China's economy in the crisis? Structural challenges of a growth nation

Xpert pre-release

Language selection 📢

Published on: April 24, 2025 / update from: April 24, 2025 - Author: Konrad Wolfenstein

Growth with question marks: China's economic figures reveal deep cracks

China's economy is fighting with serious problems: crisis, reforms and global consequences - real estate, deflation and debts

The Chinese economy, a long time engine of global growth, is currently experiencing a phase of profound challenges. What was initially interpreted as a cyclical weakening increasingly manifests itself as a structural crisis with far -reaching implications for the global economy. Despite official growth figures that confirm the achievement of government goals, there are signs of a fundamental economic transformation with an uncertain outcome. The once reliable guarantee of growth is struggling with deflation, a severe real estate crisis, weak internal consumption and geopolitical tensions - while almost a quarter of the Chinese companies operate unprofitable.

Suitable for:

- More than just a damper on growth in China? Between plan and market: The Chinese economic miracle in crisis?

The economic figures in context: growth with question marks

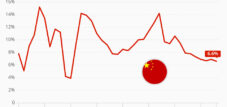

The Chinese economy grew by 5.2 percent in 2023 and thus narrowly achieved the government's official goal of “around five percent”. At first glance, this number appears solid, but on closer inspection, a more differentiated picture is revealed. If you take the years of Corona pandemic, it is the weakest economic growth in China for decades. The economic output rose to around 126 trillion yuan (around 16 trillion euros), but experts look at the official figures with skepticism.

"If you have set yourself a goal, you can achieve it, no matter what happens," comments the economist Xu Chengang from Stanford University the published data. He and other economists point out that “the statistics are usually somewhat beautified” and independent reconstructions of Chinese GDP come to lower growth rates. Alicia Garcia Herrero, chief economist for Asia Pacific at French Investment Bank Natixis, also assumes a lower actual growth.

It is noteworthy that the pure growth figures are better than it feels for most Chinese. Thomas Gitzel, chief economist of VP Bank, states: “There was no significant improvement in the perceived economic situation”. This discrepancy between statistics and reality of life indicates deeper structural problems.

The drivers of growth

The composition of growth is particularly striking. Export alone contributed 1.5 percent to Chinese growth, which means that domestic demand has only grown by 3.5 percent. This export dependency makes the Chinese economy susceptible to external shocks, especially in view of the geopolitical tensions with the USA.

Structural challenges: an economic model at the turning point

The limits of investment -driven growth

The Chinese economic miracle of the past decades was based on an investment -driven growth model with an international comparison of over 40 percent in an international comparison. However, this model is increasingly reaching limits. With growing capital stock, it is becoming increasingly difficult to invest the means of this scope profitably. The decreasing earnings rates of investments in public infrastructure and housing significantly demonstrate this development.

China already has the most nationwide high-speed access network, countless bridges and state-of-the-art highways up to the far corners of the country. The capital returns shrink, and the need for infrastructure is largely covered in many areas. At the same time, the total factor productivity (TFP) in China has tended to decrease at least since 2014, which indicates fundamental efficiency problems.

Unrentable companies and overcapacity

It is also alarming that almost a quarter of the listed companies in mainland-China are currently operating unprofitable. In some industries of the processing trade, considerable overcapacity have built up, which are now exported abroad and provide tensions there.

The province of Guangdong, the heart of the Chinese manufacturing industry, recorded a GDP growth of only 3.9 percent in the first half of 2024, which was left behind the national average of 4.7 percent. This development is particularly worrying because Guangdong has a strong private sector and is less dependent on government support than other provinces.

Suitable for:

Festom of crisis in the Chinese economy

The real estate crisis as an Achilles heel

The real estate sector, which is around a quarter of the Chinese economy, has been in a deep crisis for over two years. After the construction developer Evergrande, Country Garden is now also threatening to liquidate. The falling real estate prices and weak demand further tighten the situation.

The real estate crisis has its origin in systemic peculiarities: the communist constitution stipulates that private individuals are allowed to have no reason, but can only acquire 70-year rights from local governments. These governments artificially raised the prices and thus fueled the real estate bubble.

Despite the lack of alternatives, Chinese households have invested up to three quarters of their savings in the housing market. According to a Harvard study, over 65 million apartments were already empty in 2017-a clear sign of overheating the market.

Deflation: a dangerous downward spiral

China has slipped into deflation. In February 2025, the consumer price index fell by 0.1 percent compared to the previous year, while the producer price index decreased by 2.7 percent and thus continued its downward movement that has been going on since September 2022. This marks the fifth deflationary phase of China since the early 2000s.

Deflation carries considerable economic risks. Consumers benefit from falling prices at short notice, but the expectation of further price declines also chokes consumption. In addition, deflation presses the corporate profits, which can lead to wage cuts or layoffs - a vicious circle that would further deteriorate the economic situation.

Weak internal consumption and unsettled consumers

The Chinese economy suffers from a persistently weak internal demand. Consumption has not completely recovered long after the “zero-covid” measures ended, and private households remain greatly unsettled. The rising unemployment, especially among young people, further exacerbates this situation.

Youth unemployment is at a record level, although the statistics office has not published any specific figures since August 2023. This development additionally dampens consumption spending and increases economic uncertainty.

The problem of debt

China's municipalities and banks are massively indebted, which threatens the country's financial stability. Experts appreciate the debt of local governments at over ten trillion euros. For decades, these were mainly financed by land sales - a source of income that increasingly dried up with the real estate crisis.

Huang Yiping, member of the Central Bank's monetary policy committee, speaks of “deep structural weaknesses” in this context and calls on political leadership to courageous reforms. He thus contradicts the official line of President Xi Jinping, which only characterizes the economic problems as a “cyclical weakening”.

Our recommendation: 🌍 Limitless reach 🔗 Networked 🌐 Multilingual 💪 Strong sales: 💡 Authentic with strategy 🚀 Innovation meets 🧠 Intuition

At a time when a company's digital presence determines its success, the challenge is how to make this presence authentic, individual and far-reaching. Xpert.Digital offers an innovative solution that positions itself as an intersection between an industry hub, a blog and a brand ambassador. It combines the advantages of communication and sales channels in a single platform and enables publication in 18 different languages. The cooperation with partner portals and the possibility of publishing articles on Google News and a press distribution list with around 8,000 journalists and readers maximize the reach and visibility of the content. This represents an essential factor in external sales & marketing (SMarketing).

More about it here:

Reform pressure in China: Why the growth model reaches its limits

Foreign trade: support and risk factor at the same time

Export dependency in uncertain times

Foreign trade remains a central support of the Chinese economy. In the first quarter of 2024, the foreign trade volume of the Province of Guangdong reached 2.04 trillion Yuan (approx. 259.2 billion euros), which corresponds to an increase of 12 percent compared to the previous year. Exports rose by 9 percent, while imports increased by 17.6 percent.

But the export dependency also carries considerable risks. The weak global demand and the increasing trade inspectionism put pressure on the Chinese export sector. China also fights with falling profit margins in the export business despite increasing export volumes.

The Trump effect and geopolitical tensions

The geopolitical tensions, especially with the USA, are a growing threat to the Chinese economy. After Donald Trump's election victory in November 2024, an increase in US import tariffs from China to an average of 40 percent could cost the country around one percent economic growth in 2025.

In the run -up to his election, Trump had propagated tariffs of 60 percent on Chinese goods and, after his victory, announced a flat rate of 10 percent in addition to existing tariffs. Swiss bank UBS has prompted this development to reduce its forecast for Chinese economic growth in 2025 from 4.5 to around 4.0 percent.

Export controls and sanction lists of the United States and China also restrict the options for action of export -oriented companies, which further increases economic uncertainty.

Suitable for:

- More than just numbers: What the current developments in China's economy really mean - What's ahead?

From the economic miracle to stagnation: a historical turning point

The reform and opening policy as the foundation of the advancement

China's economic rise began with the reform and opening policy under Deng Xiaoping, which officially started in 1978 with the “Four Modernizations”. Under Deng's leadership, the popular municipalities were dissolved and replaced by a system in which the farmers were able to operate independently. Private companies were also allowed to be founded in industry and trade, and foreign capital and know-how were brought into the country through special economic zones.

According to the World Bank, the real gross domestic product (GDP) rose 48 times between 1978 and 2014. In 2010 China overtaken Japan and became the second largest economy in the world. This unprecedented economic growth led to a significant increase in living standards, but also to growing inequality and ecological problems.

At the end of the growth model

Today China faces the challenge of fundamentally transforming its growth model. The model, which has been successful for investments and exports for decades, has largely exhausted itself. Economists like Michael Pettis from the Carnegie Endowment Center argue that this development was foreseeable a decade ago and cannot primarily be attributed to President XI Jinping's policy.

The question of whether China could get into an economic stagnation like Japan in the 1990s is increasingly affirmed by analysts. The structural similarities - real estate bubble, over investments, demographic change and deflation - are unmistakable.

Future prospects and reform needs

New strategies for sustainable growth

To overcome structural growth and productivity weakness, the Chinese leadership under the economic policy model of “developing new productive forces” increases on scientific and technological innovations. By promoting “independence and self -improvement” in science and technology, industry is to be modernized and total factor productivity increases.

At the same time, the government takes various economic measures, such as the subsidized replacement of old vehicles through new electric cars or the exchange of outdated household electronics. These measures aim to boost internal consumption and revitalize the economy.

Suitable for:

The reform requirement from an expert's point of view

Almost all experts agree that China has to transform its growth model. EU trading commissioner Valdis Dombrovskis recommends that the Chinese government to set up a stimulus package to boost consumption. In the long term, China must pass from a purely investment and export-driven growth to consumer-driven growth.

Huang Yiping demands “comprehensive measures” to stabilize the real estate market and emphasize that mere symptom treatment is not sufficient - the system itself must be reformed. The International Monetary Fund (IMF) also speaks for short -term macroeconomic support and long -term reforms.

An economic power on the crossroads

China's economy is at a crucial turning point. The structural problems - real estate crisis, deflation, weak internal consumption, high debt and falling productivity - require profound reforms and a realignment of the growth model. The geopolitical tensions, especially with the United States, additionally tighten the challenges.

The success of this transformation will not only be of crucial importance for China, but for the entire global economy. As the second largest economy in the world and important trading partner of many countries, China's economic development has global effects. The question is no longer whether China has to change its growth model, but how quickly and effectively it can do this change - and at what social and political price.

Your global marketing and business development partner

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.