The consumer metaverse and the German banks using the example of Deka Bank and Deutsche Bank

Language selection 📢

Published on: August 15, 2023 / Update from: August 15, 2023 - Author: Konrad Wolfenstein

German banks enter the metaverse: new horizons for the financial world

In recent years, the Metaverse has attracted the attention of the young generation and global brands. Leading German banks such as Deka Bank daring to step into this digital world. In the style of Nike and Adidas, Deka Bank has created a digital hub on platforms such as Decentraland and is presenting its virtual products there. Banks like Sygnum Bank and Fidelity led the way for Deutsche Bank and Deka Bank to enter the metaverse. These banks see the metaverse as a potential hub for diverse digital assets, encouraging interaction and commerce.

Citibank's study estimates that the Metaverse economy could reach $13 trillion by 2030 if it is accessible on various devices. Experts predict that virtual branches could become a reality in two to three years, opening up new opportunities for financial institutions. Deka Bank enters Decentraland offering rudimentary virtual experiences with a reception hall and educational content. Although regulatory challenges remain, JP Morgan has identified success factors such as technology, security, people and rules in the metaverse.

Although some savings banks are showing interest in connecting Deka Bank with young users, the legal requirements are still restrictive. The MiCA regulation, which applies to cryptocurrencies, is also expected to be extended to non-fungible tokens (NFTs). NFTs digitize real estate and works of art, creating a broader ownership and trading base. Banks strive to secure digital property and generate possible business models. The virtual real estate market could spur demand for mortgages as virtual land enables virtual ownership. Despite declining prices for virtual land, the fusion of real and virtual worlds opens up innovative perspectives for banks. You can model real estate, cooperate and provide construction-related services. Albrecht from Deka Bank envisions increased integration of the Metaverse through advanced technologies. While the banking industry is currently focusing on customer relationships, marketing and recruiting, the long-term potential lies in closer relationships with the savings banks. Deka Bank is trying to attract customers to its Metaverse hub through traditional channels.

The Metaverse Revolution: Opportunities and Challenges

The rapidly growing importance of the Metaverse for the financial world is unmistakable. The introduction of virtual branches in the foreseeable future will open up a variety of opportunities for banks to expand their reach and customer experience. Deka Bank has already taken a step in this direction by offering virtual experiences in Decentraland. However, these rudimentary experiences could be just the beginning. Banks are challenged to drive technological innovation to ensure smooth and secure interactions in the metaverse. At the same time, they must train their employees accordingly and meet the necessary regulatory framework in order to build trust with customers.

Potential for real estate and financial services in the metaverse

An exciting potential of the Metaverse lies in the digitization of real estate and artwork through NFTs. This technology allows real assets to be transferred to the virtual world, thereby creating a broader market for property transfers and trading. Banks see an opportunity to play a key role by securing digital property rights and developing innovative business models. The introduction of virtual real estate could even increase demand for mortgages as owning virtual land creates new financing needs. The vision of merging real and virtual worlds opens up countless opportunities for banks, from modeling real estate to providing construction-related services.

Future prospects: Strong commitment and long-term partnerships

While the current focus is on customer relationships, marketing and talent acquisition, the true potential of banks in the metaverse will be unlocked through strong partnerships, particularly with savings banks. By promoting their virtual offerings through established channels and engaging customers in innovative ways, banks can reach a broader audience and improve the customer experience in the metaverse. Deka Bank is already using this strategy to attract customers to its Metaverse hub and build long-term loyalty.

It is clear that German banks like Deka Bank see the metaverse as an opportunity to reposition themselves in an increasingly digital world. The opportunities for innovation, growth and creating unique customer experiences are immense. Developments in the Metaverse will undoubtedly shape the future of the financial industry, and those who take the right steps early will gain a decisive competitive advantage.

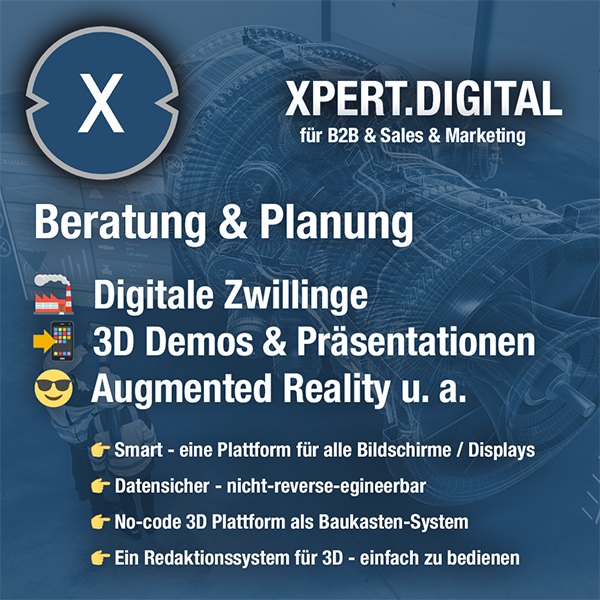

Our Industrial Metaverse configurator

Just try out our universally applicable (B2B/Business/Industrial) Metaverse configurator for all CAD / 3D demo options:

Xpert (B2B/Business/Industrial) Metaverse configurator for all CAD / 3D data can be used on all devices, one platform!

Suitable for:

Deutsche Bank - The Metaverse and the Future of Banking: Opportunities and Challenges

The emerging world of the Metaverse is opening up fresh business opportunities that invite companies and individuals to explore virtual realities. This fascinating development also has far-reaching implications for the banking sector. In this virtual universe, leisure activities such as shopping and social interactions could take on a completely new form. Companies are increasingly turning to virtual stores to address customers through AI-driven tailored offers. Deutsche Bank and other players see this as an opportunity and are creating their own virtual environments.

Virtual realities in banking

A clear example of this is Deutsche Bank's plan to establish a 3D lounge on Decentraland. This virtual platform allows avatars to explore the world, get forecasts and participate in virtual events. Visitors can purchase banking items through a token system. The bank's goal is to understand virtual world preferences and increase interactions. It's all about reaching potential future customers in the metaverse. The bank's previous 3D Lounge and ongoing efforts aim to innovate and potentially extend customer interactions to virtual product consultations.

Advanced customer interactions in the metaverse

In recent years, the concept of the metaverse has attracted increasing attention, particularly in relation to its potential impact on various industries, including banking. The idea of enhanced customer interactions in the metaverse brings forth an exciting vision of innovative approaches to customer engagement and business communication.

Virtual Tours of Bank Branches: An Immersive Experience

The idea of virtual tours of bank branches is an intriguing development as part of expanded customer interactions in the metaverse. Imagine being able to take a virtual tour of a bank branch from your own home as if you were physically there. This immersive experience would allow customers to look around, get information and even interact with virtual bank employees. This would have the advantage that customers could gain insights into different branches in a convenient and time-saving manner without actually having to travel.

Revolutionary Meetings in the Metaverse: A New Era of Collaboration

Another exciting aspect of expanded customer interactions in the Metaverse is the idea of how meetings and business collaboration could be revolutionized. A comparison is often made to an immersive Zoom-like experience where participants from around the world can meet in a virtual environment. Imagine if instead of appearing on a screen in a video call, you could interact as an avatar in a virtual conference room. This could improve interpersonal dynamics, make non-verbal signals more visible and increase the effectiveness of meetings.

The Metaverse as a Meeting Point: Transformative Power and Opportunities

The transformative power of the Metaverse as a meeting place is a key part of the discussion about enhanced customer interactions. When the Metaverse serves as a place for interaction and exchange, new opportunities open up for companies to bind customers more closely. This could be achieved by creating virtual events, training, workshops and more. It would offer a new level of personalization and interaction that goes beyond traditional digital platforms.

Opportunities for the future

Of course, in addition to the exciting opportunities, there are also challenges that come with implementing advanced customer interactions in the metaverse. Data protection and security concerns are at the forefront. Security of virtual transactions, personal information and prevention of fraud would be critical aspects to be considered. The question of accessibility for people with limited access to technology should also not be ignored.

Overall, however, expanded customer interactions in the metaverse open up exciting opportunities for banking and other industries. The vision of virtual bank branches, revolutionary meetings and the Metaverse as a meeting point shows the potential for companies to strengthen customer loyalty and explore innovative ways of working together. The future will show how these ideas will evolve and what impact they will ultimately have on the way we interact with companies and do business.

Challenges and potential

The emerging Metaverse brings both exciting opportunities and significant challenges to overcome. Comparable to a tangible Zoom session, the Metaverse opens the door to virtual worlds that enable immersive interactions and collaboration. However, there are technical limitations that inhibit the full realization of this vision.

Technical barriers and collaboration

The challenge is to transform the metaverse into a seamless and frictionless platform for collaboration and interaction. Currently, virtual whiteboarding activities are hindered by technical limitations. The ability to sketch, discuss and develop ideas together is crucial for companies that want to operate in this virtual space. Overcoming these technical obstacles will have a critical impact on the performance of the Metaverse and its full potential.

New financial services in the metaverse

The Metaverse opens up opportunities not only for immersive experiences, but also for innovative financial services. Banks could play an important role in shaping this virtual financial ecosystem. Virtual payment systems could enable companies and users to transact within the metaverse. The ability to use digital currencies and trade virtual units of value could drive the economy in the Metaverse.

Financing solutions for virtual companies

With the emergence of the metaverse, new business opportunities and virtual companies are emerging. These companies need financing solutions to grow and thrive. Banks could offer services such as loans, investments and capital raising for companies entering this virtual world. The ability to financially support these companies could be a way for banks to solidify their role in the metaverse.

Financial navigation in physical and virtual worlds

The merging of physical and virtual realities requires individuals and companies to have a new understanding of financial matters. The complexity of the financial world now extends across both areas. The ability to make financial decisions in both contexts requires an adaptation of existing skills and knowledge. Banks could play a key role in educating and advising on these new requirements.

Shaping the future

The Metaverse holds enormous potential that is still largely untapped. Despite technical obstacles, banks and companies are committed to tackling the challenges and finding innovative solutions. Shaping the financial world in the Metaverse requires not only technological innovation, but also a deep understanding of the needs and requirements of the virtual community. Those who overcome these challenges could be the pioneers of a new era of financial services and collaboration in the digital space.

The role of banks in the metaverse

The role of banks in the Metaverse, the expanded virtual space created by the merging of physical and digital reality, is a fascinating and complex topic. Here are some aspects to consider:

- Virtual Currencies and Payments: Various virtual currencies could exist in the Metaverse that are used for transactions, purchases of virtual goods and services. Banks could play a role here in converting and managing these virtual currencies into traditional currencies. They could also offer secure payment solutions for virtual purchases.

- Identity and data protection: Since the metaverse is connected to personal data and identities, banks could develop identity verification and data protection solutions. This could help ensure user safety in the metaverse and prevent fraud.

- Financing virtual projects: Creative projects and companies that need financing could emerge in the Metaverse. Banks could offer virtual loans or investments to support such projects.

- Custody and Security: Virtual assets such as digital artwork, virtual real estate, or rare digital items could have significant value. Banks could offer services to safely store and manage these assets, similar to how they store physical assets such as precious metals today.

- Currency Conversion and Trading: Since the Metaverse will be global, banks could offer virtual currency trading and conversion services to facilitate international transactions.

- Advice and Education: Since the Metaverse will be a complex environment, banks could provide education and advice to users to help them better understand the financial aspects of the Metaverse and make wise decisions.

- Interfaces and Integration: Banks could provide interfaces to Metaverse platforms to enable seamless financial transactions. This could make it easier to integrate banking services into virtual worlds.

- Regulation and Compliance: As the Metaverse will present new legal and regulatory challenges, banks could play a role in understanding these aspects and finding solutions to ensure that activities in the Metaverse comply with applicable laws and regulations.

It is important to note that the development of this role in the Metaverse is still in its infancy and many of the ideas mentioned are speculative. It will depend on banks' willingness to adapt to evolving technologies and needs of Metaverse users. The future of banks in the metaverse depends on their ability to offer innovative solutions that deliver real value to users.

Overall, the Metaverse is not only an exciting virtual world, but it also represents an opportunity for banks to reinvent themselves and offer innovative solutions to their customers. The future of banking in the Metaverse will undoubtedly be exciting, and those who recognize the opportunities early could establish themselves as leading players in this new era.

New territory for newbies: What you should know now about blockchain, tokens, NFTs, wallets, cryptocurrency and the metaverse

In today's digital world, terms such as blockchain, NFTs, wallets, cryptocurrencies and the metaverse have become increasingly present. For newcomers, these terms may seem confusing and complex at first. Here we try to explain these terms in an understandable way and give you important and interesting details about them.

More about it here:

Dekaverse: DekaBank is in the Metaverse – The Beta Metaverse – Decentraland, Marketing & Gamification

The Dekaverse serves as a kind of testing ground for DekaBank and its customers to explore new technologies and bring them closer to people. The focus here is primarily on blockchain technology, one of the most important innovations in digitalization.

In Decentraland, users have the opportunity to explore how the blockchain works and learn about cryptocurrencies and NFTs. This provides a unique opportunity for those new to these technologies to learn about them and expand their understanding of them.

More about it here:

Metaverse Science: Pioneering a New Digital Era

Metaverse Science is a fascinating and emerging field of research that explores the future of virtual reality and connected digital worlds. In recent years, interest in this area has increased exponentially as technologies such as artificial intelligence, augmented reality (AR), virtual reality (VR), blockchain and the Internet of Things (IoT) continue to advance. The Metaverse is often described as a converging space that connects both physical and digital realities, allowing users to seamlessly interact between them.

At its core, metaverse science is about blurring the boundaries between the physical world and the digital sphere. It's not just about creating new virtual reality experiences, but also about creating a rich, connected and immersive environment where users can interact with each other anywhere in the world. The aim is to create a common platform that includes social interactions, business, education, entertainment and much more.

One of the most fascinating aspects of the meta -verse science is the idea of digital representation of users, often referred to as “avatar”. Avatars are personalized digital representations of people who can act in the virtual world. They enable users to present themselves in a completely new identity and move through the room without leaving the physical world. Advances in artificial intelligence make it possible to make avatars more and more realistic, which enables an even deeper immersion and interaction with other users.

Another important aspect is blockchain technology, which plays a significant role in the metaverse. Blockchain allows users to securely own and trade digital assets and currencies. This allows real economic transactions to take place within the metaverse. Virtual businesses operating in the metaverse can have real economic impact as users can buy, sell, and even create digital goods and services. This creates completely new opportunities for entrepreneurs and innovators.

Metaverse Science also has the potential to revolutionize the way we learn and educate ourselves. Educational institutions could create virtual classrooms and learning environments that allow students to learn in an interactive and exciting way. From virtual excursions to historical sites to interactive experiments in virtual laboratories, the possibilities are endless.

In the entertainment industry, the metaverse offers a variety of exciting possibilities. Virtual concerts, theater performances, film screenings and sporting events could offer a whole new dimension of experience. Spectators could not only be part of the event, but also interact with the artists or athletes and create their own unique experiences.

However, there are also some challenges that need to be overcome. Privacy and security are critical as users move in a highly connected environment. Creating an inclusive and accessible Metaverse environment is also important to ensure that people with different abilities and backgrounds can participate equally.

Metaverse science has an exciting future that could impact our daily lives in many ways. Not only will it change the way we interact with each other, but it will also open up new possibilities for business, education, entertainment and social experiences. It remains to be seen how quickly this technology will develop and how it will shape our society in the coming years.

Xpert.Digital – Pioneer Business Development

If you have any questions, further information or need advice on the topic of Consumer Metaverse or Metaverse in general, please feel free to contact me at any time.

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital – Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital – www.xpert.solar – www.xpert.plus