More than just a damper on growth in China? Between plan and market: The Chinese economic miracle in crisis?

Language selection 📢

Published on: January 5, 2025 / Update from: January 5, 2025 - Author: Konrad Wolfenstein

More than just a damper on growth in China? Between plan and market: The Chinese economic miracle in crisis? – Image: Xpert.Digital

China in transition: How structural challenges influence economic growth

More than just numbers: What the slowdown in Chinese growth really means

The Chinese economy has experienced rapid growth in recent decades and has quickly developed into one of the most influential economies in the world. This growth has been accompanied by profound social changes, a rapidly expanding middle class and growing Chinese influence in global issues such as technology, trade and finance. But while the impressive growth rates of previous decades were long taken for granted, recent years have seen a slowdown in growth that reveals a number of structural challenges. At the same time, political decision-makers are faced with the difficult task of mastering a balancing act between reforms, social stability, international competitiveness and global responsibility.

“The Chinese economy is undergoing a transformation process that will have a significant impact on the world.”

This statement is heard in many variations from executives, analysts and observers around the world. Nevertheless, it is not easy to sum up exactly which direction China's economy will take. The developments are too complex, the sectors are too diverse, and the regional challenges are too different. The tension between a planned economy and capitalism also continues to shape the country's economic dynamics. The following remarks paint a comprehensive picture of China's current economic situation and prospects and examine how the People's Republic is attempting to overcome these challenges.

Historic rise to economic power

Since the opening policy of the late 1970s, China has completed an economic marathon and developed from a rather insular agricultural economy into an export-oriented industrial power. Within a few decades, the country rose from a low income level and initially became the “workbench of the world”. The large pool of cheap labor at the time, coupled with government support for certain key industries, fueled growth. “Made in China” suddenly found itself in almost every market, from simple consumer goods to clothing to more complex industrial products.

As productivity and prosperity increased, the profile of the Chinese economy shifted: it not only entered labor-intensive industries, but also gradually shifted into areas such as technology, research and development, highly specialized manufacturing and the service sector.

The quality of the infrastructure also grew rapidly: expressways and high-speed trains now connect almost every major city, while new ports, airports and industrial parks enable and accelerate foreign trade. It is primarily these government investments in infrastructure and technology that have accompanied China's rapid rise. At the same time, megacities emerged in which millions of people now live and work. Urbanization remains one of the most defining trends in Chinese society today. But this development also created disparities between the metropolises on the east coast and the more rural areas in the interior, which created additional political and economic challenges.

Suitable for:

Current growth rates and macroeconomic environment

In recent decades there has been an average annual growth rate of over 9 percent, which is unparalleled in the global economy. However, China's growth is no longer in the double-digit range, but has slowed down significantly. Many experts attribute this to a variety of factors: saturated markets in some segments, the high debt levels of many companies, stricter environmental regulations and the shift towards a more service-based economy.

“Even a powerful engine cannot run at full load forever,” is an apt metaphor in this context.

In recent years, the quality of growth has therefore become increasingly important. The government is now trying to promote more sustainable and stable economic growth. The goal of strengthening domestic consumption and services and reducing dependence on exports and investments plays an important role. This paradigm shift is often referred to as the “dual circulation” strategy and is intended to increase the resilience of the Chinese economy to external shocks.

At the same time, there are also considerable uncertainties surrounding the macroeconomic data situation. While official statistics often report relatively high growth figures, many outsiders are observing a more severe economic slowdown than government data suggests. Differences between nominal and real GDP growth, price indices and consumer surveys sometimes indicate weaker dynamics.

“Trust in China’s statistics has cracked,” some analysts say, referring to discrepancies between data and perceived everyday events.

However, in a country with over 1.4 billion inhabitants, deviations are not uncommon, especially when regional circumstances and industry structures are as different as is the case in China.

Demographic change and the labor market

A key challenge that will become even more acute in the next few years is demographic change. For years, China benefited from a young and growing population, but this picture is now partially reversed: society is aging and the birth rate has fallen. The fact that the one-child policy has now been abolished and families are now allowed to have more children has not yet brought about the hoped-for turnaround.

Demographic changes affect the economy in two ways. Firstly, social spending threatens to increase as more and more pensioners need to be cared for. Second, the pool of employable workers tends to shrink - a development that was completely new to China in the past. Companies and authorities are now trying to increase productivity, for example through increased automation and digitalization. At the same time, more investment in education and qualification of the workforce is necessary to make innovative and higher-quality production possible.

At the same time, the situation for career starters is getting worse. Youth unemployment has recently reached record levels, which may exacerbate social tensions. “Our youth can be an important driver of growth if used correctly,” says several government statements. At the same time, however, it is clear that a comprehensive labor market and education policy is required in order to create meaningful employment for all qualified young people. Many university graduates are not only looking for well-paid jobs, but also jobs that offer long-term prospects.

Suitable for:

The state is now trying to counteract this with various programs. These include tax advantages for companies that hire young people, higher recruitment rates in the public sector and an expansion of vocational training. However, there is a lack of modern training concepts and social recognition of practically oriented training paths. “Vocational training must be dusted off and made more attractive,” demand educators and labor market experts in unison. It remains to be seen whether these reforms will have a long-term impact.

Real estate crisis as Achilles heel

For a long time, the real estate sector in China has been one of the most important growth drivers and a main source of private wealth. Many families invested their savings in apartments and houses because the belief that real estate prices were constantly rising was widespread. At the same time, cities and provinces financed their development projects through land sales or took out loans to expand infrastructure. But the former boom segment is now showing clear weaknesses. Payment difficulties among major real estate developers have led to a crisis of confidence, and many ruined buildings are left empty. It is estimated that there are tens of millions of unused apartments in China.

“Building a house has long been the symbol of the Chinese dream,” is what real estate agents often say. But this golden era appears to be crumbling. On the one hand, many households are afraid of investing their money in projects that will not ultimately be completed. On the other hand, the demand for new apartments is falling in some regions because the population is no longer growing everywhere and the wave of urbanization is slowing down.

The government is trying to stabilize the market with various instruments. The rules for mortgages have been relaxed, interest rates have been lowered in some cases and many municipalities are now again advertising to potential buyers with preferential conditions. In addition, attempts were made to prevent over-indebted real estate developers from borrowing excessively through more restrictive guidelines. Nevertheless, uncertainty remains high as to whether the real estate market can recover sustainably or whether a longer consolidation process is imminent. While some optimists point to the large number of city residents who will continue to need housing in the long term, others are skeptical as to whether the huge vacancies can be eliminated in the foreseeable future.

Suitable for:

Consumer behavior and the social safety net

Another construction site that is closely related to the economy is private consumption. Although China's middle class has grown rapidly in recent years, consumer spending relative to the total population is still comparatively low when compared with large Western economies. This is also because social security in China remains patchy. Many people save a large portion of their income for emergencies because they lack extensive insurance benefits or a functioning healthcare system like those found in some Western countries.

“Why should we spend money on luxury goods when we don’t even know whether we can afford a hospital visit?” many Chinese people ask themselves.

This attitude dampens consumption. While it is undeniable that in metropolises like Shanghai or Beijing there is purchasing power that attracts luxury brands from all over the world, the picture is often completely different in smaller cities and rural areas.

Some observers are therefore calling for comprehensive reforms in the health system, pension insurance and unemployment benefits in order to reduce people's propensity to save and thus boost consumption. “More social security is the key to consumption growth,” is an often shared assessment. So far, however, the government has only taken cautious steps towards more robust social security. Large stimulus packages with direct cash transfers to private households, as seen in some other countries, are comparatively rare in China.

Over-indebtedness and excess capacity

China's focus on production and exports has led to significant overcapacity over the years. Some industries have a sheer volume of factories far beyond what domestic and foreign markets can accommodate. Steel, cement, solar cells, electric vehicles and shipbuilding are examples of areas where the supply side is enormous. The result is price pressure, falling margins and a race for government subsidies.

This excess capacity is closely linked to the problem of high levels of debt. Local governments and state-owned companies in particular have borrowed money over the years to achieve their growth goals. The focus was less on profitability and more on simply increasing production. “Our road to the future leads through concrete and steel,” is often quoted when it comes to the self-image of many local governments that rely on infrastructure projects. But there are now growing concerns that this enormous debt could become an obstacle to future growth.

Suitable for:

The state is now trying to rehabilitate over-indebted regions and close or merge inefficient companies. However, caution is being exercised in this process as an abrupt collapse of many companies could lead to mass unemployment and social unrest. That's why the focus is on gradual consolidation and hopes that new technologies and innovative business models will gradually replace the old structures.

Environment and green development

China has recognized that long-term growth is only possible through sustainable development. At the same time, the country is confronted with the consequences of its rapid industrialization: environmental pollution, smog in large cities, water shortages and soil degradation are omnipresent. “If we destroy the environment, we destroy ourselves” is a slogan that you read again and again in government statements.

China is now investing heavily in renewable energies and has become the world's largest manufacturer of solar modules, wind turbines and electric vehicles. The country already dominates the global value chain in some areas, such as the production of battery cells. At the same time, coal-fired power plants should be gradually scaled back and clean technologies should secure the energy supply. But the transformation is by no means easy, as coal is still one of the most important energy sources in the country and many provinces depend on the coal industry.

Various funding programs and government incentive systems are intended to accelerate the green transition. Today you can see electric buses in many cities, while the electric car infrastructure, for example, is being expanded at breakneck speed. New technologies such as hydrogen are also playing a growing role. At the same time, China is pursuing extensive reforestation and erosion control programs to stabilize long-neglected ecosystems.

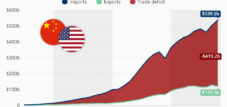

Tensions with the USA and global connections

China finds itself in a constant area of tension with the USA, which on the one hand is a very important trading partner, but on the other hand is also perceived as a competitor in geopolitical and technological issues. “We can neither with nor without each other,” is the unofficial motto when Chinese people describe relations with the United States. In fact, both countries have a great interest in not allowing bilateral trade and investment relations to escalate. However, there are also points of contention, ranging from technology transfer and patent protection to security policy issues and geopolitical tensions.

Competition is intensifying, particularly in the high-tech sector. China wants to become more independent of Western suppliers and promote independent semiconductor production. The USA, in turn, has reservations about locating critical know-how or modern chip technology in China and is looking for ways to protect sensitive technologies. “We want to compete on equal terms without getting into a technology cold war,” some Chinese officials say. But the realities are often more complicated, and sanctions or export restrictions on both sides regularly cause unrest.

At the same time, China has diversified its international relations and expanded its global connectivity in recent years. The Belt and Road Initiative, also known as the New Silk Road, is one of the world's most ambitious infrastructure projects, encompassing ports, railways, roads and pipelines in dozens of countries. This networking is intended to consolidate China's position as a global trade and investment partner, but it also provokes criticism: Some countries fear becoming debt-dependent or becoming too dependent on Chinese technology and financing.

Promotion of the private sector and role of government

A crucial factor in China's future growth is private sector confidence. After years in which private companies grew strongly and created increasingly dynamic sectors such as e-commerce, FinTech and artificial intelligence, a certain degree of uncertainty has recently emerged: stricter regulations in the tech sector, high fines and extensive market interventions have given rise to doubts among some entrepreneurs whether the government actually continues to value the private sector as an engine of growth.

“Politics should help us, not strangle us,” are statements from business circles, which make it clear that trust in stable and predictable framework conditions is central.

Authorities have now signaled that they want to support the development of the private sector and are very interested in presenting China as an attractive investment location. Efforts are now being made to expand market access for private and foreign companies in certain areas, and international economic forums are being held at which government officials emphasize China's willingness to cooperate.

However, the role of the state remains strong. Strategic sectors continue to be closely monitored and often controlled through government funding programs. These include armaments, energy, telecommunications and areas that affect China’s so-called “digital sovereignty”. It can also be expected in the future that political objectives such as “national security” or “social cohesion” will take precedence over purely economic interests.

Digitalization and innovation

China has become a global innovation center in recent years. Chinese platforms are often leaders in the e-commerce sector, and in many cities people pay almost exclusively through mobile payment applications.

“The future of payment is already here, and it is digital,” one could say in the metropolises of China.

Tech giants operate research centers for artificial intelligence, quantum computing and biotech and are striving to lead the way in these areas.

At the same time, the government is pushing ahead with projects to create digital central bank money - the e-yuan, which is intended to supplement or partially replace cash in the long term. The aim is to better control transactions, make them more efficient and facilitate international payment processes. However, this move also raises concerns about data protection and government surveillance.

China has already taken the lead in patent applications in many fields, but the practical implementation and commercialization of innovative ideas depends heavily on the regulatory environment and the availability of venture capital. China still faces the challenge of closing technological gaps, particularly in areas such as semiconductor technology and high-end mechanical engineering. “We don’t want to remain dependent on foreign key technologies forever,” is an often-mentioned claim. The country is therefore investing gigantic sums in research and development to fill these gaps and expand the value chains in its own country.

Government measures to address economic challenges

The Chinese government has taken a number of initiatives to address the challenges and stabilize growth:

1. Employment promotion

Government agencies organize recruitment events for university graduates. Public bodies are expanding their hiring quotas, while private companies are receiving tax advantages for hiring young people. The government is also focusing on campaigns to provide career advice and internships to the unemployed.

2. Stabilization of the real estate market

To restore confidence in the real estate sector, mortgage conditions for first-time buyers have been relaxed and existing loans have been refinanced to more favorable terms in certain cases. There is also a push to complete pre-sold projects quickly so that buyers are not left with building ruins.

3. Diversification of trade relations

China is increasing its efforts to expand trade ties not only with the United States, but also with Europe, Africa, Latin America and other Asian countries. The Belt and Road Initiative plays a key role in this. Broader networking of supply chains and expanding access to raw materials are intended to reduce risks arising from possible conflicts or sanctions.

4. Stabilization of relations with the USA

Despite ongoing points of contention, the government is seeking dialogue with the United States to maintain economic relations and avoid conflict escalations. High-level meetings have already taken place to discuss issues such as trade tariffs, intellectual property rights and financial cooperation.

5. Building trust in the private sector

Campaigns and PR offensives are intended to motivate private companies to invest again. At international economic conferences, the People's Republic is courting foreign investment and emphasizing that China is open to business opportunities. At the same time, the regulatory framework for some industries is being further developed in order to improve legal certainty.

6. Promote green technologies

Companies in climate-friendly sectors should be able to continue to grow through targeted subsidies and government funding programs. The electrification of transport and industry is being pushed forward in order to reduce emissions and open up new business areas.

Comparison with other economies

Despite all the challenges, China remains a heavyweight in the global context. Although the USA is still in first place in terms of nominal gross domestic product, China's contribution to global growth has steadily increased in recent years. Countries like India have high growth rates, but there are also structural hurdles to overcome before India reaches China's economic size.

“The real competition lies in technology, innovation and education levels,” is how observers describe it when comparing China's future development with other emerging economies.

While India can rely on a young population structure, China has a highly developed infrastructure and increasingly skilled human capital in key industries. It remains to be seen whether India can develop a similar industrial clout in the long term or whether China's lead is too great.

The European market also plays an important role for China, especially in areas such as premium automobiles, mechanical engineering and trade. For their part, European companies are dependent on the Chinese sales market, as a growing middle class there demands high-quality products. However, geopolitical tensions or protectionist tendencies are causing both sides to consider how they can reduce dependencies without endangering the diverse trade potential.

Perspectives and possible future scenarios

A crucial issue for the next few years will be whether China can make the transition from a fast-growing emerging economy to a mature economy with more sustainable growth rates without falling into a serious crisis. “The biggest risk is not implementing the reforms consistently enough,” warn economists, who point to the structural challenges: excess capacity, debt, demographic developments and an unequal distribution of wealth.

If we succeed in expanding the social security system, strengthening innovation, boosting consumption and defusing real estate crises, China could retain its role as a global economic engine despite lower growth rates. The shift towards a more internal market-oriented economy could bring more stability and independence from external drops in demand. Further urbanization – albeit at a somewhat reduced rate – could also support demand for higher living standards and promote modern services.

Another scenario is that current vulnerabilities worsen, creating a downward spiral of falling consumer confidence, housing crises and rising unemployment. This would also unsettle foreign investments and burden domestic demand. Such a development could lead to an economic “hard landing” that would affect the People’s Republic and its trading partners equally.

The geopolitical aspects should not be underestimated: If the trade and technology conflict with the USA continues to intensify, China could rely more on self-sufficiency and push back Western countries more significantly. In an extreme case, two technological “blocks” would emerge, which would revolutionize international supply chains. But such decouplings would be expensive and would probably burden the global economy as a whole.

Anyone who wants to predict China's future must have flexibility and the ability to change perspectives

The Chinese economy is at a crossroads. After decades of record growth and massive investments in infrastructure, industry and real estate, a new phase has begun in which structural problems and external challenges set the pace. “In the future, quality and sustainability will count for more than just quantity,” is the motto in many government announcements, which suggests that the era of double-digit growth rates is finally over.

The biggest challenges include demographic change, high youth unemployment, uncertainties in the real estate sector, declining consumer behavior, the excessive indebtedness of some players and tensions with the USA. To address these problems, China has put together a package of measures ranging from employment promotion and real estate reforms to technological upgrades and international networking.

Only the future will show whether these measures will be effective. On the one hand, China is known for its pragmatic approach and has proven time and again in the past that it is capable of realigning its economy. On the other hand, the current challenges are more complex than ever, especially since the global economy is also in a phase of change and geopolitical risks are increasing.

“If you want to predict China's future, you need to have flexibility and the ability to change perspectives,” say analysts who have been monitoring this country's dynamics for years. Because China can no longer be reduced to a narrative of pure growth. It is a country in transition, wrestling with internal and external factors to redefine its role in the world.

If the government learns the right lessons from the recent crises, the People's Republic could emerge stronger from this change by further diversifying its economic structures, expanding innovative strength, reducing social inequalities and reducing dependence on old growth models. However, getting there will undoubtedly be challenging and will require continued effort.

“China is and remains a central element of the global economy,” it is often said. If the country's rise continues - albeit at a somewhat slower pace - China will continue to have an immense influence on global trade, finance, technology and global value chains. The sheer size of the internal market makes it a crucial venue for businesses and investors. At the same time, the world will continue to closely monitor how the country masters the balance between economic dynamism, social cohesion and international cooperation.

It is clear that a slowdown in the Chinese economy would be relevant for the entire global economy: lower demand for raw materials would affect countries that are heavily dependent on raw material exports, and less Chinese investment in global projects could put poorer countries in greater trouble. Technologies that China is currently pushing forward – from renewable energy to artificial intelligence – may also be slower to take hold, which in turn could influence global innovation dynamics.

Overall, China's economic history offers one of the most fascinating transformation achievements of modern times. The “Workbench of the World” has blossomed into a competitive economy with significant high-tech sectors and is now taking the next step: the step towards an innovative, digitalized and more environmentally conscious development model. Whether this step succeeds will determine what influence China will have on the global community in the coming decades - and how it shapes global markets, political alliances and cultural trends.

The outcome of this process is open. But the government in Beijing has made it clear that it does not want to settle for a mediocre result. “We have achieved a lot, but there is still much more to come,” is a motto that you hear again and again in official speeches and documents. So for now there is nothing left but to follow developments closely. One thing is certain: whether it is a real estate crisis, youth unemployment or innovative technologies – every turn in China will not only shape the country itself, but also the global economy. And so we come to the conclusion that China, despite all the adverse circumstances, remains a key nation for global economic activity.

Our recommendation: 🌍 Limitless reach 🔗 Networked 🌐 Multilingual 💪 Strong sales: 💡 Authentic with strategy 🚀 Innovation meets 🧠 Intuition

At a time when a company's digital presence determines its success, the challenge is how to make this presence authentic, individual and far-reaching. Xpert.Digital offers an innovative solution that positions itself as an intersection between an industry hub, a blog and a brand ambassador. It combines the advantages of communication and sales channels in a single platform and enables publication in 18 different languages. The cooperation with partner portals and the possibility of publishing articles on Google News and a press distribution list with around 8,000 journalists and readers maximize the reach and visibility of the content. This represents an essential factor in external sales & marketing (SMarketing).

More about it here:

We are there for you - advice - planning - implementation - project management

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital - Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital - www.xpert.solar - www.xpert.plus