Published on: June 25, 2025 / update from: June 25, 2025 - Author: Konrad Wolfenstein

China's automotive industry: The crisis lurks behind the successes

Structural problems shake China's car industry despite impressive sales figures

The Chinese automotive industry is currently experiencing an unprecedented change that makes the apparently unstoppable success story of the past few years appear in a completely new light. While the sales figures are still impressive, there is an industry behind it that is plagued by fundamental structural problems and whose future is extremely uncertain.

The paradox of growth

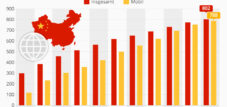

China has developed into the world's largest automotive market in recent years and at the same time replaced Japan as the largest auto exporter in the world. The numbers speak a clear language: in 2024 over 31 million vehicles were produced and sold in China, with electric vehicles achieving a share of over 40 percent. The dominance of Chinese brands that have increased their market share on the domestic market to over 65 percent seems particularly impressive.

But behind these imposing numbers there is a different reality. The rapid expansion of the Chinese automotive industry was driven by state subsidies, regional ambitions and political will to play a leading role in electromobility. Each province wanted to have its own electric brand, and large technology groups such as Xiaomi and Huawei pushed into the market. The result was an explosive increase in the number of manufacturers: there are currently around 100-150 active Chinese car brands, with a total of around 300 brands registered.

Suitable for:

- Social stability over everything: China supports loss companies and the costs of political priorities

The crisis of the overcapacity

The heart of the current problems lies in the massive overcapacity of the Chinese automotive industry. The country's production capacity is around 50 million vehicles annually, while domestic demand is only around 30 million. This overcapacity of 20 million vehicles corresponds to more than the entire annual car production in Europe.

The utilization of the factories is only 49.5 percent, and there are 3.5 million unsuccessful cars in stock. This situation forces manufacturers to drastically reduce their prices in order to be able to utilize the ligaments - a vicious circle that puts the entire industry under enormous pressure.

The brutal price war

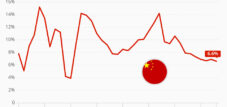

The price war in the Chinese automotive industry reached a new dimension in May 2025, as BYD, the market leader for electric vehicles, which lowered prices for 22 models by up to 34 percent. The small hatchback Seagull is now available for the equivalent of only 6,700 euros, while the Seal dual motor hybrid is offered with a price discount of 34 percent.

This aknitutive triggered a chain reaction in which other manufacturers such as Geely, Chery and Changan had to move. The consequences were dramatic: BYD lost over $ 20 billion in stock market value in just two weeks, and the average return in the industry dropped from 4.3 percent in 2024 to 3.9 percent in the first quarter of 2025.

The special thing about this price war is that it hits the lower price segments in which the profit margins are minimal anyway. The concern is growing that even brands that can be taken seriously could collapse under this pressure because many companies have financed their rise through loans.

The problem of hidden debt

Another serious problem is the non -transparent financing of many Chinese car manufacturers. The example of BYD shows how complex the actual debt situation is. According to an analysis by GMT Research, BYD's true debt is around 44 billion euros, while only 3.3 billion euros are officially shown. This difference creates due to delayed payments to suppliers and other creative financing methods.

BYD needed an average of 275 days to pay its suppliers. Chinese car manufacturers pay their suppliers on average after 182 days, while western manufacturers usually pay after one to one and a half months. This practice actually transforms suppliers into banks and veils the true debt of the automobile manufacturers.

Suitable for:

Manipulated sales figures

A particularly problematic aspect of the crisis is the systematic manipulation of sales by so-called “zero-kilometer used cars”. Manufacturers sell new cars to financing companies or dealers to achieve their sales goals. These cars then land on the market as a “used car” with zero kilometers and discounts of up to 40 percent.

The Chinese Ministry of Commerce has ordered the managers of BYD, Dongfeng and other manufacturers due to alleged manipulation of sales figures via used car channels. On platforms such as Weibo, videos of dusty new cars spread on huge parking spaces - officially approved, but never driven.

Suitable for:

The bankruptcy starts

The first victims of the crisis are already visible. The luxury electric car manufacturer HipHi had to register bankruptcy after the company has not been able to pay its bills since April 2024. The situation was similar to other companies such as Hozon, which had big plans for 2024 with his Neta brand, but remained far behind the expectations.

Even established startups such as Nio, Xpeng and Li Auto are under enormous pressure. Despite a quarterly record, Nio reported an increasing net loss of $ 700 million. A Chinese automotive analyst predicts that the likelihood of survival for NIO, XPENG and LI Auto, to survive independently in the next three years, is zero.

The challenge of the scale effects

A fundamental problem of many Chinese car manufacturers is their too small size. Experts agree that electric car manufacturers, which sell less than two million vehicles a year, will not survive because the scale effects are too small and the research and development costs are too high. Of the originally 300 new foundations in the electric car area, only 100 survived, and today there are fewer than 50 companies, of which only 40 actually sell cars every year.

Effects on the supply industry

The crisis also captures the supplier industry, which suffers from the delayed payments of the car manufacturers. The Chinese government has responded and has committed 17 large carmakers, including BYD, Geely and Chery, to limit their payment periods to 60 days. This measure shows how serious the situation has become and that even the government sees a need for action.

Failed consolidation attempts

The Chinese government has recognized that consolidation of the industry is urgently needed. However, an attempt to merge the two state carmakers Changan and Dongfeng failed spectacularly. The planned merger would have produced China's largest car company, but was canceled due to resistance in the company and complex legal problems with international joint venture partners.

The role of the international market

In view of the local overcapacity, Chinese car manufacturers are increasingly dependent on exports. In 2024 China exported 5.86 million vehicles, an increase of 19.3 percent. But here, too, they encounter resistance: the EU has introduced tariffs of up to 45 percent to Chinese electric cars, and the USA has practically completely sealed off the market.

The Chinese government reacted to these trade restrictions by asking its car manufacturers to reduce expansion in Europe and not to look for new production locations. This measure shows how limited the options for Chinese car manufacturers have become.

German manufacturer as a loser

Ironically, German car manufacturers are also affected by the crisis in China, although they are not directly part of the Chinese industry. Your market share for electric vehicles in China in 2024 fell to only five percent. Volkswagen, BMW and Mercedes partially recorded drastic burglaries, with Porsche being hit particularly hard with a decline in approvals by over 50 percent.

The future forecasts

The prospects for the Chinese automotive industry are dark. Experts predict that of the currently over 100 active Chinese car brands will only survive about seven large automotive companies. BYD will probably exist as an integrated, state -supported champion, but for many other manufacturers it will now be shown whether they have more to show than registered but unused vehicles.

The situation reminds many observers of the bankruptcy of the Evergranden real estate group, which left building ruins and millions of uninhabited residential units. The parallels are obvious: exaggerated growth ambitions, state subsidies, bloated balance sheets and in the end a systemic crisis.

Lessons Learned for the global auto industry

The Chinese automotive industry's crisis offers important lessons for the global automotive industry. It shows that apparently unstoppable growth markets also have their limits and that state subsidies and political ambitions alone are not sufficient to create sustainable business models.

The transformation to electromobility not only requires technological innovation, but also solid financing, realistic business models and the ability to survive in an increasingly competitive market. Chinese experience shows that electromobility is the future of the automotive industry, but that the way there is associated with considerable risks.

The coming years will show which Chinese car manufacturers survive the crisis and which cannot withstand pressure. For the survivors, consolidation could have positive effects because it could lead to a healthier market structure and more sustainable business models. For many others, however, there is only hope of taking over by stronger competitors or state rescue measures.

Suitable for:

Your global marketing and business development partner

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.