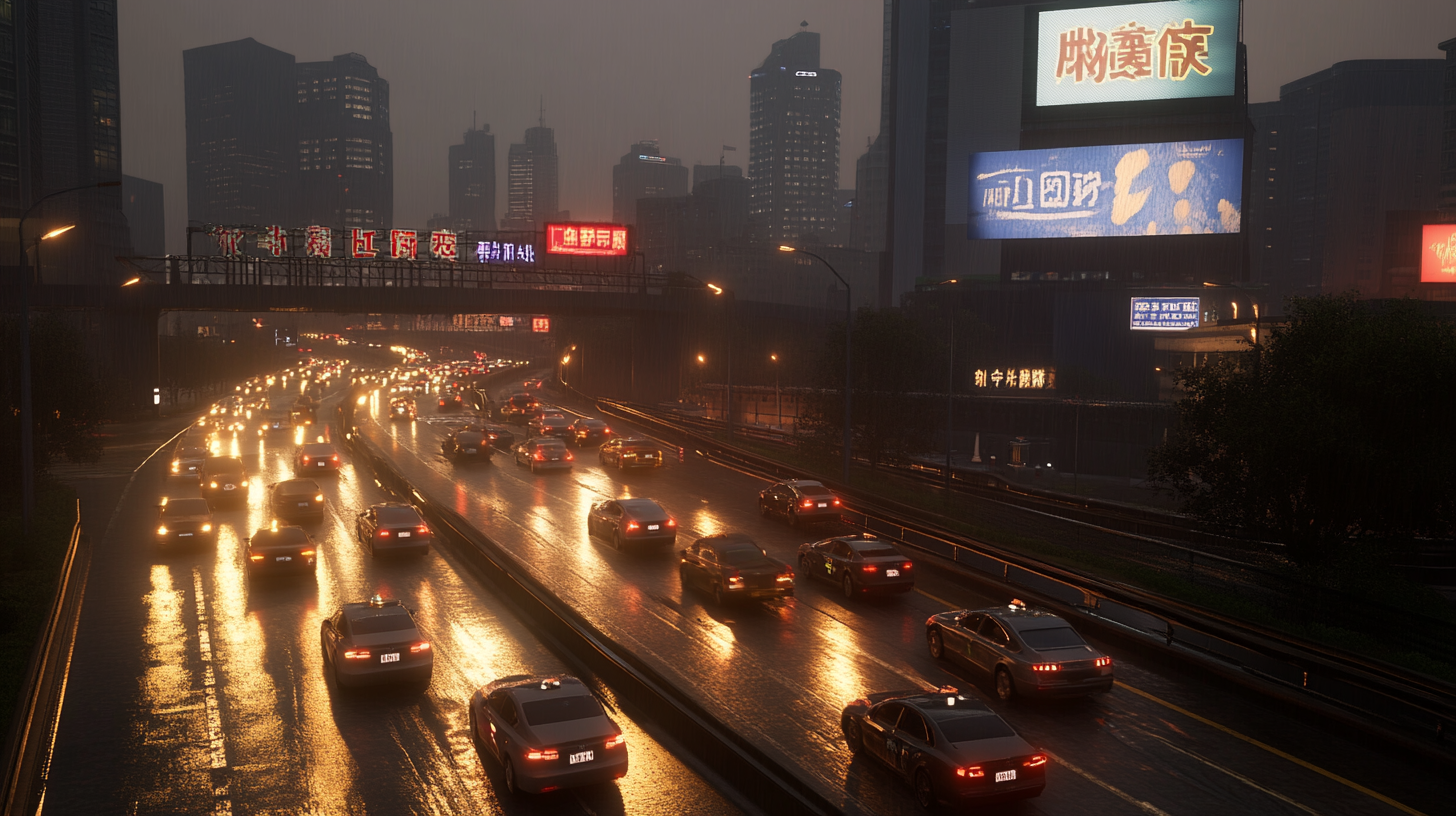

Japanese car manufacturers such as Honda, Nissan and Toyota are losing more and more market share to China - Image: Xpert.Digital

🚗🚙🚗 Challenges in China: Japan's car manufacturer in transition

🌐💼 Global competitiveness in focus: Japan's auto industry in transition

Japanese automakers such as Honda, Nissan and Toyota also face significant challenges in China, the world's largest auto market. The once strong market positions of these companies are increasingly eroding, due to a variety of factors. These include the growing dominance of Chinese manufacturers in electric vehicles (EVs), the changing preferences of Chinese consumers, and the slow adaptation of Japanese companies to the increasing demand for new energy vehicles (NEVs). These developments raise questions not only about the future of Japanese carmakers in China, but also about their global competitiveness in a rapidly changing automotive sector.

Challenges for Japanese car manufacturers

🚗 Decline in sales

Toyota, Honda and Nissan sales in China fell significantly in 2024. In the first half of the year, Toyota reported a year-on-year decline of 10.8%, Honda of 21.5% and Nissan of 5.4%. The situation at Honda is particularly dramatic: in September 2024, sales figures fell by a full 43% compared to the same month last year. This marked the ninth consecutive month of declining sales. Such figures highlight the pressure these companies are under and show that they are struggling to keep up with dynamic market conditions.

📉 Loss of market share

The market share of Japanese car brands in China has been steadily declining for years. In June 2024, this was only 17.8%, compared to 21.6% in the previous year and 22.6% in 2021. This decline is a clear sign that Japanese manufacturers are increasingly being displaced by Chinese competitors. Brands such as BYD, Nio and XPeng have significantly increased their market shares through affordable and technologically advanced electric vehicles. BYD in particular has established itself as a leader and dominates the Chinese market with a wide range of EVs that are attractive in terms of both price and technology.

🚙 Slow adaptation to NEVs

A central reason for the difficulties faced by Japanese car manufacturers is their slow adaptation to the NEV market. While they have long relied on hybrid vehicles - a strategy that has been successful in markets such as the US - this approach has resulted in significant disadvantages in China. Chinese manufacturers recognized the NEV market early and now dominate it with a market penetration of over 50% in 2023. Japanese brands, on the other hand, have failed to develop and offer competitive electric vehicles in a timely manner. This delay has caused them to be overtaken by the rapid development of the Chinese market.

⚙️ Price competition and technological requirements

Another crucial factor is the aggressive price competition from Chinese manufacturers. Companies like BYD have reduced their prices to further expand their market share. Many Chinese consumers therefore opt for cheaper models from local brands, which are often equipped with advanced technology. Japanese brands are losing ground not only in pricing but also in technological innovation. Once leaders in areas such as fuel efficiency and reliability, they are now lagging behind as Chinese manufacturers increasingly offer more advanced technologies such as autonomous driving and advanced battery solutions.

🌐 Changing consumer preferences

Chinese consumers' preferences have also changed significantly. Young shoppers are increasingly placing value on connectivity, smart features and modern design – areas where Chinese brands excel. Japanese cars, on the other hand, are often perceived as conservative and cannot always meet these demands. In addition, growing environmental awareness plays a role: many customers prefer zero-emission vehicles, increasing pressure on Japanese manufacturers to accelerate their EV strategies.

Strategies for dealing with the crisis

The Japanese car manufacturers are aware of the urgency and are now trying to counteract it. But whether these measures will be enough remains to be seen.

💡 Investments in NEVs (New Energy Vehicles)

Some companies have started investing heavily in the development of new electric vehicles. Honda, for example, has announced that it will build new production facilities for NEVs (new energy vehicles) in China. Toyota also plans to increase its focus on pure electric vehicles and is working on a new platform for EVs. While these measures show progress, it may be difficult to make up lost ground given the already dominant dominance of Chinese manufacturers.

🤝 Partnerships and collaborations

In order to gain a foothold in the market more quickly, some Japanese manufacturers rely on partnerships with local companies. Such collaborations could help close technological gaps and better address the needs of the Chinese market.

🎯 Focus on premium segments

Another approach is to focus more on the premium segment. Here, Japanese brands could score points through quality and reliability - characteristics that are still valued. However, this segment is also highly competitive: German luxury brands such as Mercedes-Benz and BMW as well as new Chinese premium brands make it difficult to stand out.

🌿 Promoting sustainable innovations

In the long term, Japanese manufacturers must focus more on sustainable innovations - both in battery technologies and in intelligent vehicle systems. The focus should be on not just catching up, but setting new standards.

🚀 A tough path forward

The challenges for Toyota, Honda and Nissan are enormous. The dominance of Chinese manufacturers in the EV sector has fundamentally changed the rules of the game. At the same time, the rapid decline in their market shares in China clearly shows that traditional strategies are no longer sufficient. To remain competitive in the long term, these companies must fundamentally rethink their approach.

The future will depend on how quickly they can adapt – both technologically and strategically. It is not enough to simply offer new electric vehicles; The key will be to adapt these vehicles to the specific needs of the Chinese market while delivering competitive prices and innovative technologies.

China remains a key market for the global automotive industry. For Japanese car manufacturers, however, this market could increasingly become a test - or an opportunity for a new beginning. The coming years will show whether they are able to regain their position or whether they will continue to decline in importance. One thing is clear: competition will be tougher than ever – not just in China, but worldwide.

📣 Similar topics

- 📉 Decline in the automobile market: Japan's challenges in China

- 🚗 Japanese car manufacturers under pressure: loss of market share

- 🔌 Electric Vehicle Revolution: Who's Leading in China?

- 📊 Sales figures in free fall: Japan's car brands in 2024

- 🇯🇵➡️🇨🇳 Change of strategy: Japan's auto industry is fighting back

- 📈 Battle for market share: China's dominance in the automotive industry

- 💡 Innovation and Adaptation: The Future of NEVs in Japan

- 🤝 Partnerships as a lifeline: Japan's answer to change

- 🌍 Global competitive pressure: New strategies for Japan

- 🌱 Sustainable innovations: A key to renewal

#️⃣ Hashtags: #JapanAutoIndustry #EVMarketChina #MarketShareLoss #InnovationPressure #Electric Vehicles

Our recommendation: 🌍 Limitless reach 🔗 Networked 🌐 Multilingual 💪 Strong sales: 💡 Authentic with strategy 🚀 Innovation meets 🧠 Intuition

At a time when a company's digital presence determines its success, the challenge is how to make this presence authentic, individual and far-reaching. Xpert.Digital offers an innovative solution that positions itself as an intersection between an industry hub, a blog and a brand ambassador. It combines the advantages of communication and sales channels in a single platform and enables publication in 18 different languages. The cooperation with partner portals and the possibility of publishing articles on Google News and a press distribution list with around 8,000 journalists and readers maximize the reach and visibility of the content. This represents an essential factor in external sales & marketing (SMarketing).

More about it here:

We are there for you - advice - planning - implementation - project management

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital - Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital - www.xpert.solar - www.xpert.plus