Conquering the China market: data, figures, facts and statistics

Language selection 📢

Published on: October 25, 2020 / update from: October 26, 2020 - Author: Konrad Wolfenstein

Decision-making aids in data, figures, facts and statistics as a PDF for free download, see below.

IMPORTANT: Not all existing documents are mentioned in this post. These may be submitted piece by piece at a later date.

China is not only the world's largest market from e-commerce to social commerce, it is also a big unknown in the Western world. The manufacturing industry received massive support from the Chinese government, especially in the B2B sector. In 2019, 2/3 of e-commerce transactions in China alone came from the B2B market.

Chinese e-commerce market observation report

The potential of the Chinese market is also a challenge for foreign companies. There is no general answer or solution.

Matching and very good as a supplement:

- Conquering the US market: data, figures, facts and statistics

- Conquering the UK market: data, figures, facts and statistics

E-commerce in China

Important note: The PDF is password protected.

Please get in contact with me. Of course, the PDF is free of charge. Important note: The PDF is password protected. Please contact me. Of course the PDF is free of charge.

English version – To view the PDF, please click on the image below.

English Version – To view the PDF, please click on the image below.

Important note: The PDF is password protected.

Please get in contact with me. Of course, the PDF is free of charge. Important note: The PDF is password protected. Please contact me. Of course the PDF is free of charge.

German version – To see the PDF, please click on the image below.

German Version – To view the PDF, please click on the image below.

The emergence of China's e-commerce market ushered in a new era of China's economy. In 2019, the value added of the digital economy accounted for more than a third of the country's GDP. Additionally, China's e-commerce sales exceeded the total of Europe and the United States combined. Today, China has the largest digital shopper population in the world, with more than 710 million people.

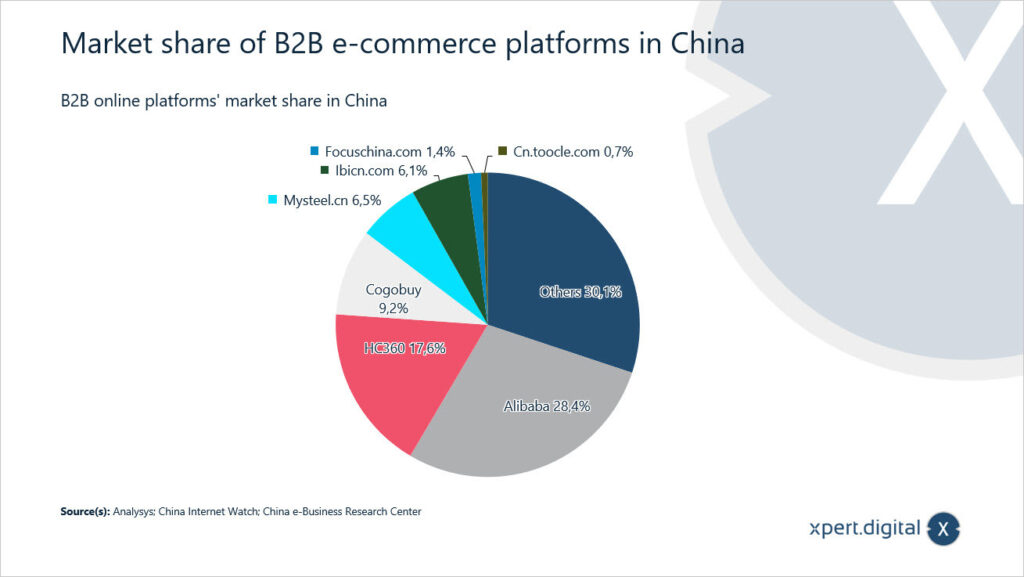

B2B E-Commerce in China

As a result of the rapidly evolving digitalization of all aspects of modern life, more and more businesses in China have gone online. Thanks to its massive manufacturing industry and government support, China is at the forefront of adopting B2B (business-to-business) e-commerce, followed by Japan and South Korea. In 2019, B2B e-commerce contributed two-thirds of the total value of e-commerce transactions in China. For almost a decade, China's B2B market was dominated by e-commerce conglomerate Alibaba. Founded in 1999, the $5 billion company is currently the largest public company in China.

B2C and C2C e-commerce in China

China's online retail sales have increased rapidly over the past decade, registering a year-on-year growth of 27.3 percent, higher than the global average growth rate. In 2019, the country's share of online retail sales reached a new high with more than 20 percent of all retail conducted online.

Thanks to rapid internet adoption across China, the penetration rate of online shopping reached nearly 80 percent. This, along with the increasing use and penetration of mobile devices, also means that shopping on smartphones or tablets has become a new norm for Chinese internet users.

Aside from technological upgrades, the rise in purchasing power of small towns and rural residents has also reshaped the online retail landscape in China. Pinduoduo, an online group discounter founded in 2015, overtook JD.com to become the second-largest online retail platform in China.

Cross-border electronic commerce in China – Cross-border e-commerce in China

Important note: The PDF is password protected.

Please get in contact with me. Of course, the PDF is free of charge. Important note: The PDF is password protected. Please contact me. Of course the PDF is free of charge.

English version – To view the PDF, please click on the image below.

English Version – To view the PDF, please click on the image below.

Since China's entry into the World Trade Organization at the beginning of the 21st century, nothing has worried China's foreign trade more than the ongoing trade war with the United States. However, this did not slow down China's booming international trade in goods. In 2019, China's imports and exports rose to new highs. For a decade, China remained one of the leading export and import countries in cross-border trade in the world. Today, China's cross-border trade is also flourishing on online trading platforms.

Cross-border exports

In 2019, there were nearly twenty thousand cross-border e-commerce companies in China, and most of them were small and medium-sized enterprises. This year, the gross merchandise value generated by international online trade accounted for almost 40 percent of the total import-export value in China. Driven by the development of logistics and digital payments, many Chinese e-commerce companies developed strategies to develop additional overseas markets. Aliexpress, the subsidiary of Chinese online retail giant Alibaba, beat eBay to become the second most popular site among cross-border online shoppers.

After the coronavirus outbreak in 2020, selling on cross-border online marketplaces such as Aliexpress and wish.com became a way for many Chinese manufacturers to manage their economic hardship. To promote the growth of cross-border e-commerce, China planned to establish 46 new pilot zones in addition to the 59 existing cross-border e-commerce pilot zones. Companies located in these pilot zones were supported by tax deductions for exports.

Cross-border imports

China's emerging middle class demanded high-quality products but didn't want to risk buying counterfeits. Therefore, cross-border e-commerce platforms became their ideal option for purchasing foreign goods. Around three-quarters of cross-border e-commerce users in China made purchases through cross-border e-commerce websites. Tmall Global and Kaola.com were the most popular sites for cross-border online shopping among Chinese consumers. Overall, cross-border e-commerce imports have skyrocketed over the past decade, with trade volumes increasing nearly tenfold. From snacks to vehicles, Chinese consumers shop a variety of international goods online.

Social commerce in China – Social commerce in China

Important note: The PDF is password protected.

Please get in contact with me. Of course, the PDF is free of charge. Important note: The PDF is password protected. Please contact me. Of course the PDF is free of charge.

English version – To view the PDF, please click on the image below.

English Version – To view the PDF, please click on the image below.

From the way we think to the way we shop, social media shapes people's daily lives in many ways. China has the world's largest social media population, nearly 580 million more than India, which ranks second. The gap will grow even larger in 2025. On average, internet users in China spent more than two hours per day browsing social media.

The Rising Tide of Social Commerce

The dominance of e-commerce and social media created social commerce, where goods were advertised, listed, and sold. Unlike traditional e-commerce platforms, consumers are encouraged to interact with others and create their own content while shopping. By using social media platforms as a bridge between merchants, influencers and potential consumers, social commerce will potentially lead the future of e-commerce in China.

China has seen sheer growth in social commerce over the past five years. The number of social trading users reached 713 million in 2019, while the market size was estimated at over two trillion yuan. The social commerce industry created around 48 million jobs in China in 2019, and this number would continue to rise.

Platforms for social trade

The phenomenal success of Pinduoduo marked a new era of social trade in China. The online discounter for group buys, founded in 2015, made it to the top 20 most valuable companies in 2020. Pinduoduo's success was based on its unique model of the “group purchase”. The users were able to achieve a better price by inviting their friends and family to buy.

While the majority of Pinduoduo's users were based in third- and fourth-tier cities in China, young women from first- and second-tier cities loved Xiaohongshu. With 300 million users, the shop-and-share platform allows its users to post content and interact with others.

Social Commerce is not just the competitive market for “unicorns”. The traditional e-commerce giant Alibaba and JD.com also joined the competition in order to take a new way on the saturated e-commerce market. Taobao, the largest B2C online shopping platform under Alibaba, started its live commerce channel to attract users, while JD.com Jingxi published, a pinduoduo-like group buying-mini program.

Social networks in China – Social networks in China

Important note: The PDF is password protected.

Please get in contact with me. Of course, the PDF is free of charge. Important note: The PDF is password protected. Please contact me. Of course the PDF is free of charge.

English version – To view the PDF, please click on the image below.

English Version – To view the PDF, please click on the image below.

China is the world's largest market for social networks with very committed and mobility -conscious users. Its market composition differs significantly from the rest of the world. Due to the “Great Firewall” China, as the Chinese government's Internet censorship project is generally called, Facebook, Twitter, YouTube and other leading international social media players are blocked in the country. However, the Chinese social media landscape is not incomparable with its western counterparts. China's media landscape in relation to social networks almost reflects that of the rest of the world, with the exception that each of these sites is a platform developed in their own country.

Who are the social media giants in China?

Compared to a few major players that dominate the Western market, despite speech censorship, China has a more dynamic, diverse and competitive social media landscape, with platforms rising and falling on a faster time frame. Thanks to its versatile functionality, Tencent's WeChat remains the most popular social networking space. It's a super version of Facebook with ride-hailing, food delivery, mobile payments and other services in a single app. Thanks to its huge user base, marketing and e-commerce thrive on WeChat. When it comes to microblogging, Chinese users have their local version of Twitter – Sina Weibo, with 140 to two thousand Chinese characters in a post. It has been used extensively as a space for free expression, with a significant proportion of online users. Other prominent Chinese social media platforms include: Youku Tudou (equivalent to YouTube), Douyin (aka TikTok), Baidu Tieba (a search engine forum), Zhihu (the Quora of China), Red (a cross-border e-commerce community) . Meitu (the Chinese alternative to Instagram), and Meituan-Dianping (the Chinese Yelp and Groupon).

What are the main trends?

Many Chinese social networking sites have copied WeChat's winning formula and developed their diverse entertainment ecosystems with additional services such as e-commerce, streaming and gaming. In addition, the use of artificial intelligence is on the rise. Facial recognition, hyper-personalization and augmented reality will become more common in social media platforms. In terms of content format, besides short videos, live streaming is the next craze in Chinese social media. Huya, YY Live and Douyu Live are the early beneficiaries of this market trend in rural China, where young people have fewer entertainment options.

Advertising in China- Advertising in China

Important note: The PDF is password protected.

Please get in contact with me. Of course, the PDF is free of charge. Important note: The PDF is password protected. Please contact me. Of course the PDF is free of charge.

English version – To view the PDF, please click on the image below.

English Version – To view the PDF, please click on the image below.

Advertising is a billion-dollar business in China. As the world's second largest advertising market after the United States, China is expected to generate over $16 billion in advertising spending between 2018 and 2021. While the traditional advertising channels of print and broadcast are generally shrinking, outdoor and internet advertising are experiencing exponential growth. The expansion is mainly driven by the country's rapid technological advancements and a mobility-conscious population.

Traditional Advertising

Advertisers in China have reduced their advertising spending on traditional media in recent years. This decline is particularly pronounced in newspaper advertising. Between 2013 and 2019, newspaper advertising revenue fell from 42.5 billion yuan to less than 7 billion yuan. Magazine advertising is also declining. In comparison, traditional broadcast advertising still holds a significant market share. Television is the cheapest advertising medium, especially for food and beverage brands.

OOH Advertising

Out-of-home (OOH) advertising, particularly subway advertising, is an effective offline-to-online (O2O) marketing medium. Subway advertising in China often includes QR codes that direct consumers to the brand's Wechat page. Another common advertising format in subways in China: Zoetrope, a digital imaging system installed in subway tunnels. Passengers can see a series of moving images inside the train on the window, which looks like a 15-second video. With these technological changes, OOH advertising spending in China would most likely exceed 70 billion yuan by 2021.

Online Advertising

In a country with the largest online community in the world, the Internet has gained a higher market share in the Chinese advertising market. E-commerce, search engines and social media advertising are thriving. In 2019, advertisers in China spent approximately $65 billion on mobile advertising. WeChat, the country's most popular app, plays an important role in brand promotion. Its mini programs offer consumers advanced features such as e-commerce and task management. With its significant market penetration and conversion rate, WeChat would likely remain the most important online advertising channel for years to come. However, it is worth noting that ad fraud is more prevalent in China than in other countries. In 2019, nearly 32 percent of online advertising traffic in China was fake or invalid. Industry reports show that over 80 percent of global fraudulent inventory came from China, costing advertisers a loss of $18.7 billion in 2019.

Retail in China – Retail in China

Important note: The PDF is password protected.

Please get in contact with me. Of course, the PDF is free of charge. Important note: The PDF is password protected. Please contact me. Of course the PDF is free of charge.

English version – To view the PDF, please click on the image below.

English Version – To view the PDF, please click on the image below.

In 2019, China accounted for about 21 percent of the global retail market, the second largest share after the United States. According to forecasts in mid-2019, China could overtake the USA as the world's largest retailer as early as 2021.

In 2018, China's retail sales were around 12.5 trillion yuan, while the contribution of merchandise trade to the country's GDP was about 34 percent. The slowdown in exports and an increase in the volume of domestic markets indicate a strategic shift in the Chinese economy to satisfy domestic demand. As rural and urban households have experienced steady growth in disposable income, the purchasing power of the Chinese population has also increased dramatically, and the Chinese market has matured into one of the largest and still growing consumer markets in the world. Foreign and domestic retailers are both vying heavily for the attention of the Chinese consumer. Retail sales of consumer goods in China have grown by an average of nine percent annually over the past five years. Around 16 percent of retail sales of fast-moving consumer goods in China were attributed to the online shopping segment as of 2019. Online consumption of consumer goods has increased significantly over the last decade.

However, amid the recent China-US trade war and associated economic uncertainties, some retail sectors and product categories have been less successful than others. For example, car sales in China fell in 2018 for the first time since 1992, and the trend continued the following year. Since the automobile industry is the main driving force of the retail sector in China, this slowdown will undoubtedly impact the overall development of the retail market. On the other hand, other major retail categories such as electronics and home appliances, FMCG, apparel and pharmaceuticals have witnessed continuous growth in the last few years.

The Chinese retail sales market is highly competitive and diversified, with the top 100 retailers expected to account for a relatively low 6.3 percent market share in 2018. A negative trend has even been observed as the market shares of the leading retail chains have declined in recent years. With a sales volume of about 336.8 billion yuan in 2018, Suning Commerce Group ranked first among the leading retail chains in China, followed by Gome Electrical Appliances and China Resource Vanguard. In the convenience store sector, Sinopec Group dominated the market from 2018. Convenience stores are among the fastest-growing retail channels for consumer goods, particularly for grocery shopping in China.

Still, according to China's leading online retailer Alibaba, the future of retail lies not in channel choice but in consumer experience. The wave of so-called new retail is changing retail strategy in China at a rapid pace through digitalization, data collection, product history tracking capabilities, improved home delivery, sensory marketing and a range of other innovative components. O2O (online to offline) marketing is being replaced by OMO (online merge offline) marketing, which combines the best of online and offline shopping experiences.

Day of the singles in China - Singles' Day in China

Important note: The PDF is password protected.

Please get in contact with me. Of course, the PDF is free of charge. Important note: The PDF is password protected. Please contact me. Of course the PDF is free of charge.

English version – To view the PDF, please click on the image below.

English Version – To view the PDF, please click on the image below.

Singles Day has been China's largest online shopping event since its launch in 2009. In 2019, around 660 million online shoppers took part in this mega shopping carnival, roughly twice the population of the United States. Chinese e-marketers recorded a gross merchandise value of 600 billion yuan in 24 hours, almost equal to eBay's annual GMV. The shopping festival is spectacular, and the icing on the cake is the Tmall All-Star Gala on November 10, the evening before the event begins. Celebrities from home and abroad were invited to this satellite show, including Taylor Swift, David Beckham and Mariah Carey. The four-and-a-half-hour countdown show opened the curtain on a 24-hour non-stop shopping event.

The day of the singles in China began in the 1990s as an unofficial celebration for young singles on November 11th or on November 11th. The number “1” is similar to a “naked stick”, a slang expression for bachelors in China. In 2009, China's e-commerce company Alibaba Group started his first singles day sale, which was successful. Today the trading value of Alibaba's singles' Day has risen by almost 400 times in the past ten years, with over a billion orders on the company's e-commerce platforms. In 2019, the singles' Day sales were no longer just a solo act from Alibaba. Now most of the most important online retailers of China are participating in this phenomenal autumn shopping event. That year, JD.com and Pinduoduo, the main competitors of Alibaba, recorded 223 billion and 97 billion active users on the singles' Day.

From year to year, sales on the singles' Day worldwide, especially in Southeast Asia, attract a growing number of online buyers. According to a survey in 2018, almost a third of Indonesian online buyers bought articles on the singles' Day. In Singapore, more than 80 percent of online buyers showed interest in participating in the singles' Day sales. In Europe, too, consumers on the singles' Day spent billions of British pounds.

Search engines in China – Search engines in China

Important note: The PDF is password protected.

Please get in contact with me. Of course, the PDF is free of charge. Important note: The PDF is password protected. Please contact me. Of course the PDF is free of charge.

English version – To view the PDF, please click on the image below.

English Version – To view the PDF, please click on the image below.

The number of search engine users in the world's second-largest economy exceeded 750 million, meaning nine out of 10 netizens in China had used online search services. In 2018, search engine business revenue was 131.6 billion yuan and was estimated to reach 203.7 billion yuan by 2021. As a continuous boost to the search engine industry, the advertising segment recorded a steady increase in market volume.

Search engine giant Google and its domestic competitor Baidu were among the pioneers back in the 2000s, when Chinese people first accessed the Internet in Internet cafes. To place their search engines prominently on computers, many early Web companies struck deals with Internet café operators. Baidu was keen to use this strategy to increase its visibility. Many first-time Internet users got to know Baidu better than its foreign rival Google. Baidu also used tactics that Google typically avoided. Aside from traditional offline advertising, Baidu offered access to popular but unlicensed music mp3 files. These tactics successfully increased his popularity in China. In comparison, Google didn't seem to be as aggressive in trying to win the game. The global search engine leader shut down its Internet services in mainland China amid disputes over censorship regulations in 2010. Users will now be redirected to its Hong Kong-based search engine Google.com.hk.

With a better understanding of Chinese characters, consumer behavior and advertiser preferences, Baidu gradually climbed to the top of the rankings. In recent years, the search engine has invested heavily in the development of artificial intelligence (AI) technologies such as autonomous driving, voice assistants and smart speakers, driving robust revenue growth for the company. Although Baidu still needs to improve the quality of its search rankings, it is quite unlikely that other market players will challenge its dominance.

In 2018, a website for investigative journalism reported that Google is building on a new, censored Chinese search engine. After a counter -reaction of its employees, government officials and human rights, the company exposed the development of “Dragonfly”. However, it is still unclear whether the search giant has plans for a comeback in China.