessary. As a result, the European Central Bank (ECB) will probably be retained, for example, its course of low interest rates until the end of next year. This means that the central bankers cannot be impressed by the currently high inflation. The aim of the ECB's monetary policy is to keep the inflation rate constant and long -term with the two percent mark. For a transition period, the inflation rate can also be above this brand. This means that the latest increase in consumer prices beyond the target brand of two percent is not yet a reason for the ECB. ECB President Christine Lagarde believes that the measures to combat corona pandemic have "led to a shortage of offer in certain sectors". As soon as these effects cover, inflation would drop again.

According to Bloomberg's forecast, interest rates should also remain stable in Australia, India, Japan and Switzerland. The US Federal Reserve will also keep the federal funds rate at the current level. The federal funds rate is the interest rate at which American financial institutions, such as banks and savings associations, lend money to each other to balance their reserve requirements at the central bank. other media reports , the Federal Reserve wants to reduce its asset purchases of $120 billion per month soon.

Other central banks, however, could end the era of very cheap money more quickly given rising inflation rates. This includes Great Britain. Bloomberg experts expect the bank rate to increase from 0.1 percent now to 0.25 percent at the end of 2022. The bank rate determines the interest rate that the Bank of England pays to commercial banks that hold money with the central bank. It influences the loan interest rates that banks charge their customers.

In Argentina, Turkey and China, according to the forecast, interest is reduced. China's economy is not struggling with a high inflation, but according to the forecast is faced with a number of downward risks, such as the shortage of electricity, outbursts of virus and weak consumption. According to Bloomberg, People's Bank of China will probably loosen its monetary policy and support the economy by pumping more liquidity into the banking system and is expected to reduce the minimum reserve rate by 50 basis in October or November 2022. A short -term interest rate reduction is unlikely, since this step would only cause the financial imbalances that the authorities would like to contain. The monetary policy of Turkish President Erdogan is criticized by the Bloomberg experts and referred to as “Unorthodox”. In Turkey, consumer prices have increased by up to 19 percent, but the central bank of Türkiye had recently significantly reduced the key interest rate and, according to Bloomberg forecast, will do so again by the end of 2022. Erdogan obviously believes that high key interest rates would heat inflation and slow down economic growth. He wants to boost loans and investments through low interest rates.

Monetary policy is the economic policy measures that a central bank takes to achieve its goals. A restrictive monetary policy can aim to combat currency devaluation by having the respective central bank reduce the amount of money in circulation and increase interest rates. An expansionary monetary policy, on the other hand, increases the money supply or the central bank's money supply and is accompanied by falling interest rates.

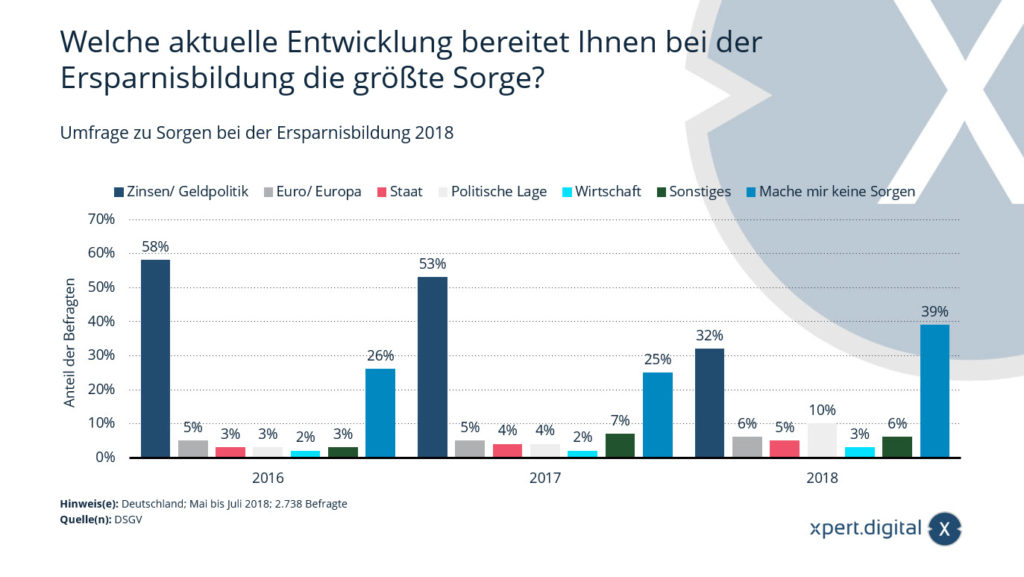

What current development are you most concerned about when it comes to savings?

What current development are you most concerned about when it comes to savings? – Image: Xpert.Digital

This statistic shows the results of a survey that shows Germans' biggest concerns when it comes to saving. At the time of the 2018 survey, the European Central Bank's interest rate policy was the biggest concern for the Germans surveyed when it came to saving. Around 32 percent of all mentions came from this area.

2018 Savings Concerns Survey

What current development are you most concerned about when it comes to savings?

Interest rates/monetary policy

- 2016 – 58 %

- 2017 – 53 %

- 2018 – 32 %

Euro/Europe

- 2016 – 5 %

- 2017 – 5 %

- 2018 – 6 %

Country

- 2016 – 3 %

- 2017 – 4 %

- 2018 – 5 %

Political situation

- 2016 – 3 %

- 2017 – 4 %

2018 – 10 %

Business

- 2016 – 2 %

- 2017 – 2 %

- 2018 – 3 %

Miscellaneous

- 2016 – 3 %

- 2017 – 7 %

- 2018 – 6 %

Don't worry me

- 2016 – 26 %

- 2017 – 25 %

- 2018 – 39 %

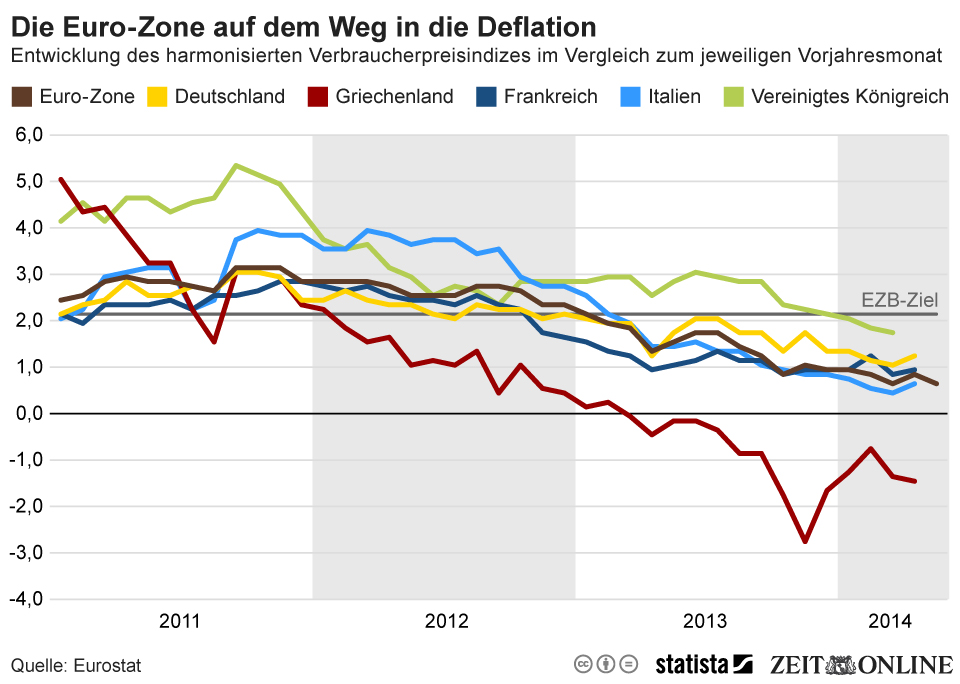

2014: The Eurozone on the way to deflation

The euro area is falling into deflation. This would mean that prices continuously fall instead of rising. Economists are afraid of this effect because it can discourage investment, thereby endangering growth and jobs. For this reason, the European Central Bank (ECB) has now lowered its key interest rate again - to 0.15 percent. The interest rate on bank deposits was even reduced to negative, to -0.1 percent.

The ECB hopes to boost inflation in the euro area again. The target is a value of around 2.0 percent. Most recently, a value of 0.5 was reported for the Eurozone, as our graphic shows. The problem: While countries like Greece are already in deflationary territory, others are still well above it. Higher inflation could cause problems here. Interest rate policy remains a balancing act.

Xpert.Digital – Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital – www.xpert.solar – www.xpert.plus